NOTICE: This post references card features that have changed, expired, or are not currently available

An astute reader has given us a heads up that if you’re considering upgrading an existing American Express card, it’s worth checking your emails as there might be an even more generous upgrade bonus available.

My wife received an email from American Express this evening offering her 40,000 Membership Rewards for upgrading her Amex EveryDay card to the EveryDay Preferred and spending $2,000 in three months. I ignored the email because she’s never had the EveryDay Preferred card before, so I thought it would be better for her to apply for it brand new at some point to get the welcome bonus, then hopefully get a similar upgrade offer in the future with no lifetime language, thereby earning a bonus on the same card twice.

Nick subsequently pointed out that 40,000 Membership Rewards is the highest offer we’ve seen on the EveryDay Preferred card (albeit this increased offer is targeted), as the previous high was 30,000 points. He therefore figured it could be worth forgoing the opportunity to earn a welcome bonus for a new signup and jump on this upgrade offer instead, especially seeing as it means you wouldn’t be burning a 5/24 slot.

Those were great points; I’ve never tracked the welcome bonus on the EveryDay Preferred card and so hadn’t realized that it hadn’t gone above 30,000 points in the past. If getting or staying under 5/24 is important to you, this upgrade offer is a good opportunity to earn a bunch of Membership Rewards without having an impact on your 5/24 status.

If you’re lol/24 and are in two player mode, you could potentially do better though. For example, my Amex Gold card is offering me 30,000 Membership Rewards when referring someone to a new Amex card (it doesn’t have to be the Gold card). The welcome bonus on the EveryDay Preferred card when using that referral link is 15,000 Membership Rewards, so between us we’d pick up 45,000 points – 5,000 more than the upgrade offer. We’re not planning on doing that right now; it’s just to point out that a couple could potentially come out even further ahead than this already generous upgrade offer.

Differing Offers

The reason for this post though is that reader Josh noticed something interesting. His wife also received the 40,000 point upgrade offer, but when logging in to her Amex account her EveryDay card only showed a 15,000 point upgrade offer.

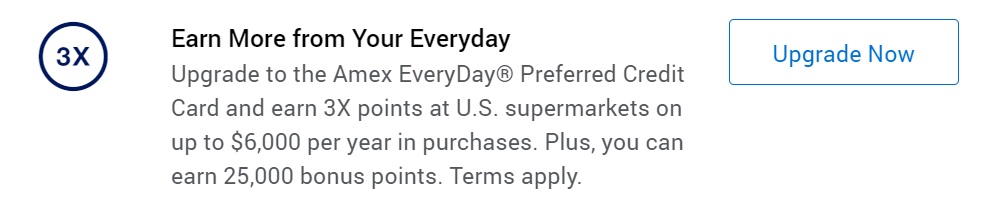

Curious, I logged in to my wife’s account and a similar thing happened. When viewing the Amex Offers listed under her Amex EveryDay card, Amex was offering her fewer points to upgrade compared to the email upgrade offer. In my wife’s case, she was being offered 25,000 bonus points to upgrade compared to the 15,000 points Josh’s wife was being offered when logged in to her account, but 25,000 points is still small fry compared to the email offer.

It’s therefore worth keeping an eye out for email upgrade offers from American Express because in some cases they’re better than the upgrade offer you’ll receive when logged in to your account.

h/t Josh J

Anyone know if you can get the same Amex upgrade bonus on one account more than once? I upgraded Hilton no-fee to Surpass a few years ago, then downgraded back to no-fee during the pandemic. Just got an email offer to upgrade back to Surpass and I don’t see any T&C indicating that having upgraded previously would make me ineligible. I also see conflicting reports online. Hope someone here has better intel.

I’ve never been lucky enough to have that happen, but have heard reports of people being able to upgrade and downgrade multiple times and so you should be OK. Just be sure to not downgrade again until at least 12 months after receiving the upgrade bonus, otherwise they’ll likely claw it back.

Stephen, sorry for the unrelated question, but the contact page didn’t seem to work. The annual fee posted on my CIP. It’s my only business card with Chase. I applied for the Ink Cash in October (sole prop) and was denied. I’m wary of cancelling the CIP for my relationship with Chase, but think downgrading would mean foregoing a bonus on one of the no fee Inks in the future, right? What would you recommend?

While product changing to a card you’ve never had with Amex prevents you from earning that bonus in the future, that’s not the case with Chase. You can therefore change to the Ink Cash and still get the bonus in the future.

Thanks, Stephen! Anything specific I’d need to do to get the Ink Cash bonus in the future (like cancelling the current one before applying or applying using a different business)?

Nope – based on your current situation it sounds like you should be fine getting a bonus provided you’re under 5/24.

If you upgrade, can you later downgrade back to the no annual fee version?

Yes, although it’d probably be best to wait a year from the upgrade.

Note that all Amex cards include language that stating that downgrading or canceling the card “in the first 12 months” can be treated as gaming the system. While you could technically cancel in that 13th month and get the second year annual fee back, I take this language to mean that Amex wants you to pay both the first year fee (if not waived) and the second year fee to avoid getting tagged as a gamer.

Got this very same offer myself via email. Question: Where would I look to ensure that the offer is free from lifetime language? I’ve never dealt with re-applying for an Amex card before.

The bottom of the email has a list of Terms & Conditions. I’m not seeing the normal lifetime language warning:

It might be that there are additional offer details when clicking through to upgrade, but I’m wary of clicking the link in the email just in case it’s a one-click upgrade.

That’s exactly the information I’m looking for. Not present in my offer either, if that’s an additional DP.