NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

Update: Unfortunately, it seems that the 50K offer on the Premier has died. The Plus link for 50K points continues to work, but the best offer available on the Premier is once again 40K after $1K spend. See our Best Offers page for links.

Update #2 (1/8/18): There is a new working link for the 50K Premier card. See more information about this link under the Premier card below.

Last fall, there were big offers on the Southwest Airlines Credit Cards. However, those offers expired in October and the signup bonus on the personal cards (both Plus and Premier) were dropped to just 40K points after $1K spend (though the business version has maintained a 60K signup bonus). As of the first of the year, the signup bonuses on both the Southwest Airlines Rapid Rewards Plus and Southwest Airlines Rapid Rewards Premier (update: see note above) cards are back up to 50,000 Rapid Rewards points after $2,000 spend. More information on these offers and how to find them below.

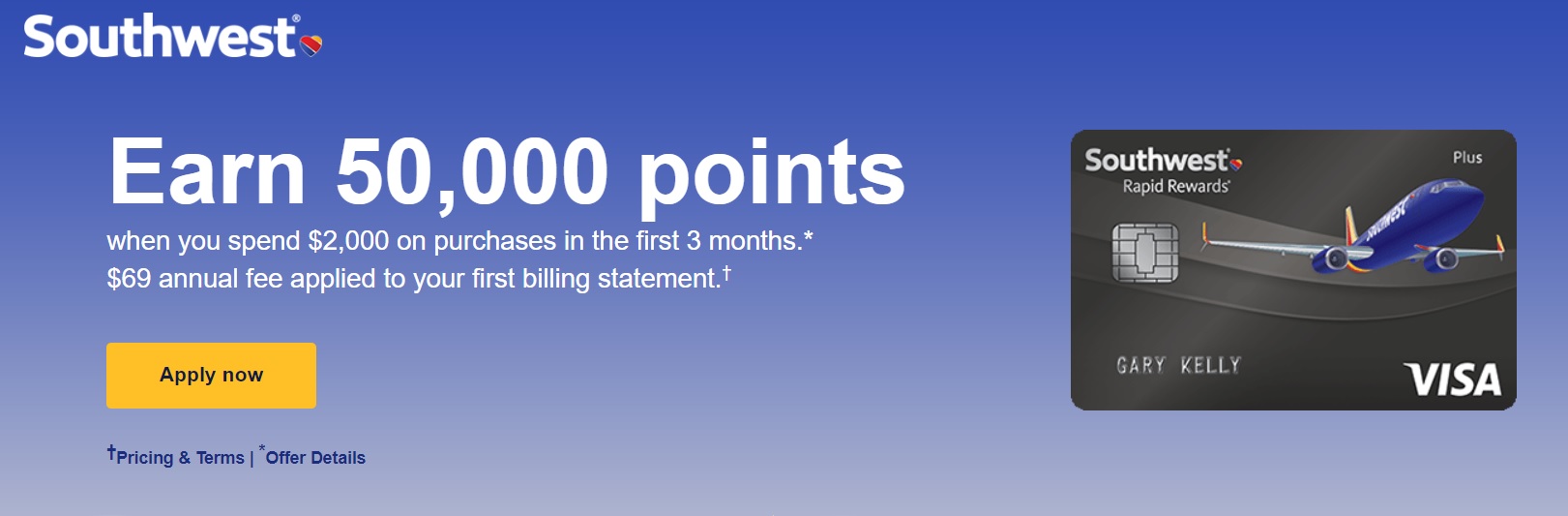

Chase Southwest Airlines Rapid Rewards Plus

The Offer

- Earn 50,000 Rapid Rewards points when you spend $2,000 on purchases in the first 3 months

- Link to offer on our Best Offers page or Southwest Rapid Rewards Plus card page

Key Card Details

- $69 annual fee is not waived

- 3,000 bonus points after your cardmember anniversary

- Earn 2X Southwest

- Earn 1X on all other purchases

Chase Southwest Airlines Rapid Rewards Premier

The Offer

Earn 50,000 Rapid Rewards points after you spend $2,000 on purchases in the first 3 monthsNote that this offer is from a referral link. When you click the offer link (from our Best Offers page or the Southwest Rapid Rewards Premier card page, it shows a pop-up saying the offer is expired and you will be redirected to the current offer. After it redirects, you should see this 50K offer)Update: See our note at the top of this post. This offer has expired.- Update #2 (1/8/18): A new working link for 50,000 Rapid Rewards points after you spend $2,000 on purchases in the first 3 months has been added to our Best Offers page. Note that the landing page clearly shows the signup bonus, the Premier card image, and the $99 annual fee. Some users on reddit reported seeing an image of the Plus card after hitting “submit” on the final step of the application, but those users later reported approval for the Premier card as expected. It’s always a good idea to take a screen shot of the offer under which you apply.

Key Card Details

- $99 annual fee is not waived

- 6,000 points after your cardmember anniversary

- Earn 2X Southwest

- Earn 1X on all other purchases

Quick Thoughts

Both cards are known to be subject to the Chase 5/24 rule. This means that if you have opened 5 or more personal credit cards from any issuer in the past 24 months (including Authorized User cards), you are unlikely to be approved. Note that some people have reported successfully convincing a recon agent not to count authorized user cards if you have no responsibility in repaying the debt on them, but the computer system will count them and decline your application initially.

For those under 5/24, these offers make the most sense if you are seeking a Southwest Companion Pass. For those unfamiliar, you can earn a Southwest Companion Pass when you earn 110,000 or more Southwest Rapid Rewards points in a calendar year. The Companion Pass benefit allows the holder to bring a companion for free (paying only the taxes) an unlimited number of times throughout the validity of the pass. The Companion Pass is valid for the rest of the year in which it is earned and the entire following year. This means that if you signed up for one of these cards and the Chase Southwest Rapid Rewards Premier Business card, which is currently offering 60K points for $3K spend, and met the minimum spending requirements, you would earn a companion pass good until December 31st, 2019. See our Complete Guide to the Southwest Companion Pass for more details on how the pass works. Alternatively, you could sign up for both personal cards and after minimum spend you would only need to earn an additional 6,000 Rapid Rewards points (either through spend, the shopping portal, referrals, etc) in order to reach 110K.

This year is a particularly good time to earn the Southwest Companion Pass as Southwest has announced their intention to begin selling tickets to Hawaii this year (See: Southwest to Hawaii: get your Companion Passes ready). Earning the Companion Pass now means that you should probably have a valid pass when they begin operations to Hawaii.

If you have signed up for one of these personal cards in the past 90 days under a lesser offer, you may be able to get Chase to match the offer. Many have reported success in the past by sending a secure message. YMMV.

As always, links to these offers have been added to our Best Credit Card Offers page.

H/T: Reddit for the Plus offer link

[…] New Southwest 50K offers on both Plus & Premier […]

I stand at 4/24. Can i get approved for BOTH SW personal cards at the same time? Or will Chase approve one, then deny the other? Seems kinda risky. Thanks

You can. There are plenty of DPs of getting approved for 2 cards when you are 4/24, but both applications need to be done on the same day. That said, I don’t know whether Chase will specifically approve you are not, but yes its possible and the only way you’ll get both if you’re at 4/24 (unless you wait to return to 4/24 to do the next app). What about it seems risky to you? There have been some reports of Chase Financial Review as of late that some claim is triggered by multiple applications and/or large spikes in your spending pattern, but many people have done both SW cards in one day.

Thanks Nick for the reply. The risk i was concerned with @ 4/24 – Apply for the two SW personals same time, Chase approves whichever first one, so that takes me to 5/24 but then make me ineligible for the other one (because that would make it 6/24). Am i over thinking this situation?

[…] week, we posted a Quick Deal noting that the signup bonuses on both the Chase Southwest Airlines Rapid Rewards Plus and […]

Update: There is a new working link for the 50K bonus on the Premier. This post has been updated and the link has been added to our Best Offers page. See the link to our Best Offers page in the post.

Hello I just hit the minimum $2000 spend on the premier and plus card, both with the 60,000 point bonus. My statement closing dates on the cards are Jan 22 and Jan 24. When would you expect my bonus points to post to my account? I’m hoping it is within a few days of statement closing dates because I wish to use a lot of these points (and the companion pass) on travel in late February.

Also is there any way to book using cash on southwest.com and then switch to points once the points post to my account? If so, are there any fees associated with this?

Based on my wife’s most recent statements, I’d say it’ll take about a week for the points to hit your account.

No, you can’t use cash and then switch to points. You *could* use cash now and then later cancel your reservation (and have a Southwest credit that is valid for 1 year from the date you book the flight) and reserve anew using points — but there is no guarantee that the price won’t have increased (on the flip side, it could decrease). Remember that either way, you only need to book one ticket. As long as the flight doesn’t sell out, you can later add your companion (no need to reserve two seats now).

One other potential trick: You may be able to get Chase to change your due date (and therefore your statement cut date). You could, for example, request that they change your due date to the 10th on both cards and have those statements cut this weekend so that you’d hopefully get the points next week.

Thanks Nick,

When you say ” a week for the points to hit my account” are you saying a week after the close dates? So in my case a week after Jan 24 close date would be approximately Jan 31?

Correct. More accurately, my wife’s most recent statement cut 5 calendar days before points deposited into her Southwest account.

So, based on that math, I’d say you should see the points on January 29th, though I’d give it a day or two beyond that in case there is a difference in the number of business days.

OK thanks for the quick response. How difficult is it to get the Business Card?

I don’t really have a side business. Occasionally do some software work on the side and had a couple of rental houses but sold those last year.

I got in on the 50K Plus offer on Wednesday before realizing the Premier offer had died.

Really wanted to get the Companion Pass from Southwest.

Should I go ahead with the 40K Premier and make generate the remaining 17K on spend to achieve the Companion pass or wait to see if Chase brings back the 50/60K Premier in the next month or two?

Thoughts?

If you don’t have plans to use the Companion Pass right away, I might give it a month and see. The 40K offer is always there, so that’s not going away. The 50k offers come around pretty regularly. Also, the business card offer is still 60k.

Unfortunately, the 50K offer on the Premier has died. We have replaced the link with the 40K offer, which is the best one currently available. Post update at the top of the page.

Any idea how long these offers will be around? My wife is dropping back down to 4/24 in a month or so.

Thanks.

I know this is off-topic, but since you mention a reason for getting the Marriott card is the free anniversary night, I have wondered at what point do you make the reservation for the free night? And must that be made with a phone call? Do you have a certain amount of time to use the free night? Please point me to an article if you have already explained this. Thank you for your thorough info!

You can make a reservation for your free night any time from when the certificate appears in your account (after your first anniversary of card membership) through the end of its validity. These certificates used to only be valid for 6 months, but they are now valid for 1 year.

You can easily make the reservation online. Travel With Grant has a great write-up on the mechanics of using your free night:

http://travelwithgrant.boardingarea.com/2014/05/28/using-a-marriott-free-night-certificate/

Thank you, Nick. I know you are in countdown for your bambino!

I’ve used those every year so you just reserve a room in a hotel in the correct category and one of the ways to pay for it is “use your free night certificate”. Reserve room with credit card, use certificate to pay and then you get a message that your free night certificate is being sent to the hotel you chose and will be in their computer already when you go to check-in. Very easy and I’ve never had a problem with it. In fact, as I remember whenever I want to reserve a room on the Marriott website it kind of reminds you that you have an unused free night certificate and “do you want to use this for your stay”? or something similar.

Would they really approve the Plus and the Premier card at the same time? I would hate to get approved for one and then get denied on the other one and be stuck in no man’s land as far as the companion pass is concerned.

Also I got approved for the SPG card last August, the Amex Platinum in November and my wife received that targeted Citi offer for their Gold AA card with the 55,000 miles + 10,000 miles sign up bonus. If you receive a targeted, direct mail, pre-qualified credit card offer, doesn’t that mean they already looked at our credit report? And does the Platinum charge card fall under the 5/24 rule since it is not a credit card?

Hi Norman! Yes, plenty of people have gotten both at the same time before. Does that mean they will approve you for both? I obviously can’t say for sure. But it’s a strategy people have used for years to earn the Companion Pass (and a family member of mine got instantly approved for both the Plus and Premier on the same day this past fall….my wife got instantly approved for the business version and one of the personals on the same day this fall as well).

To the next piece of your question: First of all, the 5/24 rule is a Chase thing. Chase looks at your personal credit report and counts all of the accounts you have opened in the past 24 months. Any personal credit cards you have opened, with any bank, will be on your credit report. Most business cards are not on your personal report (but some are — for example, Capital One business cards report on your personal credit report and count towards your 5/24 count).

Your wife’s Citi AA card has nothing to do with your 5/24 count (unless you are an authorized user on it). As for a targeted pre-qualified mailer, I wouldn’t read too much into what it means in terms of the bank having looked into your credit report. That mailer means that you are opted in to receiving pre-qualified marketing offers and that your credit report info met a marketing standard at the time it was pre-qualified (which could have been months prior). I’m not sure how much of your report information the credit bureaus sell to the bank for these marketing mailers. They certainly haven’t done a hard pull of your credit yet for that — they will do a hard pull when you apply. That said, if you have good credit, I think it’s reasonable to expect to be approved — but, for example, a targeted mailer about the Southwest Airlines credit card won’t get you approved if you are over 5/24. Targeted mailers can be great — sometimes their terms are different than public offers. For example, while Amex usually states that you can’t get a signup bonus if you have or have had the card at any time in the past, targeted mailers sometimes do not have that language (and people have in fact gotten the signup bonus a second time with those offers). And that Citi AA offer you’re noting is great if it’s on the Gold AA credit card. So I’m not telling you to ignore them — just that a mailer doesn’t mean the bank has examined your credit report as they would when you actually apply for the card.

As for the Platinum charge card — yes, that counts towards your 5/24 count (unless it’s the Business Platinum — Amex business credit and charge cards do not report on your personal credit report). All Amex personal credit and charge cards would count towards your 5/24 count.

So it sounds to me like you are at 2/24 (Amex SPG and Amex Platinum) at least. Add any other cards you have opened in the past 24 months to get your full count.

Hope that helps.

That does help a lot thank you. I do have a good credit score which was 786 on the FICO 8 scale but was over 800 last June. But I have another problem with Chase anyway which is really annoying. I’ve used their Marriott Rewards Visa for years and years now, but I just realized (because I only recently started paying attention to points) that my card only gets 3x points on Marriott stays vs 5 points on the newer Marriott cards. Plus I don’t get anything extra for dining either and since I already have the SPG card which in effect gives me 3 Marriott points on everything I was thinking I should drop the Marriott card and get a new card with the 80,000 point sign up bonus and 5x points like everyone else gets. Or two Southwest cards or the Chase Sapphire Preferred? What is your number one card out of these? Oh and I think I’m at 3/24 because I opened and closed a Barclay Red Aviator card last June that was offered on a flight home from BVI. Right now I fly mostly American Airlines but since St. Louis has no real airline hub, Southwest has almost the entire terminal 2 at Lambert to itself which is pretty nice.

Undecided! Just looking for suggestions as I am all new to this.

That’s a complex question.

First, you don’t need the Marriott card to pay for stays. Use your SPG card. You’ll earn 2 SPG points for every $1 on Marriott spend — that’s 6x in terms of Marriott points. The SPG card is the best card for earning Marriott points on spend, whether at Marriott or anywhere else. The only two reasons to get and keep the Marriott card are for the signup bonus and annual free night. If you’re a night or two short of elite status, it may make sense to spend on it since you get an elite night for every $3K in spend. If you’re looking for Marriott points, another option is to open the SPG Business card, since those points also convert to Marriott at 1:3. If you’re interested in the annual free night and the 80K points, the Marriott card can definitely make some sense…but if you’re looking to trim down your options, I might trim this one if the Companion Pass is important to you.

As far as getting the Sapphire Preferred vs the Southwest cards, that really depends on your overall goals. If you want the Companion Pass, two Southwest cards is the way to go. I think the Southwest Companion Pass is the hands down best value in domestic travel if you usually travel with someone. I also love the flexibility of using Southwest points — you can cancel up to 10 minutes before the flight and the points just go back into your account, no penalty.

If you are mostly looking to build points for international premium cabin travel, two Southwest cards wouldn’t make any sense. In that case, I’d say to sign up for a Sapphire Preferred (or Reserve) card and a Freedom/Freedom Unlimited/Ink Cash card so you can earn transferable points (and at better than 1x with the Freedom, Freedom Unlimited, or Ink Cash depending on your spending patterns). Chase Ultimate Rewards has tons of great partners where you can transfer your points.

Ultimately, I’d say that if you’re looking to travel mostly within the US, the Companion Pass is hard to beat — especially if you can earn it early in a year like this (so you basically get 2 years out of it). You can change your companion up to 3 times per calendar year, so if you might travel with one or two different people, you can still leverage it. If you’re looking at more of a long-term international award ticket strategy, you should probably consider an Ultimate Rewards approach, which means considering the Sapphire Preferred & Reserve, the Freedom cards, and the Ink cards.

Hi,

If I signed up for Chase Southwest Plus at the end of last year with the 40k points + Companion Pass offer, do you think Chase will still give the extra 10k points if we ask them to match? Actually I don’t mind asking, just worried that they will match and remove the companion pass.

Do you see the Companion Pass in your Southwest Airlines account? I assume you do, in which case you have it. I don’t think it’s possible for Chase to take that away from you at this point. At the same time, I don’t know as though they’ll match since your signup bonus actually included the Companion Pass — not sure how that will affect their view on matching the additional 10K points, but it’s probably worth a secure message.

I am just now finishing the $1000 spend to get the 40K points from last year’s “California one-year Companion Pass” offer; the Companion Pass is already in my account. I now want to sign up for the 60K point Business card.

Will the 40K pts + 60K pts + $10,000 spend allow for me to extend the one-year Companion Pass to two years?

Yes, it would.

However, you might rather consider another option: Wait until January 2019 and apply for the business card and other personal card to have a Companion Pass through December 2020 (or apply late 2018 and start the spend, finishing the spend in Jan 2019). Of course, that’s assuming:

A) Credit card points continue to count

B) Signup bonuses are still big enough to do it

C) You stay under 5/24

D) You get approved

All of which is worth considering. If you’re planning to go over 5/24 and just want to extend to 2yrs of CP now, striking while the iron is hot, go for it.

I also just got the Chase/SW promotion for CA resident with the free companion pass in November with the 40,000 points bonus and just sent a SM to Chase asking if they are willing to match the new promotion, they said yes 🙂

Thanks Nick

Hi Lana,

Did Chase say they will match the 50K points with the original $1,000 spend, or will you need to spend $2,000? Also, are you retaining the Companion Pass?

Hi Tim, Chase said they will match the 50,000 bonus points if I spend $2000 and still able to keep the companion pass

Lana, I appreciate the information.

What’s the recommendation on timing the applications if I decide to open BOTH personal cards (or) a personal & business card? Same day applications? A week apart? Thanks.

Oops, sorry Nick. Just saw your answer to Izzy…

I should note that another family member did both personal cards in the same day last fall with no issues.

My wife did a business and personal in the same day with instant approval on both. She then applied for a third card that day. It wasn’t instantly approved, but she got it approved on recon by moving credit from another card. Some say that was the cause for her Chase Financial Review, so keep that in mind if you do open both at once. Note that if you open both personal cards on the same day, most people report only getting one hard pull (but a business and a personal will cause 2 pulls no matter the timing).

See Chase Financial Review posts:

https://frequentmiler.com/2017/12/08/shop-until-youre-dropped-chase-financial-review-freezes-account/

https://frequentmiler.com/2017/12/15/chase-financial-review-results/

Personally, I wouldn’t worry about doing both in one day. It’s been done many times before. But YMMV.

I thought auth user cards did NOT count towards 5/24 rule??

Good point. They do and they don’t. They will prevent automatic approval as the computer system will count them. Many people have reported success on recon in getting the agent not to count AU cards.

Hey Nick. If my wife is at 4/24, it makes sense to open the business 60k and then the next day open the personal 50k. That should work since 5/24 doesn’t include business, right?

That’s correct, though I’m not sure you need to wait until the next day. My wife recently opened the business and a personal in the same day and received instant approval on both. Chase business cards do not count towards 5/24 status as you said:

https://frequentmiler.com/2017/09/07/chase-business-cards-dont-add-524-count/