NOTICE: This post references card features that have changed, expired, or are not currently available

Doctor of Credit warned us yesterday. Nationwide Bank had changed the terms on their Visa Buxx cards. Previously, you could load Nationwide Buxx debit cards online with a credit card for a very low fee: $2 for each $500 load. That made Nationwide Buxx a great option for manufacturing spend. According to Doctor of Credit, the new terms state, in part:

When a parent orders a Nationwide Bank Visa Buxx Card for the first time, the minimum card value is $20.00 and the maximum card value is $100.00. After the Teen receives the Card, the minimum reload value is $10.00 and the maximum reload value is $200.00 per card, per week.

Since Nationwide charges $2 per load, a $200 limit means that reload fees increase to 1%. Suddenly loading Nationwide Buxx isn’t much better than buying regular Visa gift cards (except that you can have your name on Buxx cards and withdraw money from ATMs).

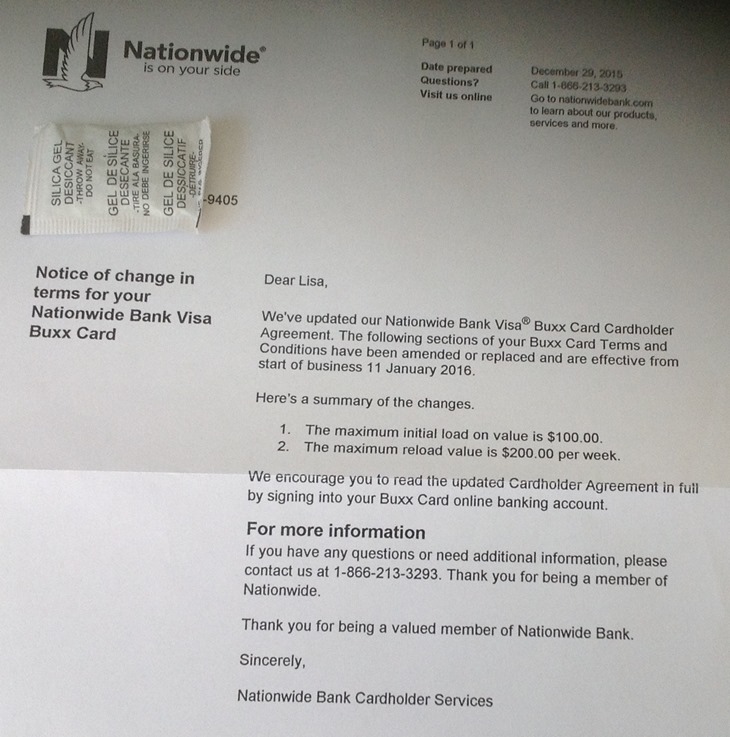

The question left unanswered in Doctor of Credit’s post was whether or not existing cardholders would be grandfathered in under the old terms. Unfortunately, it looks like the answer is no. A reader received a letter today stating that the new terms would be in effect as of start of business on January 11, 2016.

Key points from the letter:

- New terms are effective from start of business 11 January 2016

- The maximum initial load on value is $100

- The maximum reload value is $200 per week

I expect that all other current customers will receive similar letters very soon. Make sure to do your final $500 loads ASAP.

[…] Nationwide Buxx far less useful as of January 11 2016 […]

[…] Nationwide Buxx far less useful as of January 11 2016 […]

[…] Nationwide Buxx far less useful as of January 11 2016 […]

[…] So Close to Dead I Can Taste It (Pev: Mostly Dead): Goodby Nationwide Buxx. Nationwide Buxx cards were already hobbled, but now they’re being shut down completely as of February […]

[…] Nationwide Visa Buxx: No longer available to new customers. Hobbled for existing customers. […]

[…] Nationwide Visa Buxx: No longer available to new customers. Hobbled for existing customers. […]

[…] full details, please see: Connecting the dots: Prepaid cards that allow debit reloads. Also see: Nationwide Buxx far less useful as of January 11 2016. Note that Amex cards (e.g. Serve and Bluebird) are not debit cards, so they would not work for […]

[…] with a few miscellaneous purchases and a couple of Nationwide Buxx card reloads (this was before Nationwide limited reloads to $200 at a time). I thought I was all […]

[…] Adding to the MS troubles this week, the limits on the Nationwide Buxx have dropped to the point where it makes no sense to continue using this as a viable MS method. You used to be […]

[…] week has been one with many downs considering the recent changes to NW Buxx cards and the closure of most people’s Bluebird/Serve accounts to new loads. Manufactured spending […]

I thought max load per month would remain at $1000 but if it’s $200 per week at $2 per load, that’ll be $8 per $800/month/card. Buying RLs at the grocery store that takes CC for them with 5% cat bonus will be a better deal for me.

Has anyone setup on auto reload after the 11th funded for 500? Mine reloaded on the 10th and it is still showing 500 for the reload as of today.

I think that deserves another large story how to MS at Walmart, the last man standing. Keep it alive!

Aw, this is unfortunate for me because I just started using Nationwide Buxx a few months ago. I use it to pay, via telephone, my Citi credit cards. It makes putting travel spend on my Citi Premier card very worthwhile as I get bonus points and then a double dip paying the bill. Good for meeting minimum spends, too. All from the comfort of my home.

What else do folks do with these Buxx cards? With the exception of paying a Citi bill, everything else seemed like too much hassle for the reward. Do folks buy money orders with them?

I use an AllPoint ATM to take out $200/week, the weekly limit per card, and deposit the money straight into my checking account. I have 5 of these puppies.

[…] Update: Looks like these changes will go into effect on January 11th, 2015 and existing cardholders won’t be grandfathered according to Frequent Miler. […]

Miler, where are we at for best options for 1X spend generation for things like Delta Reserve card for status? I used to use Amex GC, but now, best option seems to be Simon malls which costs me $3.95 for each $475 load. Any better ideas? I hate spending that much for a Delta mile, but need the status credit.