| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

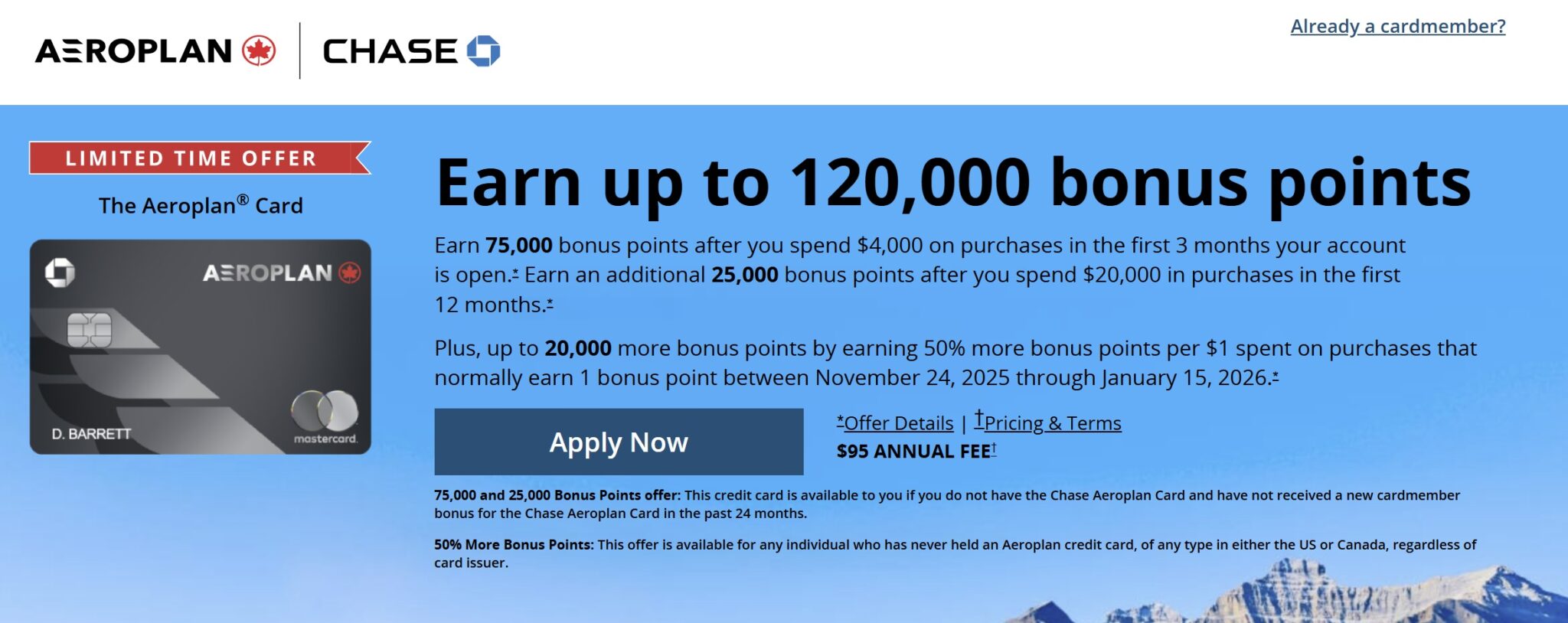

Through 12/2/25, The Aeroplan® Card from Chase is offering an additional element on the card’s current welcome bonus whereby those who apply between 11/25/25 and 12/2/25 can earn additional points on purchases that would otherwise ordinarily earn 1 point per dollar.

The Offer & Key Card Details

For more information about this card, click the card name below to go to our card page.

| Card Offer and Details |

|---|

ⓘ $694 1st Yr Value EstimateClick to learn about first year value estimates 60K Points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Earn 60K bonus points after you spend $3K on purchases in the first 3 months that the account is open.$95 Annual Fee This card is likely subject to Chase's 5/24 rule (click here for details). Recent better offer: 85K points after $4K spend in the first 3 months (Expired 11/13/25) FM Mini Review: Great card for regular or frequent Air Canada flyers Earning rate: 3X Air Canada ✦ 3X grocery stores ✦ 3X dining ✦ 500 bonus points with each $2K calendar month spend, up to $6K spend per month (1,500 points max) ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: Renew 25K status w/ $15K spend ✦ Priority Reward w/ $100K, $250K, $500K, or $750K spend ✦ Free award companion for rest of calendar year and all of next with $1 million spend Noteworthy perks: Discounted award pricing ✦ Free checked bag ✦ $120 credit for NEXUS, Global Entry or TSA PreCheck every 4 years ✦ Carbon offsets on Air Canada awards ✦ Pay Yourself Back for travel at 1.25 cents per point, up to 200K points per year ✦ 10% bonus when transferring Ultimate Rewards to Aeroplan (25K max bonus/year) ✦ Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $10 monthly Instacart credit |

Quick Thoughts

This is an interesting little twist on the standard offer for this card. In a nutshell, you can earn 50% more points per dollar spent on purchases that ordinarily earn 1 point per dollar (up to 20,000 bonus points) between 11/24/25 and 1/15/26 if you apply by 12/2/25.

That said, it would be tough to maximize this. Assuming that it takes about a week to get the card in the mail, even if you applied on the first day and were immediately approved, you’d probably only have about 7 weeks at most to spend $40,000 at 1x in order to max that out. That seems like a tall order for most people, so I can’t imagine that many folks will be maxing this out.

That said, if you’ve got big spend upcoming and you’re excited about the Aeroplan card (which certainly can be a solid card to have), then this might be the right opportunity. For instance, if you had $20,000 in tax payments to make or you were working on a renovation or something of that sort and you knew that you could hit the $20K spend threshold quickly, then you could end up with the 75K welcome bonus + 25K bonus for $20K in purchases + 10K additional bonus points from the additional 50% (assuming your expenses are in a 1x category) for a total of 110K bonus Aeroplan points (plus the 20K earned through spend). That’s not an amazing return on spend, given that there are some cards currently available that earn transferable points that feature bigger bonuses (which, in some cases, can be transferred to Aeroplan), but if you value some of this card’s other perks, this could be a good opportunity to squeeze a little more juice out of the welcome offer.

Is there any indication of whether or not ‘pay yourself back’ will be extended to 2026?

FWIW, you can get the card expedited.

Also, in a world of ballooning annual fees and coupon book cards, the annual fee is under $100 and there’s no extra effort to get the most out of the perks.

What does “purchases that normally earn 1 *bonus* point” mean? Is the same as purchases that normally earn 1 point?

Feels like y’all mailed in this review. No mention tha this card offers 25k status for the year in which you apply AND the following year so it makes almost no sense to apply this late in the year.

Even if you don’t care because you already earned AC status, with the new SQC system starting in 2026, you shouldn’t spend a dime until Jan 1 so you can put the spend towards SQC.