NOTICE: This post references card features that have changed, expired, or are not currently available

The Chase Sapphire Reserve card is awesome for many reasons, but I won’t bore you with a list right now (you can find full details here if you insist). Instead, I’ll bore you with a single reason: 1.5 cents per point value towards travel. You can move points to your Sapphire Reserve from other Chase cards, such as Freedom, Ink, or the old Sapphire Preferred card, and then book travel through the Ultimate Rewards website to get 1.5 cents per point value. That means that this benefit increases the value of points earned. When you earn 3X points with your Sapphire Reserve card you’re getting a 4.5% rebate in the form of travel. When you earn 5X points with Freedom or Ink cards, that’s equivalent to a 7.5% rebate towards travel. And, when you use the Freedom Unlimited card to earn 1.5 points per dollar everywhere, you get the equivalent of a 2.25% rebate towards travel.

Wow! Right?

But… what if points aren’t really worth 1.5 cents each? What if travel booked through Ultimate Rewards is priced higher to begin with? Or, what if you can’t even find the bookings you need through Chase?

I brought up this issue in the past with respect to the Sapphire Preferred card (you know — the one that lets you use points for 1.25 cents per point value for travel). In the post “The best way to use Chase points to book hotels” I showed that, for hotels, Chase’s prices were frequently higher than found elsewhere. The result was that points were really worth just about 1 cent per point towards hotels. I argued that using Chase points to book hotels under these circumstances was not a good idea. At the time, though, I believed that buying airfare through Chase would always price correctly.

Since then, I’ve found a few examples where Chase actually had better hotel rates than I could find elsewhere. And, with respect to airfare, a few readers have alerted me that Chase’s prices sometimes were not competitive. It was clearly time to take another look. Today I’ll look at airfare purchased through Chase. In future posts I plan to cover hotels and car rentals.

Let’s assume that Chase’s website calculates points correctly based on travel prices. That leaves a couple of reasons that points may not be worth 1.5 cents each: loss of rewards/rebates; or an inability to book the best fares through Chase…

Loss of rewards and rebates

When you pay for travel with points, you lose some of your options for earning points or other rewards. For example, when paying for travel with your Sapphire Reserve card, you would normally earn 3 points per dollar. But, when you pay with points, you give up the ability to earn those points.

With airfare, fortunately, you can still earn miles through frequent flyer programs when paying for flights with points (but the number of miles earned is often unpredictable). However, there are a number of other options for earning rewards that you must forgo:

- Credit card rewards: 3 Ultimate Rewards points per dollar with the Sapphire Reserve card

- OTA (Online Travel Agency) Rewards: Orbitz, for example, offers 1% back in the form of Orbucks which can be used to pay for hotels.

- Portals: Portals rarely offer big rewards for clicking through to an airline, but when clicking through to an OTA you can sometimes earn about 2% back.

- Gift cards: I some cases it’s possible to buy airline gift cards at a nice discount. If you book through Chase, you can’t apply those gift cards.

Full details of options for earning rewards from flights can be found here: Buying flights: Extreme Stacking savings and rewards.

Let’s conservatively assume a 5% rebate on flight purchases. If you forgo that 5% rebate by buying flights with Ultimate Rewards points, then the points are worth a bit less than advertised. For example, a $300 flight would cost 20,000 Ultimate Rewards points. If you paid with a credit card and used methods shown above to earn 5% back instead, then the real cost of the flight to you, after rebates, would be $285. And your value per point for booking with Ultimate Rewards points can be calculated: $285 / 20,000 points = 1.425 cents per point.

Chase prices higher than competition for some flights?

To see if Chase priced flights correctly, I picked a number of great deals identified by The Flight Deal to see if Chase’s website could find the same great prices that I could find via Google Flights. Yep, it could, and it did.

However, a few readers have asserted that Chase’s prices are sometimes higher than the competition. For example:

- Baqa found that flights from Dublin to Frankfurt were significantly more expensive through Chase

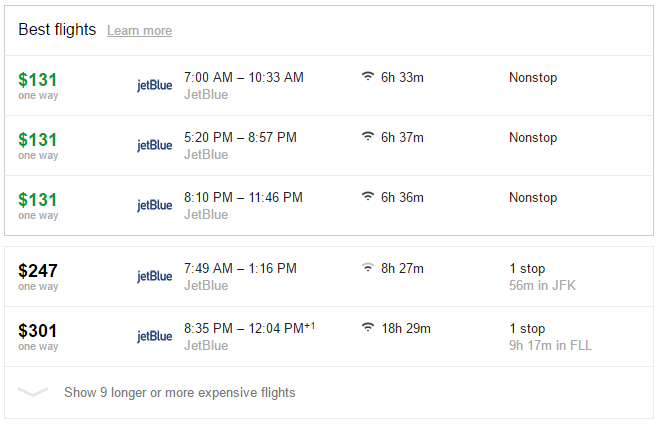

- Robin found that Chase wouldn’t display the lowest available JetBlue fares.

- dg found similar results with Emirates flights

- Nicole wanted to book a specific AA flight, but couldn’t find it all on the Chase site. When she called, the Chase agent was able to see the flight, but it was then priced $120 more than expected.

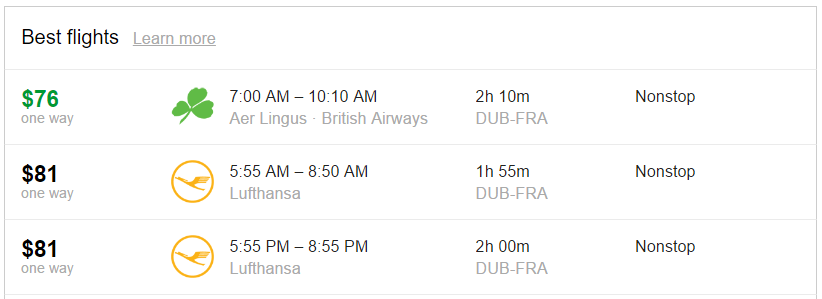

I was able to reproduce most of these problems without much difficulty. For example, Google Flights showed me the following prices for one-way flights from Dublin to Frankfurt:

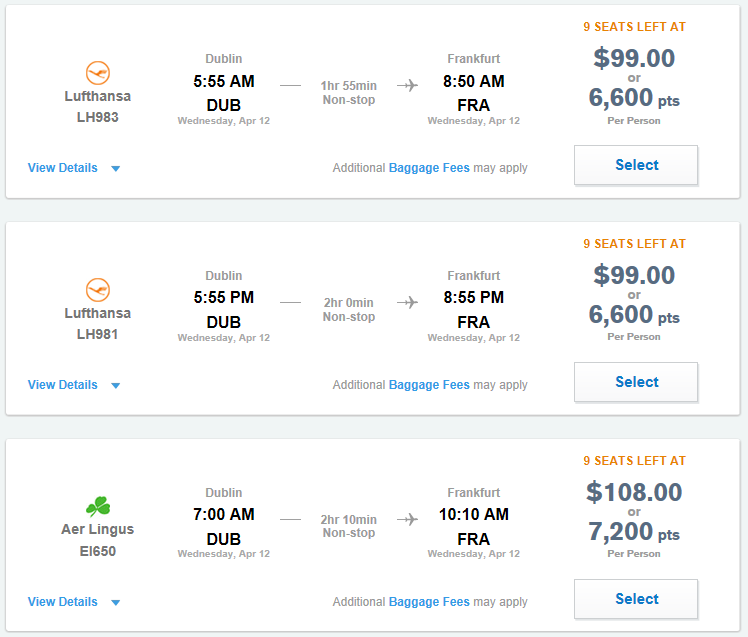

But Chase’s prices for the exact same flights were much higher:

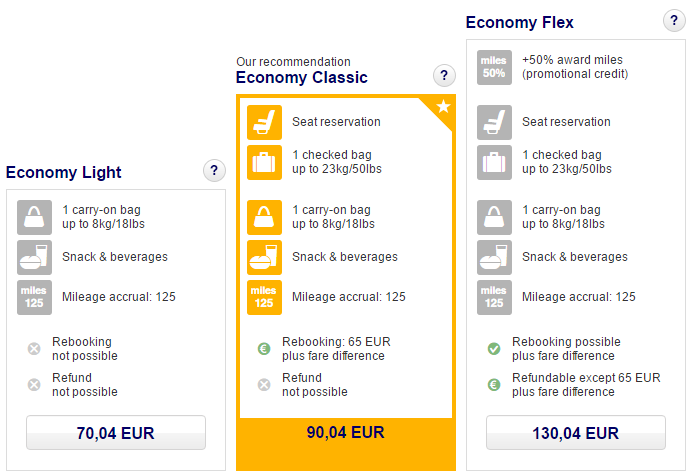

When I ran the search from the Lufthansa website, it became clear what was happening:

Google Flights was showing the Economy Light fare whereas Chase was showing the Economy Classic fare. Economy Classic includes the ability to reserve seats in advance, check a bag up to 50 pounds, and change the flight (with a rebooking fee). In other words, for many, the Chase result is preferable. This is especially true since Lufthansa supposedly limits carry-on bags to 18lbs, so the free checked bag with Economy Classic may be a necessity. Still, it’s not good that Chase doesn’t show the best available option price-wise.

As an aside, I found a flight in which Delta Basic Economy (which is analogous to Lufthansa’s Economy Light) was the best price option. My theory was that, like above, Chase wouldn’t show that option. But, it did. You can throw that theory out the window.

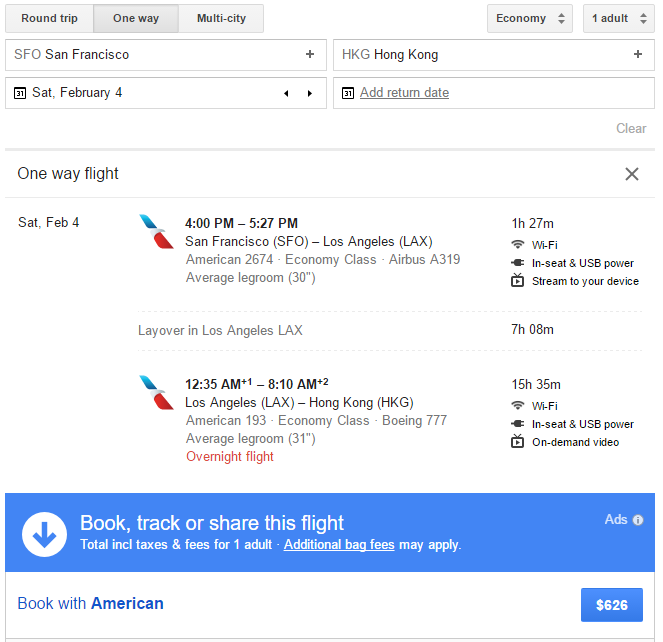

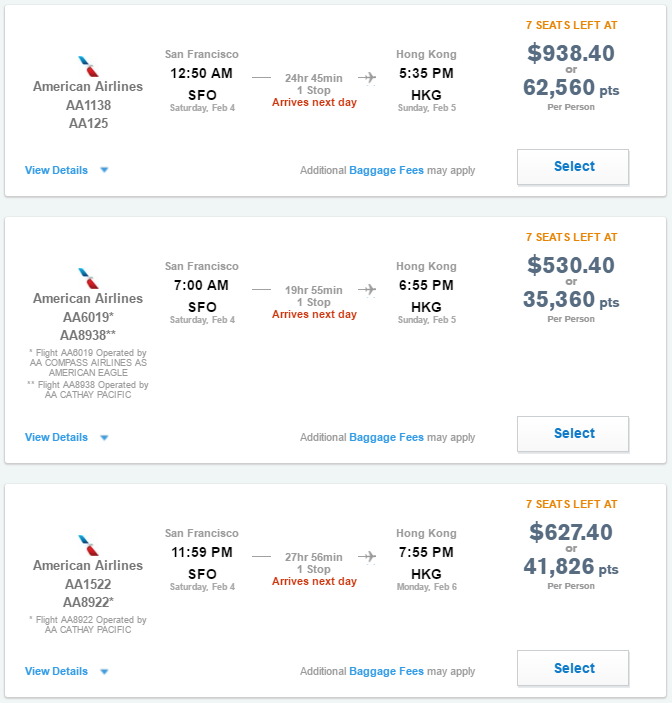

How about situations where Chase’s website couldn’t find a flight at all? Nicole and Robin encountered that issue with AA and JetBlue flights. I took Nicole’s example and identified an AA flight that I would like to take to Hong Kong (I don’t really want to take the flight — this is just an example)

Google Flights priced the above itinerary at $626. Chase? Chase’s website couldn’t find that exact flight at all, but it did find other cheap options:

I tried to force Chase to find the flight via a multi-city search, but got this:

Unfortunately, we could not find results to match this search. We recommend modifying your search parameters and searching again.

Chase airfare prices summary

Most of my airfare searches through Chase have resulted in the same best fares as found anywhere else. But, there are times where the following problems can happen:

- Chase prices a particular flight higher than the competition. I believe that this happens because Chase books into a higher fare class. I do not believe that Chase is simply pocketing the difference.

- Chase fails to show good options. I didn’t see this with non-stop routes, but it was easy to find one-stop routes in which Chase failed to show a number of good options. In those cases, you might be able to get Chase to book it for you over the phone, but they might also price the itinerary higher than you would get elsewhere.

Bottom Line

Most of the time, Chase’s website finds the best flights and prices them correctly. In those cases, assuming you’re giving up approximately 5% in rewards by booking with points, your Chase points are really worth about 1.425 cents each towards flights. That’s less than the touted 1.5 cents per point, but hardly worth making a fuss over the difference.

That said, sometimes Chase really does show higher prices. You should always search for airfare on sites like Google Flights, Kayak, etc. to find out what your fare should be before booking via an Online Travel Agency like Chase. If the flight is cheaper elsewhere, then I highly recommend running the search through the airline’s own website. This way you’ll clearly see if the cheapest fare is an “Economy Light” type of thing. In fact, unless you don’t mind basic economy restrictions, its a good idea to do this every time you book flights. That way you’ll at least know what you’re getting.

If you can’t find the flight you want, or it prices incorrectly, when searching Chase’s website, you can try giving them a call. Or, give up and book that flight some other way. See: Buying flights: Extreme Stacking savings and rewards and The best ways to pay for flights.

[…] ways. Again, 1.5¢ per point for travel isn’t as good as 1.5¢ in cash or statement credit (Frequent Miler talks about this more here). The good thing about this benefit is that it applies to all of your Chase Ultimate Rewards […]

[…] ways. Again, 1.5¢ per point for travel isn’t as good as 1.5¢ in cash or statement credit (Frequent Miler talks about this more here). The good thing about this benefit is that it applies to all of your Chase Ultimate Rewards […]

Hi,

Thanks for the article. I had always assumed that travel booked through their site would always be more expensive to compensate for the points. It’s nice to know that that’s not always true. Still, it’s tremendously annoying that we can’t trust it and have to do separate searches to ensure we’re not being gouged.

[…] variable partner award pricing Sapphire Reserve really worth 1.5 cents? Overview of 1000 Avio promotion Avios landing page Transfer SPG to Avios Transfer Chase to Avios […]

An additional thought: for those who participate in Crossover Rewards, Starpoints are only earned when flights are booked on delta.com. By booking DL flights through UR, SPG Gold/Platinum members would forgo the ~2.5% in Starpoints. Of course, who knows if that program will ultimately survive the merger.

Yes, good point.

[…] course, as I showed yesterday with regards to paying for flights with Chase points, it is possible that not all flights are available through Amex Travel, or they may price […]

I’ve found the prices to actually be pretty good on the Chase travel portal. I needed to book a specific Hilton hotel in Chicago, I paid $191 after taxes, the rate I could find elsewhere was $264, even using the TA comparison tool.

This is exactly why I prefer the Bank of America Travel Rewards card. I can use the earned points on travel booked anywhere. With my Top Tier Preferred Rewards status I’m making loads of points just from everyday spend which I then use to offset my travel expenses. Airfare for a recent trip to Europe ended up costing just a couple of hundred dollars.

Yes indeed. For those who get Platinum Honors status with BOA, the Travel Rewards card is awesome. More here (for those who don’t know what we’re talking about): https://frequentmiler.com/2014/08/20/up-to-2-625-back-for-timeshares-fortune-tellers-and-more/

I don’t think it’s realistic to assume a 5% rebate on flight purchases.

Many discount airlines only allow direct booking – no OTA, no portal, no gift cards.

All you would get would be the UR, if you use your Chase card – in the case of the Sapphire reserve, 3 points per dollar. These have a a cash redemption value of 3% .

The real value of UR is really situation dependent, somewhere between 1cpp – if your flights/room are not available for booking through UR at all – ie. redeem for cash ;and some really high cpp, if you are redeeming awards in business/first.

I have done several redemptions for coach flights at 1.5cpp where Chase UR at the best price I could find. But that is not always the case. For other fares and hotel rooms, I had to book cash. I did not redeem points at 1cpp to pay for them.

I used 5% as a conservative estimate. Yes, the worst case is 3% if you value UR points at only a penny each, but if you buy into the 1.42% value of UR points then you are giving up, at minimum, 1.42 x 3 = 4.26%

As far as the example goes, this is not a very good one. There are several nonstop SFO-HKG flights, so going through LAX is a bit silly. You can often have an open jaw – ie. return from a different city in Asia – for a reasonable cost.

The point was that the reader who alerted me to this issue wanted that exact route but couldn’t get it.

I wanted to use SWUs so in this case the routing was 100% necessary.

What about cruises? Are they worth it? If not, what’s the best rewards program to earn a free cruise?

I haven’t looked into it yet, but yes I expect that cruises would offer good value especially if you comparison shop and ask Chase to match the best alternative price (if others are lower)

Please note everyone that the fares displayed on Chase Portal are INCLUSIVE OF ALL TAXES. I did this mistake of not noticing this few months ago and when I booked the ticket directly on British Airways website it came out to be the exactly same fare.

Most airlines add the taxes at the end, but the rates displayed on the chase portal is inclusive of this taxes which make them look spuriously expensive.

I don’t think Chase will screw it up by not being fair with their prices on their portal.

Not sure I agree. At least in the US, fares displayed on airline’s websites are inclusive of taxes, always. I believe this is due to some law that was passed that requires it (though that could be a made up memory).

Also if you don’t book JetBlue direct you lose TrueBlue earnings

True

To be fair, if we’re always going to be reducing the valuation of UR for forgone credit card rewards, shouldn’t this be applied to every miles/point redemption from basically anyone that doesn’t have you get a statement credit? It’s totally fine to do, but we should be consistent and do it with all valuations then.

Yes, technically that’s true, but to me the ~5% forgone rebate is not enough to be worth quibbling over. The bigger issue is whether or not the best prices are available through Chase.

Through the Chase portal, I booked a MCT-DXB ticket on Emirates yesterday for $116 that Emirates itself was selling for no less than $311 and that Google Flights and the OTAs had at $233 as an Oman Air codeshare. That’s very rare, but that’s why I find it to be worth checking Chase. More frequently but still rarely, Chase is a sensible solution for tickets on smaller, non-alliance foreign airlines with buggy booking sites, problems handling USA credit cards, and/or credit card booking fees. In that case, it is solving the same issues that an OTA handles, but you’re not giving up those stacked points and multipliers because they mostly don’t exist. This is still rare, however, because Chase’s portal doesn’t see the smallest, most buggy airlines in the first place. So bottom line: Chase is worth checking, at least when I’m flying carriers with whom I have no alliance, status, or credit card relationship and those whose flight points don’t credit to any other airline. Just don’t expect it to be competitive or optimal very often.