Over the past week, investing app Robinhood has made a splash over its newly-announced Gold card, which is slated to offer 3% cash back everywhere. I wrote a post where I was lukewarm on the prospects for the card, but a reader pointed out a Robinhood Gold benefit that I’d previously ignored but that has the potential to be incredibly valuable: Until April 30, 2024, Robinhood is offering a 3% bonus with no cap for transferring an IRA or old 401K to Robinhood. We discussed both offers on this week’s Coffee Break podcast episode (see: Podcast: Robinhood Gold 3%: Too good to last? | Coffee Break Ep06 | 4-2-24). I had completely glossed over this bonus before, thinking that it wouldn’t be worth it for me. But when I ran some numbers, I had to question my current strategy, which includes keeping my IRA at Merrill Edge in order to qualify for Bank of America Platinum Honors to enhance my credit card rewards. Those with more well-established retirement accounts could stand to earn into the tens of thousands of dollars in retirement contributions, which might make it worth considering Robinhood Gold even if you have zero interest whatsoever in their coming credit card.

Robinhood’s lucrative IRA offer: transfer an IRA or old employer 401k and get a 3% bonus with no limit

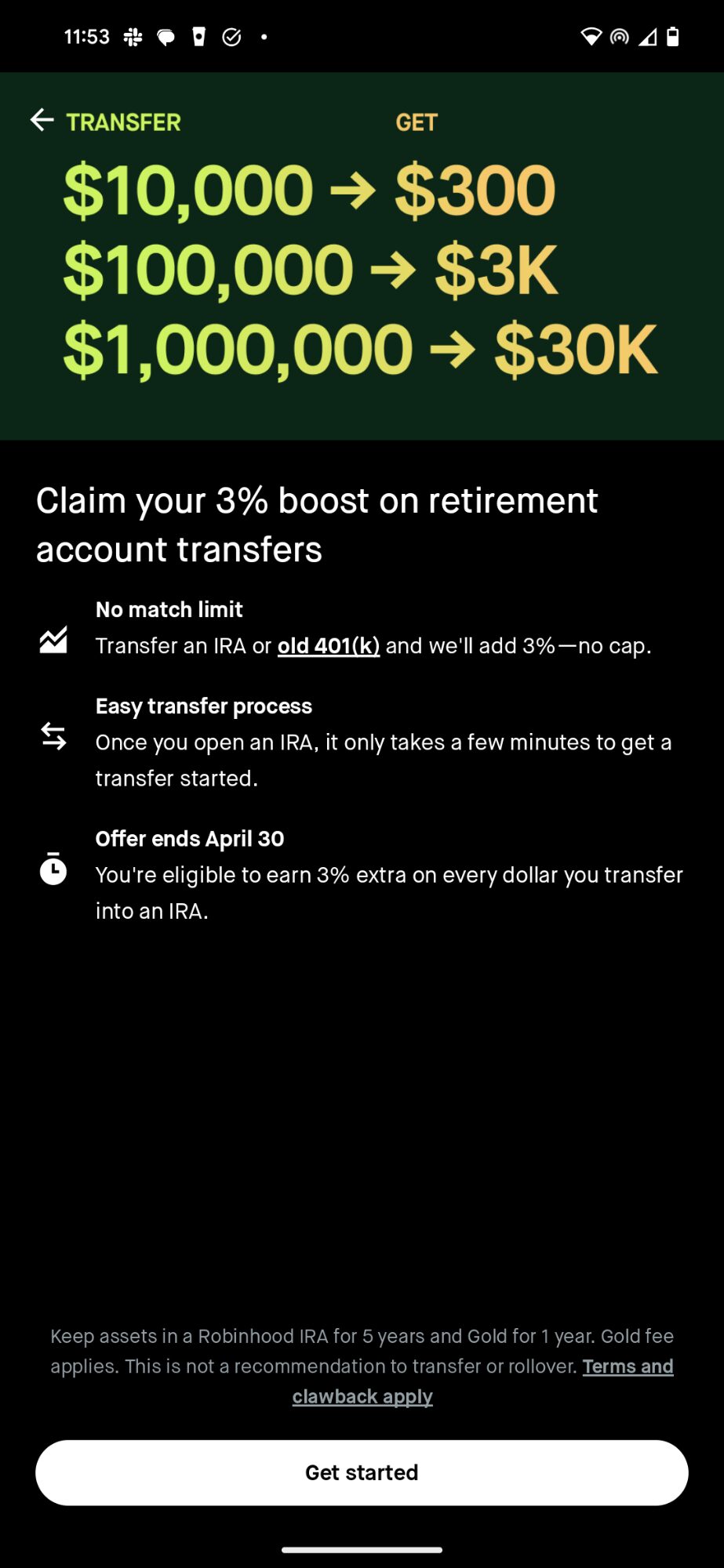

I’ve seen Robinhood and some other online brokerages advertising a bonus on IRA contributions, but something I’d totally ignored is that Robinhood is also offering a 3% bonus when you transfer an existing IRA or old 401k to Robinhood with no maximum bonus amount. In fact, they advertise in the app that if you transferred in an account with $1 million, you’d earn a $30,000 bonus, which they state will not affect your maximum contribution amount for the year.

The “catches” are as follows:

- You must have Robinhood Gold before initiating the transfer and keep it for at least 1 year after the transfer settles (which costs $5 per month or $50 per year).

- You must hold the transferred IRA funds at Robinhood for a minimum of 5 years or you may be subject to a Robinhood Gold Cancellation IRA Match Removal Fe equal to the match amount. You will incur this fee if you transfer your account out or take a distribution during that five year period (including any required distributions). Note that if your total account value has exceeded the amount of your initial deposit + the value of the 3% match bonus you received, you may not incur the fee for distributions above that total. In other words, if you transfer an IRA with $500K and get a bonus of $15K and the total value of your account rises to $600K, you may not be hit with a penalty for distributions of the difference between $515K and $600K (though you wouldn’t want to cut it terribly close since, if your account value dips, you might get some of the bonus clawed back).

- In the event that a customer deposits to a Traditional IRA and subsequently converts to a Roth IRA, the Robinhood Gold Cancellation IRA Match Removal Fee would apply to the customer’s Traditional IRA.

- The bonus will be reported as interest earned and Robinhood states that it will not count against your contribution limits.

- Read full terms here. If you’re considering this offer, I highly recommend reading the terms and fully understanding them.

This has the potential to be a sizeable bonus for someone with well-established retirement accounts. It is worth noting that based on my read of the terms, I don’t think you necessarily need to transfer an entire account — I believe that a partial transfer from another brokerage should still qualify for the bonus.

Is Robinhood safe / good / trustworthy?

The first question that anyone considering the offer should ask themselves is whether Robinhood is a safe place to park retirement funds. The short answer here is that I don’t really know. Investopedia says it’s safe. Does Investopedia know for sure? I don’t know.

I do know that Robinhood picked up a lot of bad press over the whole Gamestop thing a couple of years ago (there was a buying frenzy and Robinhood was one of several brokerages that halted trading of Gamestop). I don’t love what they did there, but I never fully understood why they took so much of the heat given that many other brokerages also restricted the trading of Gamestop that week (I remember checking and being unable to buy or sell it in my Merrill Edge account that day or two). At the same time, a million wrongs don’t make a right. There’s no doubt it wasn’t a good look for Robinhood.

That said, I’ve been using Robinhood for years. I didn’t use it to trade Gamestop (I’ve never really been into short-term trading, but like everyone else, I did take a look at it during that short span when Gamestop was booming. I didn’t ultimately day trade any shares.). I haven’t had any problems at all with the things that I use Robinhood for. In fact, I actually like the app. I have long said that I find it more intuitive / user-friendly than Webull (which I also use but I find less intuitive between the volume of information displayed and the general layout of the app) and more robust than SoFi Invest (which I think looks nice, but lacks some features I want).

When it comes to my IRA funds, I’m buying major Vanguard funds in ETF form. I’m not actively trading in my IRA apart from buying on my regular contribution schedule. I’m not too worried about the prospect of Robinhood halting the trading of Vanguard ETFs.

At the same time, I get the skepticism. Robinhood definitely looked beholden to major Wall Street interests (for what it’s worth, they claim that it had to do with regulatory requirements to maintain a certain level of liquidity with regard to the volume of trading rather than an effort to protect a hedge fund from further losses, but I haven’t studied it).

At the end of the day, I can’t answer the core question. Is Robinhood a good place to park retirement funds? I think everyone is going to have to come to their own conclusion there.

I had ignored Robinhood’s 3% match offer because of credit card rewards from Bank of America

When I first saw the 3% match offer, I didn’t even get as far as answering whether I felt safe moving retirement funds to Robinhood. I assumed it wouldn’t make sense for me because my IRA funds make it possible for me to earn excellent credit card rewards from Bank of America.

For those unfamiliar, Bank of America offers a bonus of up to 75% on credit card earnings for those with Bank of America “elite status” (See: Bank of America cards: awesome with Platinum Honors status). The short story is that if you have $100K in a mix of cash and investments with Bank of America, Merrill Edge, or Merrill Lynch, you earn 75% more credit card rewards on Bank of America-branded credit cards like the Bank of America Premium Rewards card or the Bank of America Unlimited Cash Rewards card (note: this bonus does not apply to co-branded cards like the Alaska Airlines credit cards).

A few years ago, my wife and I moved our IRAs to Merrill Edge in order to qualify for Platinum Honors status. As a result, we each get a 75% bonus on the base earning rate of 1.5% cash back on my wife’s Premium Rewards card and my Unlimited Cash Rewards card. That means we earn 2.625% cash back on unbonused purchases (and more in bonus categories). That’s as good as it gets for cash back, eclipsing the long-standing 2% cash back benchmark established by cards like the Citi Double Cash and Fidelity Rewards Visa.

I had mostly ignored Robinhood’s IRA-related offers because of the five year holding requirement. I wasn’t very interested in locking myself into 5 years of holding with Robinhood in large part because we would lose Platinum Honors status and therefore would no longer be able to earn 2.625% cash back on our Bank of America cards.

However, I hadn’t considered the potential impact of the offer. I think it is glaringly obvious what a big offer a 3% transfer match could be for folks with more established IRAs / 401Ks. Someone with a few hundred thousand dollars or more in qualifying IRA / 401K transfers could earn a really substantial bonus here that Robinhood says does not count against annual contribution limits (note: I am not a tax or investment expert and this is not financial advice — go consult your financial professionals before making a transfer).

Robinhood advertises right in the app that someone who transfers $1million in IRA / old 401K investments to Robinhood would earn a bonus of $30,000. That’s incredible. I understand that not everyone has a million bucks to transfer (I certainly don’t), but for those who do that’s a fantastic bonus.

Even at half that amount, which might be more feasible for two-player households who have both been regularly contributing for many years, that’s a $15K bonus. Thinking about numbers like that made me realize that this Robinhood Gold benefit is at least worth a moment of consideration.

In fact, I realized that I needed to do the math and then give this a bit more consideration even at my end of the spectrum (which is far from those big numbers).

Running the numbers on Robinhood’s 3% match vs Platinum Honors status with Bank of America

To keep the math simple, let’s imagine that I have $100,000 in qualifying IRA investments with Merrill Edge in order to earn 2.625% back on otherwise unbonused purchases with either the Bank of America Premium Rewards card or Unlimited Cash Rewards card rather than 2% cash back on one of the many cards on the market that offer 2% back with no investment requirements. Let’s assume that I invest in ETFs that could be purchased through any brokerage (I do).

If I moved my $100K to Robinhood, I would stand to earn a $3,000 bonus with a requirement to spend ~$50 on one year of Robinhood Gold and to hold the money at Robinhood for 5 years.

How much would I need to spend in that five year time period on a Bank of America Unlimited Cash Rewards card to make more in cash back than I would stand to earn by transferring the IRA to Robinhood? (Note: I’m using the Unlimited Cash Rewards card as a comparison point since it has no annual fee, though in reality the Premium Rewards card probably makes more sense for many readers since it has no foreign transaction fees and the annual $100 in airline incidental benefits easily negates the $95 annual fee for many).

Since I could alternatively earn 2% cash back on other cards if I lost Bank of America Platinum Honors status, I’d essentially be giving up 0.625% cash back on credit card spend if I transferred my IRA money to Robinhood (assuming I don’t get the Robinhood Gold credit card). I therefore need to know how much spend it would take for that extra 0.625% to amount to more than the $3,000 bonus I could earn by transferring to Robinhood minus the $50 Robinhood Gold fee for one year (for a net bonus of $2,950). Here’s the math:

$2,950 0.625

——– = ——- = $472,000

X 100

As you can see, I would need to spend $472,000 on my Bank of America Unlimited Cash Rewards card over the next 5 years to come out ahead over the Robinhood bonus. And that’s just in one-player mode. In 2-player mode, we’d need to spend nearly a million dollars over the next 5 years on Bank of America cards for the extra 0.625% over a 2% back card to beat the IRA bonus that Robinhood is offering for transferring!

The math there assumes that a Bank of America card at 2.625% back is my best alternative to a 2% back card, but if I were paying the $50 per year for Robinhood Gold, I could consider getting their Gold card (if and when it becomes available) and get 3% cash back — which beats the return from Bank of America even with Platinum Honors. Of course, I am far from certain that Robinhood’s 3% back will last for 5 years (in fact, I very much doubt that it will and we said as much on this week’s Coffee Break).

Still, if I got the Gold card for a single year and I spent even $20,000 on it, I would come out $25 ahead of what I could have earned on a Bank of America card even after accounting for the $50 fee for Robinhood Gold.

Before doing the math, I wouldn’t have guessed that transferring our IRAs to Robinhood would be worth it considering the hit we would take to our base cash back earnings. After realizing how much spend it would take for the Platinum Honors boost to make up for the bonus we’d miss out on with Robinhood, I see that the cost of holding the IRAs at Merrill Edge is quite a bit higher since I don’t anticipate that we will each spend $94,400 per year on our respective cards for the next 5 years.

Webull’s offer is different (but might be worth a look)

After considering all of the above, I checked my Webull app to see what Webull is offering for IRA transfers (According to Doctor of Credit, this bonus may be targeted, but I see it in my account). Webull has an offer that sounds better on the surface, but I think it requires a bit more consideration to decide whether it’s as “better” as it sounds.

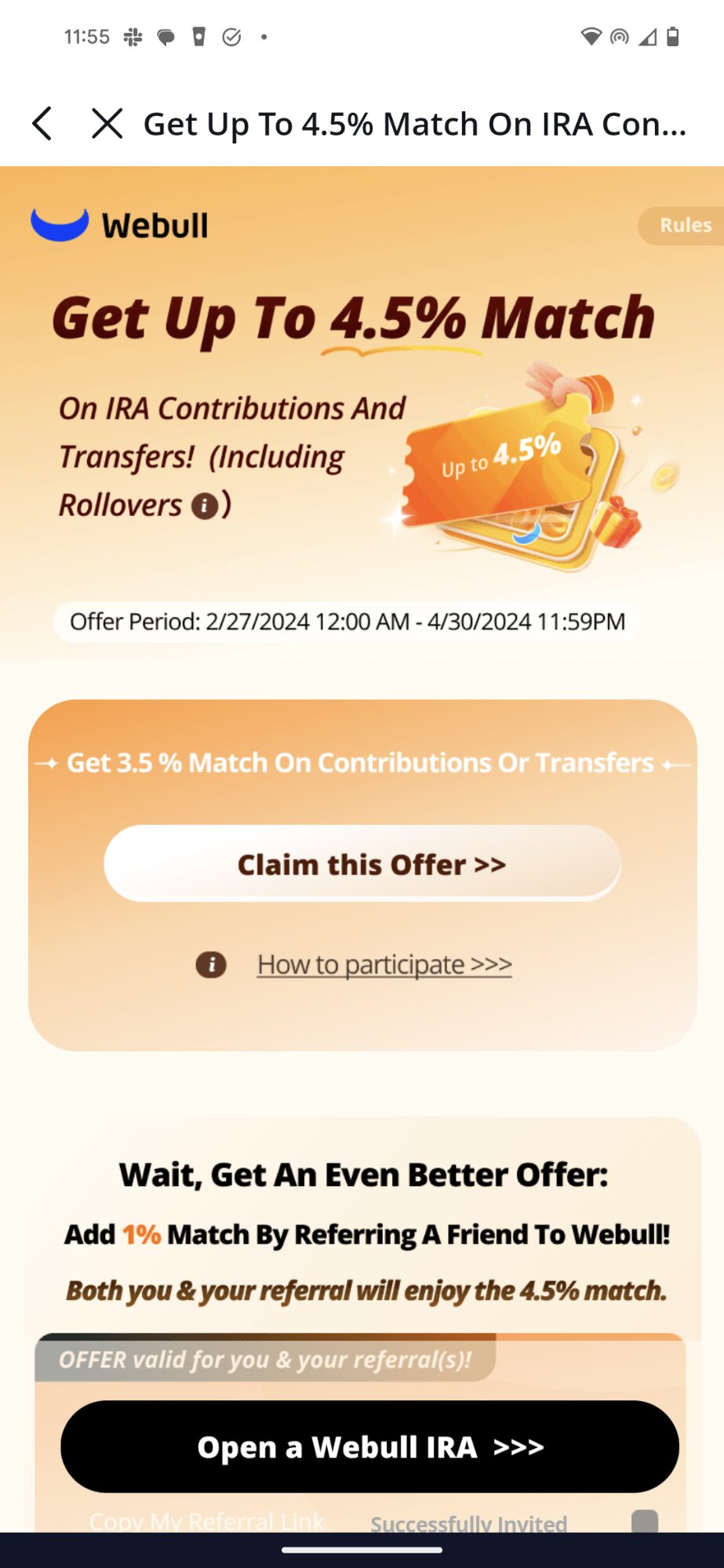

Webull’s offer, which might be targeted, is to get a bonus of 3.5% on IRA contributions, including transfers, through April 30, 2024. If you refer someone else during the offer window, you’ll both be eligible to receive an extra 1% for a total of 4.5%.

That sounds potentially 50% better, but there are a few key differences.

First of all, Webull limits the bonus to applying to a maximum of $1 million. Robinhood’s bonus theoretically has no maximum account transfer size. I imagine this won’t make a difference for most readers, but it’s worth being aware.

More importantly (perhaps), is the way the bonus is paid out. Robinhood pays the bonus directly into the IRA. As I read the terms, I think the bonus posts about a week after your qualifying contributions. As is well-noted above, Robinhood requires that you hold the money at Robinhood for 5 years, but you’ll get the benefit of potential growth on the bonus money from the get-go (along with the risk of losing it all before you’re fully vested).

As I read the terms, Webull is paying the bonus into your linked Webull brokerage account, not into the IRA itself. That could obviously make a tax difference depending on your situation / plans. The other key difference here is that Webull is scheduling payment of the bonus in 20% increments over 5 years — with 1/5 of your bonus amount paid to your brokerage account April 1st of each year from 2025 to 2029.

With my example $100K IRA, someone who refers another person (like if I referred my wife) would qualify for a 4.5% bonus ($4,500). That bonus would get paid out as $900 each year on April 1st starting with April 1, 2025 and running through April 1, 2029. This structure means potentially missing out on some gains (but of course nobody knows what the market will do).

This offer is obviously a larger bonus amount, but I don’t know whether it will make more sense to take the larger amount in a regular brokerage account vs a smaller bonus in the IRA itself. I’ll leave that between you and your financial advisor.

In terms of the relative safety of Webull vs Robinhood, Investopedia has compared them and either sounds relatively safe if you take their word for it (again, I don’t know the “right” answer here).

Is it worth the hassle to chase IRA bonuses?

I know that some readers will immediately hit the comments to say that a bonus like this shouldn’t be a significant factor in your retirement planning and that it isn’t worth moving around your IRA chasing these bonuses.

I have a different perspective.

I can absolutely see the argument for keeping your retirement money with a major, long-established firm with the level of customer service and history / scale that makes you comfortable. Everyone has a different comfort level with the idea of online-only financial entities and moving an IRA to a brokerage like Robinhood or Webull may be completely out of your comfort realm. Far be it from me to tell you that you’re wrong on that. I have family members who won’t even consider a bank account at a bank that doesn’t have a physical branch in their city (forget about investing in an online-only brokerage account!), so I get this.

I can also understand the perspective that if one plans carefully, these small bonuses hopefully won’t have much impact on retirement. That makes sense: I wouldn’t want my preparedness for retirement to hinge on the chase of IRA bonuses.

At the same time, I’m not one to turn down “free” money (my use of the word “free” here means low-effort, high-reward and I’m specifically talking about bank account-type bonuses). My wife and I have earned into the 5 figures with checking account bonuses over the years. A lot of people don’t find those bonuses worth chasing, but I look at it as more than ten grand in money that only cost me some clicks of the mouse.

Our credit card rewards game attracts maximizers who enjoy the thrill of the hunt of a good deal. I enjoy that hunt as much as anyone. Still, I try to keep some perspective. If I’m going to hunt after chances to earn an extra mile per dollar here or half a percentage point there, I feel like it shouldn’t come at the expense of putting thought into larger deals. In other words, if I’m going to calculate how much I’m paying per paper towel in the roll at Costco versus Kroger or use an app to find the gas station a mile away that is charging $0.08 less per gallon, then I’m hopefully not wasting time on those things at the expense of missing easier and more significant wins. No, I don’t really calculate the cost per paper towel or go out of my way to save a few cents per gallon on gas — they are just examples of the types of analysis that many of us do on much smaller deals all the time. My point here is that if I’m going to spend time thinking about those types of things, I should also spend time thinking about opportunities for thousands of bonus dollars.

I’m sure others will feel differently, and that’s fine. We all play the game differently.

I don’t yet know what I’ll do for sure

In terms of what I’ll ultimately do, I don’t yet know. All of this has only been swirling in my mind for a few days. I’ve got until April 30th to make a decision about either the Robinhood or Webull bonus. I have to consider whether either bonus makes more sense than either holding with Merrill Edge or trying to take advantage of several brokerage bonuses over the next 5 years.

I wrote this post in part to think it through, but I’ll ultimately give this some more consideration in the coming weeks before making a decision. The bottom line for me is that I’d initially assumed that it wasn’t worth a second thought and I was wrong. Whether I ultimately take advantage of this bonus or not, it has certainly made me realize that I should more carefully consider moving my IRAs for other brokerage bonuses when available if not this one.

Let me be clear: I don’t mean to recommend that anyone transfer their retirement funds. I don’t know what’s best for your financial situation. With this post, I’m sharing my own thought process. You should think it through for yourself.

Bottom line

Robinhood Gold is offering what could be a very lucrative bonus for transferring existing IRA / 401k accounts. I had not considered taking advantage of this offer because of its impact to my credit card rewards since taking the transfer offer would mean giving up Bank of America Platinum Honors status. However, running the numbers made me realize that I should consider this bonus. Of course, considering it is different than doing it. I haven’t decided whether or not I’ll ultimately move our IRAs to Robinhood (or Webull), but doing the math on this offer made me realize that I should be considering more brokerage bonuses that count IRA transfers in the future since the potential bonus could easily mitigate the credit card rewards I’ve been coveting.

Another thing to think of is the value of the Robinhood bonus longterm, specifically in a Roth. It’s bonus money that will grow taxfree in a taxfree account for quite a few years. That’s something.

It’s more than that; going forward they add 3% to your Roth contribution _every year_. So if you’re over 50 and can contribute another $8k next year, they will add $240 to that. More than makes up for the $50 annual fee. Of course, they could end the program and I have considered that they seem to have leeway to claw back the initial bonus as well. But if they keep their word, it’s a great deal.

I’m seeing the following on the fee disclosure, not that this would be the deciding factor.

Price for Gold

30 day subscription $6.99

Annual subscription $75

I’m showing $5 fee for the next month after signing up for it in the past week.

Of note, the $5 is pulled from the investment account you’ll need to open to at least fund Gold.

It was showing the same for me. I signed up and now it says my annual membership is $50 (due one month after the start of my trial).

Even though you haven’t recommended anything in this post, and have been very clear that you aren’t even sure if you will pull the trigger on this “deal” yourself, I still found this post to be extremely relevant (to me) and insightful. I too, had shrugged off the Robinhood credit card hype as well as the IRA matching benefit, just as you had, mostly for the same reason (I already get 2.625% with BofA Premium Rewards CC, and even 5.25% on $2500 per quarter for a very broad online shopping category with the Customized Cash Rewards CC). But reading your thoughts on this RH offer, made me seriously reconsider it as well. So @Nick Reyes, firstly, THANK YOU!

I would only like to add for your own calculations that BofA is very generous when it comes to the Plat Honors re-qualification. Your balances could drop to zero (in my case that actually happened temporarily) and they hold your Plat Honors for 12 months. Even after 12 months of near zero balances, they only notify you that you haven’t met the balance level required and then give you 3 months to catch back up so it is effectively close to 15 months while you could have the Plat Honors 75% bonus even after moving your funds to RH. If you intend to re-qualify for Plat Honors without a lapse, you have to do the math carefully since it is a trailing 3 month average balance, but if you did requalify during those 3 months grace period, I think that effectively gives you another 12 months (though to be honest, I have not tried this part out but a rep assured me that’s the way it works officially and the fine print supports it).

My point is that you may need not need $100K locked in BofA/Merill forever for Platinum Honors. You just need $100K for 3 months in any 15-month period to keep that qualification (or other combinations such as $300K for 1 month would work too, if you wanted to be nit-picky) while moving it elsewhere for bank/brokerage SUBs at other times. While this moving of balances may be a hassle for IRAs (and wont’ work for the RH offer), just something to keep in mind that the BofA requirements are less stringent than they appear at first glance. So for some folks, there might be a way to have your Robinhood cake and eat it too if you have other funds that can be temporarily moved to BofA/Merrill for short periods. And for those intending to use the 3 month strategy, do note that during that period, the funds could be kept in the currently high-paying safe T-bills in Merrill Edge without a fee (or of course in stocks, etfs etc), so you don’t lose any returns… as long as you have the addl funds available.

I personally may not need to choose between the RH offer and Plat Honors (fortunate enough to be able to do both right now since BofA funds are not “locked in”), so it might indeed be worth the effort to do the ACAT transfer to RH and get a souped-up return on my IRA. The 3% cash-back CC will be icing on the cake if it materializes.

Again, thanks for pointing out what was not obvious from the offer earlier.

I’ve considered moving my IRA as well but have held tight for a different reason. Are there any data points that indicate that indicate whether or not it helps being Plat Honors when applying for new cards? Does BOA like seeing you have over 100k with them if you apply for their cards periodically.

I don’t know for sure, but it probably doesn’t hurt. That said, I’m not terribly concerned about a factor that only might help for credit card applications that I only might make that I might be approved for anyway. I’m not telling you that you’re wrong, but if that were my core hang up I think I would take a bird in the hand.

Seeking advice: Just tried to pull the trigger and I could not transfer bc my Vanguard Roth has only mutual funds and RH said it doesn’t support the transfer of mutual funds. Is there a way around this? Does Vanguard allow me to sell my Roth accnt mutual funds and buy ETS instead, which I could then xfer? I only have VFIAX (which seems the same as the VOO ETF) and VFTAX (an ESG 500 fund–probably equivalent to an ETF like ESGV or SPDR’s EFIV). I’m willing to sell the mutual funds and buy ETF instead if that will make this work bc the bonus is so good. Thanks for any help.

Following in case someone answers but my assumption is you will get taxed if you have any gains. We transferred from Raymond James to fidelity and everything was transferred 1:1.

It’s a Roth IRA and woudl xfer into a Roth at RH. It’s all post-tax, so taxes should not be a problem, I assume.

There are no tax implications as long as you keep all trades within the IRA.

I am out of my element here and I would recommend asking a financial professional, but what others are saying here sounds to me like it makes sense regarding selling and buying the ETF equivalents within the Roth. I see that Puli below said that Vanguard was somehow able to facilitate a conversion without selling and buying. I don’t know if / how that would work, but it might be worth a phone call.

I don’t have a Vanguard account but I don’t see why they wouldn’t. That is exactly what I did for the funds in my 401K at Fidelity. ETFs have a lower expense ratio and are much easier to trade. Like you said, you can find matching ETFs to most MFs. VOO, VTI, VYM are all great Vanguard options.

If you call Vanguard they will let you convert the mutual fund to the equivalent ETF. I did this few years back in my regular brokerage account. VTSMX to VTI. You won’t be able to move the funds back to Mutual Fund without selling it once you do the conversion

If you convert a traditional IRA (or 401k) to Robinhood, when you eventually take the money out do you pay tax on just the gains from the bonus or the bonus plus gains? In other words, if you get a 10k bonus and it increases to 15k when take it out, do you pay tax on 5k or 15k?

By convert, you mean “transfer”, right? A traditional IRA is tax shielded. All funds inside it have not been taxed. The bonus is added to the rest of your tax deferred funds. You will pay taxes on the money you withdraw, whether $1k or $50K regradless of the source of that money.

Roth IRAs are different. And it is a good question as to whether you incur any tax liability for receiving the bonus. I would think you do, If not, then that’s a great deal and you’re effectively getting more than 3% match!

Thanks for talking sense into me. Somehow I was thinking of a traditional IRA as a normal brokerage account. You are correct: You pay income tax on every dollar that comes out of a traditional IRA, so in my example you would obviously pay tax on all $15k that is taken out.

This means that webull is the clear winner for anyone transferring/rolling over a pretax account (401k, 403b, traditional IRA, etc.). You get 4.5% instead of 3%, and you pay less tax (income tax on the initial bonus plus capital gains on the brokerage gains for webull. Everything is income tax with robinhood). The bonus is also more liquid with webull.

For anyone doing a Roth conversion, Robinhood is probably better, but it might not be by too much. If you happen to pay 0% capital gains on the webull bonus gains and your returns aren’t great the next few years (about 5% or less), webull will be better. Based on history, I would guess that returns will be better than that and RH will be better, but it might not really make much of a difference unless you’re transferring at least a six figure Roth IRA. In fact, if you assume 9% annual gains, are in the 22% tax bracket for the WB bonus, but plan to pay zero capital gains (you could always immediately move the webull bonus into a Roth if you’re not maxing that out), RH is better than WB by about $100 per $20k invested.

For me and P2, most of the money we would transfer is in pre-tax accounts, so webull is a no-brainer. We will probably also move about $30k in a Roth at the sacrifice of about $150.

I don’t understand how you found WeBull’s offer better tax-wise. If you are receiving $X for a bonus, you’re going to pay taxes on $X either now (WeBull) or later (RH). Capital gains are irrelevent since the bonus itself most likely will be classified by WeBull as “Misc. Income” and will be subject to regular tax rate and will sit outside the IRA (so its growth will be taxable too- which I guess where your comment about capital gains applies). But remember, with RH you’re paying $0 taxes now or the next 5 years, until you decide to withdraw.

It all depends on what tax bracket you are now vs when you withdraw the money. I generally expect to be in a lower bracket when I am retired and drawing from my IRA, in which case Robinhood is better. Plus, Robinhood pays the bonus in one lump sum upftront vs over 5 years and it stays inside the IRA which is a big advantage because it grows your IRA faster and gives it more time in the market.

I’m assuming you will immediately invest the bonus from webull in the brokerage account. So while the initial bonus is subject to income tax, the gains will be subject to capital gains.

Let’s say you rollover $100k into a traditional IRA. RH will give you $3k immediately into the traditional IRA. Assuming 9% CAGR, after 5 years the RH bonus is $4616. All of that is subject to income tax. If it is taxed at 12%, the take-home is $4062; if taxed at 22% it is $3600.

For the same rollover, Webull will give $4.5k as equal distributions over the next five years into a brokerage account. That’s $900 per year, and let’s immediately tax it at 22%, so that’s $702 per year. Even with the delayed distribution, after 5 years the total is $4201 (assuming 9% CAGR as money is added/invested). $691 of that is subject to capital gains, which would mostly be long-term at 0% or 15% to be consistent with the tax brackets in the RH example (if you wait one more year then it is all long-term capital gains). If we use 15%, then we would take another $104 off the total.

End result: After 5 years, RH would be $3600-4062 after taxes. WeBull would be $4100-$4200. The longer you keep it invested after 5 years, the better it would be for the WeBull investment since all gains would be taxed at long term capital gains instead of income tax rates. Even if you think you will be in a lower tax bracket at that point, the LTCGs brackets are always lower (0% vs 10/12%, 15% vs 22/24/32/35%, 20% vs 37%), so you will pay less tax with WB.

We could probably come up with some extreme examples where RH would be better, but for the majority of people,WB ends up with more money after taxes.

I see your point. But…

First, obviously 4.5% is 50% more than 3% so without tax considerations, WeBull is clearly the winner! However, for the sake of comparing the tax effect we need to look at the same $$ amount. And in that scenario, RH tax treatment will win- just because you have more money sooner.

Second, the point you raise regarding capital gains really applies to any contribution to your IRA. Yes, you pay less taxes on the long run on a $100 if you invest it outside of an IRA by paying LTCG instead of contributing to an IRA and invest it there to pay income tax on withdrawal. But that strategy ignores the compounding effect and also defeats the whole point of having an IRA in the first place and why people contribute to it. Using the same logic, one would discourage people from contributing at all and instead pay income and LTCG instead! But the reality is there are other beneifts to maximizing your IRA nestegg other than pure tax efficiency. It’s not a black and white question by any means, and varies dependign on the individual situation.

I don’t particularly disagree with any of your points, but they are much broader than the purpose of the current article and situation. If the bonuses were the same then RH is better since the WB distribution is delayed. But it’s a moot point since the offers are different. I’m just trying to determine which offer results in the greatest bonus after taxes. I think that for almost everyone WB is better if you’re rolling over a pre-tax account (401k, TIRA, etc), while RH is better if you’re rolling over a post-tax account (Roth).

So I’m trying to work my mind around this.

My wife and I both have both Roth and Traditional IRAs. The split isn’t 50/50 (it’s Roth-heavy), but let’s assume a 50/50 split. I’m trying to work out the best play for each type of account.

So let’s say $100K that is $50K Roth and $50K Traditional. Let’s imagine I could max out my 2024 3% match as well with Robinhood (so $7K x 0.03 = $210).

I’m thinking that I should send Roth to RH and take the extra 3% for 2024 contributions — then I’ll end up getting $1500 bonus from the $50K Roth that goes into the Roth itself + $210 for my 2024 contributions (again, paid into the Roth). I’ll expect to pay income tax on that $1710 this year but no long-term gains tax since it’s in a Roth, so that will grow without any tax when I withdraw.

Then I send the $50K Traditional IRA to Webull and get a $2250 bonus that is split over the next five years. Still paying income tax on the $2250, but now paying long-term capital gains taxes on the earnings (whereas if I created a Traditional IRA with Robinhood, I’d pay income tax on the earnings someday when I withdraw since the $1500 in bonus money would go into the Traditional IRA).

Does that make sense? Or should I just send it all to one side or the other? Should I be putting more weight on an ongoing 3% contribution match from Robinhood? I assume I’ll eventually want to move the IRA somewhere else (who knows whether that will be 5 years from now or more).

Hi Nick,

I was thinking that there weren’t any taxes on the RH matches when they are added to the IRA accounts, though I don’t know that. It would be good for someone to reach out to RH about it and see what they say. For what it’s worth, WB said that they would send me a 1099.

Maybe RH would send a 1099 for the deposit into the Roth, but they definitely shouldn’t send it for the deposit into the traditional IRA otherwise you’d pay income tax on the same money twice. Because I’m assuming that they wouldn’t send a 1099 for the traditional, I was thinking they also wouldn’t send one for the Roth. All money that goes into a Roth has already been taxed and all money that goes into the traditional hasn’t been taxed yet, so I was thinking that any money RH puts directly into those accounts would fall into those two categories. The money into the traditional, and the earnings, would all be taxed at the income tax rate when removed. The money in the Roth would never be taxed.

Those are my assumptions. Based on those, WB is better for the traditional IRA transfer. The bonus in the brokerage account would be taxed as income as it’s added over the next 5 years. If you invest that money, then the earnings would be taxed at the capital gains rate (which could be 0% if you play your cards right / wait until retirement). For Roth, despite it being 3% instead of 4.5%, RH is better because you don’t pay any taxes and you get the entire bonus immediately. That’s what the math tells me (in my examples above).

If the Roth bonus from RH is taxed at the income tax rate initially, as you were thinking, the WB would be better. Running some numbers (based on $100k invested):

RH: Bonus is $3000. After income tax (let’s say 22%), it’s $2340.

WB: Bonus is $4500. After income tax (22%), it’s $3510.

From there, assuming both grow at the same rate, I think WB always ends up ahead even if you have to take 15% for capital gains (though this can often be zero with good planning).

Bottom line: WB is definitely better for Traditional IRA transfers. If none of the bonus is taxed, then RH is better for Roth transfers. If it is taxed, then WB is better.

I forgot about the matching 3% from RH…. If I’m right about the RH Roth bonus not being taxed, then this would just make the RH offer even better (assuming that you’d be contributing to Roth annually, as you said you would this year).

I don’t think the 3% would make much of a difference with the traditional decision. WB is already a bigger bonus and less taxes. But I’d have to run the numbers. At this point, I’m not taking this (or the RH annual fee) into account. I could try to do the math if you want.

No, you don’t need to do any additional math. I appreciate the help in walking through it so far though!

In the post, I included the fact that RH’s terms say that the bonus will be reported as interest:

So I assume that will be a 1099-INT and subject to income tax.

Complicating things a little bit is the fact that Webull offers the 4.5% match if, for example, I refer my wife and she opens an IRA (though I need to double check that it counts even though she has an existing Webull account). Assuming that does count, I get the 4.5% bonus on all of my contributions through the end of April — so I could presumably also contribute this year’s $7K and get 4.5% of that also.

However, the person being referred (my P2), from my read of the terms, only gets a 4.5% bonus on their *first* deposit/transfer into their IRA.

As I read the terms, it sounds like in either case, Webull only offers the 4.5% for a single IRA account. We both have our IRA money split between Roth and Traditional. We have more in Roth — but it sounds like maybe we will only get 4.5% on one account type at Webull.

I’ll have to consider whether it makes more sense to move our (larger) Roths to Webull and just keep our Traditionals at Merrill or move them to RH for 3%. That’s kinda backwards since the bonus money would end up in a traditional IRA then.

We’re probably about 75/25 Roth vs Traditional. I guess I’ll have to reach out to Webull to clarify some details.

1099-INT for money put into an IRA? That will create taxed money inside a tax-deferred account. Is that normal? Will be a pain to track it for years to make sure it does not get double-taxed.

I agree with Alex that something seems a little fishy about getting a 1099 for a bonus posting directly to an IRA. For people doing traditional IRA rollovers, they will get taxed twice! Or maybe you can keep the paperwork showing that you were already taxed. I don’t know, but it sounds like a headache I don’t want to deal with.

Either way, if every bonus – whether WB into a brokerage or RH into an IRA – is getting an immediate 1099, then it seems like putting everything into WB is the way to go. The incrementally distributed 50% better bonus from WB will result in more money for a Roth rollover even if you have to pay 15% capital gains on the earnings. Let’s continue my math from my previous comment:

RH: Bonus is $3000. After income tax (let’s say 22%), it’s $2340.

WB: Bonus is $4500. After income tax (22%), it’s $3510.

Understanding that the WB bonus is distributed incrementally while RH is giving it all upfront, after 5 years at 9% CAGR the two bonuses will be:

RH: $3600

WB: $4201

After 15% longterm capital gains on the WB bonus, the final post-tax totals are:

RH: $3600

WB: $4097

If we let the bonus keep compounding for 20 more years, after LTCG are taken at 15% from WB on earnings, we will end up at:

RH: $20175

WB: $21230

And that’s basically the worst case scenario for WB. As I’ve mentioned, there’s a decent chance your LTCG could be 0%. You also could take your brokerage bonus from WB and immediately move it to your Roth as part of your yearly contribution to ensure you don’t get taxed on the earnings. One last benefit to WB is that a brokerage bonus is more liquid which gives more flexibility with how you want to use it.

Finally, for what it’s worth, P2 (the “referred”) is going to rollover both her traditional and Roth IRAs from vanguard at the same time. WB is telling me that she will get the 4.5% on both. I find their customer support to not necessarily be the most knowledgeable (shocking!), but I’ve asked the same question a few times and keep getting the same answer. So I’m planning on saving a bunch of screen shots in case it doesn’t work out. P2 is also only rolling over like 30k (20k tira, 10k Roth), so it’s not the end of the world if she doesn’t get one of them. I’m referring her because I’ll rollover like $120k from a bunch of different places and I want to ensure I get the bonus.

Obviously the best would be if you could both refer someone else. That would guarantee you get everything at 4.5% between now and April 30th. Maybe your wife refers you, then you can get at least one person to use your referral link from your many loyal followers?

Thanks to both of you for this analysis. I’ve been following this as I’m debating between transferring a Roth IRA to RH or WB.

I reached out to RH and got a delayed but helpful response. They said the bonus will be reported as miscellaneous income on Form 1099-MISC if the total amount of reward funds from this and other promotions are valued at $600 or more for the year.

They didn’t give an official response to whether it is taxable. I’m definitely not qualified to answer that myself. But my understanding is that while all income on a 1099-MISC is not automatically taxable, the fact that RH plans to issue one (to customers and the IRS) suggests it would be taxed. That being said, it would be strange for something being treated as interest/dividends in a Roth to be taxable.

FWIW, most commenters on this thread at Bogleheads seem to think this type of bonus is not taxable:

https://www.bogleheads.org/forum/viewtopic.php?t=389148

Anyone have a more definitive insight on reporting and taxability of 1099-MISC income?

Thanks to all of you for your thoughts here.

That Bogleheads thread is about a Schwab bonus, but I see it goes on to quote some stuff that seems relevant. And in hindsight, when I moved the Roth to Merrill Edge, I got a bonus (something like $600 or $900 I think) that was paid directly into the IRA and was treated as gains as you say, not as income.

A couple of people have made the point about Robinhood offering 3% on future contributions for Gold members (for however long that lasts). I want to note here that I did think about that — but I quickly realized that if they continue that in 2025, I could just open an IRA with Robinhood at that time and contribute there for the 3% bonus rather than contributing to the Webull one. My understanding is that you aren’t limited to having an IRA in one place, you’re just limited in total annual contributions. So if I decide that the Webull offer is the better deal for me, I could transfer all the marbles to Webull now (and make my 2024 contributions up front now for the 4.5% match) and then not touch it again and create a Roth at Robinhood in 2025 and make my 2025 contributions there to take advantage of the 3% match. All that is to say that the ongoing 3% match doesn’t matter to me. The only way it factors in is that I could get 3% from Robinhood whether I make my entire 2024 IRA contribution in April or I spread it out over the rest of the year. With Webull, I would only get 4.5% on contributions made by the end of this month I believe. So I’d have to max out 2024 contributions right now, which is not impossible.

@Captain Greg: Good thought on having my wife refer someone else. I actually think that in my Webull app it says that I already have a successful referral for 4.5% (I’m not 100% sure, the display looks weird and I haven’t followed up), but the risk there is that it says that if the person you refer pulls money out of Webull before the 5 years is up, I’ll lose that 1% bonus. So there’s some gamble in that. But maybe it’s worth that gamble to know that she’ll get the 4.5% on the whole enchilada so long as that other person sticks with Webull for 5 years.

My final consideration now is about the rules regarding funds in the brokerage account. My read of the Webull terms is that if you take money out of either the IRA *or* your linked Webull brokerage account, it they could claw back bonus (or not award it in the future). That’s not a huge deal. I have some holdings in there from referrals over the years. I think doing the IRA thing will essentially lock me into holding that money at Webull for at least 5 years. That’s not a deal-breaker. However, I need to double check whether Robinhood has the same in the terms. That *would* be a dealbreaker for me at Robinhood as I have money invested at Robinhood that I intend to probably take out / use within the next 5 years.

It’s been a fun puzzle trying to figure this all out though!

I agree with Micheal (and the bogleheads) that a bonus to an IRA shouldn’t be taxable, but if you’re getting a 1099 then it’s a red flag to the IRS if you don’t include it in your income taxes. It seems justifiable that you shouldn’t have to pay taxes on it, but what’s the cost of the potential headache of having to explain that to the IRS, getting audited, etc? I’m sure it’s still pretty unlikely to happen, but I’d be kicking myself if it did. And what’s really the gain? A few days ago, when I thought the Roth bonus with RH wasn’t taxable (and maybe it still isn’t?), I calculated that the RH Roth bonus was about $100 better per $20k invested than the WB bonus. How big does your Roth have to be for someone to decide to take the gamble of getting a 1099 from RH but not paying the taxes on it? To me, there is no amount. Even if you’re transferring $1M (and therefore I’m saying that RH will make about $5k more), at that point you’re already pretty wealthy and it probably still isn’t worth it.

Nick, I agree with your point about the 3% annual RH match. You can have as many IRAs as you want; your only limit is contribution maximum between all of them. So, since you can separately open a RH account for the match in future years, we shouldn’t consider it in the context of the immediate bonus opportunity. To me, it’s pretty similar to the capital gains taxing of the WB bonus. Anyone could take that bonus each year and immediately move it to a Roth to avoid future taxes. I suppose the caveat is that it’s not possible if you were going to max out your Roth anyway, but that’s a good problem to have. And you might pay 0% in capital gains anyway if you leave it in a brokerage.

Your wife referring someone else will probably work out. Maybe she could even refer more than one? Anyone who is doing this is probably planning to leave the money in the account. Either way, you could refer her, so she gets the match on her initial deposit, and then, ideally, see if she can refer someone else to cover both ways.

I’m happy you looked at the terms so closely. I was planning on leaving the WB bonus in the account for 5 years either way, but it’s good to know that I have to leave it there to keep getting the bonus. It seems like both bonuses have a number of gotchas to cause breakage, but it won’t be coming from us! Good luck with the decision.

My read of the terms here had been that you just needed to refer someone who didn’t previously have a Webull IRA, but in contacting customer service in advance I’ve learned that the person you refer needs to both open their Webull brokerage account during the promotional window and open the IRA during the window.

So, long story short, since me wife has had a Webull brokerage account for years (opened for some bonus where I referred her years ago), she isn’t eligible to be referred for the IRA bonus. That means we’d each only get 3.5% with Webull.

I had convinced myself that the flexibility of having it in the brokerage account where I’d have the flexibility to use it before retirement was a factor that along with the 4.5% match made it worthwhile.

Given the fact that the bonus deposit into the Roth may possibly not be subject to income tax, it’s right away, and the gains definitely won’t be taxed, I think I’m now leaning back toward Robinhood. Until they got back to me with that info, I thought I was going to go with Webull!

I’ve been doing tons of brokerage transfer bonuses for over a decade, both in taxable accounts and in IRAs.

IRA bonuses that go directly into retirement accounts are not taxable, and I’ve never received a 1099 for any such bonuses. (And yes I have received my 1099s for all my regular individual/taxable accounts.)

What is more likely:

I’m going with option 2. Yeah, there wasn’t any chance of “ruining” the deal or anything here, but this is still why you don’t call the bank.

So…. asking for a friend. If you transfer IRA over, get the bonus, abuse the 3x card and get relationship shutdown, does the bonus still get clawed? 🙂

That ol’ million dollar tax payment sneaking up on you again??

I know this is something that drives Nick nuts a bit, and I agree with him. The banks make the rules and then we play within them (granted, in a way that tries to maximize our benefit, but what’s wrong with that?). It’s a little ridiculous for them to say “we don’t like the way you are playing within our rules, so you get nothing.” Make better rules! In this case, RH could do a $50k max on 3%, or something like that. With the Gold membership offsetting some of the expense, this card could be sustainable. I hope they do something like that rather than dropping the earning rate. I also think they would have/keep more customers.

I’ll gamble a little now and then — I’ll buy a lottery ticket or throw ten or fifteen bucks down on a hand of blackjack. However, I probably wouldn’t gamble with a bonus worth thousands of dollars. If I got the 3% card, I’d be using it for legit “everywhere else” spend rather than for anything likely to get me shut down.

Can anyone confirm that individual bonds can not be held at Robinhood?

does Robinhood have low cost investments like Vanguard index ETF funds? i am worried about having to keep that much at Robinhood for at least 5 years as they can change their policy at any time and get rid of low cost index funds.

Yes. I think all brokerages that trade stocks have access to all ETFs, don’t they? That’s why I invest in Vanguard ETFs — so that I know I could always transfer them to another brokerage without causing a headache. At any rate, every Vanguard ETF in which I invest is there. I don’t think you can get the target date funds through brokerages like Robinhood though because I don’t think there are ETF equivalents of those.

You also receive 3.5% on Restaurants and Travel as well as 2.625% on everything else with the BofA card.

While that is true, there are definitely better cards for restaurants and travel.

Another important thing to consider, as others have mentioned here, is how long it takes your account to “settle” into the Robinhood account. Some transfers may only take a short time, others may take much longer. I remember when I moved a couple of my orphaned 401k accounts a few years ago from previous jobs to Merrill Edge to combine them in one place. One of the transfers took several days… that’s several days where I was missing out on investments gains because my funds were in transfer “limbo.” That’s something to consider, especially right now when the market has gained almost 10 percent in the past three months (if investing in the S&P 500).

Do you miss out on gains? You still own the funds with the same cost basis, right? You’re essentially transferring the custodian of the account. I don’t think you’ll miss out on the gains of whatever you hold. Like if you have 100 shares of XYZ on the day you initiate the transfer and those 100 shares are trading at $1 each and the price goes up to $1.10 by the time the transfer settles, you’ve still got 100 shares and you now have $110 worth of XYZ. That’s my understanding of how it works with an IRA anyway. I don’t have any past 401ks.

It was my understanding that my old 401k custodians sold my investments (ETFs and mutual funds), which then became basically cash, before transferring. The cash was transferred to Merrill Edge. Then, Merrill reinvested the funds per my instructions. It was during that transfer time from the old custodian to Merrill that my funds were not invested, therefore not benefiting from any investment gains (but also not suffering any losses either). It’s been a few years, so maybe my recollection is fuzzy.

That is absolutely not how an ACATS transfer works.

As I have learned, you cannot transfer mutual funds into Robinhood. You can transfer in ETFs. So if you want to transfer an IRA with mutual funds you need first to convert those mutual funds to cash or ETFs by selling and buying. Maybe that was the hangup.

Funds in many 401K are usually “institutional instruments” meaning they are not normal funds that can be traded by individuals. That was the case for my 401k anyway. Hence, I couldn’t do a direct transfer from the 401K to a rollover IRA at Robinhood. I was required to liquidate into cash, and then transfer the cash to a new Rollover IRA at Fidelity. Then, once that settles (one day), I could invest the cash in market traded investments, and do a normal ACAT transfer.

I was worried I’d be losing interest/gains when the money is floating but in reality the market fluctuated pretty much in place over the last and this week. The golden rule of investing: Don’t try to time the market. And that worked out this time for me too.

My ACATs transfer took less than one week for whole shares, had to liquidate partial shares at old brokerage and not quite sure when they’d sweep those to Robinhood as well. Nice feature of Robinhood is that one can purchase fractional shares on orders, which not all brokerages support.

I was in the same boat – Platinum Honors through Merrill Edge IRA for years. Primary benefits of doing this were 2.625% on CC and free safe deposit box. A few times reimbursed ATM, wire fee discounts, etc. came useful. One time BofA really fought and won my mortgage business, and I think being Platinum Honors was important there.

However, regarding the CC benefit, I actually use my BofA cards very little. With all SUBs available, it’s way more profitable to get new cards vs using BofA. Also, the value of points is pretty high, and I can easily argue that 2 TYPs from Citi DC or 2 CapOne points from VentureX are no less valuable than 2.625%.

So when RH bonus came out earlier this year, it was clear to me that my Merrill Edge days are numbered. Over the last month or so, I transferred all I could to RH and I’m happy with the experience.

Transfer takes about a week. Bonus posts within 1-2 days. Getting reimbursed for the outgoing broker fees is a bit shaky, but I got one reimbursement already and will be filing two more. Customer service is responsive, but not being able to talk to them is a bit inconvenient and when back office takes some action, there’s zero communication of that, which is annoying.

I don’t care about 5 years holding since this is IRA. Trading fees are good at RH anyway. They are insured by SIPC, so they are as safe as anyone else up to SIPC limits.

As for Platinum Honors, I’ll consider moving $100K+ from another broker’s traditional account into Merrill. Might also pick up another transfer bonus on the way. Looks like need to wait 24 weeks from the last transfer out from Merrill, but does not seem they have a required holding period after they pay out the bonus.

So are you saying that you were able to get the 3% match bonus from RobinHood on multiple different accounts that you transferred to them? I have a couple old 401(k)s at Fidelity and then an IRA at Vanguard. I’m trying to figure out whether or not I’d be able to get the 3% match on all of those accounts if I were to transfer them over.

You will (if you do it before 4/30). I consolidated several IRAs/401k accounts from different brokers into the same RH IRA and all transfers got corresponding bonuses.

Awesome. Thanks

I rolled over a 401k from Fidelity to Robinhood last week to take advantage of the offer. The ACAT transfer was extremely easy (just a few clicks on the app) and took about 4 business days to settle (the official time promised is 7-10 days). Because I was rolling over from a 401k, I had to liquidate investments to cash and temporarily move them to a rollover IRA at Fidelity. So my transfer was all cash. Not sure if I had a mix of stocks if it would have taken longer.

The 3% bonus posted simultaneously with the funds and I was able to place orders immediately.

I also have another IRA at Merrill but I’m not going to transfer. Remember SIPC insurance applies to a maximum $500k per broker, so it’s wise not to put all your eggs in one basket. I also value the Premium Rewards card and with the $100 airline incidentals credit I consider it to offset the yearly fee.

$500k per broker, per account type.

If you have traditional IRA and Roth, both will get $500k protection.

Two questions: 1) Does this apply to Roth IRAs as well? I assume so but it doesn’t specifically mention them. 2) If I do transfer a Roth, will I lose the designation on the original deposit amounts that I can now withdraw without penalty before my retirement age? The rule for Roth IRA is that I can withdraw original deposit amounts that I’ve made each year without penalty before I’m 60 (or whatever the age is) but I can’t make penalty-free withdrawals on the interest I’ve made. Right now Vanguard has tracked the amount of my original deposits and tells me how much I can withdraw penalty free. I wonder if that tracking will transfer or if I’ll lose the ability to make early withdrawals without penalty.

1) Yes it applies to Roth IRAs as well

2) You should confirm with your broker. In my case I was told by Fidelity that if I transfer my Roth, that it would reset the clock on the “5 years before withdrawal without penalty” because that is based on the age of the account you’re transferring into. I’m not sure if that rule applies across the board or specific to people at a certain age bracket.

For that reason, I decided to keep the Roth portion at Fidelity for now.

You might have misunderstood, or they lied (unlikely), but the 5 year period starts from the date of the contribution and does not reset with custodian transfer. You may have to keep the old statements to be able to prove the contribution date.

I’m pretty sure I didn’t misunderstand. I was very explicit about my plans with the Fidelity advisor and discussed various options. Maybe this was specific to my own situation (Age perhaps? Or the fact that my Roth funds are in my previous employer’s 401K plan- and taking them out of the 401K into a new Roth account causes the reset?) He did say I could transfer to my existing Roth IRA account at Merrill Ledge and that would NOT reset the clock. Who knows?? He maybe misinformed. I will ask again in a few months.

Disclaimer with: not a tax pro or an attorney but I was curious about the tax considerations for retirement account bonuses. Turns out! The IRS actually did – at one point – opine on this exact topic. PLR 201310043. The IRS characterized account opening bonuses as something similar to just a dividend that would’ve been paid on a stock owned in a retirement account and, as such, not subject to annual contribution limits.

Don’t get me wrong, I won’t be doing this because I’m pretty skeptical on Robinhood period and prefer to keep my IRA in Merrill for BoA rewards but at least they’re not wrong about tax considerations!