NOTICE: This post references card features that have changed, expired, or are not currently available

Update: This language has been updated and referrals now have the same 48-month language.

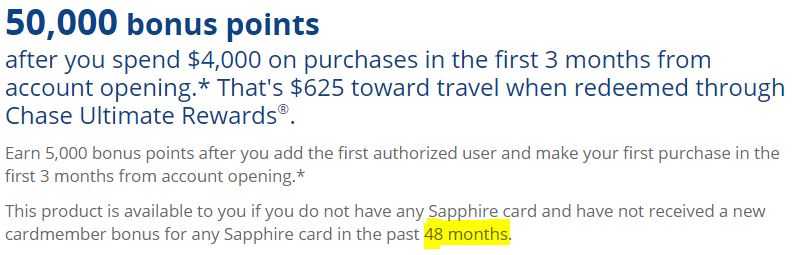

For a while now, both the Chase Sapphire Reserve, and Chase Sapphire Preferred have included 24 month restrictions for new signups. The restriction reads “This product is available to you if you do not have any Sapphire card and have not received a new cardmember bonus for any Sapphire card in the past 24 months”.

Now, though, the public links for both products have moved to 48 month language: “This product is available to you if you do not have any Sapphire card and have not received a new cardmember bonus for any Sapphire card in the past 48 months”. [Hat Tip: US Credit Card Guide]

Fortunately, links with 24 month language still exist. At the time of this writing, our Sapphire Preferred link still includes 24 month language. And, as noted by Doctor of Credit, all referral links include 24 month language. Accordingly, we have updated our Sapphire Reserve card page with a referral link rather than an affiliate link. When we find that the Sapphire Preferred link has changed to 48 month language, we’ll switch that one too to a referral link. Update: It’s dead. Referrals now have the same 48-month language.

Why does this matter?

This matters only to those who received either a Sapphire Preferred or Sapphire Reserve bonus between 24 months and 48 months ago, and who were hoping to sign up for another Sapphire card soon. And, of course, you’d have to be under 5/24.

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

This change appears to be aimed at those who signed up for the Chase Sapphire Reserve 100,000 point offer between August 2016 and early 2017. Most of us have the two year anniversary of receiving the 100K bonus coming up soon. In my case, I’ve kept my Sapphire Reserve card open all this time and have no plans to close it, so this isn’t meaningful for me. But, for those who cancelled their Sapphire Reserve within the first year, and were hoping to pick up another Sapphire card soon, it certainly is important.

24 Month Links

Our dedicated information pages for the Sapphire Reserve and Sapphire Preferred cards, including 24 month signup links (at least at this time), can be found here:

[…] or without the CSR in my pocket. However, another consideration on this card is the fact that while Chase recently instituted 48-month language on the Sapphire cards, referral links still have 24-mont…. If we keep a CSR, we can still earn up to 50K points per year in referrals. As long as that is […]

CSR Application. Applied 8/31 and “Pending” => Denied. Called reconsideration line. She said app was held and denied b/c of 48 month rule. I opened Chase Sapphire Reserve 36 months ago, strong income, 800+ score, below 5/24 rule. I explained the “details” link on app stated 24 months. She said it doesn’t matter. They have gone 48 months system wide. She said the app was flagged and stopped from processing BEFORE pulling credit, so no harm no foul. Sounds like some have pulled this off successfully, but didn’t work for me.

Wow, that’s really surprising and disappointing. Thanks for sharing that with us.

Others: Has anyone else had this happen?

Applied for the CSR on 9/6 after closing my CSP on 8/6. Didn’t get approved on the spot. Saw the CSR account appear on my Chase online on 9/11 and received the card a few days later. Wasn’t even aware until yesterday that they upped the terms for the signup bonus to 48 months (I received the CSP signup bonus in Nov 2014). I called them twice to make sure that I’d still be eligible for the signup bonus and both times was told that I was, and that they wouldn’t approve an application without being eligible for the signup bonus. I also used my husband’s referral link (I didn’t actually check the terms when I applied – assumed it was still 24 months) so that could’ve helped my approval.

Could this mean a better signup bonus for the CSR since they seem to not want ones who got the previous 100k bonus to perhaps get it again?

I think that’s unlikely, although I’m surprised we haven’t yet seen an extra bonus for adding an AU

All these rules leave me scratching my head. Do these restrictions also apply to the business cards – Ink Preferred? I have a CSR but keep getting snail mail offers for 100k points on Ink Preferred – Am I safe to apply for those? or am I out of luck there too?

No, the Ink cards do not have the same restrictions. You are safe to apply for those

Not sure why the Sapphire Reserve is even a special card at 50K bonus. There are better or nearly equal category options for travel out there. Same for restaurants and the freedom/discover are good for 5% usually half the year between the two. Now at 100K it’s s different story…

DP: Wife just got approved. She downgraded Preferred to FU in June after 24 months and got this. Thanks for the tip!!!

[…] New 48 Month Waiting Period for Sapphire Cards? […]

As luck would have it, I submitted an application for the CSR Sunday night for my husband (right before news broke of the change.) He hasn’t had this product before, but received a bonus on the CSP about 42 months ago. I didn’t check the language or take a screenshot of the offer. His app went pending, but when I called the application status line earlier today it said he was approved. I wonder if he might be approved without being eligible for the bonus?

How long ago did you cancel the CSP account?

I pc’ed it to CF about 9 months ago.

I don’t think Chase would approve your husband’s application at all if he wasn’t eligible for the bonus

I’m very close to my 24 months being up. I got the sapphire preferred in August but didn’t receive the bonus until September 20. You think there’s any chance all the sign up links will be updated within the next month?

I think that it’s likely that the referral links will still show 24 months by then.

What about those of us who are AU on spouse’s card? Are AU subject to rules as well…or only the card HOLDERS?

You should be fine if you did not receive a new cardmember bonus in the past 24 or 48 months.

AU cards don’t matter

How late can you be to the party?

If I have the basic Sapphire card from when I downgraded a few years back from the Sapphire Preferred. If I switch credit lines to other cards and cancel the basic Sapphire card. How long do you think till I can apply for the CSR?

Wait a few weeks. Some say a month

Ok, I know this is crazy or unlikely, but I wonder if this could be a recalibration, not just a tightening… I.e., if they tightening up 48 months for Sapphire bonuses, might they be more forgiving in the 5/24 arena?

I haven’t checked the stats, but it doesn’t strike me as impossible that they could be thinking of testing something more than 5/24 (perhaps 8/24), combined with 4 year limits on each card family. I can’t test it myself, I just got a CSP 10 months ago. But I wonder if you might have sources at Chase who could confirm whether there are other changes?

I’d be very happy if that were true!, but I think it’s unlikely

Greg, a somewhat relevant question: if i don’t combine my marriott and SPG accounts, do you think i can dodge the chase marriott card restrictions to get the Amex SPG luxury card?

Good question. That might work if the accounts aren’t linked.

I think you mean all referral links have 24 month (not 48) language? (third paragraph above)

Oops! Thanks! Fixed