Sometime on the morning of October 12th 2015, REDbird in-store debit loads stopped working. Cash loads continued to work, but debit loads did not. And, it wasn’t just gift cards that failed — regular bank debit card loads failed as well even though cash loads continued to work. We reported this issue on Monday: REDbird Debit Loads are not Working: Here Is What We Know & What We Don’t.

Others have written in detail about why they believe that this isn’t just a temporary system issue. This appears to be an intentional change. You can read, for example, NoonRadar’s analysis, or Miles to Memories’ post.

On the other hand, optimists still have reason to hope. There have been hints here and there that suggest that this could be temporary. I’ve heard, for example, that Target’s payment terminals haven’t been working properly with debit cards with EMV chips. And, there is evidence that Target is adding a chip to REDbird (see the image below, for example). Perhaps Target has simply turned off debit loads until these changes are in place. Or, it could simply be a system-wide glitch. But… I don’t think so.

Assuming I’m right, the ability to manufacture credit card spend by buying Visa/MasterCard gift cards and using them to load REDbird (the Target Prepaid REDcard) is dead.

UPDATE: After writing this post, but before publishing it, NoonRadar posted that he has seen a corporate memo that confirms that REDbird is cash only going forward.

UPDATE 2: Here’s a photo of the memo. It’s real.

Only with Cash

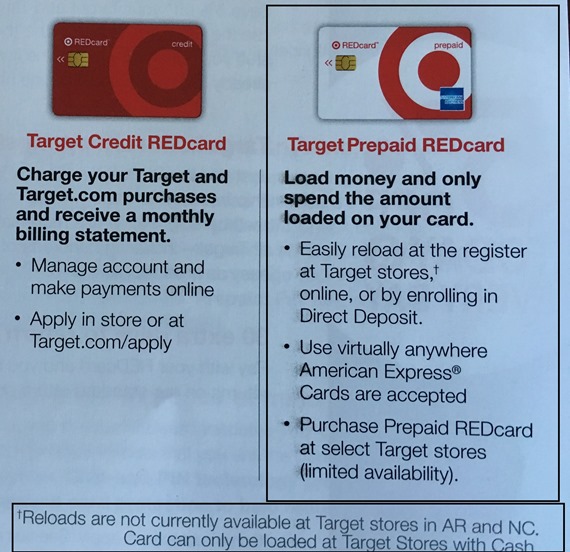

We’ve had scares like this before, but this one feels real to me. Just last week, a friend sent me photos of Target’s new REDcard brochures. Among the images was this:

Note the little box on the bottom, right. It says:

Reloads are not currently available at Target stores in AR and NC. Card can only be loaded at Target Stores with Cash.

I found it interesting that they publicly acknowledged that loads don’t work in Arkansas or North Carolina. Many of you found that out yourselves the hard way. The scary part, though, was the last bit: “Card can only be loaded at Target Stores with Cash.” I think this is the new policy.

And, this is a change. Target used to explicitly allow debit card loads in-store. Do you remember getting an email in June from Prepaid REDcard informing you that credit card loads were no longer allowed? The email arrived on June 12th despite the fact that credit card loads stopped working more than a month earlier. Anyway, in the body of the email, it said (underlining is mine):

We wanted to let you know that you will no longer be able to load your Target Prepaid REDCard® by American Express at Target stores with a Target GiftCard or a non-Target branded credit card. You can continue to load your card with cash or debit at Target stores.

Perhaps we’ll get another email in November declaring that we can no longer load with debit cards. If so, it will probably also say “You can continue to load your card with cash at Target stores.”

The one year mark

REDbird (the Target Prepaid REDcard) first appeared in select stores in early October 2014. I first wrote about it here: Amex introduces new Bluebird-like Target REDcard! At the time (and still today), the temporary card was available only in certain test markets. People frequently asked when I thought it would be rolled out nationwide. My answer had been consistent: I was betting that Target would run the experiment for a year. I figured that in October of 2015 they would either kill off the product or roll it out nationwide.

It appears that I was wrong. They didn’t roll out REDbird nationwide (not yet, anyway). And, they didn’t kill off the product. Instead, they hobbled it. They made it useless for those who want it primarily for manufacturing spend. Those who need it and use it as intended, as a checking account alternative, are probably unaffected by these changes.

What’s now?

Of course, there’s always Bluebird and Serve. Recently I wrote about my experience switching one of my REDbird cards to Serve. Please see: The switch: REDbird to Serve. You’ll find what amounts to a step by step guide in the section titled “Smooth Sailing”. Since writing that post, I switched a second card to Serve and the process went as smoothly as before. It’s important to first clear out all funds before cancelling. Then, when signing up for a new Serve (or Bluebird) card, make sure to use the exact same info as before: same email address, same phone number, etc. It’s probably the case that using the same email address is enough, but you might as well keep the other stuff the same too.

Given how easy it can be, I think that the switch makes sense for anyone with ready access to a friendly Walmart. Many will say to wait and see what happens. It is still possible that REDbird will come back to life, after all. Sure, you can do that. Or, you can try to get new Serve cards in time for October reloads. I chose the latter. If it turns out that I chose wrong, I can always switch back. Of course, that would be easier for me than most since I live in an area where temporary REDcards are available in-store. Still, I’ll probably hold back on converting a card or two just in case I want to get 5% off at Target.

To prepare for the switchover, my first step was to clear out all funds on my remaining REDbird cards. I cleared out some instantly by using the Send Money feature. I was able to send up to $2,500 instantly to my other accounts (my new Serve accounts). A few accounts had more than $2,500, so I initiated ACH bill payments instead. In a few days, when the bill payments have cleared, I’ll close most of my REDbird accounts and switch to Serve… unless REDbird comes back to life in the meantime.

Dealing with Vanilla

One of the great things about REDbird was that most Target stores happily accepted Vanilla brand Visa and MasterCard gift cards for in-store debit card reloads. At Walmart, on the other hand, Vanilla gift cards are difficult to use. As a result, I expect that many readers are now sitting on a few of these cards and wondering what they’ll do with them. In my case, I know of a local store that will accept Vanilla debit cards as payment for money orders. Others may have better luck using Vanilla gift cards at Family Dollar to load Serve. You could, of course, use them for daily spend instead of your regular credit cards. Or, suck up the 2.5% or 3% fees and use them to pay bills via bill payment services like Plastiq or Evolve Money.

What is your strategy?

I’m curious what readers plan to do next. Will you wait it out to see if REDbird comes back to life? Switch to Serve? Switch to Bluebird? Switch to something else? Give it up altogether? Please comment below.

[…] gift cards; options for liquidating gift cards dry up; and other manufactured spend opportunities, like REDbird, come and go. While new opportunities occasionally arise, the trend is unquestionably negative. […]

[…] for the highest return on invested time first. Whether its the easiest, lowest time investment like Redbird and Bluebird were. Its why the world after Redbird has been less written […]

[…] I was wrong. The Target REDcard still hasn’t been rolled out nationwide, but it has been hobbled to the point of uselessness for those who would like to use it for earning miles & points. See: I’m calling it. REDbird is dead bird. […]

Has anybody tried to load PIN enabled Visa/Master Gift Card at any Walmart Neighborhood Market? Do they have KATE and if their cashier register has authority to process BlueBird/Server Reload? Thanks.

Anyone got a good way to cash out VGC in the bay area? Now with target gone, I checked walmarts…none of working KATES. Money orders seem a no go at safeway or any financial institution.

Bob, did you check the Walmart in San Leandro?

I am waiting on my Serve cards which should arrive this week. In the interim, I was able to buy money orders @ the USPS w/ a couple of $500 VGC’s. Should work @ all Post Offices.

the big question now is: between BlueBird and Serve what is our best bet moving forward?

For most people it would be the One VIP version of Serve. Unless writing paper checks as a mean to unload funds is very important to you, then go with Bluebird.

See this resource for more details on the different versions of Serve: frequentmiler.com/american-express-serve-types-guide/

I do enjoy the 5% off regular Target purchases, maybe I’ll just keep the card until I deplete the balance using at as its creators intended.

I wonder if this is going to filter down to the old target amex? I still use that method…

Yep – the notice mentions this card as well.

What pisses me off is that all of the hoopla over redbird killed the credit card (and now debit card) loading I was doing with my oddball gift cards (looking at you AMEX gift cards).

[…] dead. First, Miles to Memories came out with a good post on what to do and leaving some hope. Then Frequent Miler called it dead, cash only going forward and all, omg! Who the phuck would use this to load cash? Oh […]

Thanks for the confirmation.

Bye, bye birdie… 🙁

Yep count me among the surprised. Geographically Target was a difficult choice for me, but Redbird got me in the store. I prefer going there to purchase everything from groceries to picture frames, but will now reluctantly make those purchases at Walmart and Family Dollar.

after spending a year a year at target, I really don’t know if I can physically go back into a Walmart without projectile vomiting. Losing Target has reminded me that there is once again a cost to this cheap travel – dignity, self-respect, etc …

Besides BB/Serve, is there anything else people are considering? What about MO? I for one made a mistake of converting my two serve cards to RB eight months go where I was allowed $1,500 a month CC upload.

[…] My friend Bill (Racerboy 80) managed to get a photo of The Memo. This is the one that asserts that REDbird loads are now cash only (for more, see: I’m calling it. REDbird is dead bird.) […]