In 2024, I intend to enjoy some of my elite statuses. I don’t anticipate chasing after qualifying for many statuses this year, but I do have a few tricks up my sleeve and angles I intend to play in 2024 in order to enjoy elite benefits with low effort to achieve them.

Hotel elite statuses

Hyatt: Here’s hoping for 40 nights

I intend to enjoy my Hyatt Globalist status in 2024. I have a couple of stays planned where my elite status will come in handy and I’ll plan a few more before all is said and done. However, I highly doubt that I’ll requalify for Globalist status.

That said, I think it isn’t impossible that I’ll get to 40 elite nights. That’s significant because the Milestone Rewards available at 30 and 40 nights are valuable. At 30 nights, I’d earn a Hyatt Category 1-4 free night certificate. At 40 nights, I’d earn a Guest of Honor stay and the ability to choose a Suite Upgrade Award. I could probably get by in 2025 with just those two Milestone Rewards (and the hopes of getting a Globalist friend who has more Guest of Honor stays sharing one with me on the occasion that I really need Globalist status benefits).

While it isn’t impossible that I’ll get to 40 nights, neither will it be a slam dunk. I had some fraud alert issues with my new World of Hyatt credit card that prevented me from getting $15K spend in the final days of 2023 for the free night certificate and full welcome bonus, so I’ll be doing $15K spend in the coming weeks / months to earn both the full welcome bonus and the additional Category 1-4 free night certificate. Between the 5 nights I get for holding the card and the 6 nights I’ll get from the spend, that starts me out at 11 nights. I currently have 8 Hyatt nights booked this year at Hyatt properties, but I am likely to imminently add a reservation for at least 3 more. That means I will be on track for about 22 elite nights without any additional credit card spend or bookings. Since it is only January, I find it very plausible that I’ll end up needing at least 8 more nights over the course of the year and as such I will likely get to at least 30 nights between nights spent in hotel and the credit card nights referenced above. Since there have been quarterly spending bonuses on Hyatt cards, I think it is likely that I’ll pick up at least another 2 or 4 nights from credit card spend. I won’t be surprised if I end up close enough to 40 to justify a short mattress run toward the end of the year.

However, again, I don’t anticipate that I’ll requalify for Globalist. It’s not that I don’t want to have Globalist status, I just know that I’ll fall at least 20 nights short and I can’t imagine dedicating enough credit card spend to bridge that kind of gap.

Marriott: Lowly Gold

I did not complete the nights required to maintain my Platinum status at Marriott last year, so I dropped to Gold status for 2024. I began 2024 with 30 elite nights (15 from having a Marriott business credit card and 15 from having a Marriott consumer card).

While I would like to have Platinum status for free breakfast and a 4pm checkout, I’m very unlikely to spend 20 nights at Marriott properties this year unless the Marriott / MGM partnership mirrors the Hyatt partnership (whereby one could earn elite nights pretty cheaply given the prices of some Vegas properties). However, I doubt it’ll work out as well as we want — I bet that Marriott will award 1 elite night per two nights spent at the cheap Las Vegas properties (and maybe institute a minimum cash price per night?).

I currently sit 2 years and about 120 nights short of Lifetime Platinum status. In 2025, perhaps I’ll make it a point to qualify for Platinum since my 30 elite nights earned on January 1, 2025 will put me 90 nights and 2 years of Platinum status short of Lifetime Platinum status. If I stay 20 nights at Marriott properties in 2025 (on top of the 30 I earn from the credit cards), that will drop me to 70 nights needed and 1 more year of Platinum status. In 2026, I’ll requalify with 50 nights and then in January 2027 my credit card nights should put me at Lifetime Platinum. But I don’t need to go after Platinum status this year and I currently only have 6 nights booked at Marriott properties this year. I’ve got free night certificates to use, so I’ll end up with a handful of nights, but probably not enough to make a difference in status this year.

I also have a bunch of Marriott gift cards, so I’ll use those when I need to pay for breakfast . . .

Hilton: Diamond via credit card

Hilton Diamond status is super easy — one only needs to hold the Amex Hilton Aspire card to have Diamond status. Diamond doesn’t offer any tangible benefits over Gold status, but if you want top-tier status, it doesn’t get easier than with Hilton. I don’t intend to do anything additional with Hilton apart from using my free night certificates and enjoying a breakfast credit when I do.

Wyndham: Diamond via credit card

I intend to keep my Wyndham Earner Business credit card for as long as it offers 8x at gas stations and Wyndham Diamond status.

I haven’t stayed at a Wyndham property in several years (update: Except for that one we stayed at just last year…whoops, forgot about Iguazu Falls!), but I still like my Wyndham points for Vacasa stays for now. But mostly I like my Wyndham Diamond status because of the easy path it provides to casino elite status.

Airlines

American Airlines: Platinum Pro (for a few more months)

I currently have American Airlines Platinum Pro status thanks to a targeted match from Hyatt Globalist status last year. I already had American Airlines Platinum status from the Loyalty Point games, but now I’ve got to complete earning 42,000 Loyalty Points by 2/1/24 in order to keep Platinum Pro status through June 1, 2024.

I expect to complete this match, though in all honesty there isn’t a lot of justification for it. I’m mostly maintaining it for now because it’s relatively easy. I did fly American with Platinum Pro status once last fall, but it was underwhelming (I didn’t expect to be wowed and wasn’t).

That said, the free checked baggage and oneworld Emerald status is bound to come in handy at some point. Unfortunately for me, the point where that is most likely to be useful is on a trip that starts at the end of July. Do I want to have to earn another 42,000 miles by June 1st to keep the status until I have some decent chances to use it while flying British Airways? I don’t know.

That said, when I finish my challenge, I’ll have more than enough Loyalty points to have AAdvantage Gold status through the end of the next membership year, so I won’t be totally statusless even if I don’t continue to chase this.

All that said, I’m not flying American or other oneworld carriers much, nor do I intend to any time soon. I’m disappointed that the partnership with JetBlue ended. At the end of the day, I probably shouldn’t be chasing American Airlines elite status…..but it’s easy enough that I may make some effort to chase if only for the chance to match it to other airlines that are more useful to me down the road.

Southwest Airlines: A-list for P2?

Southwest Airlines elite status isn’t terribly meaningful, but free same-day standby and same-day changes can save you a bit if you would otherwise book a Wanna Get Away Plus fare to get those things included.

A-list Preferred comes with a 100% bonus on points earned flying, free in-flight WiFi, and a free drink in-flight. I’d love to have the free Wi-Fi, but Southwest hasn’t offered a match that included A-list Preferred in quite some time.

Southwest does offer a match to A-list status if you have status with another US-based carrier. To keep status for a full year, you need to complete three round trips or six one-ways within 90 days.

We have a trip to Hawaii planned this winter and we could pretty easily pick up four one-way flights. If we were to time out a match shortly before that trip, we’d essentially have most of 90 days to pick up two more Southwest flights and keep A-list status.

My wife will probably earn American Airlines Gold status sooner rather than later, so I think we’ll probably have her sign up for the Southwest match. I’d rather she get A-list status than me because she is the Companion Pass holder in our household.

In other words, we usually buy tickets for my wife and our sons and then add me as the Companion after booking their seats. I’ve been booking my wife and our boys mostly into Wanna Get Away Plus so we have the shot at a free same-day change when we want it, but if she had A-list status when we could book Wanna Get Away fares and still get the free same-day change.

To be clear, this would only change our behavior when booking with Rapid Rewards points. If we’re booking with cash, we’re likely to still book Wanna Get Away Plus fares so that if we cancel, we end up with a transferable credit. However, when booking with points, the points go back in your account immediately when you cancel, so the only advantage of booking Wanna Get Away Plus when using Rapid Rewards points is for free same-day change and standby. If we can get those benefits from A-list status, it’ll save us some points.

Turkish Airlines Miles & Smiles: Elite for Star Alliance Gold

This week, I submitted a status match request to Turkish Airlines Miles & Smiles. I picked up on this match just by browsing through general data points on statusmatcher.com (and then when I went to write this post, I found that Executive Traveller wrote about it a couple of weeks ago). It seems like Turkish has a pretty widely available status match, but as is the case with many other things with Turkish, you need to fill out their online feedback form to accomplish the match.

The match initially includes 4 months of status. To extend status for an additional 8 months (for a total of one year), you just need 1 Turkish Airlines flight in that four month period. Then, to keep Turkish status for another year (for a total of 2 years), you just need to earn 15,000 miles in that first year on Turkish-operated flights. Given that a round trip from New York to Istanbul would be 10,000 miles flown without any additional segments, it wouldn’t require an unreasonable amount of mileage running to keep status for two years.

You can find the link for “Feedback” at the bottom of the home page (or click here) and chose “Membership processes” for the purpose of your feedback. I attached screen shots of my American Airlines Platinum Pro card, my recent AAdvantage activity, and the photo page of my passport along with the following message:

Hello,

I am writing to inquire about a status match with the Turkish Airlines Miles & Smiles program. I currently have oneworld Emerald status (American Airlines AAdvantage Platinum Pro). I am attaching a copy of my AAdvantage card, my passport photo page, and my recent activity. I very much appreciate your consideration and look forward to hearing from you soon.

Sincerely,

I got a response after only one day:

Dear Nicholas REYES,

Thank you for choosing Miles&Smiles, the frequent flyer program which offers a whole world of benefits.

So that we can fulfill your request to match your membership status to Elite and offer you a truly special flight experience, we need you to send us the documents listed below. You can do this by checking the “Previous feedback” option on our feedback page.

- A photograph or scanned copy of your membership card (front and back) for your other airline’s frequent flyer program that has at least 4 months of validity or a document that shows your Oneworld Emerald membership has a validity of 4 more months with QR code

We look forward to bringing you all the benefits that Miles&Smiles has to offer.

Sincerely Yours,

I responded with some additional information and they replied again with the same message shown above. My expiration date will show a date at least 4 months out soon enough, but I was hoping to execute this match sooner rather than later because I have an upcoming flight on United and we may need a checked bag and would appreciate priority boarding. Unfortunately, this won’t work out in time for the imminent trip, but those things will be even more important on a coming trip to Hawaii, so one way or another I hope to make this match happen.

Based on data points at Status Matcher, it looks like both American Airlines Platinum Pro and Executive Platinum have matched to Turkish Elite status rather than top-tier Elite Plus status. However, Elite is enough for Star Alliance Gold. There are also a handful of perks when flying Turkish that maybe I’ll dig into if my match goes through.

Singapore: Nothing (Not matching Marriott)

Singapore has a match with Marriott, but I’m not going to do it. While I didn’t requalify for Marriott Platinum status, I do still have Platinum status at this point since the Marriott membership year has not yet ended, so I think maybe I could get in on the Singapore-Marriott match…..but I won’t.

Singapore is offering the chance to get Silver status if you have Marriott Bonvoy Platinum, Titanium, or Ambassador status with the chance to earn Gold status with four flights on Singapore Airlines within six months. That sounds not so bad (particularly if you can take advantage of a fifth freedom route within Europe), but I am interested in Star Alliance Gold status relatively imminently and I wouldn’t be able to meet Singapore’s flight requirements until about six months from now (or really more like 7 months from now, which means I would have to wait to match next month).

I’m hoping that the Turkish match comes through since that will give me benefits on near-term United flights and mean that I won’t really need the Singapore match right now.

Casinos

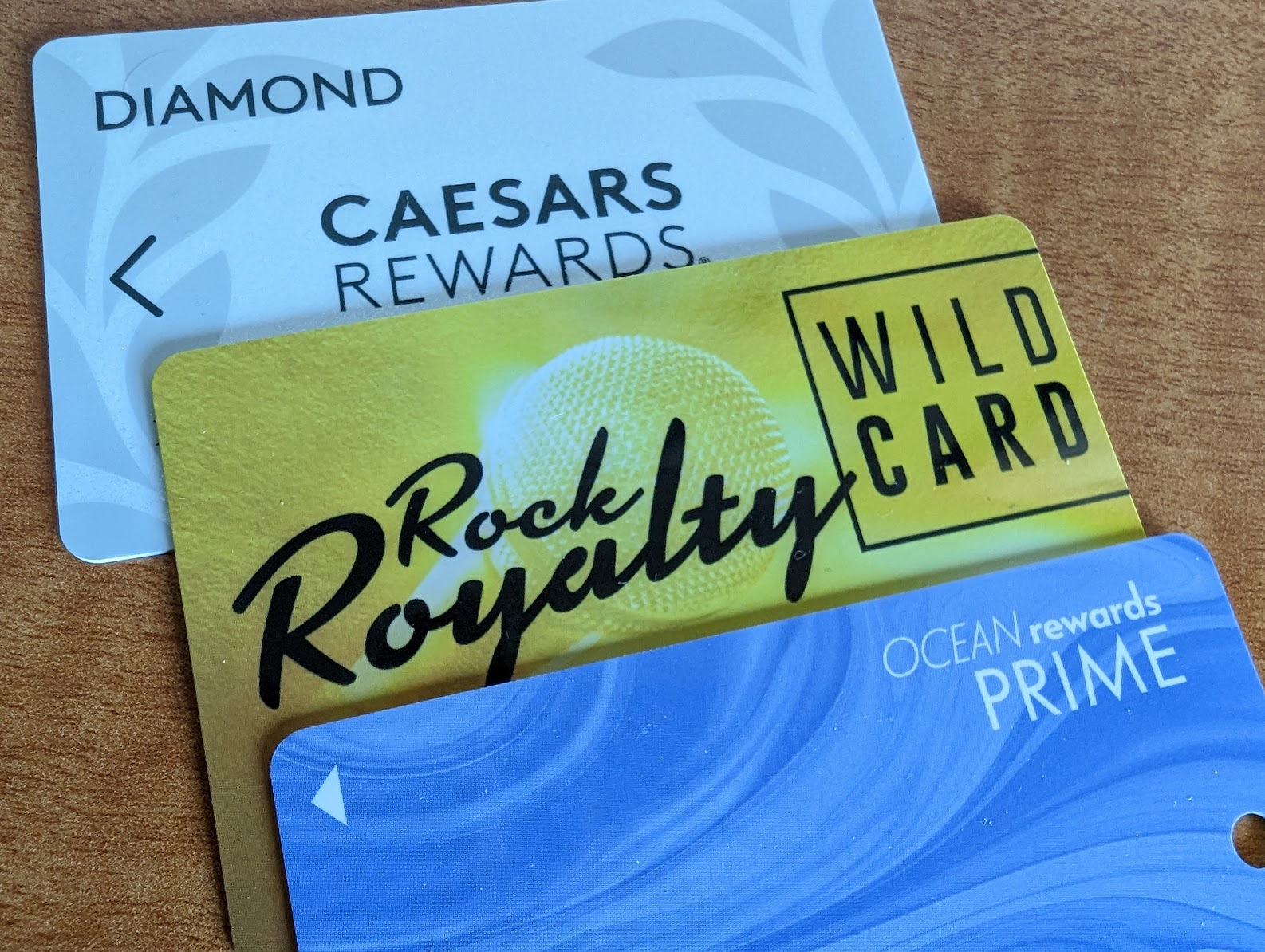

Caesars: Diamond

I hope and expect to keep my Caesars Diamond status by virtue of having Wyndham Diamond status. Some people have had problems matching between Caesars and Wyndham over the past few years. Unlike some folks, I had been able to match back and forth for years (ever since Wyndham offered a hotel match several years ago). Many people were told last year that Caesars wouldn’t match them if their Wyndham status came from a match (even though it worked for me).

However, last summer, I picked up the Wyndham Earner business card. Those whose Wyndham Diamond status comes from holding the credit card have been able to re-match to Caesars Diamond. I expect to have no trouble matching back to Caesars Diamond when my Caesars status drops on February 1st.

Ocean Casino Resort: Hoping for more Prime time

Ocean Prime status from Ocean Casino Resort in Atlantic City has been incredibly valuable for me. Since matching to Prime status last March, I’ve booked a 7-night European cruise for a $400 deposit + $259 per kid (since we have 4 people in a cabin) and my wife also matched and booked a 7-night Caribbean cruise with the same deal. We each booked 2 free nights at Resorts World in Las Vegas at the Conrad Las Vegas, where we will each get $100 in dining credit and $100 in FreePlay (we each booked our own room so that we’d both get the benefits). The cash rate for two nights during the dates we needed (we have to be there for an event) was $846. Between the cruises, the free nights in Las Vegas, and the dining credits and free play in Las Vegas, Ocean Prime has proved to be worth thousands.

We got Ocean Prime status by matching Caesars Diamond to Hard Rock Rock Royalty and then matching Hard Rock Rock Royalty to Ocean Prime. I did the match in March 2023 and my wife did it in April 2023.

As of July 2023, Ocean has required players to have 18 months of inactivity before being eligible for a match again. That means my earliest chance to match again would be November 2024. I certainly haven’t been counting on this match persisting that long, but I’ve been hoping I’ll be able to re-match when the time comes later this year.

If I’m able to do that, I’d be able to grab another free cruise before July 1, 2025 and another couple of nights in Las Vegas (assuming those benefits continue to be offered). Frankly, I’ve been surprised that the pieces of this puzzle have lasted this long. I’ll be thrilled if this works out and not too shocked if it doesn’t.

MGM: Will Marriott match up?

My MGM status is back down to no status at all, but I’m hopeful that we’ll see a chance to match something over from Marriott. We initially expected that we’d know what’s going on with the new partnership in October, but Marriott later indicated that we’d find out more in “early 2024”. Since I still have held over Marriott Platinum status at the moment, I’m hoping they get their stuff together and institute some sort of a match soon and it works despite the fact that my Marriott status is scheduled to expire. That’s probably wishful thinking, but I’ll take the long shot odds.

Cruise Lines

MSC: Diamond

MSC offers a status match whereby they will match a wide range of cruise and hotel loyalty programs (oddly, airline loyalty programs are excluded per the terms). Quite a few easily-gettable hotel elite statuses will qualify you for MSC Diamond status. Frequent Floaters has a chart for what matches, but the chart may be out of date (notice that it still has Starwood Preferred Guest on the chart for example). In our case, I matched from Hyatt Globalist and my wife matched from Hilton Honors Diamond and both of us got MSC Diamond status.

MSC Diamond has some decent benefits, including priority boarding and disembarkation, a complimentary specialty dinner once during your cruise, a free cocktail reception, a bottle of sparkling wine and macarons in your cabin, and a chocolate gift at the beginning of your cruise (along with robes and slippers in your cabin). You also get some discounts, like 40% off onboard photos. See full benefits here.

Once you match to MSC Diamond, you need to cruise with MSC once every 3 years to maintain your status. We cruised with MSC last year and will cruise with them a couple of times this year, so we’ll make use of the benefits and keep them alive for a couple of years (hopefully long enough to snag another free cruise!).

Rental Cars

National Executive (or Executive Elite?)

A number of ultra-premium credit cards offer free National Executive status. There was an Amex promotion a few years ago where you could get Executive Elite status (which sounds the same but is actually a tier higher) by signing up and maybe renting once (it was a long time ago, I’m fuzzy on the details). I completed that promotion and have subsequently kept Executive Elite status for years since.

If 2024 is the year that I finally lose the extra “elite” distinction, so be it. Executive status will be good enough for me. Either way, you can rent a mid-size car and pick from the Executive Selection, which is what I want. I have usually found (at least in the past) that I could rent a mid-size car with National and get an SUV or minivan in the Executive Selection area. I added the “at least in the past” caveat because the last time or two that I reserved a car with National, that wasn’t the case — things like minivans or any SUV with a third row were kept separately and subject to an upgrade charge. I think that might have just been the location where I rented (online reports suggested it was a less generous locale).

At any rate, I won’t put any effort into this, I’ll just maintain it via the right credit cards.

Hertz President’s Circle

I’m still an authorized user on my wife’s Capital One Venture X card, so I’ll maintain Hertz President’s Circle status in 2024 (though reports yesterday indicated that this benefit will end on schedule on 12/31/24).

I’ve actually rented from Hertz more than any other company over the past year (in part due to targeted Capital One Shopping offers in the range of 12 to 30% back). Yes, I am aware of the reports of people being arrested after returning rental vehicles and blacklisted before they’ve ever rented from Hertz, but I haven’t yet had such an issue.

Like National, I like being able to select my car from a nicer selection at Hertz, though I far less frequently find larger vehicles available via the Hertz President’s Circle section. I’ve adjusted by getting my family to pack progressively lighter to the point where we can now get by with a full-size sedan and Hertz usually has a couple of decent options available.

Nick if you do end up going after a second Southwest companion pass remember that you can get reimbursed for 365 WiFi credits with the Southwest Performance Business card. When I had the card that was nice to be able to activate WiFi on multiple devices for our family or anyone traveling with us.

Now whether the WiFi was actually usable on a majority of flights was another matter, but it at least didn’t matter much since it was no extra cost.

Hey Nick,

As someone with also 2 kids (one of them coming in 2 months)

Would love to see how you plan your trips for the year, and also what trips you took last year if they were planned or last minute.

Thanks in advance

Hey Nick, great post. Regarding MSC diamond elite status, I have that status but don’t have any free MSC cruise offers.

Do you think you can status match MSC Diamond to any other cruise line?

Would you pay for a MSC cruise if you had MSC Diamond? I can’t recall seeing any Chase or AMEX Offers for MSC.

Thank you.

I’m not aware of other cruise lines matching that status, nor am I aware of what advantages you would stand to gain. I probably wouldn’t pay outright for any of the major cruise lines without a major discount offer. I did book a Carnival cruise this year with a “free interior room” offer ($100pp for 2 people, but then more for the kids and with taxes for four people it came to about $1400 — used an Amex Offer for 25K Membership Rewards points and we’ll get $200 in free play back on board, so if we call that a net ~$1K for 10 nights of food / entertainment / lodging / transportation, I can live with that. Maybe I’d pay the same for an MSC cruise, but probably not a lot more.

The Hyatt business card might be a good add if you’re trying to do some serious spending to hit Hyatt 60 nights again 🙂

I did have to chuckle because I stayed at a lot of SLH’s last year (like the SLH Victoria Como like yourself) and obviously Globalist made no difference there 😀

For hotels: 1) late checkout and 2) breakfast outside the US. Those are the only two benefits I even think about. Upgrades? Nope.

That makes sense. Before kids, we only cared about late checkout and breakfast, also. With kids, it makes a much bigger difference to me now.

What type of activity on AAdvantage is the Turkish match looking for? a certain number of flights or what? Why is 2 months of AAdvantage activity needed?

I don’t really know. I submitted a screen shot of my last ~2 months of AAdvantage activity and they didn’t mention that, just the expiration date on the status.

If one only buys premium cabin tickets and buys them with points, does tier status really matter (other than IRROPS)?

For British Airways yes. You need silver status to pick seats at purchase, bronze to pick seats 7 days before departure.

I don’t know any other airline where that matters for premium seat holders.

Probably not. That’s always been why I wasn’t terribly concerned about airline elite status — most of my flights are international business class awards.

However, I have a couple of long-hauls to Hawaii in economy on United this year (booked with Turkish miles), so I’d love to get Star Alliance Gold from Turkish for the free checked bag and priority check-in and boarding.

Platinum (not Pro) status with American gets you Main Cabin Extra seats at booking plus access to business class lounges internationally. I was very surprised to get an upgrade the last moments of my Platinum Pro status to a business class seat on a transcon JFK-LAX flight yesterday – I was shocked to get that with just a Platinum Pro as I rarely fly business and it was a lie flat seat. The food was quite good! I could have slept just fine in a main cabin extra seat however. But what I wanted to say is using the shopping portal it can be pretty easy to rack up Loyalty Points. I got 5000 points for donating just $150 to a good cause. Not a great way to earn just AA points but a great way to get LPs for status.

My plan is to requalify mostly via the portal for Platinum status with this status match (you can soft land to Platinum by hitting 25K loyalty points in each four-month period of the challenge). I’ll probably see if I can soft land to Platinum year after year since I can do it via the shopping portals without diverting a ridiculous amount of spend.

As a 2023 Globalist you get 5x GoH which if you give them away gets you another 5 night credits

Good point!

Nick, did you plan on trying to extend the TK status?

Any interest in the Delta status match? I have no immediate plans of travelling with Delta, but being able to get top tier status for almost 2 years by spending $37.5k on a CC seems pretty achievable. I have AA PP until March 31st which I got purley from spend and won’t be renewing. I’m kind of thinking having a high status level with at least one airline is useful for matching purposes.

I might try to extend. We’ll see. I have something else booked for an itinerary of about 10,000 miles that i *could* book with Turkish (using something like a Business Platinum pay with points rebate). It’s a bit up in the air.

Oh, and I forgot to reply about Delta. No, I have no plans at all for Delta status. In the last 20 years, I’ve probably flown Delta 4 or 5 times (at least half of which has been on Virgin Atlantic awards in business class, where Delta status wouldn’t have mattered). Yes, it would be easy enough to get, I just wouldn’t make use of it.

I was looking at the Flying Blue CC today. It seems to me that crediting to Flying Blue on Delta might be a decent strategy, especially if you fly Basic Economy. They will give you 20% flight Miles in BE (which earn nothing on Delta) and low revenue tickets are not that valuable.

The other thing is that XPs seem cumulative from year to year, so if you don’t earn enough to make status in one year, you can roll over XPs until you have enough to cash in for meaningful status. Is this correct? Regardless, it seemed like an interesting program structure for getting status.

Nick, should your statement on AA Loyalty read… I’ve got to complete earning 42,000 Loyalty Points before 3/1/24

No, he has an instant pass challenge with the first qualification period ending 2/1. He’s not referring to the standard qualification year.

Darin is correct. I mentioned that I’m on that match — I need to earn them by 2/1.

I always love reading these posts, thanks, Nick. Hearing your thoughts and where your priorities lie is interesting. If you expect to hit 40 nights with Hyatt through mostly stays, what’s preventing you from hitting $40k/$50k spent on Hyatt cards to clear 20 more nights and hit Globalist again at 60 nights? It seems like you and Greg have methods to easily spend on cards, and to me, it seems like you would prioritize that highly based on your numerous Hyatt stays. Or do you prefer to divert that spend to other SUBs or 5x for office stores?

At first glance, it feels like a lot of spend to commit at 1x when I have easy ways to earn Hyatt points at 5x. While I highly value Hyatt points, I don’t so highly value earning them at 1x if that makes sense. I feel like the opportunity cost is probably too high to put another $40K or $50K spend on it, but at the time time I reserve the right to decide that you’re right :-). It’s a long year!

What are easy ways to earn Hyatt points at 5x???

PS. I would love a weekly feature where you do something similar for a reader to optimize their points earning and usage.

Using the ink cash at office supply stores for 5%/x back that can be transferred to Hyatt 1:1 would give you 5x back in Hyatt. You can buy giftcards there

That doesn’t sound so easy to me.

I guess churning Inks is also a great return but that also seems a little sketchy and painful.

One man’s trash is another man’s treasure. Staples for a long time was allowing up to 8 cards per person per day (and the stores in my area have mostly still been allowing that), so my wife and I would walk in and buy $1600 each, walking out with 16,000 points on $3200 spend. In our area, it is still easy enough to liquidate the gift cards. I’m not too interested in dedicating $50K spend at 1x when I can earn 50K points in just over 3 trips to Staples on $15.6K spend (which we might do in a week when the gift cards are fee-free).

I’m new to MS. How do you usually liquidate the giftcards?

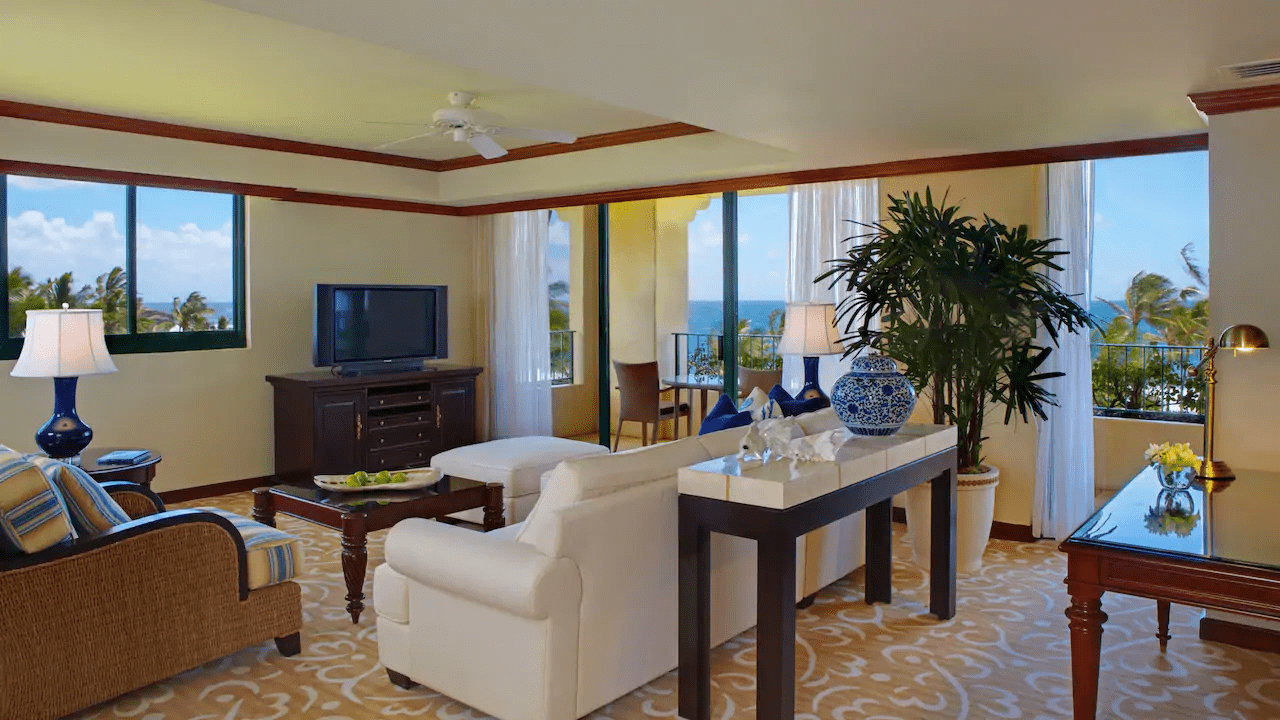

Hi, what’s the first picture’s footnote referring to? “If you were hoping to lock up this view a year in advance, you’ll now need the points to do so within 60 days.”

Sorry, that was an old caption from a different post. My eyes missed it when I added it to this post — I’ve removed that.

No worries! What post was it from? Always on the lookout for a Bora Bora deal. 🙂

Marriott used to allow Points Advance where you could book a stay without the points as soon as the schedule opened a year in advance and you’d only need to have the points in your account to cover the stay by like a week or two before the stay. It was a way of essentially speculatively holding reservations, which was helpful for high-demand properties like the St. Regis Bora Bora. However, Marriott changed that at some point and required that you have the points within 60 days of making the Points Advance reservation. That pic was used in the post about that.

You think MGM is going to status match Marriott?? Are you that naive? Cosmo merge was to be February. Now it’s late fall. Getting MGM Gold takes a ton of spending. Coin i. gambling on slots. Forget Platinum. That is 200000 points and that’s close to coin in spending. Don’t worry, we get 30-60 days free rooms with no resort fee, some slot dollars and $100 or more food comps as lowly gold. MGM platinum is casino host territory now. You are getting no match. Who actually goes to Ceasars? Mid strip is nasty.

Like I said, I’m not hopeful that there will be a match. However, I Hyatt Globalist matched to MGM Gold the entire time they had that partnership, so I think it’s not unreasonable to think that Marriott Platinum would match to MGM Gold since requirements are similar. I didn’t mean to suggest that Marriott Platinum would match to MGM Platinum – You’re right, there’s never been a match to MGM Platinum that I know of. I should have been clearer about that.

At the Cosmo, you could choose which loyalty program you wanted to credit, Marriott or Cosmo’s own. I wouldn’t be surprised if they do the same thing with the whole MGM portfolio. Given the delay, I’ll guess they’re working through all of the questions were are asking.

Nick- regarding the MSC Diamond status, I have Diamond status as well (matched from Hilton). The shown discounts (example: 20% off wifi) are not showing when I log into my cruise. I called their casino department and they said that when booked on a casino offer all of the percentage discounts as a Diamond do not apply (but the hard benefits such as Prosecco and chocolate do). In your experience did you get to take advantage of the discounts as Diamond while booked on a casino offer (wifi, laundry, photos, etc)?

That certainly may be true. I wasn’t even aware of the percentage discounts when I cruised last year and we didn’t buy any onboard photos or laundry (We took our laundry to a small laundromat in Port one day and dropped it first thing in the morning and picked it up before going back to the ship, it was much cheaper). I did buy on board Wi-Fi and I did not get any discount, though I didn’t even realize I should get one.

I recently bought Wi-Fi for an upcoming cruise and again it didn’t appear to be discounted when I logged into my cruise, but I didn’t even think about it because I was using it Capital One offer for $44 back, so It didn’t even dawn on me that I should see a discounted price.

I did get the prosecco and cookies/ chocolate, invites to not one but two free cocktail receptions (I didn’t go the second time as I’m not much of a drinker anyway, though the opera singers that performed were very good). There was only one specialty restaurant on my last cruise and it was like a sushi restaurant or something like that and I don’t like seafood, so I didn’t even try to use that benefit.

Nick- did that Capital One $44 off work, or too early to tell? Also, did you get the early embarkation and fast-track disembarkation as a Diamond even though it was a Casino Cruise?

Wanted to bump this to see if you had any thoughts @Nick Reyes Reyes