A partnership between Bilt and shopping portal Rakuten has officially launched today, whereby Bilt members can link their Bilt account to their Rakuten account and choose to earn rewards with Bilt. This is huge news for those whose primary shopping portal is Rakuten, though Bilt members without Bilt elite status will only enjoy the launch conversion rate temporarily. This change prompted me to change my own Rakuten payout format to Bilt for now, though I may go back to Amex Membership Rewards in the future when the rate for general (non-elite) Bilt members changes.

The Deal

- You can now link your Bilt and Rakuten points to earn rewards through Rakuten that will be converted to Bilt points at payout.

- Direct link to this deal

Key Terms

- Email addresses of your Bilt and Rakuten accounts must match to link (it is easy to change either)

- Changing your earning preference to Bilt will change Rakuten earnings to cash back, which will convert to Bilt points at payout. For the first six months, all Bilt members will receive 100 points per $1 in cash back. After that, Blue members will only receive 50 points per $1 in cash back. Silver/Gold/Platinum members will continue to receive 100 per $1, though this is all subject to change.

- Points earned through Rakuten will not count toward Bilt elite status

Quick Thoughts

This is great news, at least for now, for those who are fans of both Rakuten and Bilt.

Rakuten has long been one of the most popular shopping portals. That is mostly due to a combination of competitive payouts, reliable tracking, and good customer service response when things go wrong. Its popularity has also been due to the ability to link Rakuten to your American Express account in order to earn Membership Rewards points instead of cash, earning 10x Membership Rewards points instead of 10% cash back.

Today, Bilt joins the fray. It is now possible to choose to receive your Rakuten payout in Bilt points instead of cash back or Membership Rewards points. If you act quickly, you may even be able to change your preference in time to get Bilt points on your next Rakuten payout (which is scheduled to occur around 11/15/25, but my payouts sometimes arrive sooner, so I would recommend acting quickly if you’d like to switch).

There are some important things to know about linking your Rakuten account:

- Your email addresses must match between your Bilt and Rakuten accounts

- Changing your Rakuten email address is easy and instant in account settings

- Changing your Bilt email is also easy and nearly instant (you’ll need to verify the new address and then log out of Bilt and back in with the new email before you link)

- If you do not yet have a Rakuten account, the Bilt app will prompt you to create a new Rakuten account for your Bilt email address (and you can earn 2,500 Bilt points after spending $25 through Rakuten in the first 90 days, but don’t do that — if you’re new to Rakuten, sign up under the current Rakuten referral offer and earn $50, which will convert to 5,000 Bilt points).

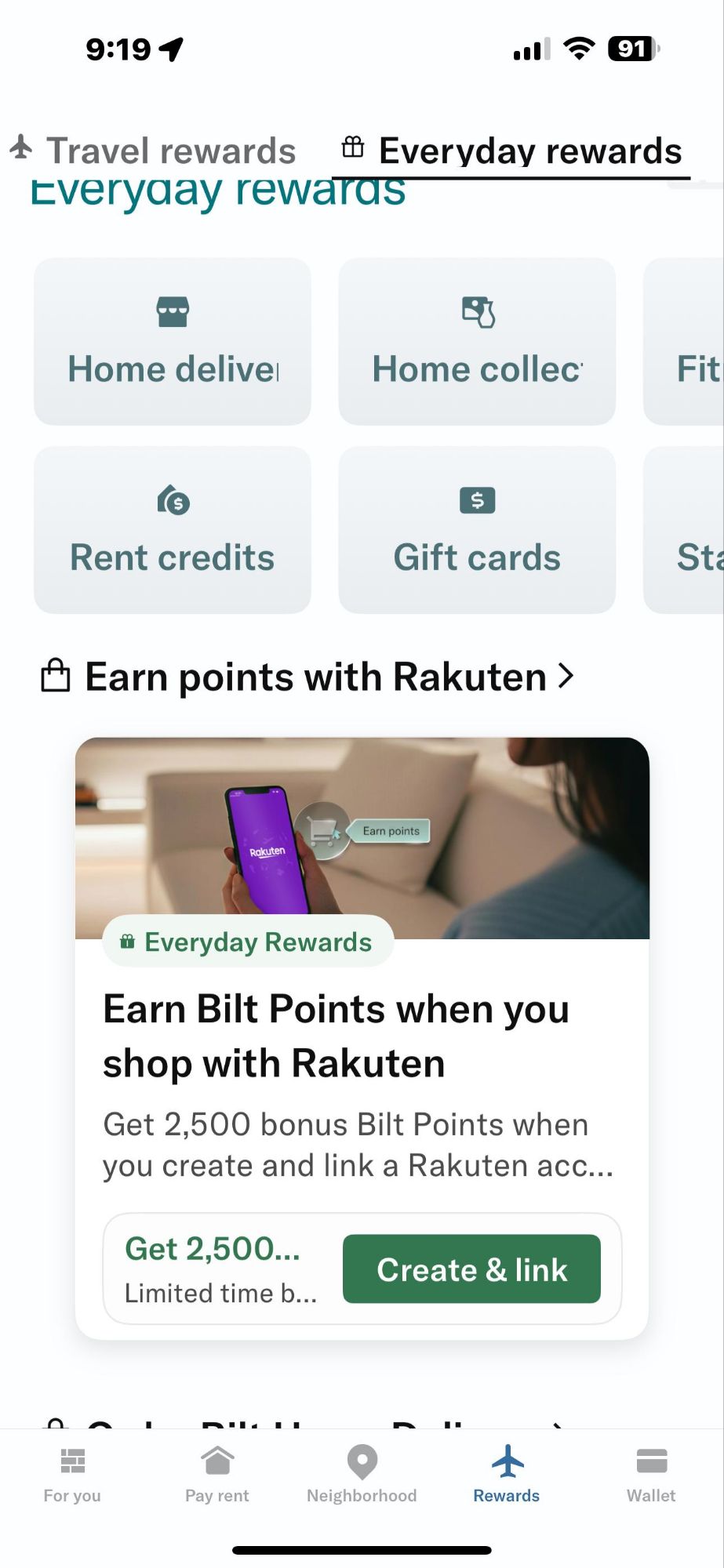

- To link Bilt to an existing account, you have to click to go to your Bilt account (on desktop or within the Bilt app), navigate to “Rewards” within your Bilt account, then “Everyday Rewards”, where you will find a section prompting you to create a Rakuten account and link (“Create & link”). If you have an existing Rakuten account, it actually just links as long as the emails match.

- At the time of launch, $1 of Rakuten cash back will convert to 100 Bilt points for all members. However, after 6 months, mayouts may change for those without Bilt elite status. Blue members are expected to earn 50 points per $1 in cash back. Silver, Gold, and Platinum members will continue to receive 100 Bilt points per $1 in cash back, though this is all subject to change in the future

- Points earned from Rakuten don’t count towards Bilt elite status

The process of linking accounts is relatively simple. I wasn’t using the same email address for Bilt and Rakuten, so I changed my Bilt email address. Greg changed his Rakuten email address. Both of us found the process to be easy and instant, so it shouldn’t matter which way you play it, as long as you make the email addresses match before linking.

You can accomplish this on a desktop or via the Bilt app; both work. Either way, just navigate to “Rewards”, then “Everyday Rewards”.

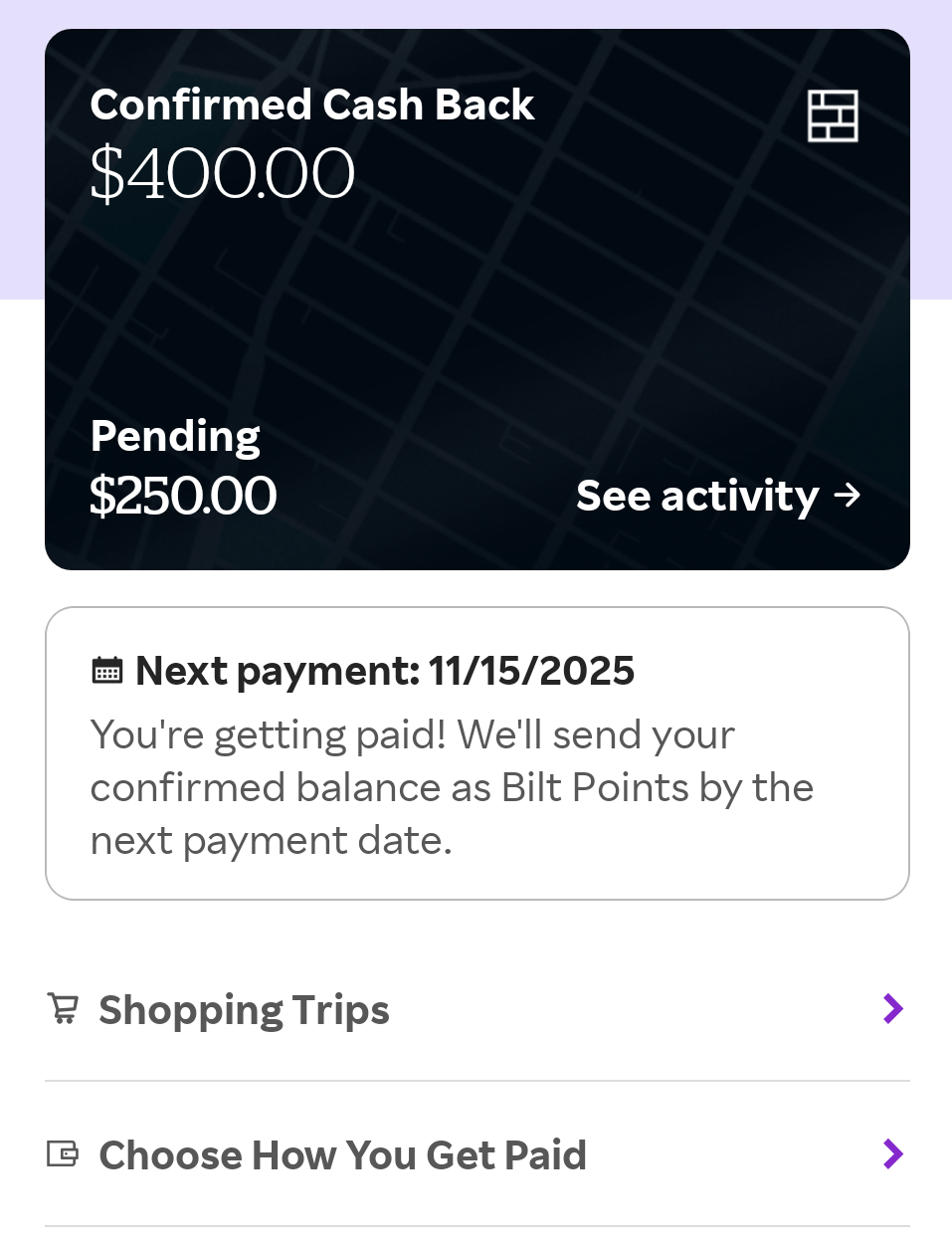

Once you link up accounts, your Rakuten rewards balance will immediately convert to cash back (assuming that you had previously chosen Membership Rewards as your payout preference). The artwork in my Rakuten account changed colors from purple to black and now displays the Bilt logo and confirms that I’ll earn Bilt points at the next payout. That’s great news, as I’m happy to have a small influx of Bilt points coming soon.

As noted above, I will likely switch back to earning Amex Membership Rewards points six months from now, when the payout for Bilt Blue members (those without status) drops to 50 points per $1 in cash back. I’d much rather earn Amex points at 1:1 than Bilt points at what will essentially become 0.5 to 1. I’ve used Gmail to schedule an email to myself to remind me when to make the switch, unless the new Bilt credit cards provide a path to elite status that I opt to take.

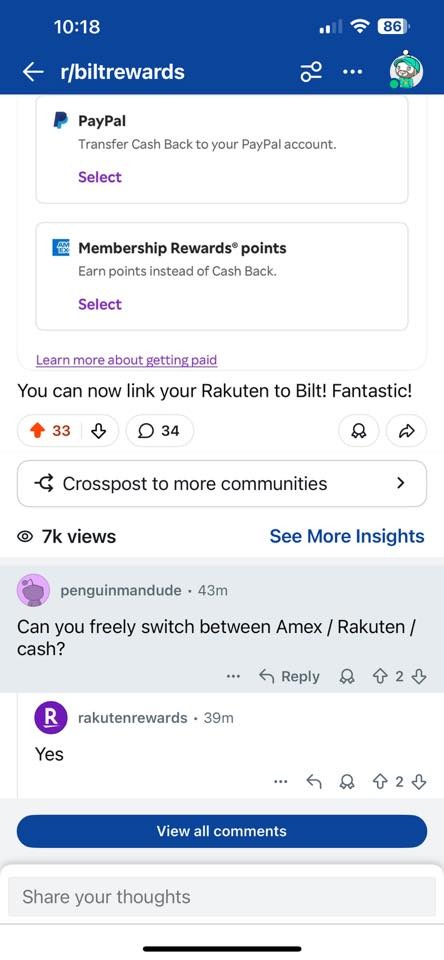

Note that some members of our Facebook group asked whether it would be possible to switch back to Amex Membership Rewards points. Like them, I had some recollection of a time when Amex said that the switch from points back to cash would mean an ability to go back to points again, but another member of our group shared this screenshot of Rakuten, indicating that it is possible to freely switch between the two.

Hopefully, that is correct. In the meantime, I’m keeping my wife’s earning preference as Amex Membership Rewards points just in case there is difficulty switching back in the future (by keeping her preference as Membership Rewards points, we’ll keep a way to use Rakuten for Membership Rewards points).

That said, this might offer some motivation for me to chase Bilt elite status in the future, as we do tend to earn a fair number of points through Rakuten. While I’ve been very happy earning those points as Amex Membership Rewards points, I would be even happier to earn them as Bilt points, which can later be transferred from Bilt to programs like Hyatt and Alaska Airlines, along with most of Amex’s best partners (and a couple of additional partners, too).

Note that the 100 Bilt points per $1 in cash back is expected to last for the first six months. That means you could potentially get the November 15th payout in Bilt points if you act quickly, and then the 2/15/26 and 5/15/26 payouts will also be at that rate.

I made the switch day after news of the Bilt – Rakuten partnership came out and can report my November Rakuten payout was deposited as Bilt points.

Glad that this community held Bilt’s feet to the fire on this one. I am sure that Bilt was well aware of the ambiguity here. Not an ideal look when switching to Cardless and not having the ability to issue any new Bilt cards for the next few months.

That said, I enjoyed getting a nice helping of Bilt points on 11/15 from Rakuten and looking forward to two more transfer dates to accumulate a stash. Depending on what they do with mortgages next year, Bilt could be a more interesting program for some.

One other tangential thing to note – got a spend $85 get a $100 gift card offer from Lyft yesterday. My (perhaps less than perfect?) understanding is purchases made with Lyft Cash do not qualify for rewards points (whether with Bilt or others), and it’s also possible Lyft may look to have you auto recharge your Lyft Cash balance. Obviously a free $15 for those who use Lyft is not nothing, but just pay attention to how that sets you up otherwise with them… wonder if this is a soft play by Lyft to get them out of paying some rewards.

On the reddit thread Rakuten said you have to switch by November 10 for the November 15 transfer date.

FYI – I switched on 11/11 and received the 11/15. payout.

I switched, but I do wonder if that 5k AMEX referral promo a few weeks ago will still post 11.15 in MRs rather than Bilt

Great news, time to switch over accounts for at least the next 6 months. Bilt is doing a good job of dangling potential benefits to generate interest in getting status with them.

Also nice to see Rakuten expanding its benefits. I don’t even shop on cashbackmonitor.com anymore and just click the purple R button now they’ve made going thru them so easily profitable, flexible, and reliable.

Nick, any word yet if Bilt points earned from Rakuten qualify toward Bilt elite status?

Already in the article – they do not.

Whoops! Sorry and thank you for pointing that out!

I have to laugh at those who were so certain for so long that Bilt was doomed to failure. Bilt absolutely went through a challenging time about a year and a half ago but here it is. One must give Bilt a hat tip for what it’s accomplished.

I don’t think they are doomed to failure, but they did have a pretty advantageous deal with Wells Fargo which is largely what has lead to their profitability. I am not sure if the details of the Bilt deal with Cardless are public, but I am sure that they are not getting the same kind of lucrative kickbacks that they were from a major US bank. It will be interesting to see how their finances fare once Bilt moves over to Cardless, which is itself still in its startup phase.

This is not to say I am not rooting for Bilt. I definitely am. They clearly have several people on their team who know a lot about the points game and they seem to be catering to enthusiasts, at least to get them in the door of the program. I personally have a pretty large mortgage (because of interest rates, not because my home is particularly valuable) that it would be really nice to be earning points on and so I am exited for the development of their program. However, you have to realize that Bilt is creating a new-ish business model that has yet to be proven, and they are far from out of the woods yet. There’s a reason that they are one of only two businesses in the rewards space offering points for housing as a loss leader.

Even if it didn’t last, those 10,000 points/1st of the month on 2x spend (and the 50,000 secret SUB) really helped towards travel

Thanks for the good article on this. I had no problem signing up for Bilt today, switching to Bilt, and then switching back to MR.

Bilt/Rakuten T&Cs say 1:1 is six months from launch subject to Bilt extending, so if today is launch, that’s 5/6/26 which is before the 5/15/26 Rakuten May quarterly transfer date. Whether Bilt will extend, who knows!

So that means a) you can get Bilt points for whatever you have pending right now on the 11/15/25 transfer date (T&Cs confirm this) and b) you can get Bilt points on the 2/15/26 Rakuten transfer date, but given how long it takes for Rakuten to confirm points that are pending, you kind of have to make those purchases around now-ish to get them on 2/15/26.

Honestly debating what to do here as I do not anticipate having status with Bilt. Like you I have a significant amount of confirmed and pending cash back with Rakuten. I like the idea of having Atmos as a transfer partner so may do Bilt for now, but with very close monitoring of what is going on with Bilt. Certainly many unanswered questions about the transition to Cardless next year.

Your comment brings up a question that I was going to make, which is whether the earn ratio is dependent on the date the cashback is earned or if it’s dependent on the date the transfer is made. In other words, if we earn $1 on 5/1/26, will that count as 100 Bilt points on 5/15/26?

The T&Cs say “Cash Back accrued but not disbursed prior to linking accounts will be eligible to be converted into Bilt Points based on your personalized offer in the Bilt Rewards platform.” So I think the implication is that it’s the transfer date between Bilt-Rakuten that matters, not the date that anything is confirmed with Rakuten.

I presume as far as Rakuten is concerned, there are 4 transfer dates, and they’ll transfer to whomever you have selected as of whenever they process the transfer that corresponds with the transfer date.

The T&Cs also say “Bilt offers an introductory point conversion ratio between Rakuten Cash Back and Bilt Points for a limited time. This introductory conversion ratio is subject to change after the first six (6) months following launch, in Bilt’s sole discretion.”

So, who knows!

Since it truly appears like you can switch back to Amex, I am making the switch, but I currently have a lot of pending points and will have a decent amount of holiday spend in the next couple weeks that will hit the 2/15 payout.

This may change my strategy for the coming year. My next card was gonna be Citi for the ability to transfer to AA, but now I am leaning towards either a BILT card (to get to $10k in spend so I keep BILT transfers at 1:1) or something in the Atmos ecosystem instead.

Just FYI: A number of today’s posts (notably the BofA 2x promotion) are missing the UI elements to post a new comment, at least for me.

Time for an article — easy strategies to reach Bilt Silver!

Nick, thanks for confirming that these points would NOT count for Bilt status.

I suspected as much, but good to know. That would have got me off the fence. (Will keep MR for now.)

Bilt silver is pretty easy to achieve, I think. I’m thrilled about this and will be moving at least some of my portal spend away from AA (for status) over to Rakuten.

Your comment on AA made me reflect on how quickly the shopping portal game has changed. AA busted on to the scene a few years ago with the loyalty points game and lucrative shopping portal payouts (especially for phone lines and mealkits). Then they curtailed their biggest payouts, cut earning rates across almost all retailers, and raised LP thresholds after the influx of newly minted Executive Platinums. Meanwhile Capital One has become a force and Rakuten keeps expanding their returns and options.

Why did you switch as opposed to just creating a second Rakuten account so you could keep both options?

Good question. A few reasons:

Nick, do you use a VPN or anything for you or your wife’s account?

I want my P2 to get an account to mimic your setup but have read about shutdowns for two people in the same household. We share an address but have different last names. Will use a different email and won’t have any overlap with linked cards.