NOTICE: This post references card features that have changed, expired, or are not currently available

Southwest is now offering welcome bonuses of up to 100,000 points for each of their three personal credit cards. If you’re interested, I recommend waiting until closer to the end date of this promotion (12/7/21) to sign up so as to maximize the value of the bonus towards a Southwest Companion Pass. More details below.

The Deal

- Offer: Sign up for either the Southwest Plus, Southwest Premier, or Southwest Priority card and earn up to 100,000 points.

- Offer Details: Earn 50,000 Bonus Points After You Spend $2,000 On Purchases In The First 3 Months From Account Opening and 50,000 Bonus Points After You Spend A Total Of $12,000 On Purchases In The First 12 Months From Account Opening

- Offer Exceptions: You will not be approved for this offer if you currently have a Southwest consumer card or if you earned a welcome bonus for a Southwest consumer card in the past 24 months.

- Offer Expires 12/7/21

| Card Offer |

|---|

ⓘ $107 1st Yr Value EstimateClick to learn about first year value estimates Companion Pass + 20K points ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer Companion Pass valid through 2/28/27 + 20K points after $3K spend in the first 3 months$99 Annual Fee Alternate Offer: 50K points after $1K spend in the first 3 months After clicking through, be sure to manually select the exact Southwest card in which you are interested. This card is subject to Chase's 5/24 rule (click here for details). Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 85K points after $3K spend in the first 3 months (Expired 12/16/25) FM Mini Review: This card can be great for its new cardmember bonus, but its ongoing perks are worth the annual fee only if fully used each year. |

ⓘ $169 1st Yr Value EstimateClick to learn about first year value estimates Companion Pass + 30K points ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer Companion Pass valid through 2/28/27 + 30K points after $4K spend in the first 3 months$149 Annual Fee Alternate Offer: 50K points after $1K spend in the first 3 months This card is known to be subject to Chase's 5/24 rule. Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 85K points after $3K spend in the first 3 months (Expired 12/16/25) |

ⓘ $201 1st Yr Value EstimateClick to learn about first year value estimates Companion Pass + 40K points ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer Companion Pass valid through 2/28/27 + 40K points after $5K spend in the first 3 months$229 Annual Fee Alternate Offer: 50K points after $1K spend in the first 3 months This card is known to be subject to Chase's 5/24 rule. Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 85K points after $3K spend in the first 3 months (Expired 12/16/25) FM Mini Review: Great for frequent Southwest flyers - this card could easily be a long-term keeper. |

Southwest Companion Pass

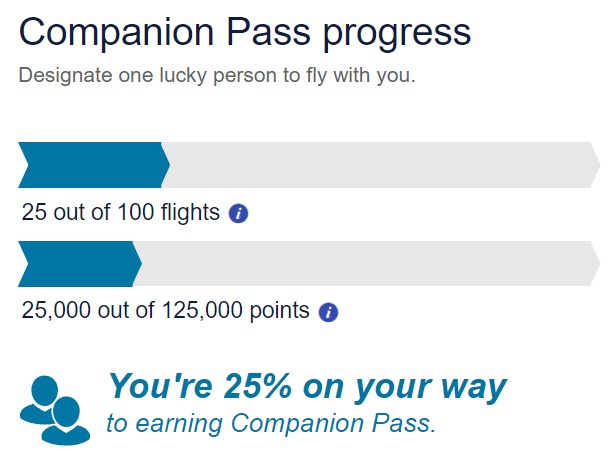

With Southwest, you will earn a Companion Pass if you either fly 100 flights or earn 125,000 qualifying points within a calendar year. Once you earn the companion pass, it is good for the rest of that calendar year and all of the next. While the companion pass is valid, you can add a companion for free to any and every paid or award flight you take.

Here’s the kicker: points earned on Southwest credit cards, including from welcome bonuses, count towards Companion Pass eligibility. So, the key is to sign up for a big welcome bonus offer near the end of a calendar year and then make sure not to earn any part of the welcome bonus until January of the next next year. With the offers described above, you can do the following:

- Wait until late November or early December to sign up

- Wait until after your December billing statement closes to put spend on the new card (if you sign up in December, you should be safe to start spending right away)

- Once you complete $2K spend you’ll earn 50,000 bonus points, and once you complete a total of $12K spend you’ll earn another 50,000 points. Try to complete the $12K spend in early 2022.

- After accounting for both the welcome bonuses and the regular earnings from spend, you’ll earn at least 112,000 points. You’ll need only 13,000 more points to earn a Companion Pass. You could earn those points through additional card spend, by flying Southwest, and by participating in other Southwest promotions that offer Companion Pass qualifying points (sometimes they offer such points for flower purchases, for example).

- If you manage to follow the above steps and earn a Companion Pass early in 2022, it will be good for the rest of 2022 and all of 2023!

My Take

If you can qualify for a new Southwest consumer card and fly Southwest often (or would like to), then this deal is really amazing. If you follow the steps laid out above, you would earn a total of 125,000 Southwest points plus a Companion Pass that is valid for nearly two full years. Since you can add a companion to award flights, that means a tremendous amount of flying for two from a single welcome bonus and a bit of spend.

Despite my glowing paragraph above, I’m going to pass on this deal. I’ve earned the Companion Pass in the past, but found then that I simply didn’t fly Southwest often enough for it to be all that useful. If I did fly Southwest often, it would be a different story and I’d definitely be interested in signing up.

Some tactical questions, if we apply on Dec 1 do we know when we’ll get the card in hand to use? I have a big spend that must be paid by the Dec 9th.

Second , if we put 12 K on the card right away, I automatically get the 100K or do I need to break the transactions into two different statement cycles to count?

1) Chase has always been good about overnighting cards on request. Just call the number on the back of one of your cards after you’re approved and explain that you just got approved and have a big purchase to make and want to see if they can expedite your card. They do it free of charge.

2) No need to split over different statement cycles. You can get the entire bonus in one statement.

I see a lot of people commenting on the business card. If you have a side business, but it makes almost no money and you don’t spend much, are you allowed to put personal spending on the business card.

If you were to ask Chase, they would tell you that you should only put business spending on a business card.

Realistically, if you put personal spending on the card the worst that will happen is your statement will have a printed notice that you should only put business spend on the card.

The card companies don’t care, but because business cards have less consumer protections than personal cards, they are required to tell you not to put personal expenses on the cards.

Just be sure you don’t try to claim personal purchases as business expenses when filing taxes- you *will* have a problem in that case. From an accounting standpoint if you’re using quickbooks/etc, just classify any personal spend on the card as an owner’s draw.

Short answer- you will not run into any problems putting personal spend on a business card. Lots of people do it.

Seems like a lot of spend to get the extra bonus. I’m taking advantage of the promo to earn the CP in Jan and Feb of 2022. I’ll get a business card and personal card and earn my way for the remainder of 2022 and 2023 as suggested previously.

In my opinion, the SWA is one of the most valuable travel tools available. One thing that wasn’t mentioned is that you can change your companion at will, 3 times during the calendar year. This means the you could conceivably have 4 different companions or mix and match throughout the year. Since you can do this each calendar year, it can be accomplished up to 6 times within the duration of the companion pass. Since your companion flies free on award and revenue flights, you also have the option of earning Rapid Rewards miles too, while amassing them for bigger flights. I’ve used my CP on many international routes since SWA started offering them a few years back.

I have the personal Southwest card and have had it for years. Do you know if I Can I cancel that card now, reapply in early Dec and still qualify?

Yes, that would work. To Greg’s point in a previous comment, cancel the card, wait a few weeks, then apply again.

My 3rd annual fee on the priority card is coming up (so its been 3 years since I got a bonus). What is the turnaround in Chase’s system for me not having the the card anymore so I can get these offers?

People have had success in as little as a few days after cancelling, but you’re probably better off waiting a few weeks if you can plan it that way.

P2 had a personal sw cc less than 24mo ago and missed the bonus by under $100. I wasn’t paying attention to it. Won’t happen again. She still eligible for this bonus? My cp runs out at the end of the year so this will be perfect timing if possible.

Getting the extra 13,000 points in a month or two can be hard. Since they spotted rapid reward members 25,000 points this year, I’m going to earn the bonus this year with the one card, and P2 can get it at the end of next year. People interested in the companion pass probably have a P2 more often than not.

They probably won’t spot us for 2022, right?

¯\_(ツ)_/¯

I do think that there’s a good chance that they’ll spot us some points towards CP and A-List again in 2022, but they probably won’t tell us about it until 2022

I’m trying to avoid the $12k in MS to get 100k on the personal cards. I would much rather get the Business card for $3k in spend for 60k points and hope they reduce the requirement or increase the Personal Plus for 60k for $2k in spend. It’s a gamble though, right? The only sure way is to get the Performance Plus for 80k and the personal for 40k and spend $5k?

You said “…Once you complete $2K spend you’ll earn 50,000 bonus points, and once you complete a total of $12K spend you’ll earn another 100,000 points…” You don’t earn ANOTHER 100,000. It’s a total of 100,000.

Thanks. Fixed.

Greg… one other thing you said that I think is incorrect. You said “So, the key is to sign up for a big welcome bonus offer near the end of a calendar year and then make sure not to earn any part of the welcome bonus until January of the next next year….” You can earn part of the bonus in the previous year yoiu just don’t want to FINISH your spend until the following year. For instance, if the spend requirement is $5,000. Get the card in November, start spending, but make sure you don’t hit that $5,000 requirement until January. that’s they way I’ve always seen it explained. That way you can get the advantages of the CP pass sooner.

The offer here is to get 50K points after $2K spend and then the rest of the points after $12K spend. If you met the $2K spend too early, you would get the first 50K points in the current calendar year and it wouldn’t count towards next year’s companion pass.

“After accounting for both the welcome bonuses and the regular earnings from spend, you’ll earn at least 112,000 points. You’ll need only 3,000 more points to earn a Companion Pass.”

isn’t it 13,000 more points since you need 125,000 points?

Oops! Good catch. Fixed.

I think the best play is to go for the Plus card and Performance Business card after December 1st. Put the $2000 spend on the plus card and $5000 spend on the business card for 137,000 rapid rewards and companion pass. After that’s done, you can leisurely put the additional $10k of spend on the Plus card to get the additional 50k rapid rewards.

That’s a good idea

Or even better, apply now, and start some of your spending. Secure message Chase and ask them to change your cycle end date to the first of the month. After Dec 1, then finish all of your spending. Around Jan 4 or 5 you’ll have a companion pass for almost 24 months

Often new accts cannot change cycle rnd dates until after at least 1 month (or more) after getting the card.

I agree but which card first? Does it matter? Aplky on same day or spaced out?

If you’re at 4/24, get the business card first because it won’t count against the 5 cards in 24 months limit that Chase sets. Right now, I’m at 2/24 so I plan to get the personal card first because I’d rather get that card while the bonus is increased. If I get rejected for the business card, I can still spend my way to a companion pass with a personal card, but it would take me a few months.