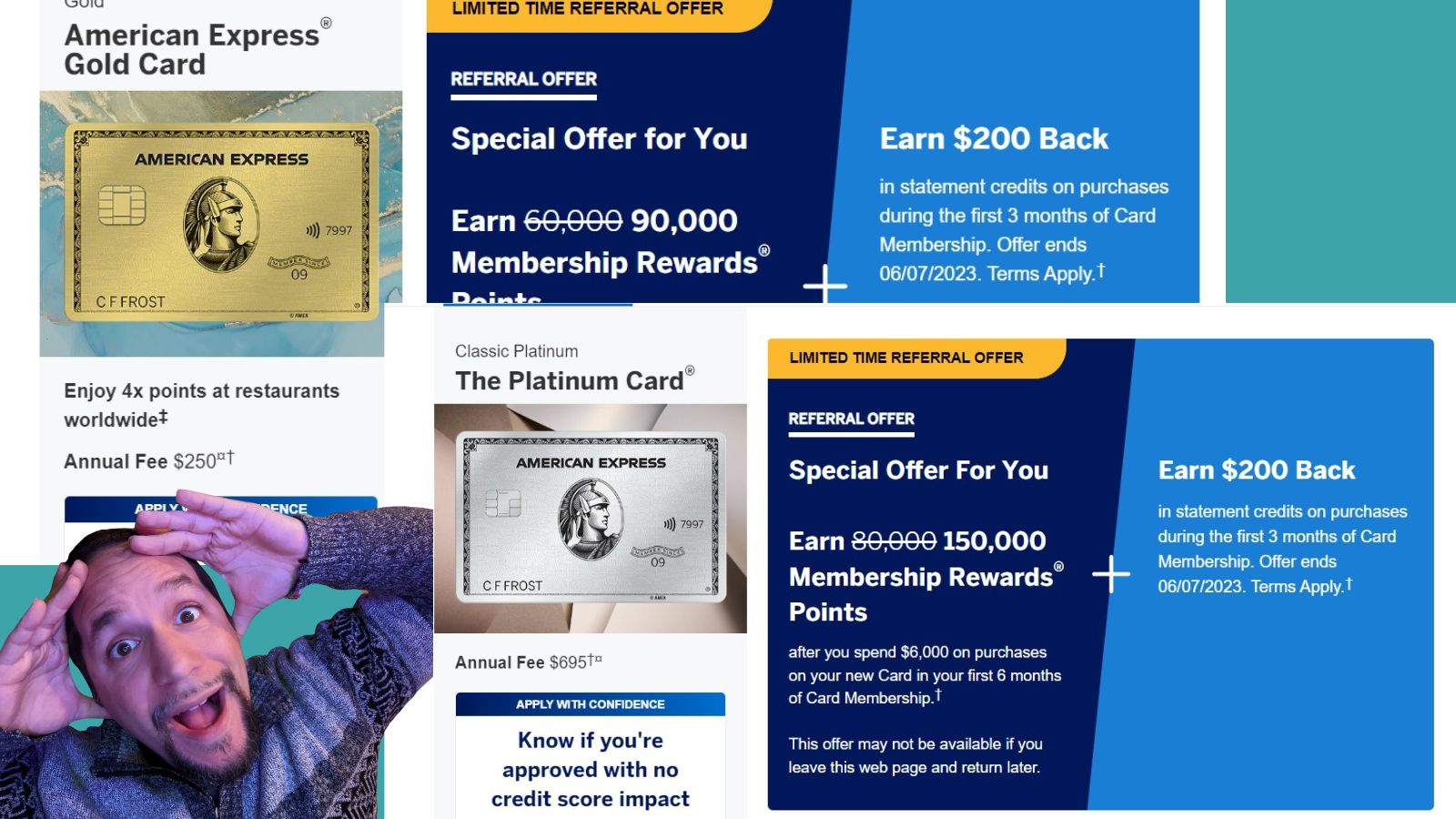

Amex is out with some new nuttiness this morning that kicks up the beat on the Amex Points Parade. First up, there are incredible new offers that kick things up a notch on both the consumer Platinum and consumer Gold cards — each adding $200 in statement credits for purchases within the first 3 months to their already-incredible points offers. These high offers are only available via referral and only some targeted cardholders can generate a direct referral link to them. And that’s where it gets even nuttier: There is a new offer out on many Amex consumer cards to get +5 additional points per dollar at U.S. Supermarkets for 3 months on up to $25K in purchases when referring a friend to an Amex card. That stacks on top of the points you ordinarily earn from referring a new cardholder — and for those with the ability to refer to these new offers, it stacks with an amazing offer for your friend.

The Offers & Key Card Details

For more details and to find a link to apply, click the card names below to go to our dedicated Frequent Miler card pages for these cards.

| Card Offer and Details |

|---|

ⓘ $2259 1st Yr Value Estimate$200 Fine Hotels & Resorts credit valued at $100, $200 airline incidental fee credit for select airline only valued at $140, $200 Uber credit ($15 per month, $35/December) valued at $100, $100 Saks credit ($50 per six months) valued at $25 Click to learn about first year value estimates As high as 175K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer As high as 175K points after $8K spend in 6 months. Welcome offers vary and you may not be eligible for an offer. Terms apply. Rates & Fees$695 Annual Fee Recent better offer: 175K points after $8K spend in 6 months. FM Mini Review: This card is absolutely loaded with high end perks. Depending upon your situation, those perks may be worth the annual fee or much more. Earning rate: 5X points for flights booked directly with airlines or with American Express Travel ✦ 5X points for prepaid hotels booked through American Express Travel Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: Up to $200 a year in statement credits for incidental fees at one qualifying airline per calendar year ✦ $200 prepaid hotel credit per calendar year valid on Fine Hotels & Resorts and The Hotel Collection bookings ✦ Up to $20 per month rebate for Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and/or The Wall Street Journal ✦ Up to $120 Global Entry/TSA Precheck fee reimbursement.✦ $15 monthly Uber or Uber Eats credit ($20 in December, use it or lose it each month) ✦ $199 CLEAR (R) Plus fee credit per calendar year ✦ $12.95 (+tax) monthly credit for Walmart+ monthly membership subscription credit when you pay with Platinum card ✦ Up to $100 in credits annually for purchases at Saks Fifth Avenue (up to $50 in credits semi-annually) ✦ Global Lounge Access benefits: Priority Pass membership (Lounges only) with 2 guests, Centurion Lounge access. Also, Delta Sky Club® access (when flying an eligible Delta flight): 10 visits per year February 1 until January 31 of the next calendar year (after 10 visits have been used, additional visits can be purchased for $50 each or earn unlimited visits after spending $75K/calendar year on the card). Access limited to eligible card members ✦ Rental car elite status ✦ Marriott Gold status ✦ Hilton Honors Gold status Enrollement required for some benefits. Terms Apply. See also: Amex Platinum Guide |

| Card Offer and Details |

|---|

ⓘ $1307 1st Yr Value Estimate$120 Dining credit ($10 per month) valued at $30, $100 Resy credit ($50 per six months) valued at $85, $120 Uber credit ($10 per month) valued at $60 Click to learn about first year value estimates As high as 100K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer As high as 100K points after $6K spend in 6 months. Welcome offers vary and you may not be eligible for an offer. Terms apply. Rates & Fees$325 Annual Fee Alternate Offer: Referral Offer - 90K points after spending $6,000 in 6 months Recent better offer: 100K after $6K in the first 6 months + 20% back at restaurants for the first 12 months up to $250 back [Expired 11/10/24 - referrals only] FM Mini Review: This card offers an awesome return on US supermarket and worldwide dining spend, putting it at or near the top-of-class in both categories. Dining credits and Uber / Uber Eats credits go a long way towards reducing the sting of this card's annual fee. Earning rate: 3X points for flights booked with airlines or on amextravel.com ✦ 4x points at US Supermarkets (up to $25K in purchases, then 1x) ✦ 4x at restaurants worldwide (up to $50k in purchases, then 1x) ✦ 1X points on other purchases. Terms apply. Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: Up to $10 in statement credits monthly with participating dining partners (Goldbelly, Wine.com, Five Guys, Seamless/Grubhub, The Cheesecake Factory) ✦ $10 monthly Uber or Uber Eats credit (use it or lose it each month - must select Amex card as payment method to redeem) ✦ $7 monthly Dunkin' credit - enrollment required ✦ $50 twice-annual Resy credit ✦ $100 hotel credit on qualifying charges on stays of 2 nights or longer, plus a room upgrade upon arrival, if available with The Hotel Collection at americanexpress.com/hc ✦ Enrollment required for select benefits. |

Quick Thoughts

These offers are terrific. The Amex Platinum and Consumer card offers that have exclusively been available via referral from chosen customers have been two of the hottest offers on the market given the incredible value you can get out of these offers thanks to the many Amex Membership Rewards sweet spots.

Our Reasonable Redemption Value for Amex points is 1.55c per point, making both of these offers incredibly strong, particularly when taken together with ongoing card benefits. Adding another $200 in statement credits on top only makes these offers better.

As mentioned above, only some select cardholders have the ability to generate a referral link directly to the offers above (and these offers are only available via refer-a-friend). In this case, it seems that most people who previously had the ability to refer to the 90K or 150K offers now have a link to the offer including the extra $200, but you’ll need to generate a new link. In other words, if you saved your referral link to the 90K Gold card offer last week, that link doesn’t provide the $200 statement credit. However, if you log in to your Amex account and pull a fresh referral link from that account, I believe it will be for the 90K + $200 offer. If you’ve referred a friend who hasn’t yet applied, you’ll want to generate a new link.

As you can see above, we currently have this new best offer on our Best Offers page. We will be setting up a brand new referral thread for each new offer in our Frequent Miler Insiders Facebook group, so be on the lookout for that to share your links to these offers. Please do not share referral links in the comments on this post as they will get caught in our spam filter and will not post.

How to find and share your referral link

Keep in mind that the ability to refer people directly to the 90K and 150K offers detailed above is targeted. Only targeted cardmembers will be able to generate a link to the above offers.

You can check the referral offers on your cards at this link.

Please do not share your referral link in the comments of this post as it will get caught in our spam filters and will not post. Instead, head over to our Frequent Miler Insiders Facebook group and share your link as a reply to my first comment on the appropriate card thread. Here are links:

- Share your Gold card 90K + $200 referral offer links here

- Share your Platinum card 150K + $200 referral offer links here.

We only share the best publicly-available offers, so please only share your link if you are targeted to offer the elevated referral bonuses above. Thank you!

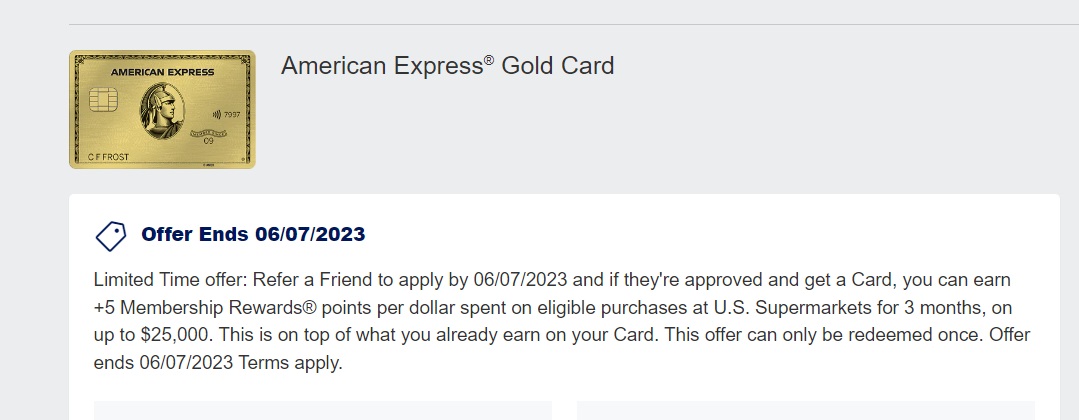

New U.S. Supermarket bonus for referring friends

American Express is offering a limited-time additional spending bonus at U.S. Supermarkets for those who refer friends from an eligible American Express consumer account: an extra 5 Membership Rewards points per dollar or 5% cash back (depending on the eligible card) on eligible purchases at U.S. Supermarkets for 3 months on up to $25,000. These are the Amex cards currently eligible for this special bonus:

-

Amex EveryDay® Credit Card

-

Amex EveryDay® Preferred Credit Card

-

American Express® Gold Card

-

American Express® Green Card

-

Blue Cash Everyday® Card from American Express

-

Blue Cash Preferred® Card from American Express

-

Delta SkyMiles® Gold American Express Card

-

Delta SkyMiles® Platinum American Express Card

-

Delta SkyMiles® Reserve American Express Card

-

Platinum Card® from American Express

This is a great deal for anyone with a consumer card that earns Membership Rewards points since these bonus points stack on top of the points you earn for each referral and on top of category bonuses. It is a particularly fantastic deal if you have an Amex Gold card and refer others since the +5 bonus stacks on top of the usual category bonus offered on that card.

In other words, if you have this offer on an Amex Gold card (as shown above) and your Amex Gold card offers you 25,000 Membership Rewards points per referral (YMMV as the amount per referral can vary), for a single referral you would earn:

- 25K bonus points for referring a friend

- +5 at U.S. Supermarkets that stacks on top of the Gold card’s 4 points per dollar on the first $25K per year in qualifying purchases at U.S. Supermarkets (then 1x). That’s a total of 9 points per dollar at U.S. Supermarkets if you’re still under the cap on that!

- Your friend’s undying gratitude*.

*Note that we can’t guarantee that last one

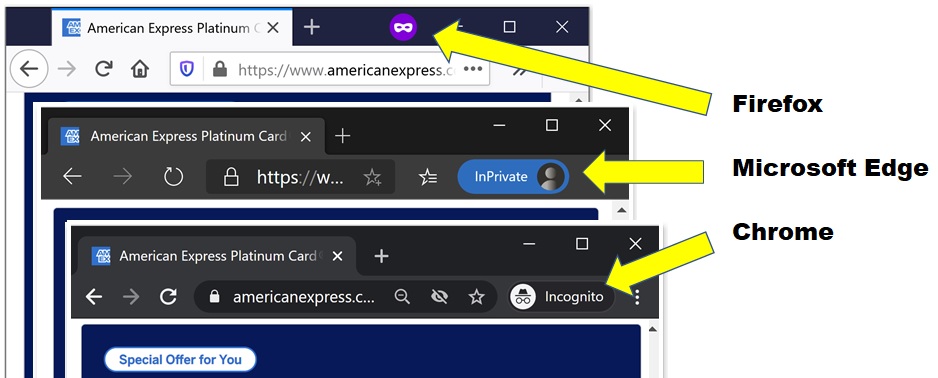

Keep in mind that even if you don’t have a direct link to the best offers on these cards, your friend might still get targeted for them when they open your link. I always have the best luck finding targeted offers when I open a fresh browser – perhaps one I haven’t used before.

Of course, if you’re not able to refer a friend to one of the best offers on the Gold or Platinum cards, remember that your friend can click “all personal cards” or the link for business cards after clicking through your referral to choose almost any other Amex card and you’ll get the bonus advertised on the card from which to generate the referral link. See this post for more detail.

@Nick Reyes the offer isn’t showing up on the application page. Is this dead?

Apparently both P2 and I are not eligible for these offers? I have never run into this issue before and have no reason why we would be black listed. Is anyone else running into this issue? P2 has never even had a gold or platinum card (personal or business) so she should be eligible and I have never had a Platinum card, but we both keep getting the popup saying we are not eligible. I tried multiple referral links with the same outcome.

I’ve put both my personal Gold and Platinum referral links out there on a couple Facebook groups and have earned a couple referral bonuses. Is there any way to tell which card the referral bonus goes with? I’m trying to keep up with my referral limits for each card, but have no idea who used my links in order to ask.

@Nick Reyes Reyes – Any idea why someone wouldn’t qualify for this bonus? I tried to refer my player 2 and got the pop up saying she wouldn’t qualify for the bonus. She has only ever had 2 Amex cards a plat closed years ago when they raised the fee and a Marriott card opened in ’21 for the 5 night free promo still open and in good standing.

My P2 got the same pop-up saying she’s not eligible for the Plat 150k+$200 offer. She’s never had any Amex cards other than the Hilton

Have you tried another refer-er (ie not referred by the spouse) – I’m wondering if Amex got smart on 2 player with referrals now….

I had my P2 chat the amex reps on her hilton account and they told her basically she was denied things by the RAT and needs to contact new accounts. Apparently her not renewing her plat 3years ago would have been the thing I guess.

Does the platinum 150K+200 offer have no lifetime language?

I had the 150K link this morning, but now it’s back down to 80,000 points.

Any of these offers have no lifetime language? I got the Gold in 2018 and took a 100k upgrade offer to Plat in Nov 2021.

Just checked my referral offer and its 30K bonus for me and 5+ more points for groceries which in itself is enough for me to refer P2. P2 offer says 90K but not the $200. OK, still good enough. BUT, P2 is at 5/24 so not wanting to add another consumer card. I do want P2 to get AMEX Delta or Marriott card. Anyone know if I still get the 30K and the 5extra if P2 navigates to one of these and opens one instead of staying with the Gold?

To clarify, I mean get the Delta or Marriott BIZ card, not consumer.

Does anyone know if AmEx will increase the welcome bonus to match this (and add the $200 statement credit) if I’m in-progress on the 150k referral offer from last month?

They don’t.

fyi, if you are trying to share a link for your P2 my referral link only offered 60k plus $200 for the rose gold card but when I opened the referral link incognito it increased to the 90k plus $200 offer.

let me get this right, do you mean 90k showed up for P1 or P2? Trying to generate the referral link in incognito in all 3 browsers, I can only see 60k pts.

Quick data point. I had the Gold card 90k special referral offer before, but now I only have 75k+$200. I wonder if it will take time for the links to refresh.

I have the referral available from my Gold card… am I missing the thread for sharing those on the Facebook group, or have you just not posted it yet?

Just haven’t posted it yet. I had a couple of links ready to put in for today and I’ll be in and out of cell service for a little while this afternoon, so I intend to post it there later today.

I find that because I have the Schwab Plat card, the refer-a-friend just bundles my personal Gold along with the Schwab into the “$100 referral” option that that card provides, and it provides zero information about what the friend would receive.

I’m on the same boat. It’s frustrating.

Is there a place we can submit our referral links to you to be placed in the rotation?

For going on three years now, I’m unable to refer personal cards. I have a mix of business and personal Amex cards, but the only cards where I can generate referral links are the business cards. I assume this is kind of like pop up jail? Does anyone else have this problem or, better yet, has anyone found any backdoor ways to being able to refer personal cards?

Following up on my own post, for whatever it’s worth. From my Amex account, I was able to generate a link to refer business platinum for 25,000. I was then able to have a family member apply for personal gold using that link, with an offer of 75,000 (4k 6 mos.) plus $200 statement credit. Not quite as good as being able to refer for 90,000 or get the grocery store kicker, but we’ll end up with 100k points plus the $200 credit, which almost covers the first year fee. I think that’s pretty good.

This can be fixed by saying you lost the card and asking amex for a replacement and the new card will have a new card number. Referrals should be once again active on the new card number

Ahh, really? I may try that. Thanks!