NOTICE: This post references card features that have changed, expired, or are not currently available

As we’ve previously reported, Chase is adding new features to their Sapphire Reserve card and raising the annual fee. The annual fee will increase from $450 to $550 on the following schedule:

- January 12th 2020: $550 for new cardholders

- April 2020: $550 for existing cardholders (this change won’t affect you until your next annual fee is due).

Given these changes, Is the card worth keeping when your next annual fee comes due?

Nick is already on the record saying that he won’t renew when his next annual fee comes due. He doesn’t get enough value from the card to justify the annual fee, especially at $550. My gut reaction to the new fee matched Nick’s. In my recent post about Chase’s new annual fee, I wrote:

Will I keep the card? My annual fee won’t hit again until October 2020. At that point I’ll assess whether the card still presents enough value to be a keeper. My guess is that the answer will be no, but we’ll see.

But of course, I try not to make too many decisions based on gut reactions. In this case, I already have a tool to use to help make the decision. Remember the Ultra-Premium Credit Card Worksheet? I’ve updated it with the latest Sapphire Reserve changes. Now we can use the updated spreadsheet to help decide whether or not its a keeper.

To read about the spreadsheet, click here: Which Ultra Premium Cards are Keepers? Version 3.2.

To view the latest spreadsheet directly: Click here to open the spreadsheet.

Make a copy of the spreadsheet for yourself so that you can edit the green cells on the card-specific tabs. Then you can go to the Summary tab to see your overall results.

Surprise: Sapphire Reserve is still a keeper for me

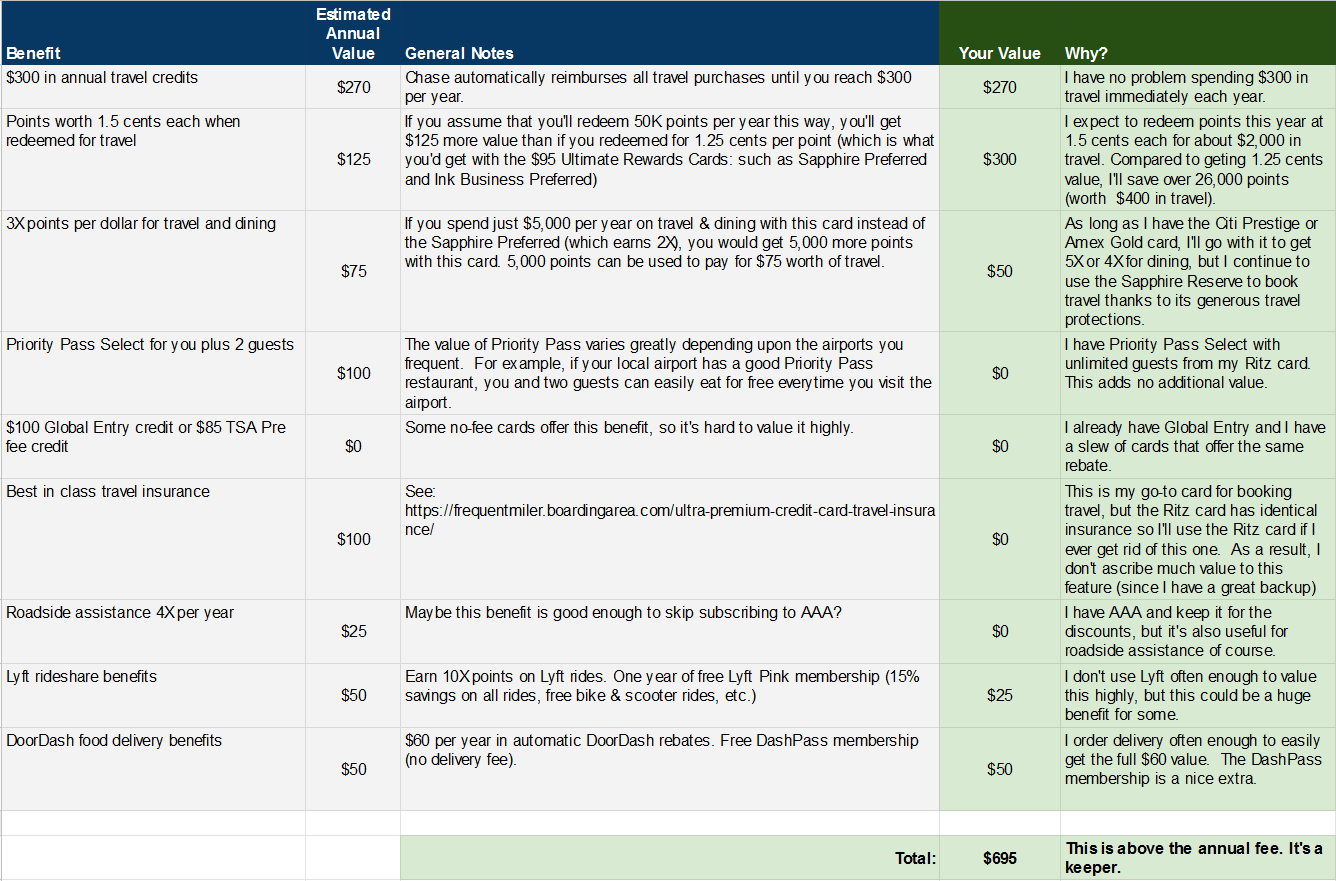

It turns out that even with the higher annual fee, my conservative valuation says that the card is a keeper. Here’s a picture of my Sapphire Reserve entries (The “Your Value” and “Why?” columns are my personal valuations — you should copy the sheet and enter your own):

It turns out that I currently value the card’s combination of perks at $695 per year. The biggest driver of value for me is the fact that the Sapphire Reserve offers 1.5 cents per point value for travel booked through Chase Travel℠. I’ve been booking reimbursable travel this way, so the difference between getting 1.5 and 1.25 cents per point (which I’d get with the Sapphire Preferred or Ink Business Preferred) amounts to real money. If you rarely use this feature then I expect you’ll likely find that the Sapphire Reserve is not worth keeping.

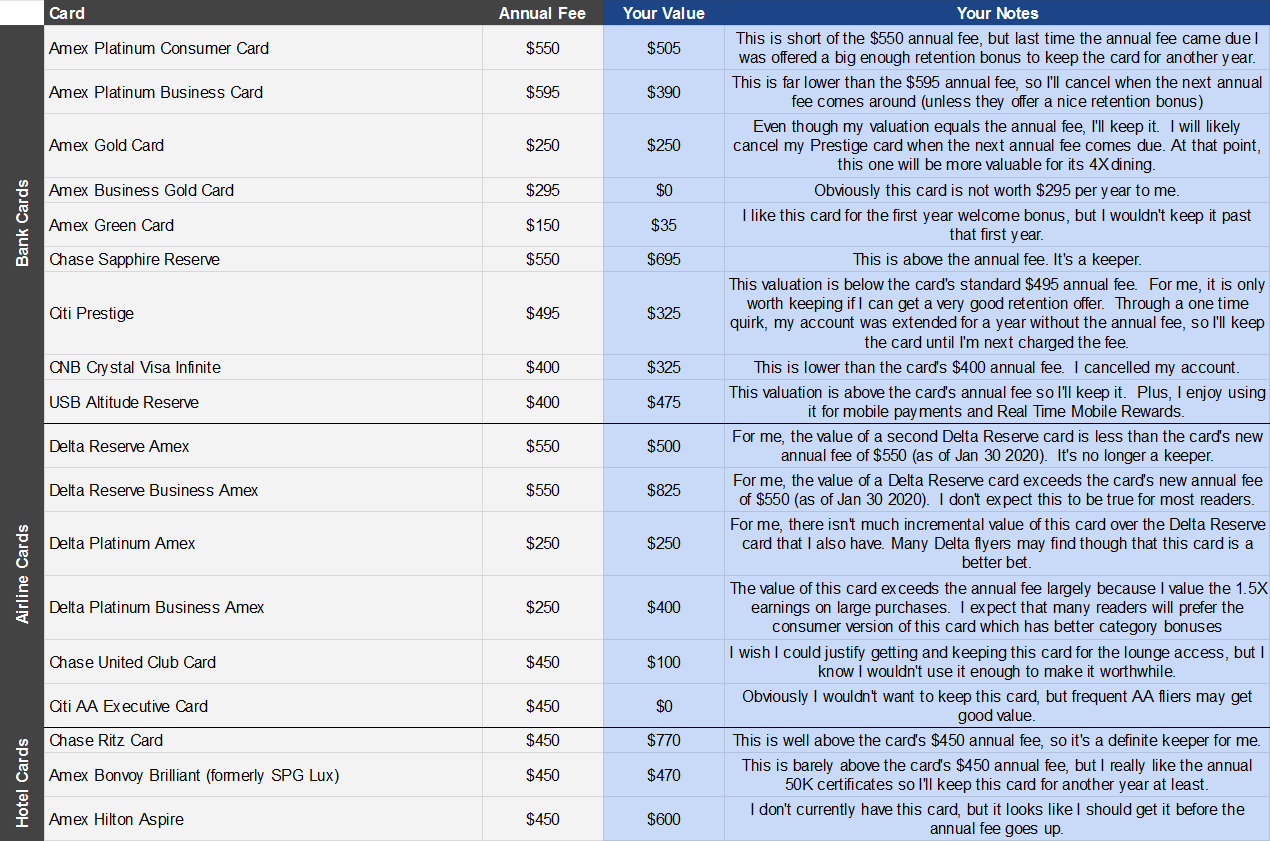

Below is my overall summary view. Given my particular situation, the ultra premium cards worth keeping include: Sapphire Reserve, Amex Gold (barely), Altitude Reserve, Delta Reserve for Business, Delta Platinum Business, Ritz, Bonvoy Brilliant (barely), and Hilton Aspire. Please keep in mind that I’m not recommending this particular lineup to you. We have different situations that will lead to different valuations. To see why I valued each card the way I did, open the spreadsheet and find the tab for the particular card of interest.

Understanding the spreadsheet

Most ultra-premium cards are worth signing up for because they have good to excellent signup bonuses that are worth more than the first year’s annual fee. That’s not the question. The question is whether the cards are worth keeping past the first year. When the second year annual fee comes due, do you keep or cancel?

Do the card’s benefits outweigh the annual fee? Each person should conservatively estimate the value of each benefit to them to figure this out. In most cases, I recommend trying to estimate how much you’d be willing to pay for this feature if it was available stand-alone as a subscription. For example, if a card offers free checked bags, you could save hundreds of dollars if you use that benefit often enough. But how much would you pay for an annual subscription to get free checked bags? That answer should be substantially lower than the amount that you think you’ll save. Otherwise, why prepay for that benefit?

Tips for using the spreadsheet effectively

- Be conservative with your estimates. Enter values that you would pay for a subscription for that benefit rather than the amount you expect to save.

- Don’t double count perks. Once you identify cards that you know that you’ll keep year after year, make sure to consider that when evaluating overlapping benefits on other cards. For example, I get an excellent Priority Pass subscription from my Ritz card (which I plan to keep) so I haven’t assigned any value to Priority Pass benefits that come with other cards.

What’s your final answer?

Is the Sapphire Reserve worth keeping? Please comment below.

[…] people to keep an ultra-premium card with a high annual fee? Given the fact that Chase recently increased the annual fee from $450 to $550, I’m not sure that a $100 credit will be enough to get people to keep it. As Greg and I […]

My annual fee hit on 4/1 last year. If it goes up, I’ll have to downgrade. No large UR redemptions in the near future, and no use for Lyft or Doordash.

I’m not sure why everyone is hating on the new benefits unless you live outside a major city. I live in downtown Houston and use Uber/Lyft all the time so the Pink membership is great. Signed up for it last night after flying back from Japan while waiting for my bags and it already saved me $9 on the ride home from the airport and I got picked up quickly while everyone else waited around. +7 extra pts per dollar (10 total) on rides in addition to the Delta & Hilton points I was already getting! Basically means I’ll be using Lyft over Uber now. Also the Doordash credits and membership that gets rid of delivery fees will be super handy as I already order food to be delivered somewhat regularly. After the annual $300 travel credit (which I already used by January 5th) the annual fee is basically $250 (or $155 more than the CSP) which I will easily recoup. Just used UR to fly Singapore Airlines to/from Japan and for a couple of Hyatt stays while there. I value UR quite highly still and will definitely keep the card.

Isn’t the primary auto rental coverage and the 4x uses of roadside assistance valuable to you? I included valuations for those in my my spreadsheet.

Is the doordash credit good right now? Or does it come into effect later?

I wonder if you have to max out the $300 travel credit before earning the 10X on Lyft.

Sorry one more question- for American Express Platinum (consumer) on your chart (line 8) it says there is an option to get cheaper international premium cabin flights via their website or some sort of portal, and you valued that low, but since I pay for my own business class fares (company will only reimburse economy fare) I would value this incredibly highly but can’t seem to find mention of it on the American Express Platinum (consumer) website. I would seriously consider this card if this was a perk! Thanks again!

Awesome charts, thank you. Confused re Sapphire Reserve first two lines. How is the $300 travel credit worth less than $300 (it says $270). And I could not follow the way you computed the second one re 1.5 cents per point since you used a different method to calculate the estimated annual value versus the column of what you value it. The first clearly shows 50,000 points example redeemed via this card is worth $125 more than redeemed via the Chase preferred with the lower fee, but then in the your value column you say you want to redeem $2,000 worth of points, not how many points. It would just be more simple if you said “in reality I expect to use X thousand points which redeemed via CSR gets me Y value, versus CSP which is Z value and the difference is (presumably) $300.

A bit unrelated but relevant to the “keep or dump” thought process. Seems that two-player mode should not keep two of these. Transfer all points to one player and the other should downgrade or close.

For me, the upside of the 1.5x travel portal more than covers the CSR fee increase. There have just been too many times this past year that award inventory stunk for the destinations, dates and itineraries I wanted. I’ve recently booked about $2400 in paid tickets, costing roughly 159,500 UR points. That same number of points with the SP card would have been worth only $1,995. That additional .25 on the portal translated to $400+ in point value.

You discount $300 travel rebate for Ritz on your spreadsheet by 10% because it isn’t automatic. But Reserve is automatic so why do you discount that too? To me, that’s the clearest dollar-for-dollar value of any card benefit. Anyone who doesn’t spend $300 on travel isn’t getting one of these premium cards.

Keep in mind that I pick values based on the question: “how much would I pay for this benefit if I could subscribe to it independently?” Why would I pay $300 to get a $300 rebate? I wouldn’t. Also note that the $300 that is rebated also doesn’t earn rewards. So, even if you easily get $300 back each year, you are losing out on $300 x 3X = 900 points. If you value those points at 1.5 cents each, then that’s $13.50 of lost opportunity. In other words, even if I didn’t discount it based on how much I’d be willing to pay, I’d still discount it by $13.50 based on the lost earnings.

I’m lucky as my renewal is in March. But you have to look at the fee increase vs all the other potential ways they could have gone (and rumors have come and gone) – restricted points transfer, cut back on travel definition (still good for parking, tolls, commute), or on the 1.5 redemption (so book on say, Alaska, and get 1.5 redemption plus the miles flown; most airline points are valued at 1.2-1.4, which is less than 1.5, and you don’t need to find award space). Still good at Priority Pass restaurants (as opposed to Amex). And, if you have the Business Cash, still good to get a gift card at Staples for anything on Amazon (so for almost anything you could possibly buy) at 5x and transfer. (Or Visa fee free this week) I’m not happy, but it’s still valuable.

Good points!

I’d be curious on your take if you were going to limit yourself to one premium card, which one it would be? And not the Ritz, since most people can’t get that one 😉

I’m glad I’m not limited to just one ultra-premium card, but if I was I’d pick the Sapphire Reserve.

I was going to cancel the CITI Prestige card after they gutted the travel insurance benefits. But when I did the math for the 4th night free benefit, It more than saved me the cost of the annual fee. I’ve used the benefit 3 times last year and am way ahead. I don’t mind forgoing the loyalty hotel benefits in exchange for saving $300+ per stay. Of course, I can only use it twice a year.

Jacob

My Prestige card will be DOA ASAP after I book the (2) 4 nites . I did the loyalty stuff when u could get 5 nites @ sign up . My green card will get me 20% off hotel.com GC’s ($3k) when they offer it .But there’s lots of 15% offers out there IF u got time .

CHEERs

Never had this card and continue to believe like I have missed out on nothing. Your analysis is good, but it continues to feel like oher alternatives are way inderplayed. For example CSP has pretty good travel insurance too, plus it now gets Doordash and Lyft benefits too, albeit not as high but for a fraction of the cost. Regarding travel, one of the great things about Chase’s ins travel benefit is that you can pay just part of the fare and get the full insurance beneift. So given that, why would you “settle” for a 3x benefit when others are offering 5x and gift card options are available? Finally, I know I will get an argument on this one, but why would I get “excited” about the ability to redeem UR for 1.5 on their portal? I feel like without this card I can get a .5 redemption without CSR by booking United, SW or whatever, if that’s all I want. Maybe for those that are so flush with points they can’t possibly redeem all of them for points bookings with partners? But if that’s the case, then why would you want or setle for 3x YR when so many 4 or 5 point options are available or even just go for straight cashback with something like BofA Premium Travel (if you have the 100k invested with with Merrill). All in all $550 (or $250) seems like it’s an expensive option to get insurance, a little extra return when going through their portal for travel when their other options to get to the exact same place more cheaply for something which would otherwise be a sock drawer card now given other better earning options.

I can only answer for myself…

When booking travel, I simply don’t want the headache of splitting the payment into credit and gift cards. In my experience, too many things can go wrong when dealing with gift cards. So, I value having a single card that offers great insurance and very good rewards (even if not best overall rewards).

I’m not “excited” by 1.5 cent redemptions, but I do have more Chase points than I’m likely to ever use by transferring to Hyatt and United. 1.5 cents is a solid return that I’m happy with even if I’m not excited by it. It especially gives me solid value for redeeming points earned at 5X with my Ink Plus or Ink Cash and Freedom cards.