Ultra-premium credit cards often have great perks like lounge access, elite status accelerators, free nights, companion tickets, etc. The problem is that the annual fees, which can be as high as $795, can be overwhelming. All of these pricey cards are worth getting for their initial welcome bonuses, but they can be very expensive to keep… especially if you have more than one. How can you decide which are worth keeping? In this update to this post, I compared my valuations of the Sapphire Reserve® to the Sapphire Reserve for Business℠.

The premium card worksheet

In order to help identify which cards to keep or cancel, I created a Google Doc spreadsheet with tabs for each of the most popular premium (hundreds-of-dollars-per-year) rewards cards. I’ve also thrown in some $95-ish cards for comparison. On each tab you can enter your estimated value for each perk and then return to the summary tab to see which cards are keepers.

–> Click here to open and copy the spreadsheet into your own Google account

The rest of this post goes into detail about how I recommend using this worksheet, but here are quick tips for those who don’t plan to read the rest (I get it: even though there’s some really good stuff below, you’ve got other things to do):

- Don’t double-count overlapping perks! For example, assign value to Global Entry credit only to the card that you’re most likely to keep.

- Value perks based on how much you’d be willing to pre-pay if it was available as a subscription. Don’t estimate based on how much you’re likely to save.

- If your total value of perks equals or exceeds a card’s annual fee, then its a keeper.

Background

To make up for big fees, issuers have been adding “sponsored perks” where you can get rebates from spend with specific vendors (Peleton, DoorDash, Dell, Lyft, Saks Fifth Avenue, etc.). On paper, it looks like you can get back more money than the annual fee for these cards. And you can, if you would actually pay for these products and services anyway. The reality, though, is different. Take the Amex Platinum Saks credits, for example. Each year, January through end of June and again July through end of December, you can get $50 back from Saks and Saks.com purchases, for a total of $100 back. If you regularly buy $50 or more from Saks, both early in the year and late in the year, then the rebate really can be thought of as being worth nearly its face value. But, if you find yourself scrambling twice per year to figure out what to buy, the rebate should be worth considerably less to you. In my case, I hardly value these Saks rebates at all. It’s nice to get a free pair of socks and other miscellaneous stuff twice per year, but not anywhere near face-value nice.

When it comes time to pay the annual renewal fee on each of your premium cards, it makes sense to evaluate whether or not the card’s perks and rebates are at least as valuable as the card’s annual fee. If the answer is “no”, then I recommend calling to cancel the card. If the card issuer offers a great retention bonus, great — keep the card for another year. If not, go ahead and cancel or, better yet, product change to a fee-free card if possible (note that Amex Platinum cards do not have a product change path to a free card).

If you decide to cancel rather than downgrade, please take a look at our checklist for cancelling credit cards to avoid losing points and other rewards.

How to estimate value

When you pay a credit card’s annual fee, you are essentially pre-paying for a year of perks that this card offers. The best way to determine what these perks are worth to you is to decide for each one, how much you’d be willing to pay if it was available independently as an annual subscription. Consider the Amex Gold card’s Uber credits, for example. The Gold Card offers $10 per month in Uber / Uber Eats credits. On the surface, that sounds like an easy $120 for those of us who use Uber or Uber Eats often. But you shouldn’t value it at the full $120. Imagine if Uber sold a benefit like this separately: What would you pay annually to Uber in order to get $10 per month in use-it-or-lose-it credits? You wouldn’t pay $120, would you? It wouldn’t make any sense to pay $120 up front for a total of up to $120 in savings spread out through the year. Instead, you might pay $60 (for example) for $120 in credits.

Other examples:

- Chase Sapphire Reserve $300 Travel Credits: This is a really easy credit to earn since all travel purchases count. But how much would you pay in advance to get $300 back? Keep in mind, too, that the Sapphire Reserve doesn’t give you points for that $300 in spend. I’d argue that you shouldn’t value this perk at more than $285, and it would be reasonable to value it less.

- Amex Platinum $200 Prepaid Hotel Credit: Consumer Platinum cards offer $200 back per calendar year towards prepaid Fine Hotels & Resorts or The Hotel Collection bookings. That’s great, but how much would you pre-pay for this rebate? Keep in mind that unless you habitually book through Fine Hotels & Resorts or The Hotel Collection, you might end up not using this perk at all. Personally, I wouldn’t value this at more than $100 per year.

- Marriott Bonvoy Brilliant 85K free night certificate: You might save $500, $700, $900 or more off a hotel night when you use this certificate, but there’s no way you should pay that much in advance. The only reason to pay in advance for a free night certificate (especially one that expires after a year) is if you expect to get way more value than you paid. So, for example, you might be willing to pre-pay $300 for the chance of saving $500 or more.

Overlapping perks

One and done perks

There are many valuable perks that have no incremental value if you have the same perk from multiple cards. For example, getting Hilton Gold status from one credit card is great, but getting it from a second card has no incremental value. Here are some more examples where you might value a perk from one card, but having on multiple cards doesn’t make it any more valuable:

- Free checked bags

- Elite status with a specific hotel, airline, or car rental service

- Lounge access to a specific type of lounge

Diminishing return perks

Some perks have diminishing value with each extra card that offers the perk. For example, each of the Amex Platinum consumer cards (the regular consumer Platinum card, and the one’s from Schwab and Morgan Stanley) offer $240 per year in Digital Entertainment Credits: Up to $20 per month rebate for select digital entertainment services. In my case, I subscribed to the New York Times e-edition anyway, and so value this perk on my generic Platinum card pretty highly. I pay about $17 per month, or $204 per year and so I value these savings at about $180 (i.e. I would be willing to prepay $180 for those savings). But I also have the Schwab Platinum card which I have used to subscribe to Peacock Premium for $14 per month. I wouldn’t pay for Peacock Premium without the rebate, though, so here I value the perk at only about $25.

How to value overlapping perks

The trick to doing this right is to first figure out which of your cards are the most likely “keepers” and assign perk values to those cards first. Then go to your next most likely to keep cards, and only assign incremental value (if any) to perks that overlap with your keeper cards. And repeat with the next most likely to keep cards, and so on.

If you have a bunch of premium cards, this is not easy! For example, many premium cards offer Priority Pass memberships. If you have more than one, then it’s a good idea to figure out which card is the most likely “keeper”, but keep in mind that the value of Priority Pass varies by card. Many versions of Priority Pass no longer include free meals at Priority Pass restaurants. And details vary about how many guests you can bring in and what it would cost (if anything) to add authorized users with their own Priority Pass membership. One of the best options overall is with the Chase Ritz card which offers Priority Pass with unlimited guests, and free authorized users, each of which can get their own Priority Pass with unlimited guests. But the Ritz card isn’t easy to get (you have to start with a Chase Marriott consumer card and upgrade) and its perks aren’t ideal for everyone. Still, if you have the card and highly value its key benefits like the $300 incidental travel rebate and 85K free night certificate, it makes sense for this to be your first-in-line keeper card. Estimate the value of Priority Pass on that card, but not on any others (unless the other card’s Priority Pass is better because it includes restaurants).

Sapphire Reserve & Sapphire Reserve for Business

I used to show my own entire spreadsheet here, but my situation has become too complicated to explain in a single post. Many of the cards I have are keepers just because writing and talking about credit cards is my career. So, instead of using the spreadsheet for all of my premium cards, I instead filled it out just for the Sapphire Reserve and Sapphire Reserve for Business. You’ll find my valuations below…

Important background: I have (and plan to keep) the Ritz-Carlton card which offers a better version of Priority Pass than the Sapphire Reserve offers. The Ritz version offers the same access to Sapphire lounges, but at regular Priority Pass lounges the Sapphire Reserve’s version allows 2 guests at whereas the Ritz version is unlimited (Nick recently used his to bring 8 people into a lounge!). Additionally, Ritz card authorized users are free and they each get their own Priority Pass.

Sapphire Reserve

| Card Offer and Details |

|---|

ⓘ $1585 1st Yr Value Estimate$300 travel credit valued at $285, $300 StubHub credit ($150 Jan-Jun and again Jul-Dec) valued at $75, $500 Chase The Edit credit ($250 Jan-Jun and again Jul-Dec) valued at $125, $300 Chase Dining credit for dining at Sapphire Reserve Tables restaurants ($150 Jan-Jun and again Jul-Dec) valued at $75, $500 Chase Travel credit valued at $400 Click to learn about first year value estimates 100K Points + $500 Chase Travel℠ promo credit ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 100K + promo credit good for up to $500 towards a single Chase Travel℠ booking after $5K spend in 3 months. $795 Annual Fee Note that promotional travel credit is one-time use and if it is applied to a transaction of less than $500, the remaining value will be forfeited. FM Mini Review: Good all-around card for frequent traveler. Best when paired with no annual fee Chase Freedom Flex, Freedom Unlimited & Chase Ink Cash cards. Click here for our complete card review Earning rate: 8X Chase Travel℠ ✦ 4X flights and hotels booked direct ✦ 3X Dining ✦ 5X Lyft (through September 2027) Card Info: Visa Infinite issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: After spending $75,000 each calendar year, get the following benefits: IHG One Rewards Diamond Elite Status ✦ Southwest Airlines A-List Status ✦ $500 Southwest Airlines credit when booked through Chase Travel ✦ $250 credit to The Shops at Chase Noteworthy perks: $300 Annual Travel Credit ✦ Transfer points to airline & hotel partners ✦ Up to $500 The Edit credit annually ($250 January to June and again July to December) ✦ Up to $300 Dining credit through Sapphire Reserve Exclusive Tables ($150 January to June and again July to December) ✦ Complimentary AppleTV+ and Apple Music through 6/22/27 ✦ Up to $300 in StubHub credits ($150 January to June and again July to December) ✦ Points worth up to 2 cents each towards qulalified bookings through Chase Travel ✦ Transfer points to airline & hotel partners ✦ Primary auto rental coverage ✦ Priority Pass Select lounge access ✦ Access Sapphire Lounges for yourself and 2 guests for free ✦ Access select Air Canada Maple Leaf lounges when flying Star Alliance ✦ Up to $120 Global Entry or TSA PreCheck® or NEXUS Application Fee Statement Credit ✦ Free DoorDash DashPass through 2027 ✦ Two promos of $10 off each month on non-restaurant orders from DoorDash ✦ $5 off restaurant order each month from DoorDash ✦ $10 monthly Lyft creditPrimary auto rental coverage ✦ Priority Pass Select lounge access ✦ Access Sapphire Lounges for yourself and 2 guests for free ✦ Access select Air Canada Maple Leaf lounges when flying Star Alliance ✦ Up to $120 Global Entry or TSA PreCheck® or NEXUS Application Fee Statement Credit ✦ Free DoorDash DashPass through 2027 ✦ Two promos of $10 off each month on non-restaurant orders from DoorDash ✦ $5 off restaurant order each month from DoorDash ✦ $10 monthly Lyft credit See also: Chase Ultimate Rewards Complete Guide |

Here are my personal valuations for the Sapphire Reserve card. With one exception (Priority Pass), I only show perks that I gave a value to. All perks not shown were assigned $0 value. Please, please, please understand that your personal valuations should be different than mine. Additionally, there’s a good chance that you value some of the perks that I didn’t include at all below…

| Sapphire Reserve Benefit | My Value | My Notes |

|---|---|---|

| $300 in annual travel credits | $285 | I use this card for flight and hotel charges and so the rebate is automatic every year. |

| Priority Pass Select & Sapphire Lounge access for you plus 2 guests | $0 | I have a better version of Priority Pass thanks to my Ritz-Carlton card. |

| Best in class travel protections | $100 | I highly value this for the peace of mind it offers when paying for travel with this card. I like too that when paying for airfare and hotels I would earn 4x. If I was into booking cruises or other types of travel that don’t earn 4x, I’d be less enthusiastic about this. |

| Free subscription to Apple TV+ and Apple Music | $110 | I pay $10 per month for Apple TV+ anyway. This also gives me the opportunity to try out Apple Music to see if I like it as much as Spotify (and could therefore save money by cancelling Spotify) |

| The Edit hotel rebate, $250 per 6 months | $100 | It will be interesting to see in practice how often I book 2+ night stays through The Edit. If it’s common, I’ll end up valuing this much more than $100 per year. |

| Sapphire Reserve Exclusive Tables rebate, $150 per 6 months | $100 | The list of eligible restaurants is very small, so I don’t know how often I’ll use this benefit. My guess right now is that I’ll use it at least once per year. |

| Stubhub rebate, $150 per 6 months | $50 | I don’t buy from Stubhub often, but I’d be willing to pay $50 in advance for this semi-annual rebate. |

| Lyft rideshare benefits. $10 ride credit per month plus earn 5X points on Lyft rides through September 2027 | $25 | I’m guessing that I’ll use the $10 Lyft discount at least 3 or 4 times per year, and often more. |

| DoorDash thru 12/31/27: Free DashPass for 12 months after activation. Two $10 discounts per month on non-restaurant orders and one $5 discount per month on restaurant orders. | $25 | Just guessing that I’ll get enough value from this to be worth “paying” $25 per year |

| My Total: | $795 |

This was a weird coincidence! My valuation came to $795, which is the exact new annual fee for this card. Since my estimates where based on what I’d be willing to pay in advance for these features, rather than the amount of value I expect to get, this means that I should keep the Sapphire Reserve even when my annual fee goes up to $795. Of course, by then my valuations of some of these things are likely to change, so I’ll do this exercise again at that time.

Sapphire Reserve for Business

| Card Offer and Details |

|---|

ⓘ $2185 1st Yr Value Estimate$300 travel credit valued at $285, $500 Chase The Edit credit ($250 Jan-Jun and again Jul-Dec) valued at $125, $100 GiftCards.com credit ($50 Jan-Jun and again Jul-Dec for cards purchased from https://reservebusiness.giftcards.com/) valued at $50 Click to learn about first year value estimates 200K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 200K points after $30K spend in first 6 months.$795 Annual Fee FM Mini Review: Could be very appealing for a business that books a lot of travel, as it earns 8x through Chase Travel or 4x when booking direct through airline and hotels. It has decent perks, best-in-class travel protections, and earns valuable Chase Ultimate Rewards points. Best when paired with no annual fee Chase Freedom Flex, Freedom Unlimited & Chase Ink Cash cards Earning rate: 8X Chase Travel℠ ✦ 4X flights and hotels booked direct ✦ 3X social media and search engine advertising ✦ 5X Lyft (through September 2027) Card Info: Visa Infinite issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: After spending $120,000 each calendar year, get the following benefits: IHG One Rewards Diamond Elite Status ✦ Southwest Airlines A-List Status ✦ $500 Southwest Airlines credit when booked through Chase Travel ✦ $500 credit to The Shops at Chase Noteworthy perks: $300 Annual Travel Credit ✦ Up to $500 The Edit credit ($250 January to June and again July to December) ✦ Up to $400 ZipRecruiter credit ($200 January to June and again July to December) ✦ $200 Google Workspace credit ✦ $100 Giftcards.com ($50 January to June and again July to December) ✦ Points worth 2 cents each towards qulalified bookings through Chase Travel(SM) ✦ Transfer points to airline & hotel partners ✦ Primary auto rental coverage ✦ Priority Pass Select lounge access ✦ Access Sapphire Lounges for yourself and 2 guests for free ✦ Access select Air Canada Maple Leaf lounges when flying Star Alliance ✦ Up to $120 Global Entry or TSA PreCheck® or NEXUS Application Fee Statement Credit ✦ Free DoorDash DashPass through 2027 ✦ Two promos of $10 off each month on non-restaurant orders from DoorDash ✦ $5 off restaurant order each month from DoorDash ✦ $10 monthly Lyft credit See also: Chase Ultimate Rewards Complete Guide |

I was curious whether the Sapphire Reserve for Business might be a better option for me than the Sapphire Reserve. So, I filled out the tab for this card as if I didn’t also have the Sapphire Reserve. Here are the results…

| Sapphire Reserve for Business Benefit | My Value | My Notes |

|---|---|---|

| $300 in annual travel credits | $285 | I use this card for flight and hotel charges and so the rebate is automatic every year. |

| Priority Pass Select & Sapphire Lounge access for you plus 2 guests | $0 | I have a better version of Priority Pass thanks to my Ritz-Carlton card. |

| Best in class travel protections | $100 | I highly value this for the peace of mind it offers when paying for travel with this card. I like too that when paying for airfare and hotels I would earn 4x. If I was into booking cruises or other types of travel that don’t earn 4x, I’d be less enthusiastic about this. |

| The Edit hotel rebate, $250 per 6 months | $100 | It will be interesting to see in practice how often I book 2+ night stays through The Edit. If it’s common, I’ll end up valuing this much more than $100 per year. |

| Google Workspace rebate, $200 per year | $190 | I spend more than $200 each year on Google Workspace, so this is an easy win. |

| Gift card credit, $50 per 6 months for purchases at giftcards.com/reservebusiness | $50 | I’d pay $50 to get two $50 gift cards each year. |

| Lyft rideshare benefits. $10 ride credit per month plus earn 5X points on Lyft rides through September 2027 | $25 | I’m guessing that I’ll use the $10 Lyft discount at least 3 or 4 times per year, and often more. |

| DoorDash thru 12/31/27: Free DashPass for 12 months after activation. Two $10 discounts per month on non-restaurant orders and one $5 discount per month on restaurant orders. | $25 | Just guessing that I’ll get enough value from this to be worth “paying” $25 per year |

| My Total: | $775 |

This one ended up just barely shy of its $795 annual fee. So it’s clear that the consumer version of the card is a better fit for me.

A friend’s example (From Feb 2024)

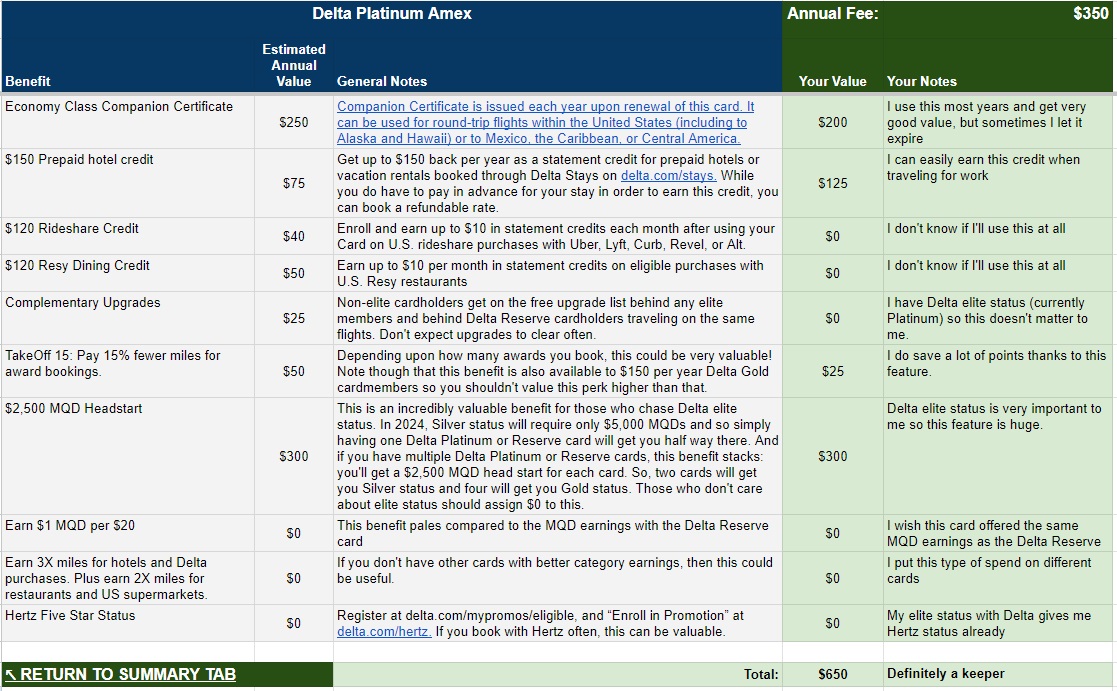

In this example, I created a spreadsheet for a friend. She has the Delta SkyMiles Platinum card. She also currently has Delta Platinum Medallion Elite status and values that highly. She is thinking about upgrading her Delta Platinum card to a Reserve card in order to get Delta Sky Club® access and to get a better way of earning Medallion Qualifying Dollars towards elite status through credit card spend. She has a job where she is reimbursed for travel that she pays for herself and so she believes that it would be very easy for her to use the Delta Stays hotel credits available through Delta cards.

For this exercise, I filled out the spreadsheet on my friend’s behalf as if I were her and imagined her valuations for each card perk…

Delta SkyMiles Platinum Card

| Card Offer and Details |

|---|

ⓘ $682 1st Yr Value Estimate$150 Delta Stays credit valued at $75 Click to learn about first year value estimates 90K miles ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Limited Time Offer: Earn 90,000 bonus miles after you spend $4,000 in eligible purchases on your new card in your first 6 months of card membership. Terms apply. Rates & Fees (Offer Expires 7/16/2025)$350 Annual Fee Alternate Offer: Dummy booking offer of 70K + $400 credit. See this for more details. FM Mini Review: Good choice for frequent Delta flyers who can make use of annual companion certificate Earning rate: 3X Delta ✦ 3X purchases made directly with hotels ✦ 2X restaurants ✦ 2X US Supermarkets Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Earn 1 Medallion Qualifying Dollar (MQD) per $20 spent Noteworthy perks: 15% off when using miles to book an award flight (Delta metal only) ✦ Receive $2,500 Medallion(R) Qualification Dollars each Medallion Qualification Year ✦ US, Caribbean, or Central American economy companion certificate (subject to taxes & fees) each year upon card renewal ✦ Earn up to $150 as a statement credit each year after booking prepaid hotels or vacation rentals with your Card through Delta Stays on delta.com/stays ✦ Up to $10 per month in statement credits for US purchases with select rideshare service providers [enrollment required] ✦ Up to $10 per month in statement credits on eligible purchases with U.S. Resy restaurants [enrollment required] ✦ Priority boarding ✦ First checked bag free on Delta flights ✦ Complimentary Upgrade list: get added to the complimentary upgrade list after Delta elite members and Reserve cardmembers ✦ Cell phone protection ✦ Terms and Limitations Apply. |

Mostly due to the fact that my friend highly values Delta elite status and that this card offers a $2,500 MQD Headstart, it’s a clear winner. That said, she may do even better with the Delta Reserve card and so I filled that out on her behalf too…

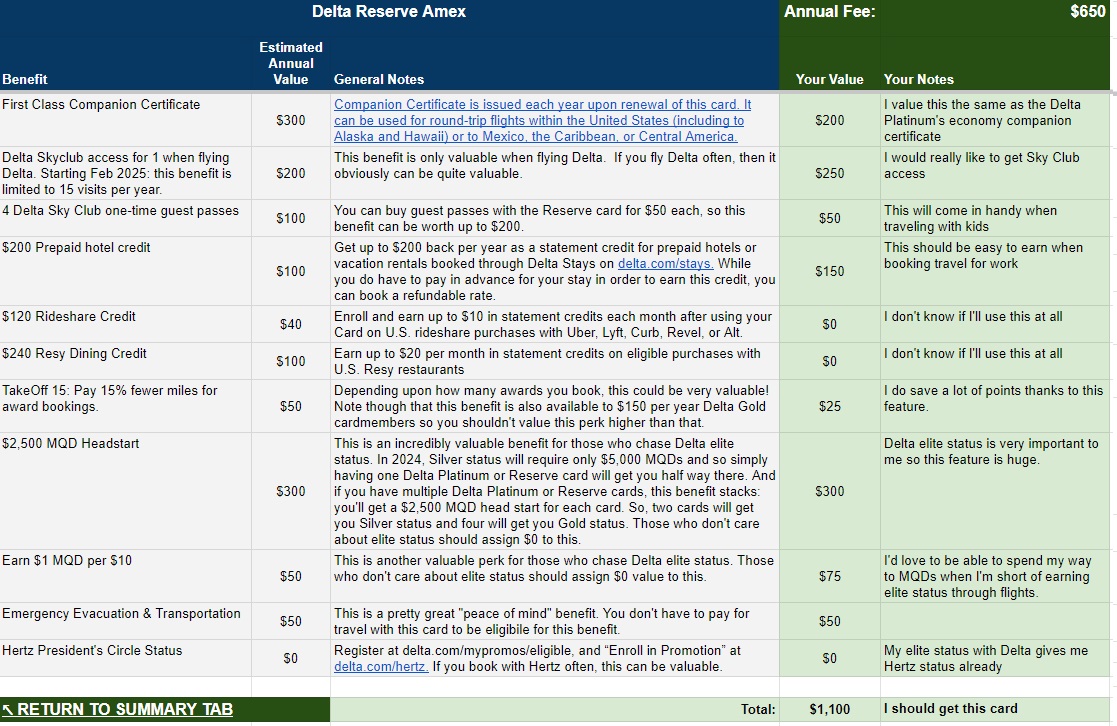

Delta Reserve Card

| Card Offer and Details |

|---|

ⓘ $483 1st Yr Value Estimate$200 Delta Stays credit valued at $100 Click to learn about first year value estimates 100K miles ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Limited Time Offer: Earn 100,000 bonus miles after you spend $6,000 in eligible purchases on your new card in your first 6 months of card membership. Terms apply. Rates & Fees (Offer Expires 7/16/2025)$650 Annual Fee FM Mini Review: Excellent choice for frequent Delta flyers who can make use of Delta Sky Club® access and companion certificate. Also a good choice for big spenders seeking Delta elite status. Earning rate: 3X Delta Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Earn 1 Medallion Qualifying Dollar (MQD) per $10 spent Noteworthy perks: 15% off when using miles to book an award flight (Delta metal only) ✦ Receive $2,500 Medallion(R) Qualification Dollars each Medallion Qualification Year✦ US, Caribbean, Mexico or Central America roundtrip main cabin companion certificate (subject to taxes & fees) after card renewal ✦ Delta Sky Club® access when flying an eligible Delta flight: 15 visits per year to be used from February 1 until January 31 of the next calendar year (after 15 visits have been used, additional visits can be purchased for $50 each) or to earn an unlimited number of visits, spend $75K or more on eligible purchases each calendar year. ✦ 4 Delta SkyClub one-time guest passes ✦ Centurion Lounge access when flying Delta ✦ Earn up to $200 as a statement credit each year after booking prepaid hotels or vacation rentals with your Card through Delta Stays on delta.com/stays ✦ Up to $20 per month in statement credits on eligible purchases with U.S. Resy restaurants [enrollment required] ✦ Up to $10 per month in statement credits for US purchases with select rideshare service providers [enrollment required] ✦ Complimentary upgrades ✦ One statement credit every 4 years for the $120 Global Entry application fee or one statement credit every 4.5 years for the $85 TSA Precheck application fee ✦ Priority boarding ✦ First checked bag free on Delta flights. ✦ Hertz President's Circle Status [Enrollment required] ✦ Terms and limitations apply. See also: Delta Reserve complete guide |

The Delta Reserve card has even more upside in this example than the Delta Platinum card. My friend would get Sky Club access and the ability to earn a reasonable number of MQDs through spend. She should apply for a Reserve card (that’s better than upgrading because she’d be able to earn a welcome bonus) and then either keep or cancel her Delta Platinum card. An advantage to keeping it is that the MQD Headstarts are additive so she could get even more of a boost towards elite status. If she thinks that she can make good use of two companion tickets each year then this would be a good strategy.

An even better strategy for my friend would be to look into getting Delta business cards. They have the same annual fees and perks as their consumer counterparts but come with even more hotel credits. To keep things simple for this exercise, though, I made the assumption that she is not comfortable applying for business cards.

Greg, when you get around to updating this for the CSR changes, can you add the BOA premium elite?

Yep, that’s high on my list

I’ve been looking for something like this. Thank you so much for putting this together!

Great spreadsheet. Overall the lounges are far less value to me, and especially the passes/access that come with the cards.

For lounge value I used this approach:

I calculate first the actual money saved per person and visit, like what would have been spent buying food/beverage otherwise and then add what value it is to have more quiet place (that also means if from my experience the places are over crowded, than it is 0 value).

Then I multiply that with the amount of expected visits incl. guests I will have for the AF period. That considers maybe several places I would not able to use a lounge because there is none or always full or long wait. Or more likely fore me is, because guests are not included, like Amex lounge and now VentX, the value is pretty much zero. I don’t travel alone and always as family.

Amex lounge is $0 for me. VentureX PP is now also 0$ for me with recent changes.

The doesn’t mean I will drop the VentX, because it still pays for itself with the credits and some benefits. Amex on the other hand became too much forced spending, which I will not keep up with anymore.

@Greg

please note in the spreadsheet the PP at Venture X changes after new year travels.

Love this tool and use it often! Question on the Delta Reserve sheet – it lists Emergency Evacuation & Transportation coverage- but I don’t see that coverage listed anywhere on AMEX card benefits page OR the terms and conditions link. Google searches coming up short – Are you sure it is an included benefit?

Yes but it is hard to find. You need to look for a benefit called “PREMIUM GLOBAL ASSIST® HOTLINE”

You can look up individual cards here to see whether they have “premium” global assist or not:

https://www.americanexpress.com/us/credit-cards/features-benefits/policies/global-assist-terms.html

Thanks so much for the reply! FM is the best. I don’t think I would have ever found that- very helpful.

just a quick suggestion for your next version – put borders around each of the rows in each sheet. I do it for the cards I’m interested in and it really helps legibility and usefulness of the sheets.

thx for doing this

I’m now down to VX as only keeper, and even that is marginal for me now that it’s a portal credit, so considering canceling that next cycle. You’re better off with downgrade/upgrade, cancel/reapply, find a substitute or just do without.

Going through this worksheet exercise you will inevitably overvalue benefits, underestimate risks of not getting expected payoff for upfront investment, and undervalue your time and stress dealing with couponing and such. Better off just getting the SUB, canceling after a year, and moving on. There is virtually no CC benefit that is not replaceable by an alternative card with a SUB.

I would say the aspire is a keeper for some people as well. I go on maybe 2 or 3 international trips a year, and the benefits and club access are well worth the cost of the card. Hiltons in Asia, Europe, and Africa are often very nice and they treat diamonds very well.

It’s certainly worth it if you travel internationally and can easily max out the resort credit without spending money you otherwise wouldn’t, but still, I think doing the upgrade/downgrade game with it is the way to go.

Would it make sense to add a value to Sapphire Reserve lounge access? It would be limited of course for many people but for me, (SAN, PHX, LAX) it has some value.

Yes. The goal is to modify the chart for your specific needs, so place a value on it. For me, Cap1 has very few lounges, but one is in IAD–my primary airport for international flights. Therefore, I value lounge access much higher than most folks.

Yeah probably. I put that info under Priority Pass but maybe it deserves its own row.

Couldn’t copy or open the link!

What happened when you tried? You do need to be signed into a Google account for it to work

Don’t forget to value referrals. My Amex Business Platinum consistently offers me 25k or 30k per referral. I’m able to get at a couple referrals a year so that’s the real difference maker in making it keeper.

What’s the difference between a premium card and an ultra premium card?

About $300/yr

I just don’t get the use of “ultra.” There are travel cards like the Amex Green, Citi Premier, and WF Autograph. Then, there are the premium travel cards like the Amex Platinum and Chase Sapphire Reserve. Use of “ultra” seems sensationalistic.

When I first created the spreadsheet years ago, i only included cards that cost around $450 or more. Those are the ones i consider ultra-premium. Over time I’ve added more and more cards after reader requests which are much less expensive.

I used to hate the Platinum bc it was such a pain and loved the Gold Card for it’s earnings. Surprised that the Platinum was worth (slightly) more than its fee. Gold card delivered by far the worst value. That was not only bc of the higher fee but also bc I can get 5x at US restaurants w Citi Custom and 4.5% of nearly cash-back from grocery stores and foreign restaurants w Altitude, obviating the 4x back from the Gold Card (and I use every point I earn from Altitude, whereas I have a few hundred thousand Amex points that always are sitting there).

In the “summary” it’d be nice to include the Frequent Miler “Estimated Annual Value”.

It can be nice if we are thinking of getting an additional card and see which might be keepers.

Something else might also be including the authorized users.

The text regarding priority pass on some sheets mentions restaurant access, but I believe this has been removed from all the major cards (big loss in my case for CSR). If I’m correct, it might be worth editing to reflect that.

What about primary insurance for car rentals for the CSR and CSP? It’s pretty valuable and a definitely a cost savings.

SiriusXM no longer offered for the entertainment credits on Amex Consumer Plat cards.