A few days ago, a moment I’d long been waiting for finally arrived: I was finally offered the chance to product change an old card to the Capital One SavorOne card. I am thrilled to finally have that card in my household even if the physical replacement card isn’t yet off the presses, but the addition of the SavorOne to my wallet begs the question: will I finally dump the Amex Gold card?

A hot reader tip leads to my product change

I have to start out with a word of thanks for reader Darin, who reported a few days ago in our Frequent Miler Insiders Facebook group that he was “finally able to product change a card to the SavorOne” after trying “for ages”. That was music to my ears as I had also been trying to find a product change path to a Capital One SavorOne card for ages.

For those unfamiliar, it’s worth noting that Capital One product changes are an odd bird / mixed bag. Capital One refers to any product change as an “upgrade” (even when changing from a card with a higher annual fee to a card with a lower annual fee or no annual fee). Unlike most issuers, there is no clear pattern as to product change options. Capital One’s computer system provides certain options to certain cardholders and if the computer system doesn’t offer you the product change that you want, you’re just out of luck.

That’s significantly different than how product changes work with other issuers. Most issuers allow product changes within a “family” (like you could product change a Hilton Surpass card to an Aspire card or a plain Hilton Honors card for instance). Some issuers offer a product change to almost anything (Citi will generally allow you to product change a consumer card to almost any consumer card they offer). Some other issuers don’t generally offer product changes at all. But I think that Capital One stands alone in offering a random, specific assortment that is targeted to the individual cardholder.

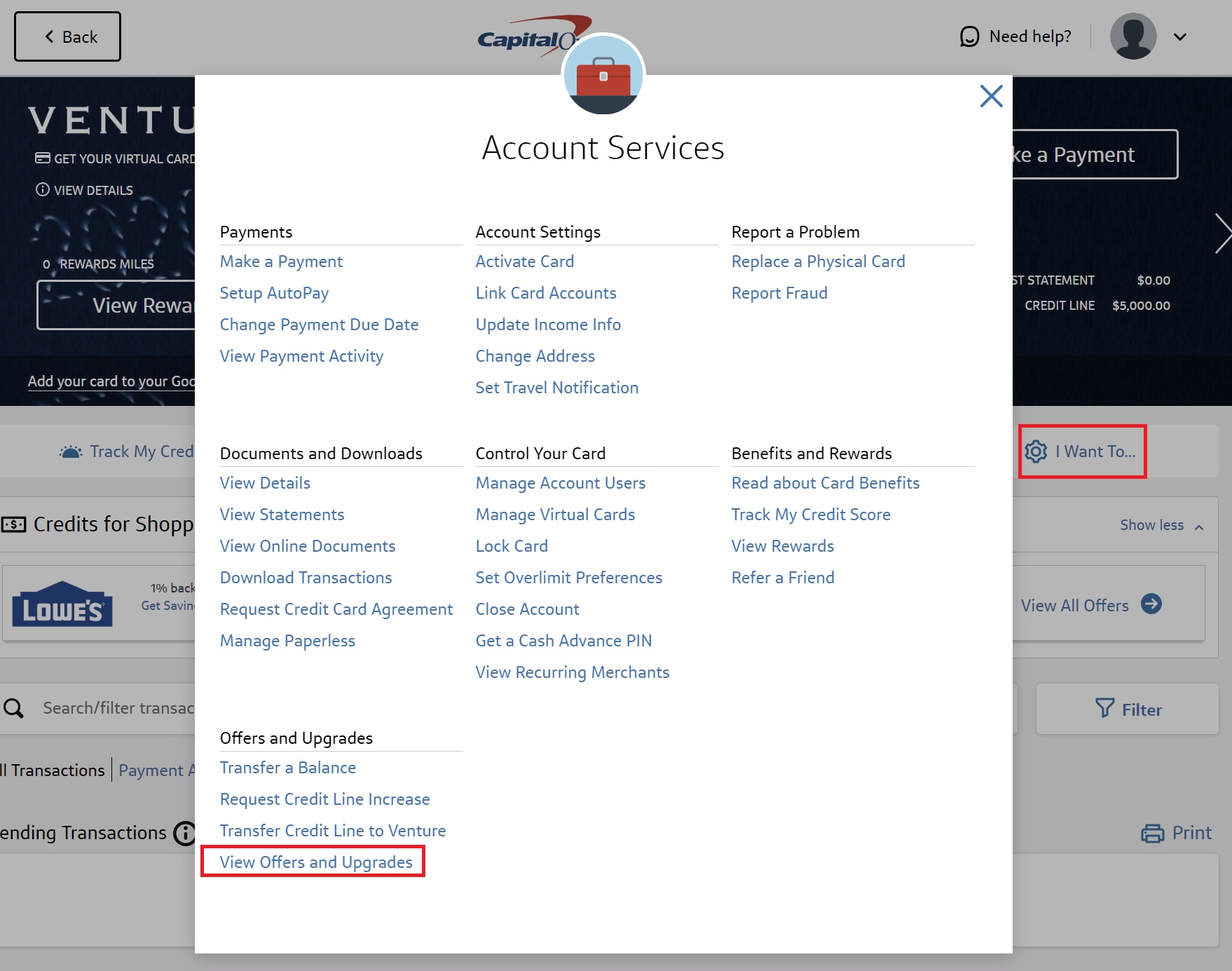

I periodically check for upgrade offers. On desktop, you can do this by logging and navigating to card account and then clicking the “I Want To…” cog and selecting “View Offers and Upgrades”.

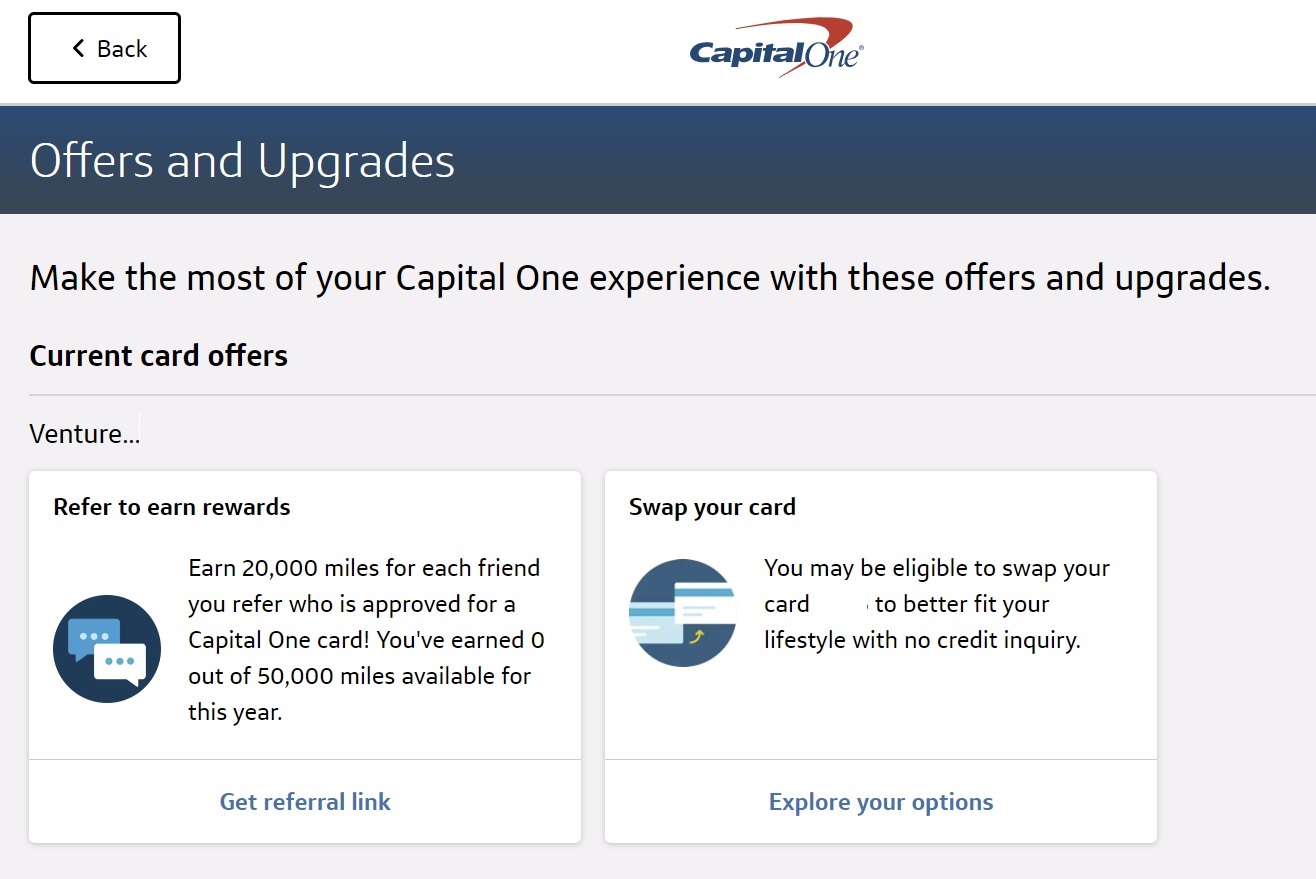

That link brings you to a page where you may see the option to “swap your card”.

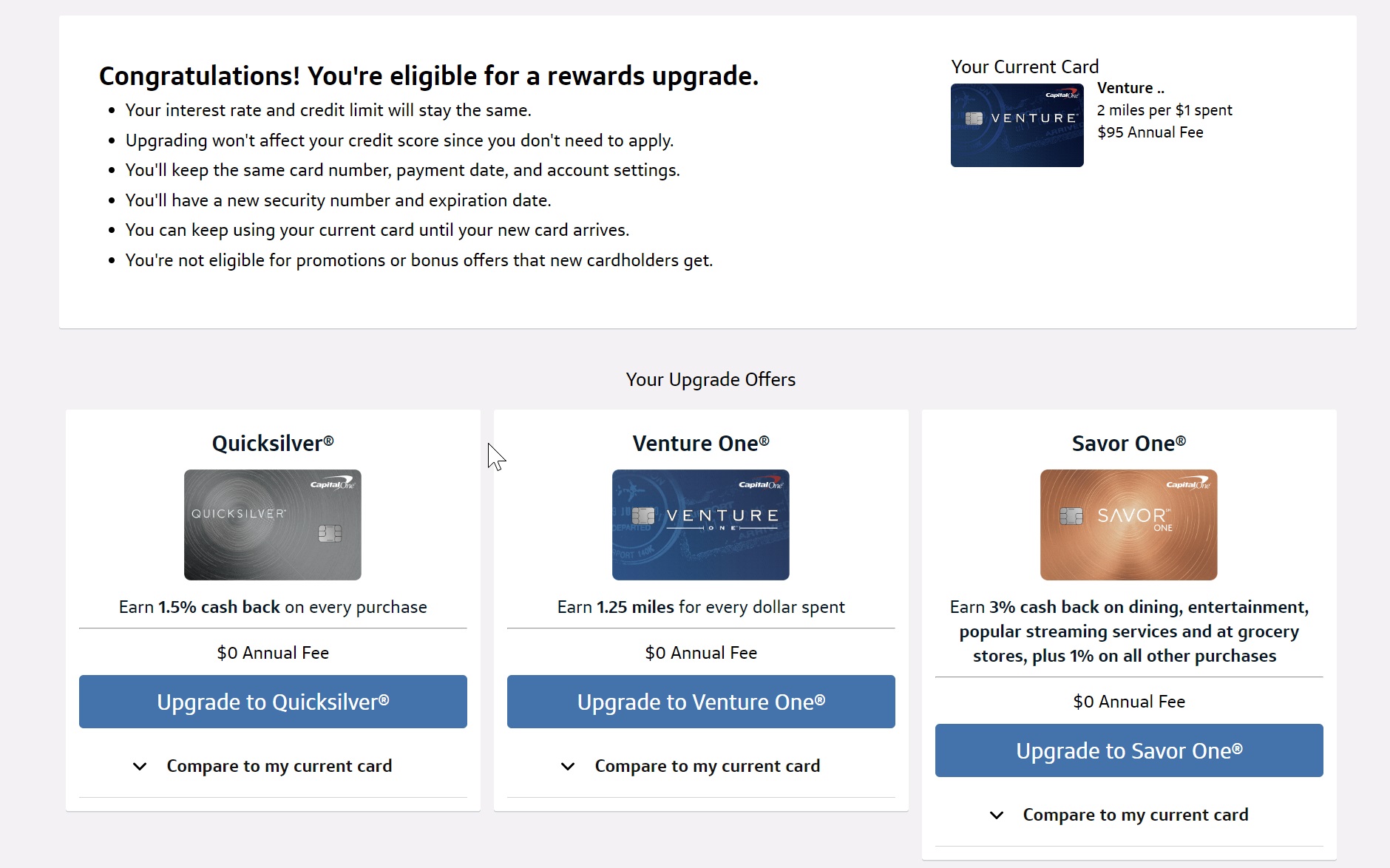

If you’re eligible for a product change, you’ll then see your options for an “upgrade”.

I put the word “upgrade” in quotation marks because you’ll notice that in my case I had a Capital One Venture Rewards card (which has a $95 annual fee) and my “upgrade” options are all to no-annual fee cards: The Capital One Quicksilver Rewards Card, the Capital One Venture One card, or the Capital One SavorOne card. We would traditionally refer to that as a downgrade, although in this case I do feel like I’m getting something of an upgrade.

I selected to upgrade to the SavorOne and received the confirmation message that my upgrade might take 2-3 days to complete and that I’d receive a new card in the mail but that the card number wouldn’t change, so I could continue to use my current card. Within the next 24 hours, the card changed to the Savor One in my Capital One login.

I’m really thankful that Darin shared his experience with this as I’d been looking for this “upgrade” offer for a long time and was thrilled to finally get it. For what it’s worth, Darin reported seeing the Savor One as an “upgrade” from a Quicksilver Mastercard. In my case, it was an “upgrade” from a Venture card, through my Venture card began life as some other more generic Capital One card that I eventually upgraded to a Venture card. At the time when I upgraded, Capital One had long been issuing Venture cards as Visa cards, but my old generic card was a Mastercard, so my Venture card has been a Mastercard for years. I mention that only to say that both Darin and I had Mastercards. I’m not sure whether that made the difference in making the product change available for us.

I should also note that my wife has a Venture X card (and also a Venture card), so there was no good reason for me to keep the Venture card. It’s one of my oldest cards, so I’ve wanted to keep the line open for average age of account purposes but had been hesitant to product change to a no-fee card hoping to not lock myself out of a change to a Savor One should it ever become available. That moment finally arrived!

Why I’m excited about a product change to the Capital One SavorOne card

It may seem surprising or strange to some that I’m excited about product changing from a Venture card that earns miles to a no-annual-fee cash back card. That excitement comes from both the earning structure of the SavorOne card and the transferability of Capital One rewards.

The Capital One Savor One card offers unlimited 3% cash back on grocery, dining, entertainment, and popular streaming services (and 1% back on all other purchases). It also temporarily (through November 14, 2024) offers 10% back on Uber and Uber Eats and provides a monthly statement credit for UberOne membership through 11/14/24.

That’s already not bad at all for a card with no annual fee, but it gets better if you also have a card that earns Capital One miles.

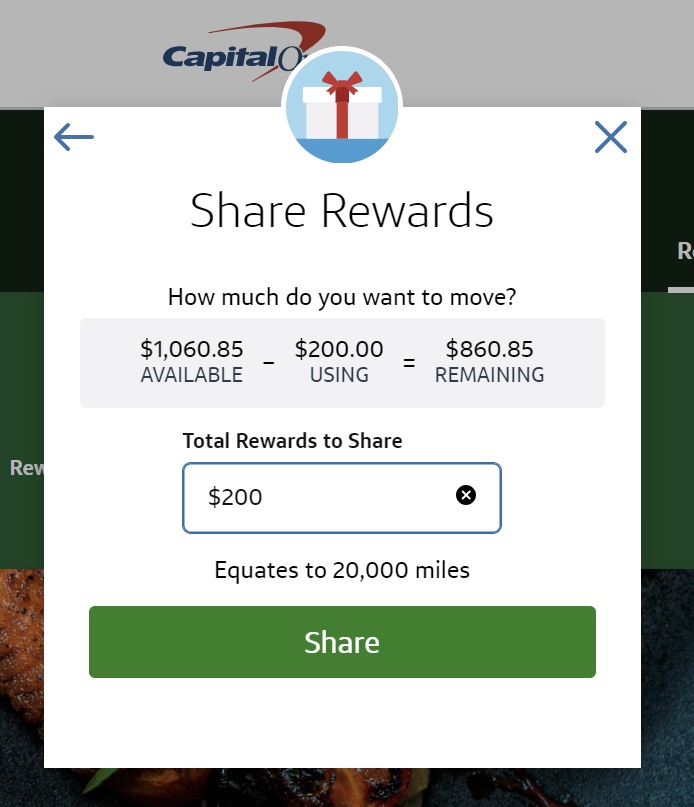

That’s because Capital One offers the ability to easily move rewards between your own cards (and somewhat less easily to move rewards to others). It is possible to move rewards from a card that earns cash back to a card that earns miles at a rate of $0.01 = 1 mile.

Within your own account, you simply hit the “View Rewards” button and then select “Move Rewards” in order to do this. Note that you can only move rewards from cash back to miles, not the other way around.

This makes Capital One’s cash back cards very intriguing since 3% cash back can alternatively become 3 transferable Capital One miles per dollar spent. I also have an old Capital One VentureOne card (which also has no annual fee), so I now have the capacity to earn an unlimited 3% cash back on grocery, dining, entertainment, and popular streaming services and convert that to 3x Capital One miles and then transfer on to airline and hotel partners using my Venture One card. With no annual fee at all, that’s a great deal given Capital One’s strong stable of transfer partners.

As mentioned above, it is also possible to move rewards to another cardholder, though you can’t do that online. You’ll need to call the number on the back of your card and have both your card number and the card number of the cardholder to whom you want to move your rewards. My wife has done this numerous times to move miles from her account to mine and even cash back from her Spark Cash card to my VentureOne card.

For those curious, the reason I’m excited about product changing rather than opening the card new is two-fold. First of all, Capital One is known to be tough on approvals for people with many credit cards and I haven’t had any luck with them in the past couple of years. Second, the welcome bonus on the SavorOne card tends to be quite small. While I like a welcome bonus as much as the next person, I don’t really want to jeopardize my ability to get approved for a more valuable bonus elsewhere for a bonus that is often just $200 cash back (which can become 20,000 miles) on the SavorOne card. I’m happy to have its ongoing earning structure to complement my spending patterns while I simultaneously work on more valuable bonuses.

Is it time to finally dump the Gold cards in my household?

About a year and a half ago, I published a post wondering whether I should go after a SavorOne card and dump the Amex Gold card (See: Should I dump the Amex Gold card for the Capital One SavorOne Cash Rewards credit card? (On Nick’s mind)). At the time, the internal debate was mostly philosophical since I didn’t have the option to product change to the SavorOne and wasn’t convinced that I wanted to waste a new account application on such a small welcome bonus.

However, now that I have a SavorOne card, I need to revisit my thoughts a bit.

You should see that old post if you’re interested in my previous math regarding my break-even point, but I feel like the tide has changed a bit.

At the time, I said that I’d value the monthly Uber credits offered by the Amex Gold card at 80% of face value, though I noted that might be a bit generous. I think it definitely was too generous of a valuation for the monthly Uber credit.

On the one hand, my wife and I have a few Platinum and Gold cards in our household. By adding all of our cards to a single Uber account, the monthly Uber credits stack in one account and so we have enough in credits each month to easily cover a complete meal for the family.

On the other hand, we continue to have some breakage with our credits. We had at least one month this year where we forgot to use the credits entirely and another where we didn’t use them completely. Furthermore, we very, very frequently see Uber gift cards go on sale for at least 10% off of face value (and sometimes at 20% off of face value). Although I could buy an Uber gift card at 90% of face value almost any time or 80% of face value now and then, I haven’t found myself pre-paying for Uber credit at those rates because I just don’t use Uber often enough to make it worth tying up the money in those gift cards.

And yet that’s exactly what I’m doing with my Amex Gold card annual fee money: I’m effectively tying up my money (in paying the annual fee) in Uber credit. But worse than gift cards, that credit expires at the end of every month, use it or lose it (and I sometimes lose it). I’d probably feel differently if I lived in an area with many Uber Eats options, but I don’t, so using the credits requires some planning and effort.

So how much do I value the monthly Uber credit on the Amex Gold card? It’s hard to say.

Obviously, a 10% or 20% discount on Uber Gift Cards isn’t enough to make me a buyer (and a 10% discount shouldn’t be enough of a discount for now since my SavorOne card will earn 10% back on Uber through 11/14/24 and that can convert to 10x miles that I value at around 1.5c per mile, which makes it effectively like 15% back). I’m not even sure that a 30% discount would be enough to force my hand to the “buy” button. At 50% off of face value though, I’d probably load up on some Uber credit knowing that I’ll eventually save half off of dinner at some point during our travels.

However, the Gold card’s monthly Uber credits aren’t something I can use “at some point during our travels” but rather are a “use it or lose it” once-a-month credit. I am therefore not convinced that I should even value those credits at 50% of face value. Greg often says that you should consider the price you’d be willing to pay to subscribe to a particular benefit. How much would I be willing to pay in advance to subscribe to a monthly $10 Uber credit that expires at the end of every month? Honestly, not very much given the fact that we’ll lose it some months and might have to stretch to find a use during others. I’d probably be willing to pay $30 up-front to subscribe to those $10 monthly credits, but I don’t don’t think I’d pay far more.

As I’ve previously noted, I just don’t often use the other $10 monthly credit on the Gold card. I should make a concerted effort to buy a $10 gift card each month at a qualifying merchant, but I don’t. So for me, I don’t really value that monthly credit at all.

That has me considering the $250 annual fee on the Amex Gold card at more like $220 (after subtracting the $30 that I’d be willing to pay for the monthly Uber credits). Keep in mind that this is just a personal valuation based on my circumstances. If you live in a city where you order from Uber Eats and GrubHub weekly, I imagine that you would value the monthly credits much higher than I do.

The Amex Gold card of course offers more points on its category bonuses. With the Gold card, I can earn 4 points per dollar spent on dining or 4 points per dollar spent at U.S. Supermarkets on up to $25K in purchases per year (then 1x).

By contrast, the Savor One only offers 3% back (an effective 3 points per dollar spent) in those categories. However, Capital One offers those categories without caps and worldwide (with no foreign transaction fees). It also adds “entertainment”, which is a category I had mostly ignored, though the Wells Fargo Attune card has me thinking that I need to dig into what qualifies as “entertainment” with Capital One.

Ignoring annual caps and additional bonus categories, does it make sense to keep the Gold card for 1 additional point per dollar spent?

If we imagine that I value both sets of points at 1.5c per point (which isn’t exactly spot on with our Reasonable Redemption Values, but it’s close enough), how much would I need to spend on the Amex Gold card to earn enough to outweigh the $220 that I view as the “net” fee?

Amex Gold

- $220 = 14,667 points at a value of $0.015 per point.

- I would therefore have to spend $14,667 at 4x to earn 58,667 Membership Rewards points

- 58,667 Membership Rewards points at a value of 1.5c per point = $880

Capital One SavorOne

- $14,667 x 3% cash back = $440.01 = 44,001 miles

- 44,001 miles x value of 1.5c per point = $660.02

If I will spend much more than $14,667 in the Amex Gold card’s 4x categories, then I’d still come out ahead with the Gold card despite the $220 in “net” annual fee (though keep in mind that I’d stop earning 4x at U.S. Supermarkets after $25K in annual spend there, so I’d inevitably switch to spending on the SavorOne at that point and I would want to bring my SavorOne card when traveling abroad both for wider acceptance and what I expect would be 3x worldwide on grocery).

In my household, we do spend more than $14,667 per year between supermarkets and dining. It therefore looks like we probably should keep an Amex Gold card.

That said, I’m less convinced now than I was before that keeping a Gold card makes sense given the fact that I now have a SavorOne. At the moment, both my wife and I have Gold cards. It just isn’t worth having two of them at $500 in combined annual fees. We’ll definitely drop one at next renewal. The math dictates that I should rationally keep one Gold card open and still use that as my primary dining and U.S. Supermarket card.

One intangible here is access to unique transfer partners. Amex and Capital One have a few differences in transfer partners. Of those differences, on the Amex side, I like ANA quite a bit in theory (though in practice, the slow transfer time and need to book round trip make it less practical). On the Capital One side, I still like Turkish for travel to Hawaii when it can be found. Given that the Amex partners that I most frequently use (Aeroplan, Avianca LifeMiles, Air France / KLM Flying Blue, and Avios) are also available to Capital One, I find the programs to be close to break-even. I might tilt a bit towards Capital One simply because I think I’m more likely to use Turkish than ANA. That gives me a slight preference for the Savor One from a transfer partner perspective, but it’s slight.

Despite the math telling me that I should keep a Gold card, I’m going to continue to monitor this. I’m not sure that I want to spend $250 per year to lock myself into spending $14,667 or more on a single card — and if I would spend less, I should definitely go with the SavorOne.

Bottom line

I was very excited to finally be able to product change an old Capital One Venture card to a SavorOne card. Capital One targets its product change opportunities, so there is no guarantee that readers will be able to make a similar product change. However, a few members of our Facebook group have reported recently being able to product change to a SavorOne after years of it not being an option, so I think it is at least possible that Capital One has targeted a wider range of customers with this product change option. I was thrilled to finally add a Savor One to our household wallet. While the math dictates that we should still keep a Gold card, I’ll have to more carefully track the numbers on that because it’s hard to ignore the allure of an effective uncapped 3x grocery and dining with no annual fee.

[…] was recently reading a blog post by frequentmiler (link here) that got me thinking about how I look at annual fees and credits or perks that some cards have. […]

I have an original Savor card – no annual fee and after about a year a lovely letter from CapOne grandfathering me into the card with no fee forever, and higher rewards. I also have a Venture X which I love and recently canceled my Quicksilver as I wasn’t using it with low rewards. This is my favorite pair of cards. I recently got an Amex Gold because I had a big spend coming and wanted the welcome bonus, but I don’t see any reason I will keep it. Do you?

I was able to find the “Move Rewards” button on desktop as soon as I chose my account, but I could not find that feature on Capital One app.

Nick, another thing to consider is the Amex biz gold, especially in light of many people recently being targeted for its 150k SUB. That also offers 4x on US restaurants (edit: if it’s one of your top 2 categories) though not on groceries, but it might change your math. Even if it’s not a keeper card for you, if it’s a card you or your wife have sometimes then it has an impact.

In valuing the Amex gold, why do you fail to factor in its $10 per month in GrubHub credits? Also, if you only value the $120 per year of UberEats credits at $30, then of course you might decide the gold card is not a good value proposition, but I believe you are in the minority in valuing those Uber credits so low. There are more options besides restaurants for using UberEats credits and often substantial promo discounts. E.g., If you own a cat, you can use your UberEats credits to have cat litter delivered to you from pet supply stores, especially valuable when there’s a promo on pet supply purchases, plus there’s an added value to having delivered an item that is so heavy.

I said in the post that I never use that credit (I didn’t get info why, but there aren’t any GrubHub restaurants anywhere around me and if I’m going to use it when not at home, then having only one $10 credit is far less useful. I just don’t bother with it

As for valuing Uber more highly, I tried to be pretty clear that I’m not telling you that you should value it at $30 and that I imagine someone who lives in a city and orders from both UberEats and GrubHub regularly would value those credits more highly. Essentially, the post says what you’re saying.

But at the same time, you can regularly find Uber gift cards that don’t need to be used within one month for 10-20% off face value, so even if you use Uber often, I wouldn’t think it would make sense to prepay for credit that expires monthly unless you’re getting a significantly better discount.

For grocery stores you have uncapped 3x earning from your Altitude Reserve, since now all grocery stores accept mobile pay. And those are more valuable points (even though they are worth 1.5 cents max, you can use them with the flexibility of cash, which is way better than possible slightly higher value with points/miles). You should not use your Savor card for groceries at all. So it basically comes down to restaurants and there you can get effectively 5.5 points per dollar with a Custom Cash (plus a Rewards+), though that is capped at $500/month. There is a foreign transaction fee but overseas you can use mobile pay in restaurants and get your 4.5% back with AR. So the SavorOne, best case scenario, would only be your best card for domestic restaurants and only after you’ve put $500 in a month on your Custom Cash.

That’s an excellent through that I meant to address. It’s certainly a good point, but I’m not convinced that it is “way better than possible slightly higher value with points”.

The problem with the AR is that it only officially works with US merchants. Most of my travel is international. When I’m buying airfare from foreign airlines, there is no guarantee that I’m going to be able to use real-time mobile rewards (and in several of my attempts, it hasn’t worked yet on a foreign airline). I do intend for the points to mostly be my reserve for car rentals, but even then I don’t know for sure that when a charge comes in from a rental car office in a foreign country that it’s going to work for real-time mobile rewards.

I’m not saying that I don’t like the AR. I do. I’d generally rather use it than a 2x card when paying for stuff in-person. But at 3x, I’d rather have the miles as I do tend to use those to more value — and alternatively, I can still cash them out at the $0.01 per penny that I could get out of Altitude Reserve points for flights I can’t book via their portal or with real-time mobile rewards.

The 3x travel may not work with foreign travel companies, but the 3x mobile pay works abroad 100% of the time. I’m looking at my rewards page now and every mobile payment I made in Spain earned me 3x (effective 4.5% cash back, if you know what you’re doing) whether that was travel (tours, renting surfboard), groceries, restaurants, whatever. The same has been true for all other trips. So you are talking about a different kind of purchase (over the internet travel purchase).

I’m talking about redemption. Yes, I understand what “know that you’re doing” means, but I’m more interested in using it legitimately. I can’t use points at 1.5cpp to, for example, book a great paid business class fare on Air France or British Airways or something like that. I’d rather earn 3x transferrable points at the grocery store (or 4x if I were to keep the Gold).

I’ll certainly continue to keep my AR for in-person purchases that are not otherwise bonused, but I’d rather have 3x transferrable points still.

So I’m in a similar boat with my oldest card, a Capital One Quicksilver (Visa tho, I worry if a product change to the Savor One may only possible from another Mastercard?). I’m planning on signing up for the VentureX at some point soon and have long wanted to product change my QS to a Savor One to hopefully be able to pair with it. But as it stands, my “upgrade offers” have only ever been to the VentureOne/Venture. Capital One’s 2 personal card rule definitely affects my strategy here too. Like Nick, I’d rather not have to sign up for the SavorOne for the lower bonus, plus that might lock me out of being able to apply for a VentureX. Sure would be nice to have a useful no AF card as my oldest card.

Feel like I’ve also heard that I should consider putting some spend on the Quicksilver (which I try not to do because of the poor 1.5% return), which may possibly improve my upgrade offers, but don’t have a sense of how much that would look like, a total, a percentage of my credit limit. If anyone has a sense of perspective of how much spend might improve odds of an upgrade or even whether that’s a viable strategy, I’d appreciate your thoughts!

The Savor One seems like a good card for people WITHOUT an Amex Gold card, but if you keep the Amex what will you use the Savor One for? Overseas grocery stores? That doesn’t sound like a big category for US residents.

Overseas anything, restaurants too. Also I’m asian and when my wife and I shop at asian grocery stores and/or eat out some asian restaurants (in the US) they dont take Amex.

On a separate note, the Apple Card is worth a second look for any Apple/Mac fan out there. The 3% return on Apple purchases can go on a Goldman Sachs savings at 4.4%, regardless of the size of it. Worth using on Apple products only. Better return and terms than the older Apple Card issued by Barclays (forced product changed to some generic Barclays with 1% Barclays points).

But with zero signup bonus. It sounds nice in theory, but how many laptops are you really buying in a year and how much are you really saving compared to a 2% cash back card (as a benchmark example). Might as well get a Citi Double Cash/Wells Fargo Active Cash or the like, earn the sign-up bonus, and have a versatile card that’s not so brand specific and that isn’t a pain to use to get the 2%, because Apple Pay isn’t always an option (or even better, get the Citi Strata Premier or the WF Autograph Journey, earn those bigger bonuses, then downgrade to the 2% card when the annual fee comes due).

You’d have to spend so much more on apple products at that extra 1% rate to balance out what you’d earn on the sign up bonus on even a simple bonus on a cash back card. And don’t even get me started on that savings rate, which is solid, but there are many, many reputable banks offering 5% APY or higher right now that I wouldn’t brag about 4.4%.

No consideration for the Savor instead of the SavorOne? Even with the fee: higher sign-up bonus, and after exchange to miles you only need to spend like $6000 or so on Dining and Streaming to make it worth it. In this economy many are probably pushing that figure each year.. my wife and I certainly are.

I agree. The AMEX Gold has far better welcome and referral offers (we’re earning 14X dining while still in the SUB period on one right now!) but as a keeper card the Savor seems like a replacement for the Gold if you’re not into the coupon book game with its credits. You lose 1X on grocery but gain 3X more on entertainment – a rarely bonused category – and drop the annual fee by $155. The loss of 3X airfare on the Gold card doesn’t matter since you’re putting that spend on a Platinum, CSR, or Ritz anyway.

Compared with the SavorOne you do need just over $6K in spend on the 4X categories to come out ahead as you noted. But if Nick is already doing over $14K in grocery + dining then that is likely true (unless that spend is incredibly skewed towards grocery).

On that Entertainment category – I compared previously and Capital One has a broader inclusion than what Citi counts on a Custom Cash, the only other option really out there for Entertainment as a bonus category. Notably Citi excludes museums, movie theaters, and tourist attractions which is really broad (effectively making it a sports and concert ticket only category). The one bummer with Capital One is college events are excluded and my most common sports ticket purchases are for college football – but there’s a merchant coding issue there anyway as college tickets often show up as an education expense or donation.

Thanks for sharing – wasn’t familiar College sports didn’t count. Rarely have the chance to go to them, but now I’ll be aware! We got NCAA tourney tics this year but through StubHub so it counted. We get maybe $150 in movie tickets annual, $400-$500 in concert tickets, and like to do entertainment stuff on vacation (museums, tours, etc.) and have a couple local annual passes so that 4x category definitely helps. The only one I’m mildly disappointed on is YouTubeTV doesn’t count for streaming (at least the one month I tried it).

The key is whether they use a professional ticketing service. If they go through Telecharge, Ticketmaster, or one of the 3rd party vendors, they will code as entertainment. But if you are buying direct from a non-profit organization, it often doesn’t.

Yes, all of the C1 coding is pretty broad. I find them similar to Chase in that regard. As such, I really like the Savor One. It is a card that is always in my wallet. It works really well with edge case restaurants/coffee shops because bakeries code as grocery. It also works really well at stadium vending because the coding can be either restaurant or entertainment. Even when I’m spending on other cards (I tend to use Bilt for restaurants, as I value those points more), I still use the S1 for some restaurants because of the coding reliability.

In entertainment, I have had the same issue with non-profits not coding. College sports has this issue, as do non-profit theatres and movie houses (most code as education). But that’s a merchant issue, not a C1 issue. We subscribe to a few non-profit theatre seasons and I always have to remember to put those on a 2x catch all card, especially since they aren’t trivial charges.

That’s a clever catch on event concessions – I hadn’t considered that the Savor cards could get the bonus for entertainment if they didn’t code as dining.

The non-profit coding pops up with museums as well. Discovery World in Milwaukee tripped me up when purchasing tickets on a Chase Freedom during an Entertainment quarter and I think I had issues with an aquarium also. Unfortunately for those with kids a number of family attractions like children’s museums and science centers are a toss up on what their merchant code will be.

One workaround – if the attraction is big enough that you can buy tickets through a tourism site that will usually code as a travel agent and get the Travel category coding. Similar to how folks can use UndercoverTourist for Disneyland tickets.

Citi Custom Cash considers DisneyWorld, etc. as entertainment. As one of the few cards that always bonuses entertainment within the $500/month cap, we have 2 of them. We will soon get a 3rd Custom cash, because the categories that bonus are many.

That’s good to know, the tourist attraction exclusion must be more limited (maybe National Park entry and similar attractions).

For Disney specifically I like to wait and cherry pick category bonuses and sales to try to get better than 5X on Disney gift cards. I’ve had luck with snagging the 10% off sale Costco ran last year during the same quarter Visa Chase Freedom cards had 5X on warehouse clubs, and burned most of the stacked 9X grocery quarter earnings on a Freedom Flex first year bonus on Disney. But those are limited quantities capped at $500 to $1500 each time. It works for us only doing something Disney every two to three years, but if you have annual family trips or DVC ownership then a dedicated Custom Cash would give you a much higher spending cap.

Thanks to a prior article of Nick re SavorOne a year or more ago, I applied for it got instantly approved, although I had 4 CapOne accounts already and have seen my CapOne points soar. A $100 dinner for 200 pts on the VentureX is 300 pts on the S1. Sweet.

I have the V1 from a V downgrade hangin in there. I can’t see anything else worth to downgraded to. For now.

Congrats Nick!!!!

Time to shrunk your Annual Fees.

Nice! Now I’m wondering if I should keep my Savor One card.

I’ve been trying to get into the Venture family for years but no luck even with a high credit score. Each time they deny me with too many revolving accounts. I was able to get the Savor One with no issue. I’d like to eventually get a Venture card that earns miles instead of cash back. Just checked the upgrade section and saw that they are offering upgrade to the no fee Venture One (1.25x miles) and Venture Rewards (2x miles). Thoughts of upgrading to one of these to “get my foot into the door”? I’m kind of giving up on applying to Venture cards since I get denied every single time.

Ugh, I just cancelled my Venture One a few months ago, because I wasn’t getting the Savor One upgrade offer, and when I tried to apply for it outright they told me I had too many accounts. So now I use City Strata for dining/grocery, and Venture X for everything else.

Not trying to play Monday morning quarterback on you, but what was your thought process behind cancelling the Venture One? It doesn’t have an annual fee, so little harm in keeping it in the hopes of getting a good upgrade offer or needing a product change to something else some day. Were you just trying to simplify your accounting by getting rid of an account?

Thanks for this post. Datapoint: I was just now able to product change to SavorOne from my Quicksilver (Mastercard) that I’ve kept open because it was one of my older cards (2011). 10X on Uber is huge, really hope that gets extended.