For years, the main purpose of an ultra-premium credit card has been to take advantage of its benefits. Whether the ability to redeem points for increased value, get lounge access for authorized users, or enjoy other swanky perks, ultra-premium cards were once chock-full of premium benefits to accompany a premium price tag. They were simple to explain and wise tools for informed consumers.

Unfortunately, we’re seeing a new trend take hold: ultra-premium cards chock-full of time-consuming coupons. It is still possible to get value out of these ultra-premium cards, but it is becoming surprisingly complicated despite rising price tags. I have to question the wisdom of what the banks are doing here: the high annual fees suggest that they want to attract affluent customers, but most affluent folks I know are looking for simplicity rather than more complexity. After all, the purpose of paying for a more premium product should be that it provides premium value. It feels like the new model is designed to provide more appeal to a coupon-clipper like me than to someone looking for a premium experience. When Amex refreshes the Platinum cards, I hope they hear those who are losing enthusiasm for the coupon book model.

Still, welcome offers will almost always be strong enough to make the ultra-premium products worth a test drive. And I’m hopeful that we’ll see big ones to accompany product launches and refreshes. Through that lens, I’m hopeful that we’ll see issuers make some noise in the weeks and months to come.

This week on the Frequent Miler blog…

All the Sapphire news that’s fit to print

Details of the revamped Chase Sapphire Reserve and the coming Chase Sapphire Reserve for business became official this week. There was far too much information for a single post, so we had to split it up into several posts to bring proper attention and focus to each aspect. You’ll want to read all of these posts, ideally before 6/23/25 so you can decide whether you want to upgrade a card now, wait for a new offer, or steer completely clear.

- Introducing the new couponified Chase Sapphire Reserve

- The new Chase Sapphire Reserve for Business surprises, but doesn’t delight

- Chase removing Sapphire family rule, expanding 48 month rule & allowing new cards without welcome offers

- Chase Travel℠ ending 1.5c & 1.25c redemptions, replacing with Points Boost

- The Edit by Chase Travel℠ is suddenly interesting…

- The real Sapphire Reserve for Business | Coffee Break Ep59 | 6-17-25

- Contemplating $75K spend on the new Chase Sapphire Reserve card

In a nutshell, the annual fee on the consumer card is about to shoot way up. Coupons are coming with it, but the truth is that it’s just going to be a much harder card to recommend in its new form. That is in no small part because the base redemption level is dropping to 1c per point, though savvy users will find some hope in the chance to get 2cpp on some nice hotels. The business card is utterly perplexing; I haven’t yet figured out the business owner to whom I would recommend it. Still, read all of the above and familiarize yourself so that you can make a good decision before the clock makes the decision for you.

Major deval: Amex Business Platinum ending 35% points rebate on business & first class flights

Not to be outdone by Chase’s big splash this week, Amex got into the action as well. First, they launched a press release to say that they will refresh the Platinum cards later this year. Then, they dropped this bombshell: starting in September, you will only be able to get the 35% pay-with-points rebate when booking on your chosen airline, ending the ability to get that rebate with business or first class bookings on any airline. The big bummer here is that this effectively ends use of this rebate on any foreign carriers since Amex only allows choosing selecting a domestic carrier for airline fee credits and this rebate. That’s a big hit since international premium cabin flights were sometimes a better deal with points through Amex than they are as award tickets.

Delta and Amex planning to release a super-duper, mega, ultra-premium card?

Amex wasn’t content with only making noise about the Platinum cards this week. They also launched a rumor about a coming ultra-premium Delta credit card above the Reserve card. given that the Reserve card is already among the the most expensive co-branded cards in the market. Just how much will people be willing to pay for a Delta credit card? We may soon find out.

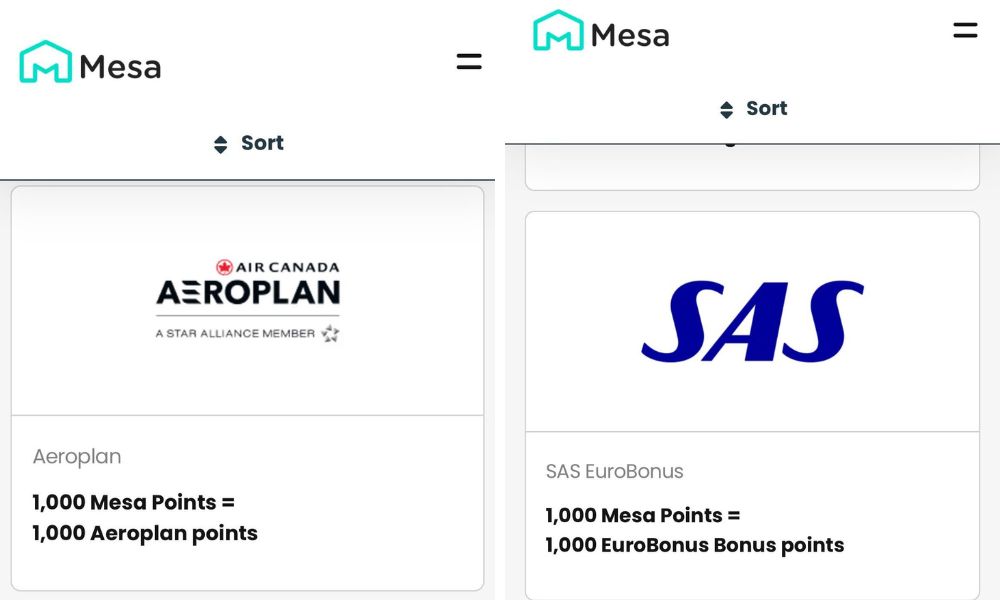

Mesa Homeowners Card now transfers to Air Canada Aeroplan & SAS EuroBonus

Good news for Mesa Homeowners Card holders: transfer partners have now expanded to include Air Canada Aeroplan and SAS EuroBonus. Those are two solid adds that make the program a bit more serious. The card itself was already potentially worth considering for its fairly unique bonus categories (3x on daycare, anyone?), but with a couple more solid transfer partners, it is becoming pretty intriguing.

A $50,000+ family trip to Europe, booked with miles and points

We recently traveled to Europe for 2.5 weeks as a party of 8. Adding up the cash costs of tickets and hotels would put the sticker price for this trip over $50,000. We did it for far, far less thanks to miles and points. This type of trip is exactly why I put time and focus into this hobby — few other side passions could produce a trip like this, and yet if you put time and effort into earning and maximizing miles and points, this type of trip can be an easy reality.

Emirates transfers from Citi, Capital One, Amex, Chase and Bilt are back online

I’m including this post to alert readers who had been frustrated by the inability to transfer to Emirates. Those transfers from various major transferable currencies had been down due to an IT update. Good news: that update appears to be complete as transfers are back up and running.

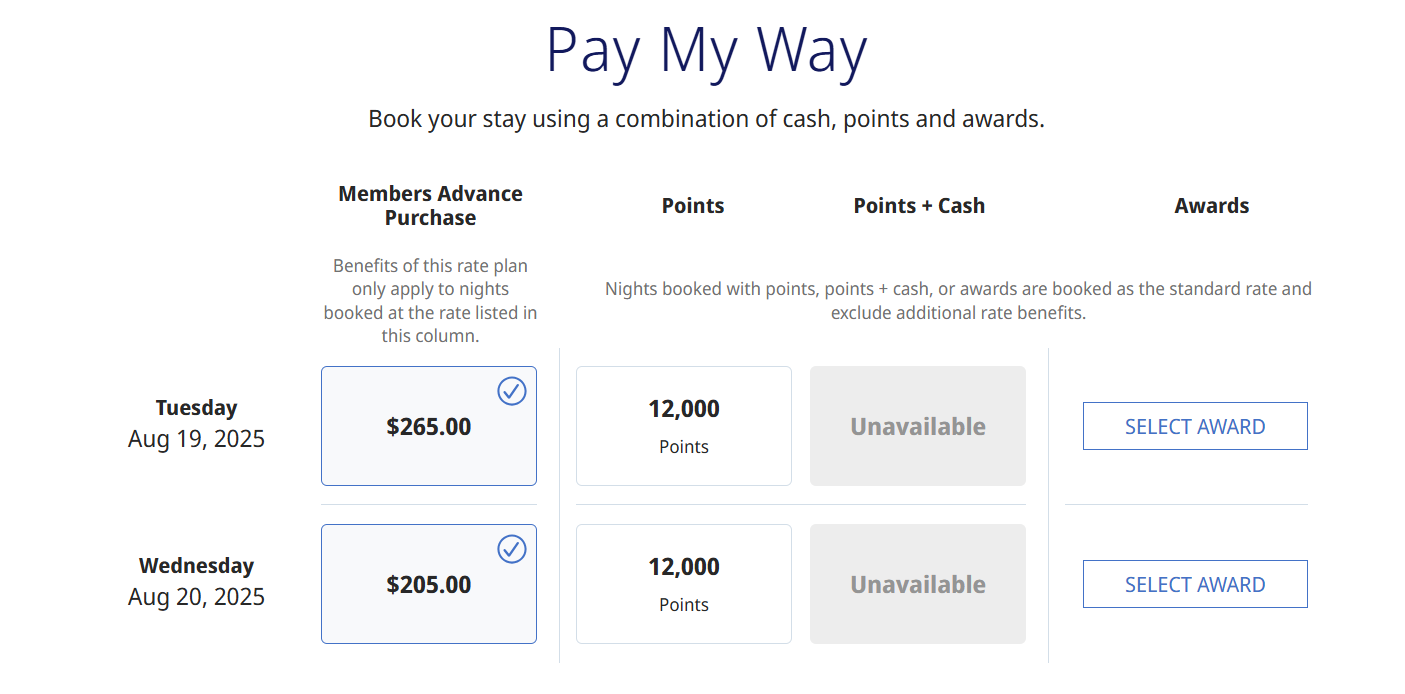

How to use Hyatt free night certificates on a multi-night stay

I actually thought that Hyatt had gotten rid of the “Pay my way” option until I saw that we updated this post this week. I’m glad to know where to find this, though there is a safety tip in the comments: be sure not to select an advance purchase rate before you pick “Pay My Way”.

Best Credit Card Big Spend Bonuses

Hey there, big spender! If you have a lot of spend and you’re wondering about the best you can do for that spend in terms of the best big spend benefits, this post offers all of the best options. Keep in mind that you’ll always get better return on spend by putting your purchases toward a new welcome offer, but for those with more than enough spend to go around, these big spend bonuses can be worth consideration.

![Mileage running 2026-style, playing the AA transition, a coming points conference and more [Week in Review] a group of toy airplanes on a game board](https://frequentmiler.com/wp-content/uploads/2022/01/American-Airlines-Game-218x150.png)

![Cutting our collections, comparing free night certificates, and expediting new cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/07/Nick-Platinum-cancel-218x150.jpg)

At least Capital 1 Venture x gave almost 8 months to make a decision to keep or cancel. I hope AMEX does the same, hopefully announce something before my next renewal in November.

I think Tim has established that there is a new moniker for these cards: super-duper, mega, ultra-premium.

The new moniker is “cards for people with more money than sense “

And that’s the bank’s desired demographic.

The Amex cut should be the story of the year but Chase sucked out all the air in the room. Great timing Amex to not have us all go ape! Just brutal week.