Southwest Airlines has been hacking away at many of the most popular elements of its business model and rewards program over the last couple of weeks. The airline has announced that it’s reducing earnings on paid flights, bringing back expiration dates to flight credits and will soon begin charging for checked bags. These are all things that, until recently, would have been considered brand heresy.

As part of those inauspicious changes, Southwest also said that it would soon begin instituting “variable” award pricing:

We are changing our redemption rates factoring in how much demand exists for a flight. For example, flights with lower demand will have a lower redemption rate, and flights with peak demand may have a higher redemption rate, and some flights will have the same or similar redemption rates as they do today.

Southwest awards have always priced dynamically, meaning that the price of an award fluctuates in concert with the cash price. However, the value of points when used towards awards were fairly static. Most recently, Nick found that they averaged around 1.4 cents each when redeemed for flights.

Now, the actual value of points will change according to the what Southwest ascertains the “demand” is for a given flight is, meaning that your points will be worth less for higher demand flights and more when the demand is lower.

This pricing change now appears to be live and, at a quick glance, I’m seeing prices that range between 1.1 – 1.7 cents per point in value.

Southwest Variable Pricing

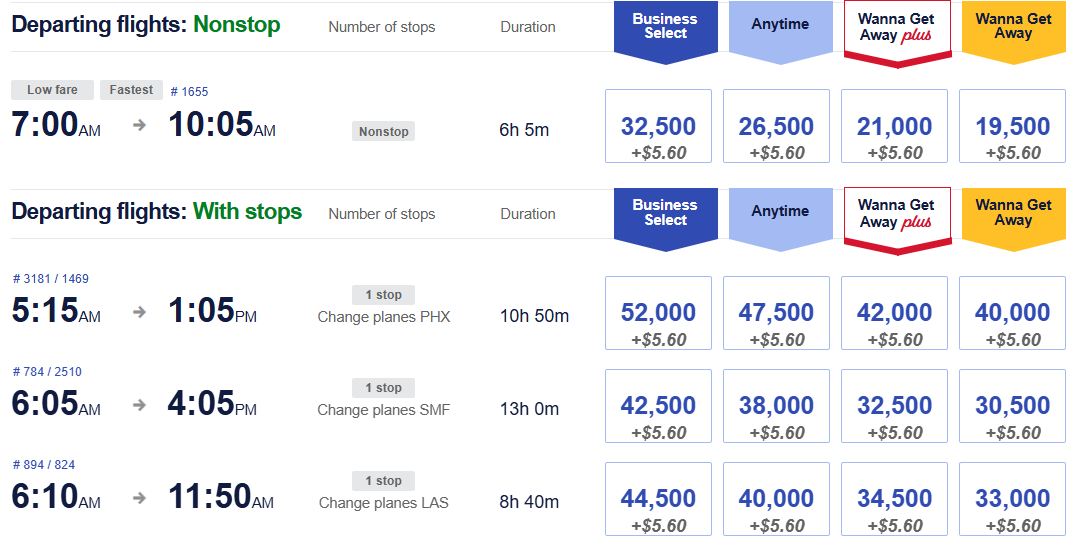

Looking at award pricing between LA and Honolulu on May 15th, here’s what I see for award prices:

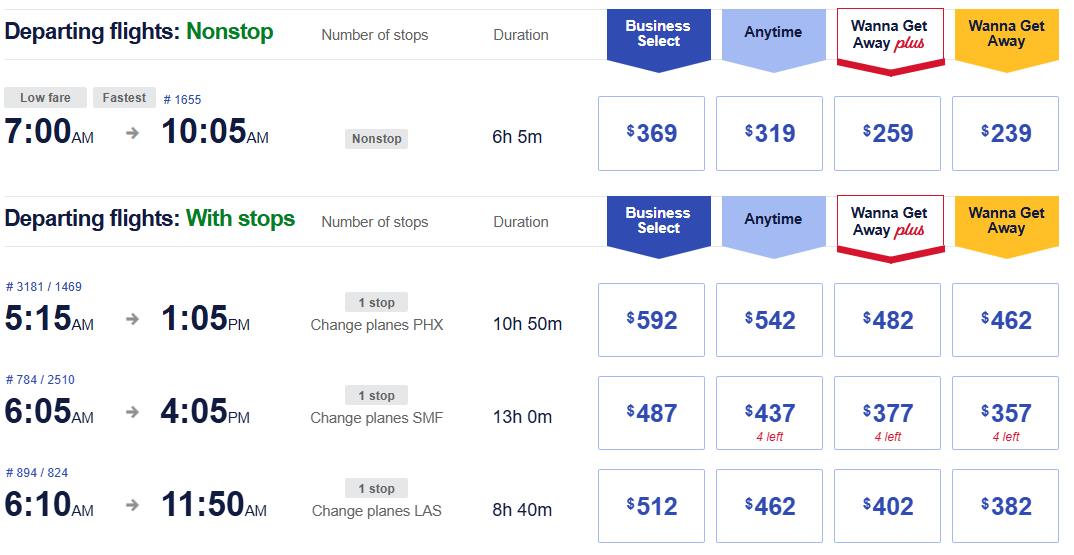

Let’s compare those to the cash prices:

All three of the connecting flights are pricing out at ~1.1 – 1.15 cents per point (cpp) value, while the nonstop is slightly better at ~1.2cpp. However, all of them are significantly below the ~1.4 cents per point that we’d normally expect for Rapid Rewards points. Those general ratios hold through all four fare classes.

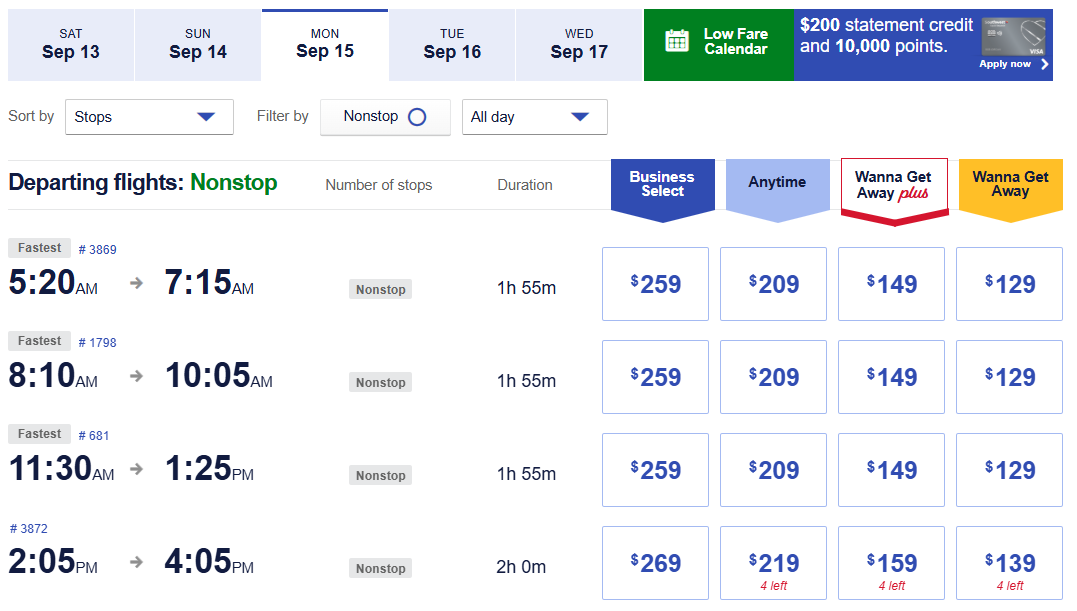

As another example, let’s take a look at Oakland to Phoenix on September 24th, further out in the schedule. First, the cash prices:

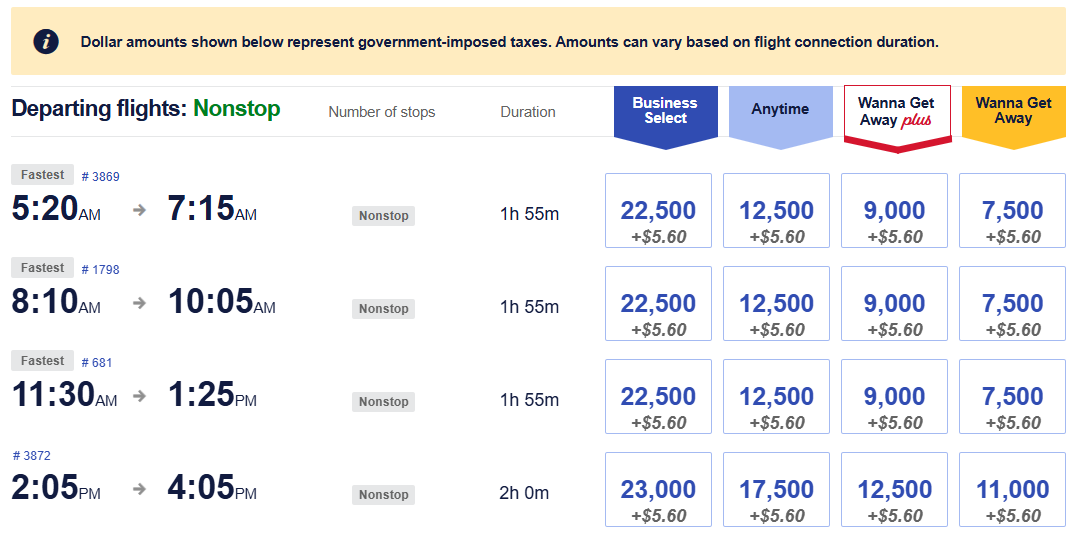

Now, let’s again compare those to the prices in Rapid Rewards points:

The first three options offer exceptional value for Rapid Rewards points, at just over 1.65 cents each. The fourth is much worse at just over 1.1 cents each. Yuck.

Quick Thoughts

I searched through 12 different route combinations over five dates throughout the current schedule and seemed to find a similar theme. The low end of Rapid Rewards award redemptions provides ~1.1cpp in value, while the high end is now between 1.6-1.7cpp. There were still plenty of examples that were hanging out in the old 1.4 range, which makes it seem like those might now be the general “low,” “standard” and “peak” ranges.

It’s hard to say definitively how this affects the overall “value” of Rapid Rewards points. If 1/3 of redemptions are ~1.1cpp, 1/3 are ~1.4 and 1/3 are ~1.7, it may average out to more or less of a wash. However, at first glance, I’m seeing many more flights that are pricing in the 1.1 – 1.2 range than at 1.6 – 1.7. We’ll have to do a more systematic analysis, but if that initial impression pans out, it would represent an overall decline in the power of of Rapid Rewards when used for award bookings.

How you feel about all this will probably depend on how captive you are to Southwest points. If they’re the primary currency you use for flights, you could be stuck having to redeem them at the low-end, in which case this represents a decided devaluation. On the other hand, if you utilize a variety of airline currencies, this could provide an opportunity to get better value for Rapid Rewards points than you have over the last several years, as you’d be able to pick and choose when you use them for maximum effect.

That could be a hard pill to swallow for those who have been most loyal to Southwest and might provide solid motivation to begin collecting different currencies in addition to Rapid Rewards.

Found 1.88 cents / point on a flight from ISP to MCO on 10/21/2025 – 5,754 points for the $114 flight.

I received1.85 cents per point from Punta Cana to Sacramento on November 30. For Business Select the price is $1175, and the points are 59,000 plus $81.50.

My theory is 59,000 is the max cost for points after a small sample. The cash cost of anytime and Business Select differs but the points price is the same. On different days if the price is a little less the cost is still 59k.

I found 2.3 cents per point. HOU-CUN on 05Apr.

Don’t forget that you have to pay $48 in taxes on that award flight. If you subtract that from the cash price, the difference is probably closer to 1.7. Still good value, though!

Unfortunate but not unexpected. Time to burn down the points balances while we can at better value. While there are opportunities to cherry pick better value for now holding large amounts of Southwest points for a lengthy period seems like a bad bet, as the dynamic algorithm could “adjust” again to have all flights shift towards the 1.1 – 1.2cpp range.

A TPA to PHX flight I needed still came out to 1.38 after the changes so not all is lost. Worked out to 14K + $5, Alaska had competing AA flights at 12.5K + $18 which put them roughly even and will let me save the Alaska miles for a better redemption.

All true except that points booking have some added value now, since the flight credits from cash bookings expire after 6 or 12 months. So for many there will be value in saving some points for speculative bookings.

True, cash flight credits are going to quickly be unappealing with Southwest as the expiration policy goes from the best to one of the worst in the industry. You just want to carefully consider your exposure based on the typical size of your traveling party. I’ve usually carried 200K – 250K in Southwest points for a family of three based in one of their hubs but with the direction things are going I’m hesitant to have total mileage balances much above 6 figures now. That should be enough to book two or three speculative or backup flights without feeling too crunched if another hammer drops on the points value.

I ran about 100 searches yesterday and found a fair amount under 1.1 – look at Hawaii flights in particular. OAK to HNL can be as low as 1.05 on peak fall break weekend for example. Most routes I fly seem to be about 1.2 average now – a pretty substantial devaluation.

I think we know who wins here

I found quite a few bookings where the points were 1.4 cpp+ vs the cash rate that I had booked so I immediately swapped those to point bookings to burn my points before this gets worse…… out of 12 one-way flights I have booked the rest of the year, I was able to get better value with points for 4 flights compared to what I had booked initially, which isn’t a fair comparison because I almost always book flights during sales but just one data point.

I was planning to do the same thing with the 8 one-ways I currently have booked. But I had one flight that was 1.3cpp and the other seven were all 1.2cpp and below.

My brief check, RDU to Vegas jumped significantly but TPA to RDU was about the same in points/dollar.

I have been trying to burn through my SW points since before the terrible changes were announced earlier this month and I so I have a whole slew of future flights booked. Just went in and found that a bunch of the upcoming flights are now significantly fewer points than they’d been when I booked. Updated to the new point prices and saved tens of thousands of points… so I’ve got even more points to try to burn through hooray

I found something indicating the price increases are much worse. This morning the new schedule came out for Nov and Dec. I pounce the morning these are released to get good prices for the two holidays. For the first time I see there are no WGA fares available during any of the days leading up to Thanksgiving on the BWI-SJU route. If you look at the low fare calendar, every day until Wed Nov 20th has fares as low as 13k or 11.5k points. Then starting on Thurs before Thanksgiving the lowest fare suddenly becomes 50k points. When you click you see there are no WGA fares for those dates. I checked this early enough that there is no way that all WGA fares could have sold out this fast, especially for Monday and Tuesday of Thanksgiving week. The same price jump on that route is evident for Christmas, with the big jump starting on Thursday before xmas week (going from 23k pts on Wed to 59k pts and no WGA on Thursday and after). This is more than a devaluation of points bc it also corresponds to an increase in cash fares. I haven’t see this before.

They have been doing this for quite awhile. High demand, usually Caribbean or Hawaii routes don’t always release WGA right at schedule open. Hopefully they will come out later for you. I had same thing happen for spring break to Mexico this year.

Thanks Jim. So do they usually release them later? If so, any guess as to when? I’m also looking at Costa Rica from BWI for xmas and the price there 59k (same for anytime or for business select).

Yes, this has been happening since 2022 – but don’t panic. I always booked our Hawaii flights the moment the booking window opened but in 2022 this suddenly changed and for peak days like Thanksgiving they only sold anytime and biz select initially. And this has been the case for hawaii routes now every year. However, they always drop later. Some years you could even reprice the week before flying to get the lowest price. But unfortunately, there is no rhyme or reason when they drop, but they always do. I never ever had to pay the anytime price. Alaska does the same and while I rarely fly them to Hawaii due to SWA companion pass, they also always charge something like 2k round-trip from the West Coast to Hawaii during peak season and I have NEVER seen their prices drop, but admittedly haven’t checked as frequently as Southwest flights. It’s a complete mystery how Alaska could flill the plane at these prices.

Almost assuredly coming next are changes to the refund policy of 10 mins, and changes to the policy of allowing you to easily recoup differences in fares if the price decreases.

That would have to be next. What else is left to take away?

Southwest has always been my primary domestic, but have currency in UR, MR, and then several airlines since I like options.

What I am absolutely sure about is that Southwest is no longer my primary domestic.

If they tinker with the two benefits left above, they likely remove themselves as even an option for me.

I currently hold personal, and business cards from Southwest; as well as, A-List and companion pass.

I will ride out these benefits until the end of 2026, at which point I will be a free agent.

Yeah same boat here. It’s been a slow erosion.

We have a family of 4, 2 companion passes, and live in a SW hub… so we’ve been married to SW for quite some time.

If the companion pass or the ability to get the companion pass via credit cards is removed then that is the last straw for us. I would imagine after that they won’t be significantly cheaper in our situation anymore.

It is very unfortunate where things are trending… had some Air Canada award bookings and there are numerous fees on top the traditional award taxes, no free changes/cancelations, no ability to recoup fare differences, and sitting slightly over 1 cent/point. How many years will it be until southwest is in the same boat.

It’s odd because I thought I added Companion Pass to the list I posted above. I definitely intended to do so.

Either way, I have noticed the same in regards to the level of fees on top of awards.

Delta points values can be crappy, I do appreciate the low fees, and ability to get a refund of points.

My family has been hard core Southwest so long that it is extremely tough to see the total collapse of their business model.

I had been telling my family the last few years that there was no doubt Southwest would have to make some changes to stay relevant in this post Covid world, but never thought they would be involved in a hostile takeover.

Good luck going forward!

Same to you!

Oh yeah, seat selection fees on award tickets… that’s another rough spot on air canada.