NOTICE: This post references card features that have changed, expired, or are not currently available

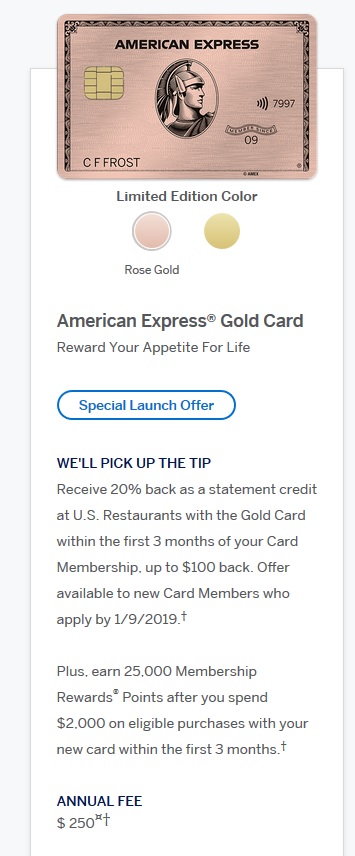

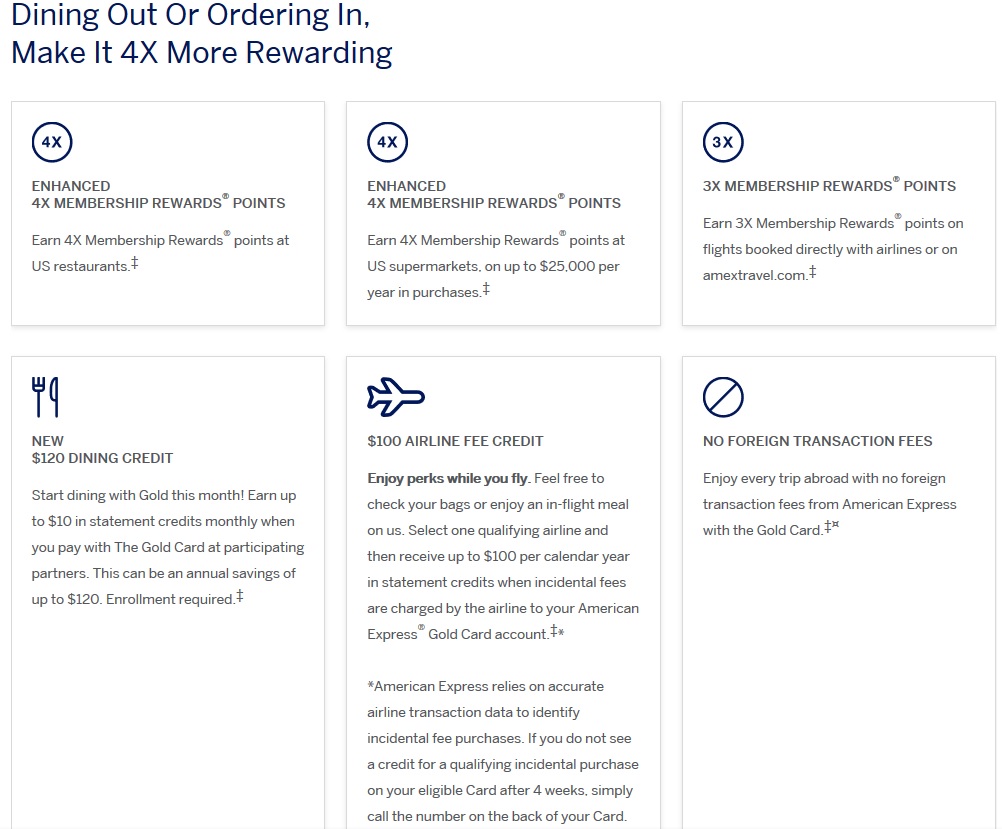

The new American Express Gold Card is now starting to show up for some people while browsing the Amex site — and in fact I saw this offer moments ago while browsing (it may be targeted to me). As expected, the card features the awesome bonus categories we thought it would (See: Amex knocks it out of the park with new 4x dining / $120 credit benefits…), like 4x at US Supermarkets on up to $25,000 in purchases (then 1x) and 4x at US Restaurants. Unfortunately, it also features a new $250 annual fee. To make matters worse, it looks like the fee is not waived the first year according to the offer I was shown. I’m personally really kicking myself for not applying when I had the app open last night with the old structure…..

As you can see above, the new offer I saw was exactly as expected: 25,000 points after $2,000 in eligible purchases within the first 2 months plus 20% back as a statement credit at US restaurants in the first 3 months. All of the benefits are exactly what we expected based on what some cardholders saw a couple of weeks ago.

Reports from existing cardholders indicate that the new benefits are already showing up in online logins and I expect that the new earning structure will likely start today for those cardholders. Amex reps have been giving conflicting info about requesting the new rose gold or yellow gold metal card designs, but it sounds like existing cardholders should be able to request the new cards at some point later today. As shown in the screen shot above, the rose gold is apparently a limited edition.

Hopefully, I just got a targeted offer in my browser and there will be an even better public offer to come later today. If not, I’ll surely be disappointed in myself for not applying last night when the application page still showed a lower fee that was waived the first year…..as we are able to confirm more details, we will post an update.

If I have had the PRG in the past, would I qualify for this new card?

We don’t think so. The terms say no. (I assume you’re really asking “Would I qualify for the welcome offer?”. You can of course get the card, but most likely not the new cardmember bonus).

If I do the self referral, do I get the referral bonus?

[…] reported very early this morning about the new American Express Gold Card, featuring the previously-rumored benefits like 4x at US Restaurants, 4x at US Supermarkets (on […]

I’m wondering if existing card members will be grandfathered into the $195 annual fee (thinking probably not). Just received a retention offer (and combining that with an authorized user offer) so my annual fee is about to hit. Was expecting to pay the $195 annual fee.

Official info from Amex: “The new fee will go into effect for current Premier Rewards Gold Card Members beginning April 1, 2019 on their account renewal date.”

Wow, that is service! (From you and Amex) Ask and you shall receive!

@Greg, any word on if current card holder already have substantial spend on the groceries category or over $25k already, would there be any 4x opportunities?

Great question. I don’t know. I’ll ask them.

DP: Applied for PRG 50K/$2K targeted offer via incognito about a week ago. Confirmed new benefits last night but was told I had to wait 24 hours to request new metal cards. Got on chat this morning and was able to successfully get new (rose gold) metal card. I will probably only keep the card for a year so I’m not too upset about the jump from $195>$250 but pretty glad I applied before the get AF waived 1st year. That’s easily 50KMR + ~$330 value + healthy bonuses in first year!

I happen to know the launch day was Oct 4…. Anyone should be able to see it. If you are an existing PRG customer, login and go to your page to see updated benefits.

I do not have the Gold today and seeing the exact same offer you are showing on this article. I think the most important question with the release of this card is, do you keep the Chase Sapphire Reserve? This card now gives you 4x on restaurants vs. Reserve at 3x, which was the #1 factor for me keeping the Reserve (by far my biggest yearly expenditure). I am thinking the only reason to keep it would be to ensure ALL travel is 3x, including Uber / Lyft etc. This card will also make me cancel my Amex EveryDay card (no fee), since the only reason I kept it was for the 2x supermarket earnings. What do you think?

I downgraded my CSR a while ago to a Freedom. You can equal or beat the restaurant rewards easily with a combination of cards like the Wells Fargo Amex, the Uber visa, the Savor, the B of A premium rewards and now the Amex Gold. I actually use my ink preferred for non airfare travel expenses but you can also use a ton of other cards for 3x rewards, most of which have benefits that offset the annual fee, or are fee free. Combined with the 5x rewards from converting to the Freedom, I could not justify the $150 effective annual fee.

Can you elaborate on how you beat the 3x on restaurants given by the CSR? CF is only 1.5% cash back no? The Wells Fargo Amex (assume this is the Propel) does give you 4% but it limits your redemption options versus Amex and Chase, which I find incredibly valuable. The same is true for the Capital One Savor and for the Uber Visa, both offering 4% back on dining. These are higher than the 3x but lower redemption options. Lastly, the B of A premium, isnt this only 2% back? Thanks!

Is it a new product so we’re all eligible?

I highly, highly doubt it.

ok maybe they will target me!!!

Does the complimentary gold cards from the Amex platinum waive the fee?

I don’t believe those cards will get these new benefits — I believe AU cards on a Platinum earn based on the Platinum structure whether they are Gold/Green/etc.

Yup, that is what I see. Too bad, that would have been nice.

I would apply for 50k bonus but 25k seems low for this product.

Are ppl with Ameriprise Gold seeing new benefits?

I have Ameriprise Gold and I still see the same old benefits

I wasnt able to replicate the 50k offer so I decided to wait. Bad idea 🙁

I was able to….and still decided to wait. Doh!

[…] Hat tip to /r/churning & FM […]

[…] Hat tip to /r/churning & FM […]