NOTICE: This post references card features that have changed, expired, or are not currently available

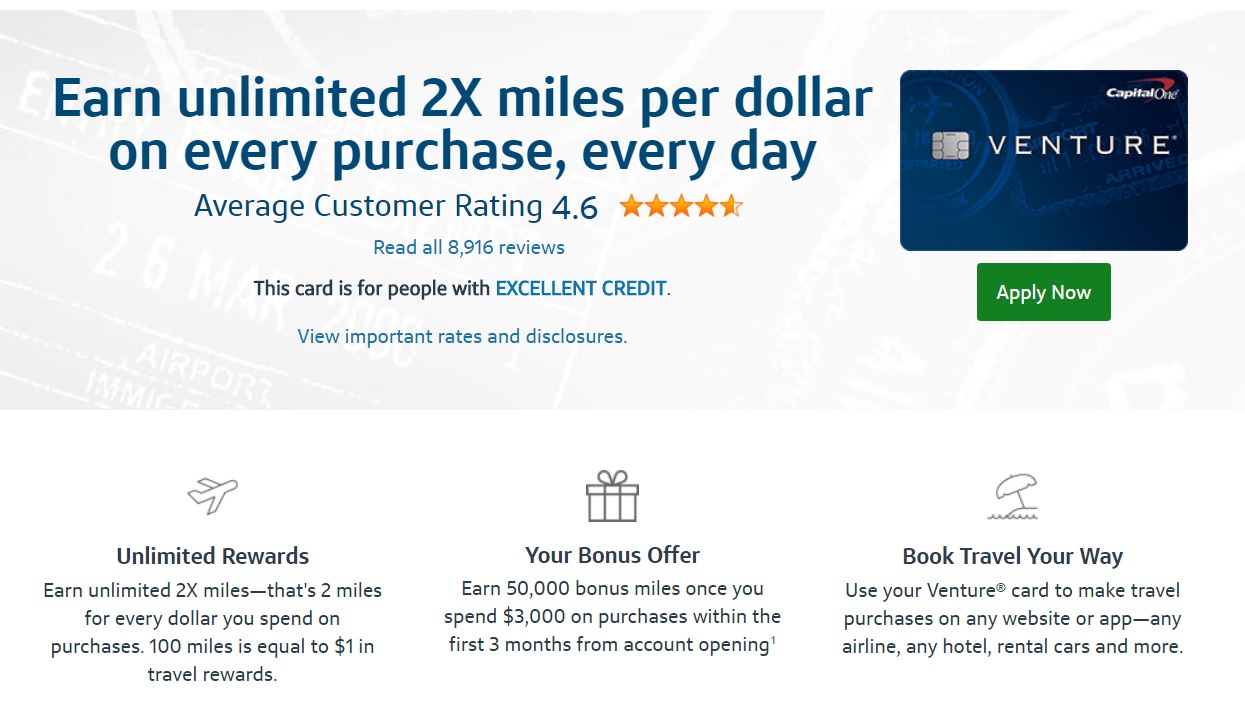

Capital One has increased the signup bonus on the Capital One Venture Rewards card to 50,000 Capital One miles after spending $3,000 on purchases in the first 3 months — enough for $500 worth of travel expenses. That beats the previous signup bonus by 10,000 points and matches the best offer we’ve seen on this card over the past couple of years.

Capital One Venture Rewards Card

The Offer

- Earn 50,000 miles after spending $3,000 in the first 3 months (enough for $500 worth of travel)

- Link to more info on this card

Key Card Details

- Earn 2x miles on everything

- $95 annual fee is waived the first year

Quick Thoughts

The Capital One Venture Rewards card earns Capital One miles. These miles can’t be transferred to partners — they can instead be used at a value of 1 cent per mile as a statement credit to cover the cost of travel purchases. The Venture Rewards card was the first rewards credit card in my household and I spent several years using this card exclusively before I expanded into airline miles and hotel points. The appealing part of this card is the ease of use — just pay for travel with your card and use your miles to get a statement credit for all or part of your travel cost. That makes it easy to use and adds some flexibility over airline miles. For example, I used Capital One miles when my sister-in-law wanted to take a family cruise for her birthday. I’m not really into boat travel, so I was happy to use my Capital One miles to cover the cost of the cruise.

And while I’d rather be in the sea than on the sea, the trip was a lot of fun. That’s how I got to Maho Beach, which was sadly devastated by the recent hurricanes.

And on Barbados, we enjoyed the local fauna at the Barbados wildlife reserve.

It was a few years ago now, but I was happy to have points to use for that trip. I also used Capital One points for Europe rail passes years ago.

I’ve since learned that rail passes aren’t as economical as buying separate tickets — I’ve learned a wealth on info on that front from the Man in Seat 61 since those days….but if not for those days, I wouldn’t have this picture of my wife, spontaneously challenged to a duel in Hofbrauhaus.

Bottom line

Unfortunately, the annual fee on this card has gone up to $95. The good news is that it’s waived the first year. The Capital One Venture Rewards card carries a signup bonus that can be used towards $500 worth of travel — that kind of return on $3,000 spend is always worth a look, especially with an annual fee that is waived in year 1. And while I certainly prefer diversifying miles and points in a variety of other programs, there is no doubt that this card still appeals to those who like to keep it simple. While a no-fee 2% cash back card (or 2.5% card like the Alliant card) certainly carries some advantages over this one, the fact that this card does not charge foreign transaction fees and has some travel protection make this card a decent choice for those starting out in rewards or who have a good use in mind for the signup bonus points. We’ve added this offer to our Best Offers page.

I just got an offer in the mail for the Venture card of 100,000 miles after 5k spend

Nice! Mind sending me a picture of that mailer? I’d love to be able to share it so people can be on the lookout. My email is just nick at frequentmiler dot net.

[…] New 50K signup offer worth $500 in travel […]

[…] New 50K signup offer worth $500 in travel […]

[…] New 50K signup offer worth $500 in travel […]

Thanks for the heads up on this card.

Is it churnable if you have had it before?

Nick, what are your thoughts on getting approved for this? It states above that this is a card for those with excellent credit, but Flyertalk has reports of people with scores around 800 getting denied, while those who carry a balance get approved. If I have a lower credit score but excellent on-time payment history, what do you think my chances are?

Also wondering how redemption works (can’t find too much info on this online, alas) – can you redeem “miles” towards your purchase down to the dollar, or do you basically have to redeem in increments of $25 (or some other amount) and therefore “lose” value?

So will I need to unfreeze all 3 to be approved ??

What’s there churn rule/ratio? Seems like a hard case.

Don’t forget Capital One does 1 hard pull for each credit bureau, so 3 total. Not a huge deal for me since Citi and Amex both do a pull on EQ and EX, and only Barclays pulls TU, but it’s something to keep in mind if Amex/Citi only pulls one bureau for you.

True. The last time I opened a C1 card, I had one bureau frozen, so they only pulled two.

Apparently that doesn’t fly anymore according to reddit 🙁

https://www.reddit.com/r/churning/comments/7701z9/capitalone_venture_now_with_50000_bonus_points_on/dohy5uv/