Southwest Airlines Rapid Rewards is a loyalty program that shares some characteristics common of airline frequent flyer programs (like priority check-in and boarding for elite members) and additional key features (like the ability to bring a companion for free after earning enough points in a calendar year and the fact that points never expire). This guide is designed to include everything you need to know about the Southwest Rapid Rewards program.

Southwest Rapid Rewards Overview

Southwest Rapid Rewards shares traits that are common to most airline rewards programs:

- Earn points from paid flights (based on the cost of the fare)

- Use points to book free flight awards

- The cost, in points, for award flights depends on the cash price of the flight and demand for that particular flight. Therefore, the number of points required for an award flight will vary.

- Those who spend a lot on paid flights earn elite status.

- There are two elite status levels: A-list and A-list Preferred. The higher your status, the more perks you get.

- Branded credit cards can be used to earn points and to help earn elite status. They also carry checked baggage and seating benefits.

Rapid Rewards also has a few traits that are unique:

- If you earn 135,000 Rapid Rewards points in a calendar year, you earn a Companion Pass. The Companion Pass allows a companion to fly with you for free (paying only the taxes) every time you fly, whether the primary passholder’s ticket was purchased with money or points. See more details in our Southwest Companion Pass Complete Guide.

- Southwest Rapid Rewards points never expire

- Award flights are highly flexible and can be cancelled or changed with no fee up until 10 minutes prior to departure

- Tickets can now be booked with a combination of cash & points, though this yields poor value per point

In 2025, Southwest has changed the Rapid Rewards program in several key ways:

- Most passengers no longer receive free checked bags, unless they are credit card holders

- Flight credits from flights booked and cancelled now expire after 12 months for most fares or 6 months for Basic fares

- Award pricing is more dynamic, with redemptions requiring more points when demand is high and fewer points when demand is low

More details on many of these changes can be found below.

How To Earn Southwest Rapid Rewards Points

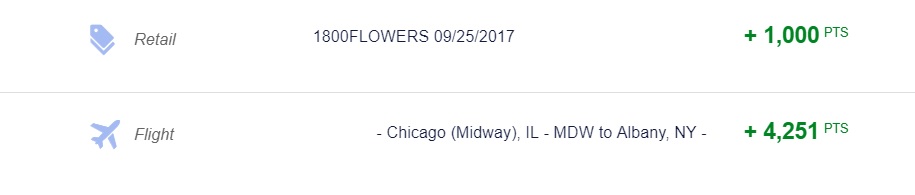

Members can earn points through paid flight activity, credit card spend, and bonuses, and many types of partner activity (including the shopping portal, car rentals with partners, flower delivery, and more). Southwest Rapid Rewards points do not expire, which means there is low risk in collecting points.

On paid flights, members earn points based on fare type and price:

- Basic Fares: Earn 2x points per $1 of base fare

- Choice: Earn 6x points per $1 of base fare

- Choice Preferred: Earn 10x points per $1 of base fare

- Choice Extra: Earn 14x points per $1 of base fare

Elite members earn bonuses (A-list gets 25% bonus points, A-list Preferred gets 100% bonus).

Partner activity that can increase your points balance includes:

- Credit card spend

- Credit card bonuses (including new cardmember welcome bonuses and any short-term spending bonuses)

- Hotel partners

- Rental Car partners

- Rapid Rewards dining

- 1-800 Flowers (1,000 miles per order of $29.99 or more with promo code RR22)

Do Southwest Rapid Rewards points expire?

Southwest Rapid Rewards points never expire, so there is no activity necessary to keep them alive. Note that if you close your account, you will forfeit any points in the account at the time of closure.

How much are Southwest Rapid Rewards points worth?

Our Reasonable Redemption Value for Southwest Rapid Rewards points is 1.3 cents each. The actual value of points varies based on the price of the flight and route, and Southwest adjusts the value of points based on demand for individual flights. This means that, in some cases, points will be worth more or less, depending on how much demand there is for that specific flight.

Southwest Airlines Rapid Rewards award flights

All seats available for sale on a Southwest Airlines flight can be booked with points as an award ticket. The number of points required for a flight depends on demand and the cash price of the fare, and points can be used regardless of fare type (“Basic”, “Choice,” “Choice Preferred”, and “Choice Extra” fares are all available using points).

A nice feature of the Southwest Rapid Rewards program is the flexibility of award tickets: awards can be cancelled up to 10 minutes before the flight is scheduled to depart for no fee. Points are immediately redeposited into your Southwest Rapid Rewards account. Flights can alternatively be changed just as easily, sometimes without even paying a fare difference. If you change to a cheaper fare, you can actually get points back. If the fare has dropped on a flight you already booked, you can even “change” to the same flight and receive a refund of the difference in points.

Southwest Airlines Elite Status Overview

Southwest offers two levels of elite status: A-list and A-list Preferred. Companion Pass is arguably a third level of elite status, though it comes with no elite benefits other than the companion ticket, so we’ll cover that separately in this guide. Requirements for A-list and A-list Preferred status are straightforward, and benefits are similar.

A-list

Requirements: 20 one-way qualifying flights or 35,000 tier-qualifying points

Benefits:

- Priority boarding (the system automatically assigns a position 36 hours before your flight, same as Early Bird check-in). Starting 1/27/26, Priority Boarding will mean no later than Group 5.

- 25% bonus points earned on paid fares

- Free same-day standby (note that this does not extend to any companions on the same reservation)

- Priority check-in and security (where available)

- 1 free checked bag for member + up to 8 companions traveling on the same reservation

A-list Preferred

Requirements: 40 one-way qualifying flights or 70,000 tier-qualifying points

Benefits:

- Priority boarding (the system automatically assigns a position 36 hours before your flight, same as Early Bird check-in). A-list Preferred receives priority over A-list, but both are behind Choice Extra passengers. Beginning 1/27/26, Priority Boarding will mean Group 1 or Group 2.

- 100% bonus points on paid fares

- Free same-day standby (note that this does not extend to any companions on the same reservation)

- Priority check-in and security (where available)

- Free in-flight Wi-Fi

- Two free premium drinks per flight on flights of 250 miles or longer

- 2 free checked bags for member + up to 8 companions traveling on the same reservation

Shortcuts to Southwest Rapid Rewards elite status

Southwest Rapid Rewards® Premier Credit CardRapid Rewards Premier, Southwest® Rapid Rewards® Premier Business Credit Card, Southwest Rapid Rewards® Priority Credit Card, or Southwest® Rapid Rewards® Performance Business Credit Card cardmembers earn tier points for purchases at varying rates:

- Southwest Airlines Rapid Rewards Premier: 1,500 tier points per $5,000 in purchases

- Southwest Airlines Rapid Rewards Premier Business: 2,000 tier points per $5,000 in purchases

- Southwest Airlines Rapid Rewards Priority and Southwest Rapid Rewards Performance Business: 2,500 tier points per $5,000 in purchases

Those who spend their way toward a Companion Pass will find themselves racking up tier points.

Southwest checked baggage benefits

The new checked baggage policy for Southwest is:

- Two free checked bags

- A-List Preferred Members

- Choice Extra fares

- One free checked bag

- A-List Members

- Southwest credit cardholders

- Zero free checked bags

- Everyone else

Note that free checked baggage benefits will apply to up to 8 passengers traveling on the same reservation.

Note also that if a Companion Pass holder qualifies for a free checked bag(s), the benefit will ultimately extend to their companion. The companion will initially need to pay for their checked bag(s), but they will be refunded to the original form of payment after travel is complete.

Get free checked bags with Getaways bookings

As first reported in this maxmilespoints video, you can still get two free checked bags if you book your flights through Getaways by Southwest.

Getaways by Southwest bookings include two free checked bags per person, free changes, and flexible cancellations (you get credit for future Getaways bookings).

However, note that Companion Pass holders can not add their companion to Getaways by Southwest bookings. Additionally, points earned from Getaways bookings are not Companion Pass-qualifying.

Southwest Flight Credits

If you book a Southwest revenue fare (i.e., if you pay “cash”) and you later cancel your flight, you can get a Southwest Flight Credit. Flight credits expire after 12 months for most fares or after 6 months for Basic fares (unless they were booked prior to 5/28/25).

Southwest Companion Pass Overview

The key details of the Southwest Companion Pass are:

- A member who earns 135,000 Rapid Rewards points in a single calendar year earns a Companion Pass, enabling the pass holder to bring a companion for free (the companion just pays the taxes)

- The companion can be changed up to 3 times per calendar year

- As long as a seat is available for sale on the flight, a Companion Pass holder can add their companion. The same fare type does not need to be available.

- If the Companion Pass holder has a free checked baggage benefit, that benefit will ultimately extend to their companion. The companion will initially need to pay for their checked bag(s), but they will be refunded to the original form of payment after travel is complete.

The Southwest Airlines Companion Pass can be an extremely valuable tool, given that it enables the primary passholder to bring a free companion an unlimited number of times, whether the passholder’s flight was purchased with money or points (the primary passholder’s ticket can even be purchased with points from someone else’s account, and they can still add the companion for free). It is worth noting that the companion can be added at any time up until 10 minutes before departure, as long as there are seats available for sale and regardless of the fare type originally purchased. In other words, if the primary pass holder buys a Basic fare, their companion can still be added even if only Choice Extra fares remain for sale.

The 135,000 points required for a Companion Pass can be earned from paid flights, credit card spend, credit card welcome bonuses, or many types of partner activity, including shopping portal purchases and rental cars. Southwest cardholders get a 10,000-point boost toward the Companion Pass, meaning that a cardholder only needs to earn 125,000 additional points within a calendar year to get a Companion Pass.

Shortcuts to a Southwest Companion Pass

The Companion Pass has a multitude of shortcuts.

The most popular shortcut is via new credit card bonuses, since even the new cardholder bonus counts toward the 135K points that must be earned in a calendar year to get the Companion Pass. Southwest cardholders automatically get 10,000 Companion Pass qualifying points each year (note that these are not redeemable points; this effectively just means that cardholders only need to earn 125,000 points to earn a Companion Pass).

For instance, if a member were to open a Southwest consumer credit card and a Southwest business credit card, and they each featured an offer like 60,000 points after spending $3,000 in 3 months, opening both cards and meeting the associated spending requirements in the same calendar year would yield 126K total points. Together with the 10K Companion Pass Qualifying points automatically credited to cardholders, such an individual would have 136K Companion Pass Qualifying points – enough for a Companion Pass.

However, there are also many other ways to earn Companion Pass qualifying points. In practice, we have found that the following things do count:

- Paid flight activity

- Points earned from credit card spend, including the new cardholder bonus

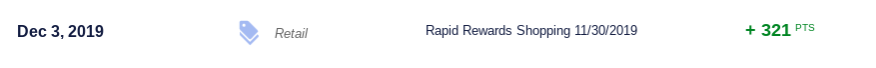

- Points earned from the Southwest Rapid Rewards Shopping portal (however, seasonal bonuses from the portal do not count)

- Most (but not all) points earned from partners

Keep in mind that you do not need to earn all of the points from a single source; mix and match points from each of these shortcuts as you please.

Which points qualify for the Southwest Companion Pass?

Credit card welcome offers

Chase frequently offers valuable welcome offers for new cardholders of Southwest cards after meeting introductory spending requirements. There are several versions of the Southwest credit cards. In terms of consumer/personal credit cards, there are three: the Premier, Plus, and Priority cards. On the business side, there are the Premier Business and the Performance Business. Welcome offers on these cards increase and decrease throughout the year, but it is often possible to earn enough points for a companion pass, or very close to it, by opening two credit cards and meeting the minimum spending requirements. Here is the current offer information on each of the Southwest credit cards:

| Card Offer |

|---|

ⓘ $651 1st Yr Value EstimateClick to learn about first year value estimates 80K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 80K points after $5K spend within first 3 months your account is open$299 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). |

ⓘ $577 1st Yr Value EstimateClick to learn about first year value estimates 60K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 60K points after $3K spend within first 3 months your account is open$149 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). |

ⓘ $533 1st Yr Value EstimateClick to learn about first year value estimates 50K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 50K points after $1K spend in the first 3 months$99 Annual Fee After clicking through, be sure to manually select the exact Southwest card in which you are interested. This card is subject to Chase's 5/24 rule (click here for details). Recent better offer: 85K points after $3K spend in the first 3 months (Expired 12/16/25) FM Mini Review: This card can be great for its new cardmember bonus, but its ongoing perks are worth the annual fee only if fully used each year. |

ⓘ $483 1st Yr Value EstimateClick to learn about first year value estimates 50K points ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer 50K points after $1K spend in the first 3 months$149 Annual Fee This card is known to be subject to Chase's 5/24 rule. Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 85K points after $3K spend in the first 3 months (Expired 12/16/25) |

ⓘ $403 1st Yr Value EstimateClick to learn about first year value estimates 50K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 50K points after $1K spend in the first 3 months$229 Annual Fee This card is known to be subject to Chase's 5/24 rule. Recent better offer: 85K points after $3K spend in the first 3 months (Expired 12/16/25) FM Mini Review: Great for frequent Southwest flyers - this card could easily be a long-term keeper. |

It is important to note that Chase added new rules on the Southwest credit cards in recent years. Each of the Southwest credit cards now carries a 24-month language. In a nutshell:

- You are ineligible for the welcome bonus on a Southwest personal credit card if you currently have any Southwest Rapid Rewards personal credit card or have earned a new cardmember bonus on any Southwest personal credit card in the past 24 months

- You are ineligible for the welcome bonus on a Southwest business credit card if you currently have that specific Southwest Rapid Rewards business credit card or have earned a new cardmember bonus on that specific Southwest business credit card in the past 24 months.

In short, the easiest path to earn the Companion Pass via credit card welcome offers requires opening at least one business card.

| Applying for Business Credit Cards Yes, you have a business: In order to sign up for a business credit card, you must have a business. That said, it's common for people to have businesses without realizing it. If you sell items at a yard sale, or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort. When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business' address and phone, and your social security number as the business' Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website. Is it OK to use business cards for personal expenses? Anecdotally, almost everyone I know uses business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: don't use the card for personal expenses if you're not comfortable doing so. |

Ideally, you would time the applications and spend so that the points would be earned as early in a calendar year as possible. That way, you’ll have the Companion Pass for nearly two years.

Southwest Rapid Rewards points post to your Southwest Airlines account upon statement close. Timing out purchases in order to earn points from welcome offers at the appropriate time is fairly easy to do. For example, if you would like to earn the welcome bonus on a card in January, be sure to wait to meet the minimum spending requirements until after your December statement closes (since purchase activity after your December statement has closed should post to your Southwest account upon the close of your January statement). The safest bet is, of course, to wait until January to meet the minimum spending requirement to avoid the risk of points posting early.

If you open more than one Southwest credit card in close proximity to each other for the purposes of earning the Companion Pass, be sure to time the spend so that you earn both bonuses in the same calendar year. If you choose to pursue such a strategy late in the year with the goal of earning welcome bonuses in January, be careful not to meet the spending threshold early. A member who earns 63,000 points in December and another 63,000 points in January will not have a companion pass since the points were not earned in the same calendar year.

Unfortunately, Chase does apply its 5/24 rule to these cards. That means that you most likely won’t get approved if you’ve opened 5 or more cards (with any bank) in the past 24 months.

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

Credit card spend

If you’re a big spender, then another way to get the Companion Pass is to simply charge $125,000 worth of expenses on a Southwest credit card (or cards) during a single calendar year.

Since the cards only award 1 point per dollar on most spend, this wouldn’t be the fastest way to earn the Companion Pass, nor the cheapest in terms of opportunity cost. However, if you know you’ll use the Companion Pass a ton, it might be worth it to you.

1-800-Flowers

1-800-Flowers lets you earn 1,000 Companion Pass qualifying Southwest points per order with promo code RR22. To qualify, orders must be $29.99 or more, and only one promo code can be used per order. The terms of this deal indicate that you can only receive these points a maximum of 12 times per year (i.e. max of 12,000 points).

Online Shopping

If you do a lot of online shopping, you can earn points that qualify for the Companion Pass by shopping through the Southwest Rapid Rewards shopping portal. The portal offers different point bonuses for different stores. It is often possible to earn 5 or more points per dollar for shopping at popular merchants. Note that points from seasonal portal bonuses (such as “Spend $300, get 500 bonus points”) do not count towards the Companion Pass.

Hotel partners

Southwest Airlines has several hotel partners (as seen on this page). Some hotel partners only allow for points transfer, but others allow you to earn Southwest points for your stays. These points are Companion Pass-qualifying.

For example, Southwest has a partnership with MGM Rewards whereby you can earn 600 Rapid Rewards points per stay at most of the MGM hotels in Las Vegas. As shown above, these points count towards the Companion Pass.

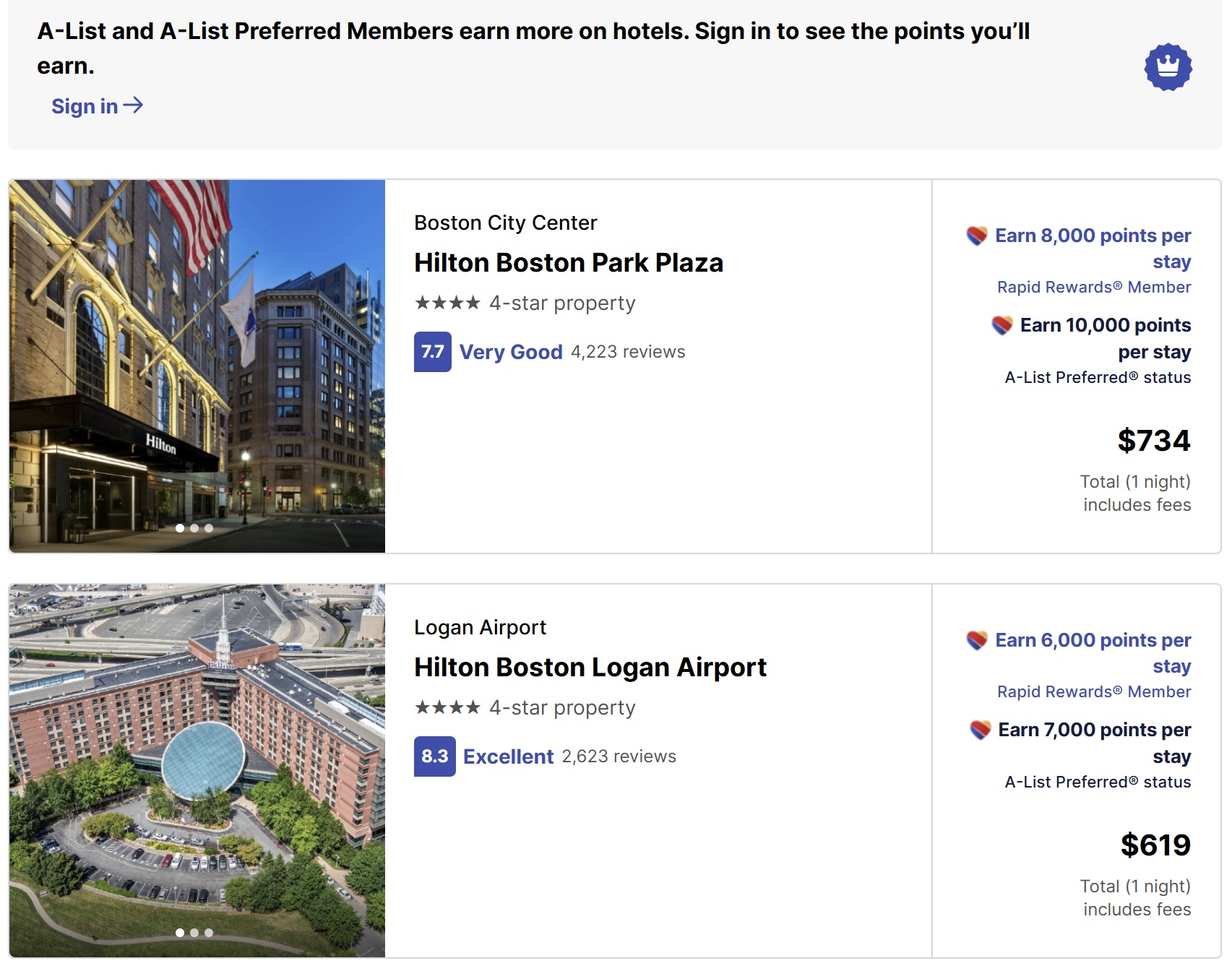

Book hotels through Southwest Hotels

Southwest Hotels is a hotel booking site that rewards you with airline miles instead of hotel points, elite credit, etc. Search for your date and city, and the search results show the price of the hotel per night and the number of points you can earn. You should expect to earn an equal number of Companion Pass qualifying points for your stay.

Keep in mind that you will not earn hotel points or elite credit for bookings made through Southwest Hotels. If you have elite status with the hotel chain, it will probably not be recognized, so you will not receive the benefits of your status, like free breakfast.

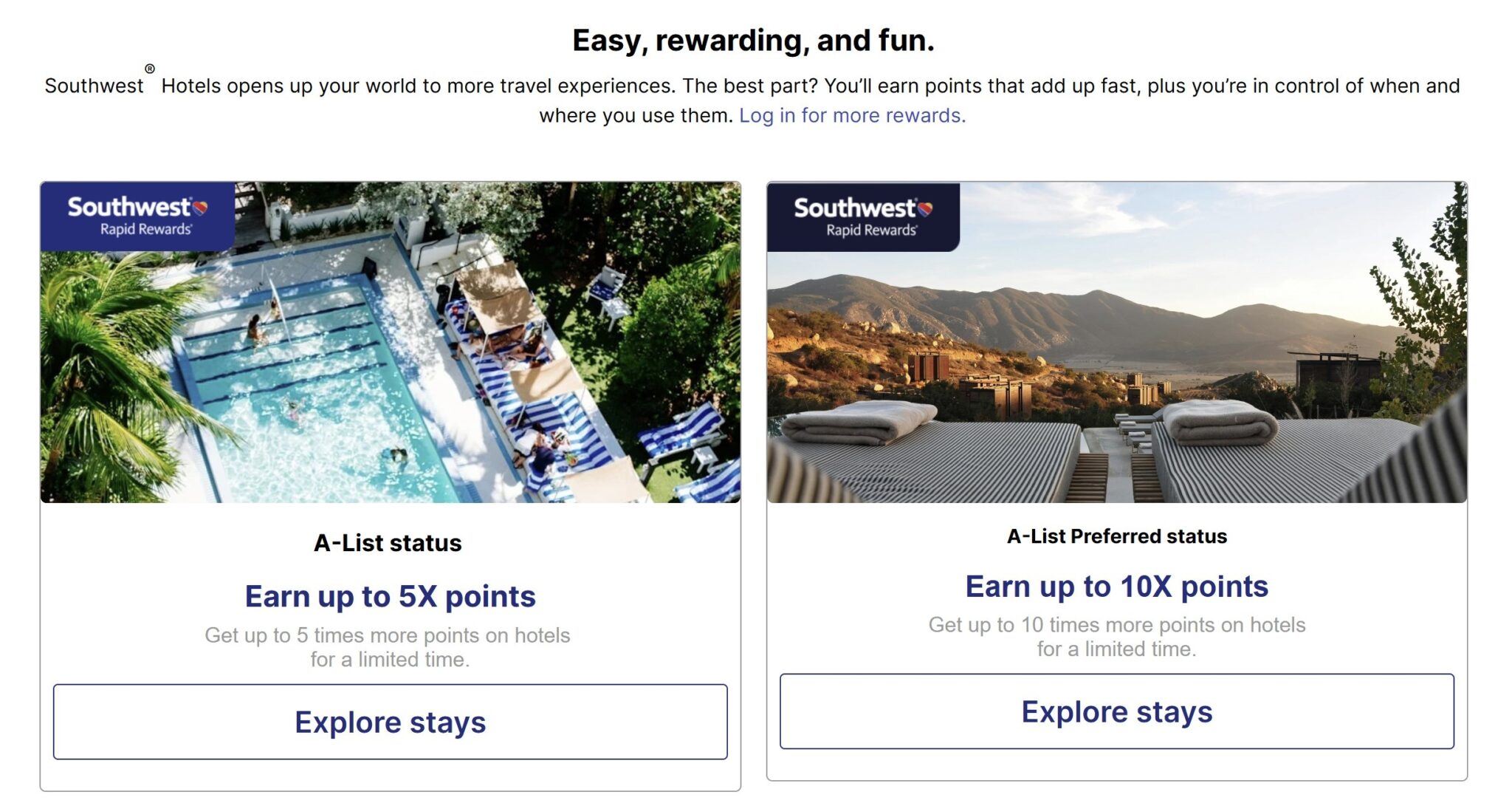

That said, if you have elite status with Southwest, you can earn even more points per stay.

Rental Cars

Southwest Airlines partners with a number of rental car companies to offer points for renting through Southwest (see the current list here). Always be sure to compare the cost using any associated rate codes. Base points earned from car rentals do count toward the Southwest Companion Pass, but be aware that additional bonuses beyond base points may not.

Referring friends

Chase sometimes offers bonuses for referring friends to apply for a card you have. You can check to see if you have any referral offers by entering your last name, billing zip code, and the last four digits of your Southwest card here. Typically, you can earn 20,000 Rapid Rewards points per referral up to a maximum of 100,000 points per year. What’s more, your Southwest credit card referral link can now be used to refer someone to any Southwest credit card. In other words, if you have the Southwest Airlines Rapid Rewards Premier credit card, you could refer someone to the Southwest Airlines Rapid Rewards Performance Business credit card or vice versa. This opens up more possibilities in terms of earning referral points.

It is furthermore noteworthy that referrals collected late in the year can be an interesting way to earn toward the Companion Pass. We discovered that referrals earned after your December statement closes but before December 31st will count toward the current year’s Chase referral cap, but will not post to your Southwest Rapid Rewards account until your next statement cuts (in January). One could therefore essentially double up on Companion Pass-eligible points by doing the following:

- Make sure your Southwest credit card statement cut date is set for early in December. As an example, let’s say your December statement posts on December 10th

- Refer 5 friends between December 11th and December 31st (100,000 point cap for this calendar year)

- Refer 2 more friends between January 1-January 9th (40,000 points earned in new calendar year that count toward the new year’s 100K cap)

- When your statement cuts again on January 10th, your Southwest account would theoretically be credited with 140,000 referral points from a single credit card (100K “earned” the previous calendar year from Chase’s perspective and 40K “earned” from the current calendar year, but all posted to your Southwest account in the same calendar year, yielding a Companion Pass)

Again, the trick here is to make sure not to refer people to apply until after your December statement cut date. For more information on this method, see: An unexpected path to the Companion Pass.

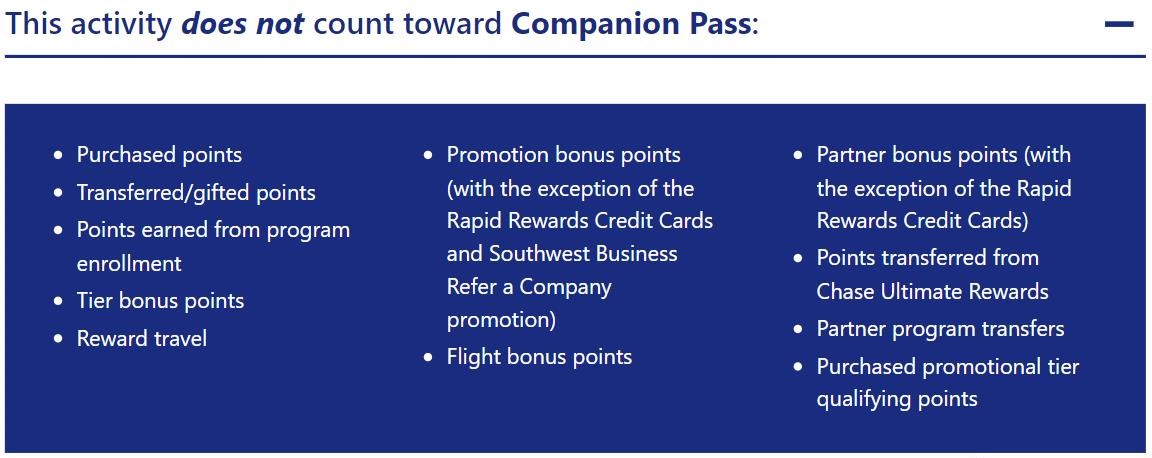

What doesn’t count towards a Companion Pass

The most notable sources of non-qualifying points include: transfers from hotel partners and those transferred from Chase Ultimate Rewards. These points will NOT count towards earning a Southwest Companion Pass.

Purchased points, transferred points transferred between members, points converted from hotel and car loyalty programs, and e-Rewards, e-Miles, Valued Opinions and Diners Club, points earned from program enrollment, tier bonus points, flight bonus points, and partner bonus points (with the exception of the Rapid Rewards Credit Cards from Chase) do not qualify as Companion Pass Qualifying Points.

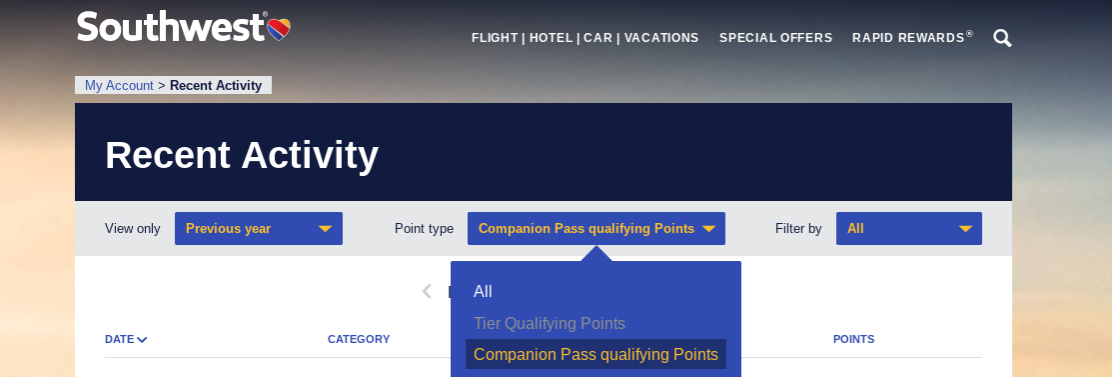

It is also important to note that bonus points at many partners do not count. Base points earned from partners do count in many instances — such as the 1,000 points with the 1800Flowers coupon code above, base Southwest hotels points, etc. However, an extra added bonus may not count (such as when the Rapid Rewards shopping portal offers a bonus on top of normal earnings for spending $X cumulatively across all stores during a certain period). You can easily go to your Southwest Airlines Rapid Rewards account and click “Recent Activity”, then filter by “Companion Pass qualifying points” to verify which transactions count toward your current total.

Sharing points with others

Sharing points with others

You can transfer points to another member, but Southwest charges a fee to do so. Instead, you can simply use your points to book a flight for someone else, whether or not you will travel with them. Note that if you use your points to book a flight for someone who has a Companion Pass, he or she can still add their companion for free. There is little reason to consider paying for a transfer.

Southwest “More Rewards”: International flights, experiences, and more

Southwest credit card holders have access to additional redemption opportunities via “More Rewards”. These opportunities generally yield less value per point than redeeming for Southwest flights, but open the possibility to use points for international flights (including in premium cabins), experiences, gift cards, and more. Cardholders can click through the link on this page and log in to view options.

International flights can only be booked on routes that are not served by Southwest, and it is possible that some carriers may not be available. However, based on sample searches, it appears that flights can be booked at a value of approximately 1c per point. Flights do not need to be to/from the United States (for example, a flight from Germany to Spain or Hong Kong to Bangkok can be booked via the air portal.

You can also use points to pay for car rentals, experiences, vacation packages, and even travel insurance, though the values tend to be quite poor.

Southwest Credit Cards

Chase issues quite a few Southwest Airlines consumer and business credit cards. Current offer information for these cards can be found below:

| Card Offer |

|---|

ⓘ $651 1st Yr Value EstimateClick to learn about first year value estimates 80K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 80K points after $5K spend within first 3 months your account is open$299 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). |

ⓘ $577 1st Yr Value EstimateClick to learn about first year value estimates 60K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 60K points after $3K spend within first 3 months your account is open$149 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). |

ⓘ $533 1st Yr Value EstimateClick to learn about first year value estimates 50K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 50K points after $1K spend in the first 3 months$99 Annual Fee After clicking through, be sure to manually select the exact Southwest card in which you are interested. This card is subject to Chase's 5/24 rule (click here for details). Recent better offer: 85K points after $3K spend in the first 3 months (Expired 12/16/25) FM Mini Review: This card can be great for its new cardmember bonus, but its ongoing perks are worth the annual fee only if fully used each year. |

ⓘ $483 1st Yr Value EstimateClick to learn about first year value estimates 50K points ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer 50K points after $1K spend in the first 3 months$149 Annual Fee This card is known to be subject to Chase's 5/24 rule. Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 85K points after $3K spend in the first 3 months (Expired 12/16/25) |

ⓘ $403 1st Yr Value EstimateClick to learn about first year value estimates 50K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 50K points after $1K spend in the first 3 months$229 Annual Fee This card is known to be subject to Chase's 5/24 rule. Recent better offer: 85K points after $3K spend in the first 3 months (Expired 12/16/25) FM Mini Review: Great for frequent Southwest flyers - this card could easily be a long-term keeper. |

It is important to note that each of the Southwest credit cards carries 24-month language. In a nutshell

- You are ineligible for the welcome bonus on a Southwest personal credit card if you currently have any Southwest Rapid Rewards personal credit card or have earned a new cardmember bonus on any Southwest personal credit card in the past 24 months

- You are ineligible for the welcome bonus on a Southwest business credit card if you currently have that specific Southwest Rapid Rewards business credit card or have earned a new cardmember bonus on that specific Southwest business credit card in the past 24 months.

Those looking to earn a Companion Pass via credit card welcome offers will need to open at least one business card.

Southwest check-in process and assigned seating

The Southwest boarding process has changed significantly. While Southwest historically has not assigned seats and instead assigns boarding positions based on a number of factors, most notably when a customer checks in, they are now selling seating assignments for travel beginning in late January 2026. Basic tickets do not include a seat assignment. Choice fares include seat selection from standard seats, Choice Preferred fares include seat selection from Preferred seats, and Choice Extra fares include an Extra Legroom seat. There are also seating benefits for elite members and credit card holders. Those seating benefits extend to other passengers on the same reservation.

Cardholder seating benefits are as follows:

- Southwest Rapid Rewards Plus and Plus Business cardholders: Select a Standard seat within 48 hours of departure on any fare, when available.

- Southwest Rapid Rewards Premier and Premier Business cardholders: Select a Standard or Preferred seat within 48 hours of departure on any fare, when available.

- Southwest Rapid Rewards Priority and Performance Business cardholders: Select a Standard or Preferred seat at booking, on any fare, when available. Upgrade to Extra Legroom within 48 hours of departure on any fare, when available.

Early Bird Check-In

Note that Early Bird Check-in will likely end in 2026 as Southwest is selling seat assignments for travel beginning in 2026. Until assigned seating begins, Early Bird Check-in may be your best bet for securing a good boarding position/seat.

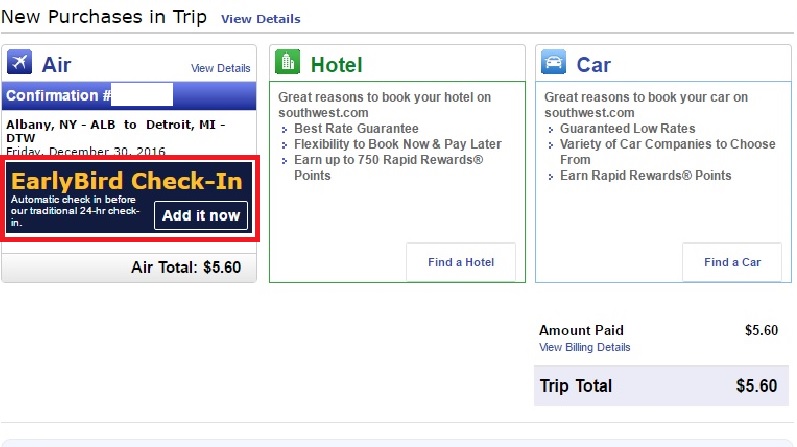

For a fee that starts at $15, Southwest will automatically check you in beginning 36 hours before your flight — 12 hours before general check-in opens. They will prompt you to add Early Bird Check-in on the booking confirmation page:

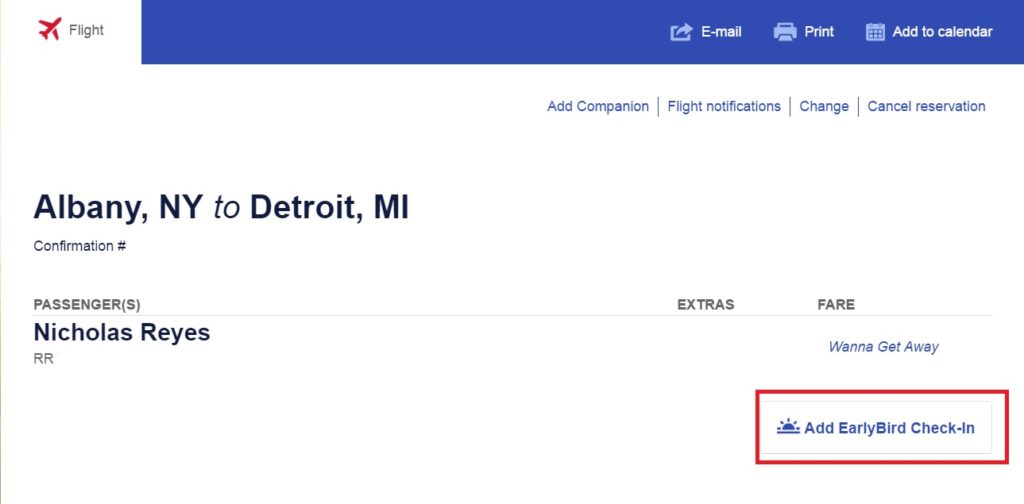

Alternatively, you can always add Early Bird later on by clicking on a reservation in your account and then clicking the button to add early bird check-in.

However, there is one notable problem with early bird check-in: If you cancel your reservation, you will lose the money you paid for early bird check-in. Normally, if you cancel a paid reservation with Southwest, you receive a flight credit. If you booked your ticket on points, you can choose to have the taxes refunded to your original payment method. However, if you paid for early bird check-in and you cancel your ticket, you get neither a refund nor a credit for the Early Bird Check-in fee. If you simply change your flight, you keep Early Bird Check-in.

The utility of early bird check-in can depend on your origination point (and note that Early Bird Check In will likely be eliminated when Southwest begins selling assigned seating).

Early Bird Check-in might not be worth it

The usefulness of Early Bird Check-in will likely depend on two main factors: whether or not you have a seat preference and your point of origin.

Southwest only uses the Boeing 737, though it flies several different variants of that plane. The smallest version they fly has 23 rows. Assuming that aisle seats and window seats are equally desirable, that means that there are about 92 “preferred” seats on even the smallest planes (23 aisle seats and 23 window seats on each side of the aisle). Each Boarding group has 60 people. Therefore, everyone in Boarding Group A will get a preferred seat if they want it. Since at least some of the people in Groups A and B will be traveling together (and therefore someone in the party will take a middle seat next to their companion), I think it’s generally true that nearly everyone in Group B will have access to a preferred seat as well. By the time Group C gets on board, it is much more likely that only middle seats are left. In my experience, checking in exactly 24 hours before the flight often (though not always) produces a Group B boarding pass.

However, that may vary a bit depending on the second factor: your point of origin. Southwest normally allows you to check in 24 hours before your scheduled departure. When you check in for your first segment, you are automatically checked in for all of your segments that day. This results in an advantage for those passengers who are not based in Southwest hubs.

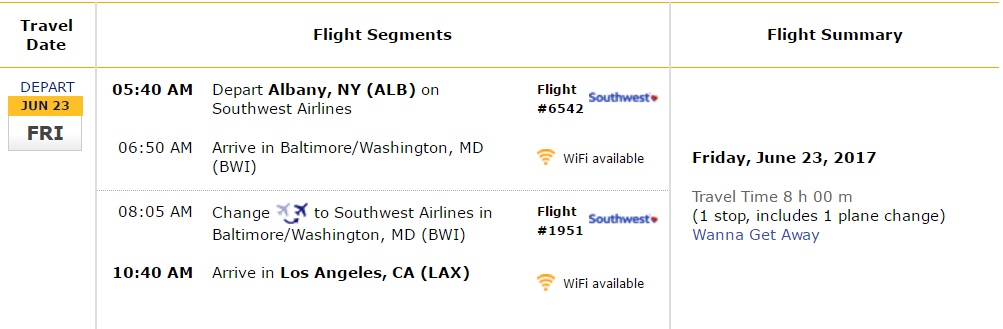

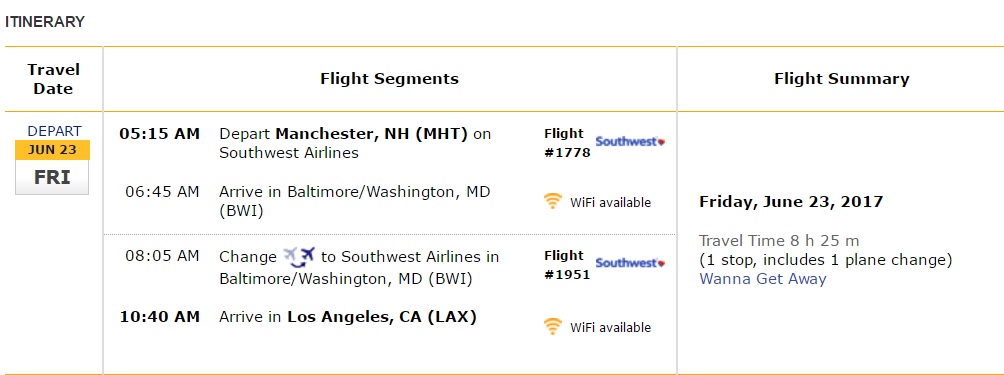

Let’s consider that you are based somewhere in the Northeast — like Albany, NY. Southwest only flies a couple of direct routes out of Albany. Most itineraries from Albany connect in Baltimore, Chicago, or Orlando. So let’s take this Albany, NY to Los Angeles, CA itinerary as an example:

The initial flight (Southwest Flight #6542) leaves Albany at 5:40 am on Friday morning. There is a connection in Baltimore to Southwest Flight #1951 — that flight leaves Baltimore at 8:05 am. Since passengers can check in 24 hours before their initial flight, a passenger starting in Albany can check in for both flights together at 5:40 am on Thursday. This means the Albany passenger will be checked in for that second flight from Baltimore to Los Angeles 2 hours and 20 minutes before someone originating in Baltimore is able to check in online. Of course, it’s not only passengers from Albany who have an advantage. Passengers originating in Boston get a 10-minute head start on Albany — their first flight is at 5:30 am. Those folks starting in Manchester, NH, are going to beat Boston and Albany with their 5:15 am departure:

The point here is that if you live in Manchester, NH, you probably don’t need Early Bird Check-in. If you can check in right at 5:15 am, 24 hours in advance, you only have to contend with folks originating in Manchester on your first flight, and you will be among the first checking in on the Baltimore segment. You have a nice head start on the people who live in Baltimore.

Of course, on the flip side, this means that people who live in Baltimore may need to pay for Early Bird Check-in to have any chance at a decent boarding position. The people in Manchester, Boston, and Albany who also paid for Early Bird Check-in will continue to have a head start. However, those originating in Baltimore can put themselves ahead of the 24-hour check-ins from Albany, Boston, Manchester, etc, by paying for Early Bird Check-in. Therefore, if you live in a Southwest hub city, you may want to consider paying the premium.

Southwest Choice Extra Overview

Southwest sells Choice Extra fares that include priority security and A1-A15 boarding (or for flights departing 1/27/26 or after, Choice Extra includes complimentary seat selection from Extra Legroom or any available seat). While these tickets are generally much more expensive than Choice fares, they are sometimes not much more than “Choice Preferred” fares. If you are booking close to departure, Choice Extra can be a better value in terms of securing a good boarding position (or extra legroom seat) and priority security in some airports. These fares also include a free premium drink and earn more miles per dollar. They are refundable as well. Choice Extra passengers receive two free checked bags.

Tier Member seating and checked bag benefits will extend to both you and your Companion for flights taking off January 27, 2026, and beyond

FAQ

Here are a few other common questions that people ask about the Southwest Companion Pass:

Q: Can I change my flight on a companion booking?

A: Yes. You will first need to cancel the companion’s reservation. You can then change the primary traveler’s flight.

Q: How soon are my points refunded for a canceled booking?

A: Immediately. Points go directly back into your account and do not expire.

Q: Can a companion pass holder cancel the companion’s reservation if he/she cannot travel with me?

A: Yes. You can cancel their reservation and either receive a refund of the taxes or keep them as a credit to use on a future flight. Note that you need to choose the option to refund to your credit card rather than as travel funds if that is what you prefer.

Q: Can a Companion Pass holder’s companion travel without the primary passholder?

A: NO! The terms of the program explicitly forbid the companion from flying without the primary traveler, and Southwest will likely revoke your companion pass if you do this. It is theoretically possible to do — both travelers check in and only the companion shows up — but it will almost certainly get you in trouble with Southwest. Furthermore, if the itinerary is round-trip, the companion might have his/her return flight cancelled. Don’t do this.

Q: Does my companion earn Southwest Rapid Rewards points?

A: No, they do not. The primary traveler does earn points on a paid reservation (not a reservation made on points).

Q: What happens to my companion’s reservations if I change my companion?

A: You must first cancel your companion’s reservations before changing companions.

Q: Can I book a round-trip flight that begins before my Companion Pass expires on December 31st, but returns after the pass has expired?

A: This isn’t possible. Southwest won’t let you add a companion to a reservation that extends beyond the pass validity period. You would have to book a one-way in December (you could add your companion to this reservation) and then a one-way return in the new year, where you pay for both seats.

Q: Is there an advantage to booking one-way flights or round-trip flights with the Southwest Companion Pass?

A: It makes more sense to book one-way flights with Southwest in general. In the vast majority of cases, the round-trip price (at least on domestic flights within the US) is simply the cumulative total of the two one-way flights. You will enjoy greater flexibility in making changes to one segment or the other if you book one-way flights.

Q: What are some of the best uses of the Southwest Companion Pass?

A: This is obviously completely subjective. You can enjoy trips around the US, but keep in mind that Southwest also flies to numerous international destinations in Mexico, the Caribbean, and Central America.

Additionally, you can use Southwest to position for an award flight or a cheap flight deal out of a different city. This can be a great option when saver-level awards on American/United/Delta are not available from your city.

Q: What happens if I booked a flight by 5/27/25, but cancel after 5/28/25? Will the flight credit be subject to expiration?

Any changes or cancellations made from 5/28/25 onward will be subject to the new policies. Flight credits created on or before 5/27/25 never expire, but flight credits created from 5/28/25 onward will expire 12 months after booking (or 6 months after booking for basic economy).

Q: Will my checked baggage benefits extend to companions?

Yes. If someone on the reservation qualifies for free checked bags (such as through elite status or by virtue of being a Southwest credit card holder), up to 8 companions on the same reservation will have the same checked baggage benefit.

Q: Does Southwest have an extra seat policy for customers of size?

A: Yes. Southwest allows customers who need more than one seat’s worth of space to purchase two and then apply for a refund for the second seat: “Customers who encroach upon any part of the neighboring seat(s) may proactively purchase the needed number of seats prior to travel to ensure the additional seat(s) is available…You may contact us for a refund of the cost of additional seating after travel. If you prefer not to purchase an additional seat in advance, you have the option of purchasing just one seat and then discussing your seating needs with the Customer Service Agent at the departure gate. If it’s determined that a second (or third) seat is needed, you’ll be accommodated with a complimentary additional seat.”

- The flight departs with at least 1 open seat or with passengers traveling on space-available passes.

- Both seats are purchased in the same fare class.

- The refund request is submitted within 90 days of the travel date

Question. P2 will earn a companion pass after Jan 1 and designate me as his companion. I have a southwest business preferred card and debating whether to keep or cancel. When he goes to make a new reservation after Jan 1, and designates me as his companion, will we both get benefits of selecting a preferred seat at booking? And later being able to upgrade to extra legroom seat? (Or not, since that benefit is tied to my card and I’m the companion on the itinerary). TIA!

Edited – I have the Southwest Performance Business Card

I think it is time to update the expected value from Southwest points. On most flights that I check I’m seeing only 1.1 cents / point. Huge devaluation since the recent changes were rolled out.

I’m confused by the new basic fare on southwest’s fare product update chart. It says you can’t make changes to a basic fare, but it also says you can cancel. So wouldn’t that mean you can just cancel and rebook using the flight credit?

Yes you can (but keep in mind that flight credit expires after 6 months)

Southwest gutted their award pricing today so this is outdated.

[…] For example, I have the Southwest Rapid Rewards Premier card, and it was news to me (after reading Frequent Miler’s complete guide to the Southwest Rapid Rewards program) that the card gives me free Early-Bird check-in on two flights a year. Who knew? Not me! I want to […]

Hey Nick, I’m curious. You often mention that you fly Southwest a ton, but I don’t think I’ve heard you say how you are booking. Are you just swimming in points from referrals? I think I’ve heard you say that you aren’t big on transfers from Chase UR, but if you weren’t that into Hyatt and you didn’t have the ability to generate so many SW points from referrals, would you consider transferring from Chase then?

No — I would pay cash using credits generated by credit card airline incidental credits and/or discounted gift cards (you can pretty frequently get Southwest cards on sale for 10-15% off face value).

I don’t know that I’d say I fly Southwest “a ton” — they are our domestic airline of choice, so when we travel domestically, we almost always fly Southwest. That said, we only travel domestically a few times a year these days.

The bottom line for me is that I can only get ~1.3c per point from Chase points transferred to Southwest. I’ll get far more value than that by transferring those points to Hyatt or foreign airline programs to book international premium cabin travel. It’s not worth it to me to burn those points at such low value. I would rather use cash than accept 1.3c per point — it’s just below my acceptable range for UR points.

In terms of not being “that into” Hyatt, the thing about that statement is that even if I didn’t have elite status with Hyatt, there are still so many situations where Hyatt hotels would by far be my best value option for booking a hotel. Obviously footprint is an issue, so if you’re mostly traveling to places without Hyatt hotels, than it makes sense that you wouldn’t value that transfer opportunity so much. Even in that case, I’d rather save my Chase points and use them at a value of 1.5cpp (with a CSR) to book travel through the Chase portal. Every 100K points I transfer from Chase to Southwest would be “costing” me $200 since I could have used them for $1500 worth of travel through Chase.

In terms of how we’re earning Southwest points, yes I usually earn some every other year from referrals (we aren’t often using a referral link on our Best Offers page, but I do still tend to get a chance to pick up referrals toward the end of the year every other year so that the referral points from December and January will all post in January to combine toward the Companion Pass). I also make use of the quarterly spending bonuses when it makes sense. But I also have a lot of Southwest credit from airline incidental fee credits.

Hey Nick, thanks for the thoughtful response. I hate it when I see things differently from you, because it means my reasoning is probably wrong.

I have purchased a lot of discounted SW gift cards in the past, but I want to get away from that. My points balance has gotten pretty high, and I’m still earning faster than I spend them, so I want to avoid paying cash when I can use points.

Take grocery stores this quarter. If I use the freedom and eventually transfer to SW, that’s like 6.5% back. You have endorsed using the Amex Blue Cash Preferred for 6% cash on groceries, so right now using the freedom to transfer to SW beats that. I’m also targeted for 5x on grocery with one of my SW cards, but it seems totally irrational to touch that before maxing out the freedom’s $1500 spend (x2 when you count P2).

The other piece that you seem to undervalue a little bit is the advantage of booking SW flights with points rather than cash. If you speculatively book and cancel a lot of flights, it’s way more convenient to get your points back than have to keep track of flight credits. Same with repricing when the price goes down.

So maybe the rubric goes something like this. IF 1) Hyatt doesn’t consume all of your UR earning; 2) you earn enough Amex points or other transferrable currencies to meet your needs for international flights; 3) you can easily earn 5x URs from Freedoms and Inks; 4) you either don’t have Sapphire Reserve or don’t like dealing with OTAs and 5) you fly SW -> THEN transferring URs to SW equates to a 1.3cpp cash out of URs (you can even call it 1.1-1.2cpp if you factor in the ability to buy discounted gift cards), which represents good value. It’s at least equal to, if not better than, cashing out Amex points via Schwab, which I don’t get the sense you are super excited about, but has least gotten more approval from you than UR->SW transfers. I’m thinking that you (and Greg) would fail on point #1, which is why any UR->SW transfer seems so wrong to you.

You make some fair points. A couple of quick thoughts:

1) It’s not particularly important to your point, but I’m not sure where I’ve “endorsed” using the Blue Cash Preferred for groceries. I can’t remember the last time I talked about using that card and I’ve never had it myself. But nonetheless, like I said, that part isn’t very important – you’re right that I wouldn’t talk someone away from earning 6% at grocery stores.

2) “It’s irrational to touch Southwest 5x grocery until you’ve maxed out Freedom grocery”. Agreed. I would max that in one shopping trip though, so I still do the a Southwest ones also (but correct not instead).

3) “Points enjoy more convenience than cash”. Good point – you’re right. But what cost am I willing to pay for that convenience? If the points were only worth half a cent, I wouldn’t give up the points for the convenience. Obviously you would at the 1.2 or 1.3c (or whatever) value point. I wouldn’t. That doesn’t make you wrong, it just means we have different thresholds. From my perspective, even if we eliminate Hyatt altogether, as someone flying a family of four usually intentionally at least twice a year and in business class, I know I’ll redeem those points toward a far more comfortable long haul flight experience *that I otherwise couldn’t or wouldn’t pay for*, whereas domestic tickets on Southwest for four people the couple/few times per year that we’d need to buy them would fit into the bucket of costs that I would consider paying for whether or not I had credit card rewards. So essentially, I’d rather pay “cash” ( in the form of flight credits or discounted gift cards) that has finite value than my points which often provide far outsized value. Of course, if I had 10,000,000 Ultimate Rewards points, I would lower the value at which I were willing to use them since I’d want to prioritize using points (which do not grow over time) over cash. In my case, we both earn and use a lot of points every year and I’m typically not sitting on a huge stash of UR points (obviously recognizing that what constitutes “huge” or “not huge” varies considerably from person to person).

Further to that point, a few years back you may or may not recall that Greg was sitting on a few million URs and he had noted how he had started prioritizing using the travel portal to use points at 1.5cpp since he felt like he had so many points that he had to get himself into the habit of spending the balance down some. I then remember a point not all that long ago where he remarked that he regretted that to some extent because he had suddenly started burning through Hyatt points super fast and suddenly felt like his supply wasn’t keeping up with his needs. I have some level of fear that there will come a day when points acquisition is much slower or more difficult and I’ll wish that I had more points – I’m somewhat hesitant to use points at suboptimal value for that good ole FOMO later. That’s not a totally rational way of thinking about things though and I recognize that.

4) You make a decent case for transferring to Southwest. Ironically, stay tuned for a post coming this week with my feelings about the Schwab cash out (that I promise you I mostly wrote yesterday morning – haven’t finished it yet – without any thought about this conversation at all). Here’s the thing: I earn way more Amex points per year than I do URs. I also burn far more per year than URs. But I still don’t burn at a rate that keeps up with my capacity to earn. And given the way Amex has mostly kept the Points Parade marching on, I ironically am more comfortable redeeming Amex points at 1.1cpp. That’s driven in large part by the fact that even when I’ve driven my Amex points balance close to zero, we build it back up much more quickly. I haven’t yet hit the time when I’ve wished I had some more Amex points available (meaning not that I don’t always want more points but rather that I haven’t hit a situation where I’d have done something differently “if only I had more Amex points”). I’ve been able to regenerate quickly enough to always have what I need on hand and not have to miss the points I redeemed at lesser value. My Chase points have been down in that “shoot, I’m going to need to cancel a speculative reservation in order to free up points to book this other thing” range with my Hyatt bookings a few times.

Can I ask you a question: if you’re transferring to Southwest and you’re not transferring to Hyatt, how are you booking your hotels?

For the past several years, I’ve been averaging about 40 nights per year in “hotels,” so think I travel way more than the average American, but not as much as you. I manufactured Hyatt Globalist in early 2021 (when everyone else did), so I had a lot of Hyatt stays in 21-22 and burned a ton of URs. Totally agree with the hype that if you can swing it, Globalist is the benchmark loyalty status. But there is no way I can consistently earn Globalist. So when I stay at Hyatt, I focus on places where I won’t feel like I’m missing out too much on not being a globalist (last year, one of my only Hyatt stays was Zilara Cap Cana). Marriott is probably my top hotel chain, because starting at 30 nights each year, I can realistically hit platinum with the double night promotions. But the Vacasa partnership has been a huge hit to my chain hotel nights, as I’ve been averaging 10+ nights there the past few years. And I took advantage of the free Carnival cruise last year, so I didn’t even reach Marriott Platinum. There just aren’t enough nights to go around.

Correction: Southwest no longer flies to Mexico City. 🙁

Question: What non-Chase cards complement having a Companion Pass? Probably just something that comes with a Priority Pass lounge access?

Thanks for turning on the comments for this post once again!

I’m assuming that spend towards A-list is timed like spend towards a companion psss. That is, it counts as of the time the statement which includes the purchase cuts. So, if my statement date is Dec 2, and I spend $10k on December 10, which is included on my Jan 2, 2024 statement, then that spend will count towards A-list 2024 A-list qualification.

Do I have that right? TIA.

As of July 28, 2022, travel funds no longer expire. Under your “Early Bird Check-in” section you note that canceling paid travel gives you credit that expires one year from the original booking. That should be updated to reflect the current SW policy.

Good catch. Updated.

I am a RR member and need 500 points for A-lost 2023I am halfway into my trip that started 12-23-2022 and returned 1-2-2023. The total earnings for the flight are 2400 pts. Does the first leg of my flight and the points count in 2022?

Situation: have travel funds expiring prior to being able to use, and SW will not extend (even for 2 weeks!). Looking for a way to salvage this.

If I use the funds to buy an “Anytime Fare”, and then cancel that, will I then have a new travel voucher with a different expiry date? The terms say, “If you used Southwest travel funds from a previous reservation toward an Anytime fare, those funds will be refunded as flight credit”. The term ‘flight credit’ is vague to me, given they have defined what travel funds are. Anyone (Nick) have experience here?

I am 97.6% sure that will not work. Your new flight credit will maintain the same expiration date as your current one. I haven’t done it myself, but like I said I’m almost certain that will not work.

To add to toomanybooks’ comment about purchasing an A1-A15 boarding position for $30 to $50, note that you are purchasing for only one segment if you have a multi-segment flight. EarlyBird, in contrast, covers all the segments.

I think the worst EB I ever got was approx B45.

A-List members can’t purchase EB, because it isn’t needed. As an A-Lister, for a recent 2-segment flight I had A-40 and A-26.

[…] Good reference guide if you fly Southwest a lot: Southwest Airlines Rapid Rewards Complete Guide. […]

Wow, this is incredibly comprehensive.

I concur with toomanybooks. The boarding position thing is somewhat overrated. There are ones or two really good seats depending on plane variant (exit row with seat in front of you missing) and they first row bulkhead seats have a bit more legroom. Other than that, if you check in at T minus 24 you’ll avoid a middle seat. And there’s also an advantage to boarding towards the end.

Worth noting if it’s not obvious that Southwest has no premium seating — no first class, no premium economy. Except for minor bulkhead and exit row issues all rows are the same.

Ones thing I just learned yesterday that is not directly related to the points program itself. You can only use three methods of payment per reservation and each individual voucher from a past refund is a separate payment method.

So, if you have four $100 vouchers and want to buy a $310 fare then you can only use two of the vouchers and a credit card for the rest. It won’t let you apply a third voucher because you would have used up all the payment method slots and not paid the whole fare.

Therefore, if you collect many smallish value vouchers it will take multiple flights within the time limits you have to use them up.

One way to buy a $310 fare with four “vouchers” (or travel funds) is to first find a flight (on any itinerary) with a price between $110 and $200, book that flight using two of the vouchers/Travel Funds, then cancel that flight. This will now give you a single voucher with a value of $110 to $200, which can be combined with the other two $100 vouchers/Travel Funds you have to book your desired $310 flight.

Also, Nick didn’t mention anything about paid tickets being almost as flexible as award tickets (cancel by 10 minutes before the flight, but travel funds from the ticket are locked to the original passenger vs. points just going back to their original account which can then used by anyone).