NOTICE: This post references card features that have changed, expired, or are not currently available

A few months ago American Express increased the annual fee on the Business Platinum card and added a number of new benefits. (See Business Platinum: New Perks, New Price)

The annual fee increase and additional/increased benefits (like the $200 Dell credit going up to $400) got most of the attention, but there was another benefit that flew under the radar – the ability to earn 1.5x Membership Rewards in a number of categories.

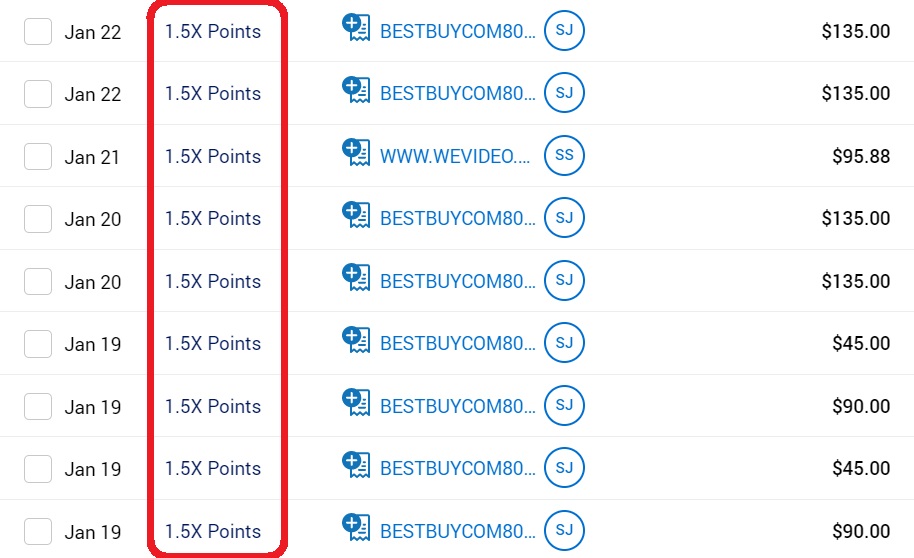

I was reminded of the benefit flying under the radar following a comment on yesterday’s post about some gift card deals Best Buy is currently running. I’d mentioned in that post that the Amex Business Platinum card could be a good payment option seeing as it now earns 1.5x Membership Rewards.

A reader asked about those 1.5x earnings, wondering if it related to an Amex Offer or something else. Thankfully you don’t have to be targeted for an Amex Offer to earn 1.5x – you just need the Business Platinum card due to the new earning categories.

I therefore thought it was worth publishing a post as a reminder that the card now offers 1.5x in several categories as it was a new benefit that was easy to overlook. It was something that I myself hadn’t paid attention to initially until someone in a group I’m in mentioned a couple of months ago that they’d earned 1.5x at Best Buy.

As a reminder, here are the categories that now earn 1.5x Membership Rewards on the Business Platinum card:

- US Construction material and hardware suppliers

- US Electronic goods retailers and software & cloud system providers

- US Shipping providers

Those categories cover a broad range of retailers and American Express provides some examples here. It’s not specifically listed as an example, but Best Buy falls under the ‘US Electronic goods retailers and software & cloud system providers’ category.

This can be particularly useful for people taking advantage of buying groups or who would like to take advantage of the card’s extended warranty and/or purchase protection benefits. Earning 1.5x at Best Buy can also be useful for gift card resellers seeing as they run weekly deals (and sometimes daily deals) that can be profitable or break even for reselling which can’t be paid for with discounted Best Buy gift cards.

The Point debit card offers 5x on Best Buy purchases, but that’s limited to $1,000 spend per month and for some it can be easy to exceed that spend. Point also excludes gift card purchases; while that doesn’t seem to always be enforced, there’s no guarantee that it’ll always earn 5x on excluded purchases, so some might prefer to take the sure thing of 1.5x Membership Rewards.

So the 1.5x points need to be in those categories? If not, then 1x?

Woot (an Amazon company) is also 1.5x

Puhhleeaaze…you are becoming like the Points Pimp. Why would anyone get 1.5x at BB when you can get 2x all day long with the no annual fee BBP up to $50K/year (times n player mode)?????

A lot of people who have the Business Platinum won’t have the Blue Business Plus and/or will spend far more than $50k with Best Buy.

The purpose of this post wasn’t to encourage people to apply for the Business Platinum card – that’s why there’s no link for people to apply for the card. It was to remind people who already have the card that it earns bonus points at retailers they might not have been aware of.

OK, Stephen, but you should have mentioned the Business Blue Plus because it earns 2X for everything up to $50L. There are a LOT of folks who have both both cards, but for those churners or CC enthusiasts, they all permanently have the BB Plus, not the Plat. Most of your readers would fall into the churner/enthusiast camp. You should know this by now.

In which case I’d like to think those readers are savvy enough to not need me to tell them that earning 2x is better than earning 1.5x.

Again, the purpose of this post was to inform/remind people that the Business Platinum card now earns 1.5x in a number of categories, one of which includes Best Buy – it wasn’t to list all the cards that could possibly earn you better rewards on those purchases.

The purpose of your post is fine but purposely ignoring the BBP up to $50K (per business) is PointsPimpy and below the standard-of-care Greg and Nick have maintained so far.

I thought this post was great. I think I was on vacation when the 1.5x categories originally got announced and was surprised when I got 1.5x on a purchase. I thought it was a great idea to put out a reminder for ordinary folks like me who might have missed it or forgotten about it.

Also useful for those of us who have +4x on Business Platinum for

adding an employee cardrecommending someone. As a parallel example, although there was another 20K MR points to be had for each employee spending $4K, I had them do $5K purchases to trigger the extra 0.5x on the base. I hadn’t remembered that there were other places to shop at 1.5x base. Point is, Stephen’s info has some uses for other than card comparisons. One size doesn’t fit all. You should know this by now.This is only useful for big spenders. I’d still rather earn 2X on my BBP card on the first $50K.

just made a large purchase ( over 5k) with my biz plat at home depot…I wonder if HD qualifies as “US Construction material and hardware suppliers” …because it’s over 5k, it already gets 1.5x, but I wonder if I get some extra points

I’d assume Home Depot would qualify seeing as Lowe’s is listed as being eligible. Let us know if you do end up earning 2x on the purchase; I’m assuming it’ll be 2x rather than 2.25x if it does work seeing as it’d be half a point extra for it being Home Depot and half a point extra for spending $5,000, rather than it being 1.5x * 1.5x.

I have a pending transaction for Home Depot for $6200. It says 1.5X for US Construction material and hardware suppliers. Not seeing any extra points for being over $5000. Ill make a phone call to find out.

mine showed 1.5x also. I was planning on use the pay over time since it was 0% , but I was told it didn’t apply for purchase over 5000 (my limit?), so canceled and used a double cash card instead. Damn it Amex