Online brokerage Robinhood has announced a waitlist for a soon-to-launch credit card that they claim will offer a flat 3% back on most purchases (and 5% back on purchases made through the Robinhood travel portal). I hesitated about whether to write a post about this because I am somewhat skeptical as to whether it will launch and how long it will last, but on this weekend’s podcast we referenced it in explaining why we’re not jazzed about the prospect of earning 5 Hilton points per dollar spent (more on that example in the post below). I hope that this card works out, though I do have my skepticism.

Update: We originally wrote that Robinhood Gold costs $6.99 per month or $75 per year, but it actually costs $5 per month or $50 per year. We have updated this post accordingly.

The Deal

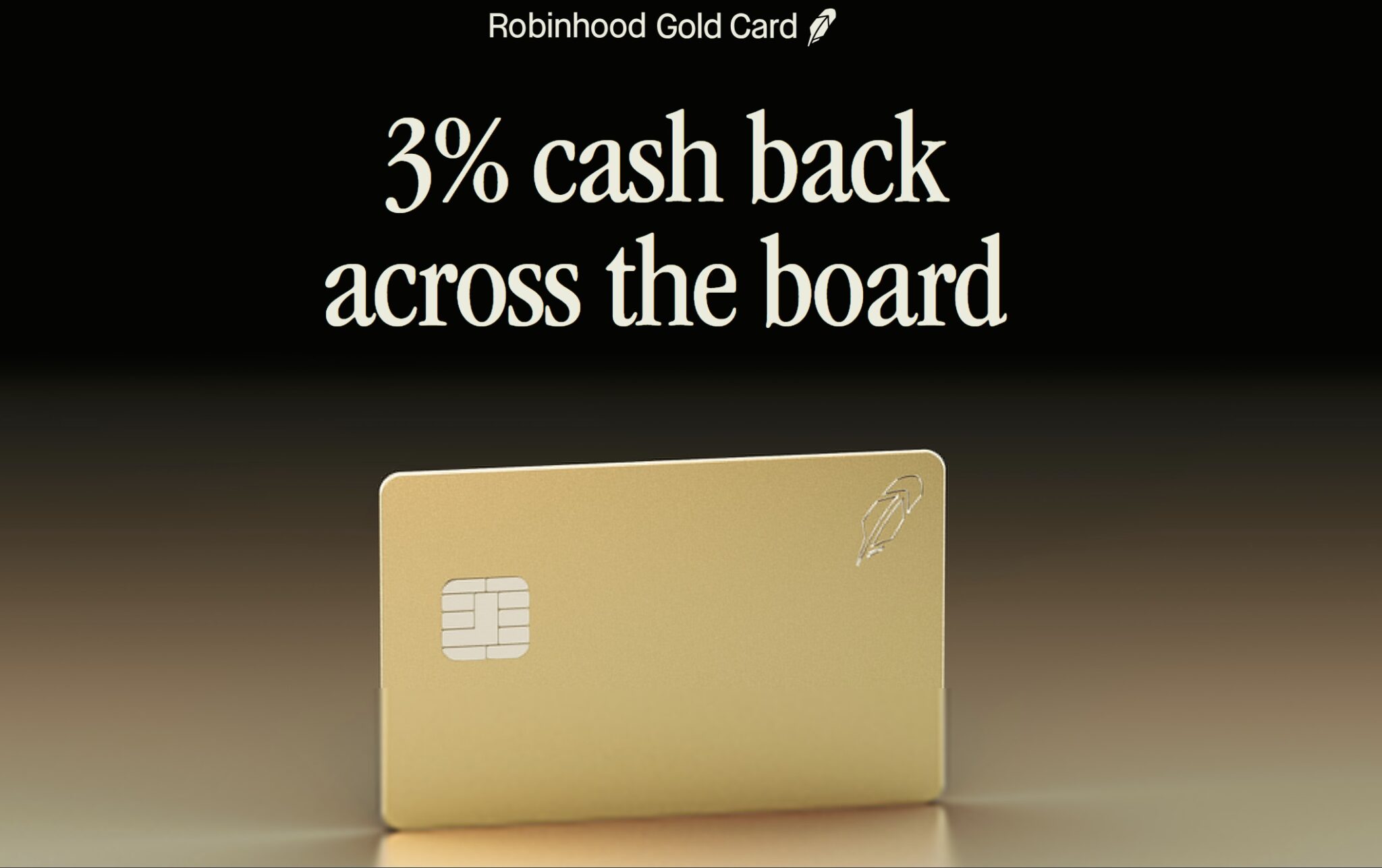

- Online brokerage Robinhood has announced a new “Robinhood Gold Card” that will earn 3% cash back on all purchases with no limits. The card itself is expected to be a relatively heavy stainless steel card. More card details are here.

- In order to get the card, you’ll need to subscribe to Robinhood Gold, which costs $5 per month or $50 per year.

- Currently, you have to join a waitlist to get a chance to apply for the card (it isn’t yet publicly available). Joining the waitlist does not obligate you to apply, it just puts you on the waitlist for an opportunity to apply.

- Robinhood is offering a referral promotion whereby you can get an actual 36c 10K Gold credit card or $1,100 with 10 referrals who sign up for Robinhood Gold and pay at least their first monthly or annual subscription fee. This is outlined in more detail in the post below. See full terms of the referral offer here.

- If you’re interested in signing up for Robinhood Gold to join the waitlist, consider using one of our referral links with our thanks (though read on for more information before you do this):

More card details

The Robinhood Gold card is advertised to offer 3% back everywhere (and 5% back on purchases via the Robinhood travel portal) whenever it launches “soon”.

In order to get on the waitlist for the card, you have to be a Robinhood Gold member, which costs $5 per month or $50 per year.

Robinhood Gold comes with some small benefits, like 5% APY on cash held in your brokerage account and a 3% IRA match (though note that this requires holding the IRA with Robinhood for years). Those benefits are probably worth something to some people, but you could get 5% APY on cash in your Webull brokerage account without paying a monthly or annual membership fee, so unless you’re taking advantage of the IRA match, I think it makes sense to think of the $50 per year cost of Robinhood Gold as the annual fee for the credit card.

I have some reservation in recommending this yet for a number of reasons.

First, you have to join Robinhood Gold to get on the waitlist for the card. That means either ponying up $50 now or $5 per month for however long it takes for the card to actually launch.

Second, we’ve seen other cards offer 3% back for a limited amount of time, but none that have lasted long-term offering that return on all purchases. I have a hard time imagining that the 3% will last forever.

Third, I imagine this has all come about because Robinhood bought X1 last year. The X1 card was certainly intriguing for a while, but over time they hampered it enough that it became not at all interesting. The fact that X1 didn’t maintain a position as a game-changer for long makes me not confident that the Robinhood Gold card will either.

That said, I often say that you have to strike while the iron is hot. The chance to earn 3% back everywhere with no cap for however long it lasts will probably be intriguing enough for some.

On the podcast this weekend, I noted that with a card like this on the market, I would have a hard time paying $195 for the newly-structured Hilton Business credit card. That Hilton Business card offers 5x Hilton points everywhere now on up to $100K in purchases per year.

However, Hilton is almost always offering their points on sale for 0.5c per point. Therefore, if you earned 3% back with your Robinhood card, every dollar you spend would earn 3 cents. You could in turn use your 3 cents to buy six Hilton points at a price of half a cent per point — eclipsing the earn on the Hilton card for a far lower annual fee (particularly if you value other Robinhood Gold benefits). For the sake of completeness, we also talked about using a Bank of America card, like perhaps the Unlimited Cash Rewards card, which could earn 2.625% back with no annual fee if you have Platinum Honors status with Bank of America.

Get a solid gold card with 10 referrals (maybe…..)

Robinhood is trying to build interest in the card by offering a solid gold card (36g of 10K gold) worth $1100 (or an actual $1100 in cash as an alternative) for the first 5,000 customers who each refer 10 people to sign up for Robinhood Gold. I have to admit that I saw that and immediately imagined how cool it would be to have an actual solid gold card to plunk down on a tabletop when paying for something. It is completely impractical (What would you do with it once it inevitably expires? Is someone really going to pay you spot price for that and melt it down? It would be a very fun novelty for sure, but not highly practical). If you have ten friends who are each willing to throw down $5 to join Robinhood Gold, the return on spend there could be worth it. And the 3% back card certainly may be a good choice for a lot of people. Still, the referral promotion is sort of littered with potential issues.

First of all, it is scheduled to end as soon as 5,000 people hit the target of 10 referrals — which means that if you are at 9 referrals on the day that the 5,000th person has scored 10 referrals, you’re not going to get anything at all. (By the same token, you won’t get a second gold card or payment if you get 20 referrals, etc).

Second of all, the person you refer must make at least their first monthly or annual payment for Robinhood Gold service and join the Robinhood Gold Card waitlist. There is no requirement that you or they apply for the credit card. Your referees just need to join Robinhood Gold (they must be a new Robinhood Gold customer) and join the waitlist for an opportunity to apply for the card and pay at least their first $5 monthly charge for Robinhood Gold. On the one hand, that is a low bar — finding ten people who can throw down $5 each and join a waitlist probably isn’t awfully tough. On the other hand, you’re counting on the people you refer to take two steps (or really three): create a Robinhood brokerage account (if they don’t already have one), pay $5 for Robinhood Gold, and join the waitlist. That might be too many steps for more casually-interested folks.

Note that I think you’ll only get the solid gold card if you have a Robinhood Gold card account open at the time when you hit 10 referrals. That said, I have to imagine that some people may hit 10 referrals before they even have an opportunity to apply for the card. According to the full terms, you’ll receive a cash equivalent of $1,100 if you don’t have an open Gold card account at the time when you reach 10 referrals.

Apparently, Robinhood will notify you via email as you get referrals. I don’t yet know what that looks like.

Bottom line

Robinhood’s new 3% back everywhere card certainly sounds intriguing. And at what you could effectively imagine is a $50 annual fee, getting 3% back on all purchases certainly could be interesting. I’m not sure that I have high faith that this will last for long, but it might be worth taking advantage of it for as long as it does make sense. All that said, there is no welcome bonus for new applicants and the “referral bonus” is a one-time deal that you only get if you receive at least 10 referrals (with no bonus for fewer than 10 and no incremental bonus for more than 10). That all mixes for a questionable value proposition for prospective customers. That said, at $5 to sign up for Robinhood Gold and join the waitlist to see if it goes anywhere, some will find it worthwhile.

Does the solid gold card offer additional benefits? I tried looking around but couldn’t find any info on it

Why is this a big thing? Isn’t US Bank Altitude Reserve also giving us 3% cash back everywhere, with an option to reach 4.5% with travel related spending?

after the gamestop stock manipulation…want nothing to do with Robinhood

The solid gold version actually comes with a Louis Vuitton wallet.

“hesitated about whether to write a post about this because I am somewhat skeptical as to whether it will launch and how long it will last”

But when you post about Bilt you don’t have any hesitation about how long it will last. In fact you pump it up, get in now while the transfers are hot.

Come on nick. This is a bad take.

i want gold credit card badly but i won’t be able to get 10 people :C

After looking at the Robinhood site carefully, I discovered another benefit of Robinhood Gold for those who have existing IRAs: if you are a Gold member and transfer your IRA to Robinhood by 4/30/24, they will pay 3% of the total value of that transfer into your IRA account. You have to hold the funds in the IRA with Robinhood for 5 years or they will claw back the 3%, and you have to be a Gold member at the time of transfer and for at least a year after that. However, for those with substantial IRAs that they don’t plan to use for the next 5 years, this could be a big payday: someone with $1M in an IRA would get $30K, and that’s an untaxed contribution. They will also cover up to $75 in transfer fees charged by the institution you transfer from, as long as your transferred IRA is at least $7500. (You have to call them to get reimbursed, though.)

I will point out, however, that Robinhood does not offer mutual funds, so it may not be a great option for holding retirement funds. They do offer ETFs, so those with their IRAs in mutual funds might be able to find ETF equivalents. Note that I am not a tax or investment advisor, and I might be missing other downsides of these IRA transfers.

Makes sense that will be a drawback for some. Personally, I invest my retirement funds in ETF versions of Vanguard funds specifically so that they will be easy to move for account opening bonuses.

That said, the retirement to hold for 5 years is a deal breaker for me. If I had a million though, I’d feel differently.

Are IRA transfer bonuses common? Especially uncapped bonuses? I’ve gotten a few bonuses over the years for moving funds between brokerages, but there was always some kind of cap, and I’ve never done that with IRAs.

Uncapped transfer bonuses are not common at all. Most capped bonuses still have tiers up to the $500k or $1 million level, so “uncapped” only matters if you’re transferring more than that.

Relatively speaking, the RH transfer bonus is better the larger your account is. Good brokerage bonuses for large balances are not always available, but you won’t often find better than ~0.5% with 1 year holding, e.g. something like $2.5k for $500k or up to $5k for $1 million. More frequently, bonuses for large accounts are in the 0.3% to 0.4% range.

For small balances, RH may not be worth it simply because there’ll be bonuses at other places like $100 with a $500/$1,000 deposit. That’s really high percentagewise (20% or 10%, respectively), but then again, it’s just $100.

Long story short, this is a good bonus if you have a larger account.

Yep, this has been my experience with bonuses — they’re usually a flat rate on each level of investment.

And I agree, this wouldn’t make sense for someone with a relatively small amount in an IRA.

The other question I’m asking myself is, do you trust Robinhood, and do you think they’ll even be around in 5 years?

FWIW, I’m doing this bonus and have already submitted my transfers.

As far as the trust question goes, what are you worried about specifically? The bonus is paid up front, so if you’re worried about whether they’re going to pay out, you find that out right away. If you mean something more drastic like, “What if Robinhood steals all of my money?” I don’t consider that a realistic scenario for any large brokerage, but that’s just my opinion.

And as to whether they’ll still be around in 5 years, I mean, I think they will, but it doesn’t matter. The bonus is paid up front, and them going out of business wouldn’t give them legal cause to claw back the money.

Getting technical here, but bankruptcy does have a lookback period of 90 days for payments made, so if this bonus would fall under that, I guess you have to be confident that Robinhood won’t file for bankruptcy in the next 90 days. I’m okay with assuming that.

I don’t have any specific reason, just a vague sense of unease because they are a relatively new brokerage, they were in the middle of that meme stock mess (very possibly due to no fault of their own) and their founders have always struck me as being in the “move fast and break things” tech bro camp.

For those with large IRAs, it’s worth noting that SIPC covers up to $500K per account.

Robinhood does have supplemental insurance as well, in a similar way to other large brokerages: https://robinhood.com/us/en/support/articles/how-youre-protected/

That’s still not a full guarantee since the limits can theoretically be exhausted, but it’s the same with the big-name brokerages.

Personally, I don’t have any reservations about doing this bonus, but of course do what you’re comfortable with.

I was able to join the wait-list without an active Gold subscription- I just don’t get “priority access” to apply. Also, I believe the Gold subscription is $5/mo or $50/yr.

Correct. Not sure where @Nick Reyes is getting $6.99 from… it’s $5 a month or $50 annual