NOTICE: This post references card features that have changed, expired, or are not currently available

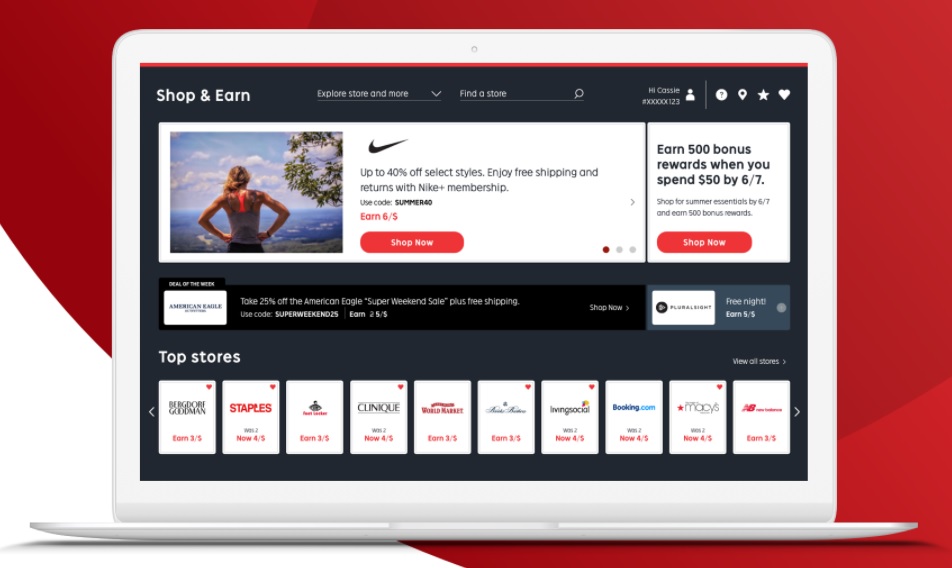

In not-so-breaking news, Rakuten owns Cartera – the company which runs most airline shopping portals such as those for American Airlines, Alaska Airlines, Delta, United, Southwest and more.

It turns out that this is actually old news as Doctor of Credit reported this almost four years ago to the day, back when Rakuten was Ebates. We’d all missed the news and so only just discovered it when Greg saw this press release regarding Bumped using Rakuten’s network for their latest offering.

We therefore figured it would be worth covering it here in case you’d also missed the news. The reason it’s notable is because it can affect the ability to stack deals.

For online shopping purposes it doesn’t really matter, because even if Cartera wasn’t owned by Rakuten it wouldn’t be possible to stack the two as you can only earn cashback/points/miles from one online shopping portal at a time.

It’s the overlap for in-store offers which is affected. Rakuten’s shopping portal has card-linked offers for in-store purchases at a wide range of retailers. Both the Alaska Airlines and United shopping portals have in-store offers as well, so the fact that those run on the Rakuten Card Linked Offer Network means you can’t double up on earnings from one of the airline portals and Rakuten’s own portal.

This sadly means there’s an increasingly long list of card-linked programs using the Rakuten Card Linked Offer Network. The Bumped app changed their card-linked program a few months ago, transforming it from being something unique and somewhat compelling to being a replica of Rakuten’s shopping portal but only offering about 1/3 of the value that Rakuten does. Even the newly relaunched Google Pay app uses Rakuten for its card-linked element for tracking purchases, as does Swagbucks according to DoC’s comprehensive resource of card-linked programs.

Thankfully there are still some card-linked programs which do offer stacking potential. Many of those run on the Empyr network, while Dosh seems to use its own tracking system. With the Rakuten Card Linked Offer Network expanding recently (by adding Bumped and Google Pay), it’ll be interesting to see if other companies start using their network.

American Express has been using Drop to track some Amex Offers in recent months. It’s a little surprising that they chose Drop rather than Rakuten given their partnership which enables Rakuten portal users to earn Membership Rewards rather than cashback. Still, the more card-linked options the better from a stacking perspective.

Do you know if either Capital One Shopping or Sams Club Cash (card-linked) are part of Rakuten/Cartera? They’ve had some overlapping offers for HBO Max.

I thought you wrote a more detailed post about various cashback companies but I’m having trouble finding it.

Thanks!

I think Capital One Shopping works more as a shopping portal than a card-linked program, so it should stack with a Rakuten or Cartera option.

I don’t have an active Sam’s Club membership right now and so haven’t had a chance to check out Sam’s Club Cash since they launched that feature. I’m planning on getting a new membership in the next day or so though, so I’ll be taking a look at it at some point.

With regards to the more detailed post, this is probably what you’re looking for: https://frequentmiler.com/card-linked-programs-the-networks-they-run-on-aka-which-programs-stack/

Thank you! And thanks for that link!

I read some people did the HBO Amex offer combined with sams card-linked offer plus Rakuten portal. Sams didn’t pay out and claimed it’s due to overlapping rewards. I thought if Sams uses Rakuten that would explain it.

In my case I did Amex offer, sams, and cap 1. Last 2 have been pending for 2+ weeks but I’m not counting on it.

Interesting. What might’ve happened is that HBO might be a little more sophisticated than other retailers and might have some way of tracking rewards paid out through their affiliate program, thereby being able to deny cashback for one program if they’ve paid out via another even if they don’t run on the same network. That just one option though – it may well be that they run on the same network.

Maybe you’re right. The suspense is killing me while I wait to see what happens. Meanwhile I noticed the dining options with Sam’s match Citi Merchant Offers, so I bet they’re on Rewards Network. Your other article says Capital One is on Figg. So at least my stack has 3 separate companies. Thanks again.

To follow-up, all 3 paid out so this stack works: Amex Offer, plus Capital One Shopping (Figg), plus Sam’s Cash (Rewards Network).

I hate Cartera. I hate all these points portals, all looking for the smallest reason not to pay out. I used the portals frequently in the past and remember all the times I would wait and wait to see if the points would ever come and half the time they would be denied or reversed for some reason. Got sent the wrong item and returned it for the right item? No points for you! Initiated an exchange to get a different size at the local store? No points for you! Used a coupon on the website? No points for you! Lost/deleted/didn’t keep your receipt for three months? Too bad. No points.