| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

Yesterday, the offers on all three Chase Southwest Rapid Rewards personal credit cards increased to now offer 60,000 Rapid Rewards points when you open a new card and spend $2,000 in the first 3 months. While it’s awesome to see those offers return, and one could now pair any one of the personal cards with a business card to earn an easy companion pass, the timing on these offers is not ideal for maximization.

The Offers

| Card Offer |

|---|

ⓘ $758 1st Yr Value EstimateClick to learn about first year value estimates 65K points Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 65K points after $1K spend in the first 3 months.$69 Annual Fee After clicking through, be sure to manually select the exact Southwest card in which you are interested. This card is subject to Chase's 5/24 rule (click here for details). Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: This card can be great for its new cardmember bonus, but its ongoing perks are worth the annual fee only if fully used each year. |

| Card Offer |

|---|

ⓘ $533 1st Yr Value EstimateClick to learn about first year value estimates 50K points ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer 50K points after $1K spend in the first 3 months$99 Annual Fee This card is known to be subject to Chase's 5/24 rule. Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: The combination of 6,000 points plus 2 EarlyBird Checkins each year make this card a keeper for those who fly Southwest often. |

| Card Offer |

|---|

ⓘ $483 1st Yr Value EstimateClick to learn about first year value estimates 50K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 50K points after $1K spend in the first 3 months.$149 Annual Fee This card is known to be subject to Chase's 5/24 rule. FM Mini Review: Great for frequent Southwest flyers - this card could easily be a long-term keeper. |

Key Card Details

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: This card can be great for its new cardmember bonus, but its ongoing perks are worth the annual fee only if fully used each year. $69 Annual Fee Earning rate: 2X local transit and commuting, including rideshare ✦ 2X internet, cable, phone services, and select streaming ✦ 2X Southwest Card Info: Visa Signature or Platinum issued by Chase. This card imposes foreign transaction fees. Big spend bonus: If you earn 135,000 points in one calendar year, you'll get a companion pass good for the rest of that calendar year and all of the next year. Noteworthy perks: 3000 bonus points each year upon card renewal. 2 EarlyBird Check-Ins each year. 10,000 Companion Pass qualifying points each year ✦ Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $10 monthly Instacart credit |

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: The combination of 6,000 points plus 2 EarlyBird Checkins each year make this card a keeper for those who fly Southwest often. $99 Annual Fee Earning rate: 3X Southwest ✦ 2X Rapid Rewards(R) hotel and car rental partners ✦ 2X local transit and rideshare ✦ 2X internet, cable, phone services, and select streaming ✦ 1X on all other purchases. Card Info: Visa Signature or Platinum issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: If you earn 135,000 points in one calendar year, you'll get a companion pass good for the rest of that calendar year and all of the next year ✦ Earn 1,500 TQPs for each $5K in purchases Noteworthy perks: 6000 bonus points each year upon card renewal. 2 EarlyBird Check-Ins each year. 10,000 Companion Pass qualifying points each year ✦ 25% back on in-flight purchases. ✦ Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $10 monthly Instacart credit |

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: Great for frequent Southwest flyers - this card could easily be a long-term keeper. $149 Annual Fee Earning rate: 3X Southwest ✦ 2X Rapid Rewards(R) hotel and car rental partners ✦ 2X local transit and rideshare ✦ 2X internet, cable, phone services, and select streaming ✦ 1X on all other purchases. Card Info: Visa Signature or Platinum issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: If you earn 135,000 points in one calendar year, you'll get a companion pass good for the rest of that calendar year and all of the next year ✦ Earn 1,500 TQPs for each $5K in purchases Noteworthy perks: ✦ 7,500 anniversary points each year ✦ $75 Southwest annual travel credit ✦ Four A1-15 boardings every year ✦ 25% back on in-flight drinks, Wi-Fi, messaging, and movies. ✦ 10,000 Companion Pass qualifying points each year ✦ Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $10 monthly Instacart credit |

Quick Thoughts

It’s nice to see increased offers return on these cards, and 60K Southwest points represent a good return on spend as that should buy around $900 in Wanna Get Away fares (or perhaps as much as $1,140 worth of airfare since you can get up to 1.9c per point in some instances). While other airline cards offer the opportunity to get outsized value with international premium cabin redemptions, Southwest points can arguably be better for domestic redemptions provided you plan in advance.

Of course, the most popular use for these 60K offers has long been as a shortcut to the Southwest Companion Pass. Unfortunately, Chase has made it a bit more difficult to do so, now including language that disqualifies you from getting a new cardmember bonus if you currently have any of the Southwest personal credit cards or have received a new cardmember bonus on any of them in the past 24 months. Note that this does not include the business card, thus it is still possible to open two Southwest credit cards (one personal and one business) and earn a Companion Pass from the new cardmember bonuses on those two cards. You can read more about the Southwest Airlines Rapid Rewards Premier Business credit card here.

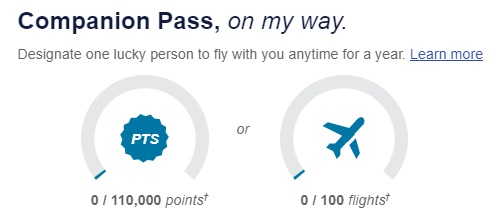

See our Complete Guide to the Southwest Companion Pass for full details, but the short story is this: if you earn 110K Southwest Rapid Rewards points in a single calendar year, you will earn a Companion Pass that is good for the remainder of that year and the entire next year. This means that a companion can fly with you for free (paying only the taxes, which are typically $5.60 each way within the US) every time you fly during the validity of the pass. This is true whether you pay for your ticket with cash, gift cards, Rapid Rewards points, or even if someone else uses their points or money to pay for your ticket. You can even change the companion up to 3 times per calendar year. It’s a a great deal — in my opinion, the hands-down best deal in domestic travel.

However, consider the timing on earning the pass. If you were to open one of these personal cards and the Southwest business card right now, the soonest you would earn the new cardmember bonuses would be June. That means you would have a Companion Pass valid for the remainder of 2019 and until December 31, 2020. About a year and a half with a Companion Pass sure isn’t bad.

On the other hand, the best time to open Southwest credit cards (for the purposes of earning a Companion Pass) has historically been during the last few months of the year. For example, if you were to open a Southwest personal card and a Southwest business card in November and then hold off until January to meet the spending requirements on both cards, the new cardmember bonuses would then post in January or February, putting you on a path to earn a Companion Pass that is valid for nearly two years. Of course, the gamble there is not knowing whether or not the new cardmember bonuses will be high enough to get you to a Companion Pass at that time of year — though they usually do offer these increased bonuses a couple of times each year (and often with good timing for scooping up the Companion Pass early in the year).

Common questions / confusion

Whenever these bonuses come up, there are a couple of common questions / misconceptions that are worth noting here:

- You do not need 110K points in your account to earn the Companion Pass. Many people get confused about whether their current point balance counts towards the pass. To be clear, only the points you have earned during a single calendar year count. If you have 60K points in your account that you earned as a new cardmember bonus in November 2018, those do not count towards the Companion Pass in 2019 (you needed to have earned 110K during 2018 or you’ll need to earn a fresh 110K during 2019).

- You can start using the points as soon as they are in your account. Even if you haven’t yet earned 110K yet this year, you can make bookings for the future and then add your companion later after you’ve earned the pass. Log in to your account at Southwest.com to see your companion pass meter — this will show your progress towards earning the 110K points necessary. Once you earn the pass, you can call in to name your companion and then add them to any of your existing reservations (provided there are any available seats on the flight).

- Count 24 months from the day you last earned a new cardmember bonus on a Southwest personal card to determine your eligibility. It doesn’t matter on what date you opened or closed the card, the date that matters is the date that you earned the new cardmember bonus. That would typically be the statement date for the statement on which you received the bonus.

- Yes, Chase typically matches the increased bonus if you have applied within the past ~90 days and you ask nicely. This is always YMMV as they are under no obligation to match a higher offer, but if you applied for the card recently (within the past 90 days) for a lesser offer, it’s always worth sending a secure message to Chase to ask if they would match you to this new higher offer. Chase is typically good at matching when the new offer is publicly available.

Bottom line

It’s nice to see 60K offers return on the Southwest Airlines Rapid Rewards Plus, Premier, and Priority cards. It is still possible to earn a Southwest Companion pass via welcome offers, and these increased bonuses make that easier — though you’ll have to open one of these cards plus the business card in order to do so. The timing isn’t the best — I’d personally rather earn Southwest bonuses at the beginning of the year to position myself for a longer companion pass period — but if you can put the points to good use this year, maybe one of these offers makes sense for you.

I was able to email chase and get my personal offer matched. Had got my personal card in the last 2 months and met the spend for both offers.

I have a follow up to question #3. Do you have to wait 24 months from earning a cardmember bonus to apply for a new card? Or is that restriction only for earning a new bonus? If I earned a bonus in June 2017, do I have to wait until July 2019 to apply for a card or can I apply now and make sure I don’t earn the bonus until July 2019?

You need to wait until July 2019 to apply.

Thanks! I’ve been looking for an answer to this question for months!

You’ve mentioned a few times that once you earn the Companion Pass you retain it for the remainder of the year and the following year. However, the promotion that was running towards the end of 2018 and early 2019 was spend $4,000 in 3 months and receive 30K points and the Companion Pass – however, it is only good for the remainder of the year and does not extend to the following year. Just wanted to double check and make sure that was still the case for that promotion that was being offered earlier.

You understand things correctly.

To be sure to eliminate confusion, full explanation:

To earn a Southwest Companion Pass, you ordinarily have to earn 110,000 Rapid Rewards points in a calendar year. If you earn 110K points, your Companion Pass is valid for the rest of the year in which you earn it and the entire next year.

However, they did run a new cardmember offer earlier this year (in 2019) that awarded a Companion Pass through December 31, 2019 and 30K Rapid Rewards points after meeting minimum spending requirements. That’s the only time they’ve ever run that offer publicly (they did run a similar offer for California residents only in the fall of 2017 and that CP was valid until December 31, 2018). You are correct that the Companion Pass awarded with that offer is only valid through Dec 31, 2019.

However, if you earned your 30K points in 2019, you can still earn a Companion Pass that is valid through the end of next year (Dec 31, 2020) if you earn another 80K points this year. Since that previous offer you’re referencing was on the personal cards, you could open the business card for 60K. Alone with the points earned for spend, that should put you at around 95K points earned. You could close the gap with the shopping portal / car rentals / hotels / paid flights / 1800Flowers / spending on your cards / etc.

Hopefully that makes sense.

So, if I already have had a RR Visa for 5 years, signing up for the newer top level card won’t get me the 60k bonus towards companion pass unless I cancel my current card? Could I cancel one and apply for the other the same or next day, or on the same call with an agent?

You’ll need to cancel the one you have before applying for a new one. Some people have been able to cancel and reapply in the same day on some cards in the past, but others have had trouble with that. Conventional wisdom says to wait at least a week or two before you reapply.

If i have one slot openinign up.. dropping to 4/24 next month… would it be wise strategy to apply biz version first, wait, then personal?

Definitely.