NOTICE: This post references card features that have changed, expired, or are not currently available

A reader recently asked me about booking a hotel with Chase Ultimate Rewards points. She had found a Marriott property that had good reviews and was available for a free night award for 30,000 Marriott Rewards points. She could have transferred her Chase points to Marriott to book the room, but first she checked Chase Travel℠ and found that she could pay 13,419 points for the same night at the same hotel.

She concluded her email with this: “the room booked through Chase Travel is less than half the points of the Marriott Points. What am I missing?”

I often claim that the best use of Ultimate Rewards points (for those with a premium Chase card such as the Sapphire Preferred, or Ink Plus) is to transfer points to loyalty programs to book flights or nights. So, my reader’s question was reasonable. What was she missing?

While I’ve often mentioned the ability to use Ultimate Rewards points for 1.25 cents each to book travel, I’ve never suggested that it is a good way to book hotels. Why not? In my reader’s example, booking travel with Ultimate Rewards points is clearly a much better deal than transferring points to Marriott, so why wouldn’t I recommend it?

As a general rule (this isn’t 100% true, but mostly true), the only Chase hotel partner worth transferring points to is Hyatt. With Hyatt, you’ll usually (but not always) get very good value from your points. With most of their other hotel transfer partners, hotel points tend to be worth less than 1 cent each, so you’re actually better off simply redeeming Ultimate Rewards points for cash, at a rate of 1 cent per point (I don’t generally recommend this – it’s just an example of why it’s bad value to transfer to Marriott, IHG, etc.)

So, assuming that Hyatt isn’t an option for your stay, the next question is whether it makes sense to book the hotel through Chase Travel. Assuming you’re not saving up your Ultimate Rewards points for higher value options, here’s how you could evaluate this question:

- Search for the best paid rates for the place and dates you need (I usually use Kayak.com for this)

- Search Chase Travel for the same hotels: ultimaterewardspoints.chase.com/travel (if you have multiple Chase Ultimate Rewards cards, make sure to log in with a premium account to get 20% off the points price for travel)

- If the hotel is part of a chain in which points can be transferred from Chase Ultimate Rewards, then check the point price for the same hotel. Current hotel transfer partners include: Hyatt, IHG (Holiday Inn, Intercontinental, etc.), Marriott Rewards, and Ritz-Carlton (which is really the same as the Marriott program)

- Compare the above results.

In all of the examples I’ve looked at, Chase’s paid rates are higher than the direct-pay alternatives. And, this often wipes out most or all of the 20% discount given to those with premium cards. Here’s an example:

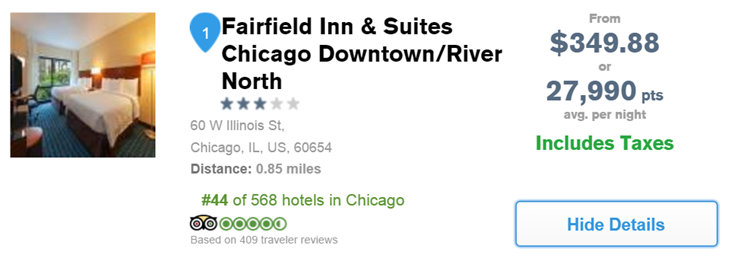

Chase Ultimate Rewards Travel:

For a particular night in Chicago at the Fairfield Inn & Suites Downtown / River North, Chase shows a paid price of $349.88 (including taxes), or a point price of 27,990. The point price reflects the 20% discount given to premium cardholders. Without the discount, the $349.88 price would translate to 34,988 points.

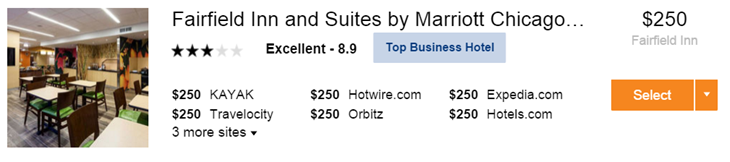

Kayak:

For the same hotel and the same night, Kayak shows rates starting at $250. After taxes and fees, the rate comes to $291.

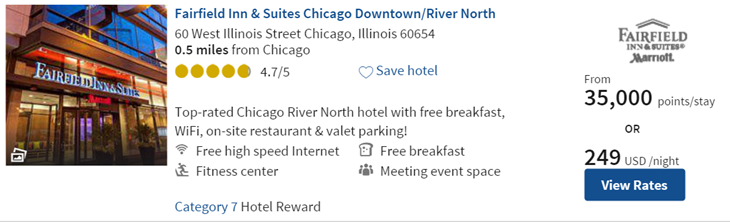

Marriott Rewards:

The same hotel can be booked with 35,000 Marriott Rewards points.

Compare Options

We now have identified three options for this hotel:

- Pay with Chase Ultimate Rewards points: 27,990 points

- Pay with credit card: $291

- Pay with Marriott Rewards points: 35,000 points

If you already have a healthy stash of Marriott Rewards points, then paying with Marriott points is a reasonable option. You would get .83 cents per point value compared to the best available paid rate. That’s quite a bit higher than the current .56 cents per point Fair Trading Price for Marriott Rewards.

If you don’t have many Marriott Rewards points to spend, then transferring points from Chase To Marriott is clearly a bad idea. 35,000 points is more than the cost of either of the other options.

If you pay with Ultimate Rewards points, you would get $291 / 27,990 = 1.04 cents per point value. That’s not very good. My recommendation is to go through a rewards portal to book the room (to get extra points or a cash rebate), and pay with a credit card that earns bonus points for travel, or pay with a gift card that you bought at a discount.

Booking the room

If I were to book the Fairfield Inn after running the above comparison, my first step would be to see if Marriott.com offered competitive prices. In this case, they do offer the same best rate (otherwise I might look into submitting a Best Rate Guarantee claim, but that’s a whole different story…). I’d prefer to book through Marriott so as to ensure that I earn Marriott Rewards points from the stay and potentially qualify for any current Marriott promotions I may be enrolled in. So…

- I search for Marriott on CashBackMonitor to find the best available portal option. I find that 5% cash back is the best I can do (or, up to 7% cash back for new TopCashBack customers, but I don’t qualify). I go to the portal in question (uPromise, in this case), find Marriott, and click through to Marriott.com to book the room. After my stay, I should receive 5% cash back from uPromise.

- To pay for the room, I would use the Citi Premier or Citi Prestige card, either of which offers 3 points per dollar. If I didn’t have a card that offered 3X points, I would opt for the Chase Sapphire Preferred (which offers 2X for all travel) or the Chase Ink Plus (which offers 2X for hotels). If I really wanted the hotel to be “free”, I would pay with a card in which points are best used to offset travel expenses. Two good examples are the Barclaycard Arrival Plus and the Capital One Venture Rewards cards.

Summarized Advice. When to use Chase points to book hotels

Here’s an oversimplification that may be useful:

When considering whether to use Chase Ultimate Rewards points to book hotels, don’t do it unless you want to stay at a Hyatt. There are situations here and there where this advice is wrong, but I’d bet that it is the right call 95% of the time.

Note: there are situations where Ultimate Rewards transfers to Marriott make sense in order to book a Marriott Travel Package. Read more here: SPG Nights & Flights vs. Marriott Travel Packages

Have you considered looking at your math again with the 1.5 you can get with the CSR…I’ve found some very compelling options.

Yes, actually, I am planning to redo this analysis. I’ve recently seen great prices through UR with hotels, but bad prices for flights! So, it’s time to go back to the drawing board…

Thanks Greg. I had the same question as David–seems like the 1.5 changes the math on this. And no one provides better analysis than you do–truly.

Thanks! Yes, its still on my to-do list…

When paying for the Marriott stay, would it not make more sense to pay with the Chase Marriott Premier Rewards CC since it gives 5 Marriott points per $ spend rather than 3x for Citi Premier / Prestige or 2x for CSP? Unless the value of the Citi Thank you points or Chase UR is much higher than Marriott points?

If you value Marriott points at .56 cents each, then the rebate for paying with your Marriott card is 5 x .56 = 2.8%. If you value ThankYou points at only 1 cent each, then the 3x rebate is higher = 3%.

[…] points for hotels, you only do it for Hyatt. That’s pretty much the conclusion in this Frequent Miler […]

I’ve used URs to book hotels where there are no chains, usually at very favorable point rates.

That works in most cases. However, I have found rates on the UR portal that were better than anywhere else. Never for big chain hotels, mind you, but it happens.

I think it is worth checking some of the booking portals occasionally as the amounts fluctuate. I first noticed when airlines started letting you use points for car rentals and hotels. Most car rentals didn’t include taxes and fees, just the base charge and some charged more points and included everything. Hotels were different amounts as well, depending on which booking engine the airline points portal used. At the time there were 3 different orbitz style booking providers, each with their own fluctuating prices. Each had similar high point prices for the majority of hotels, no doubt to pay for the point conversion during the payment, but all had some bargains sprinkled in that were absent on other airlines bookers. Not just independent hotels either, we wound up in a Sheraton in Waikiki for much less than starwoods rates. Even better… upgraded rooms were available for a few more points, something I couldn’t do with the hotel points. I don’t know if UR uses the same system as everyone else now, or if their flavor booking engine has bargains worth searching for….it never hurts to check all the options.

I always think about Southwest as the backup. If you live by an airport that Southwest serves, you can transfer your UR points to Southwest points, which can generally be redeemed for flights at a value of 1.4 cents per point. And with Southwest there are no limited number of award sweats, and the refund policy is exemplary. Using URs for anything less than 1.4 cents a point seems like a waste to me.

Another way to think about this is as an option to make a really expensive time period or location feasible when the larger budget or frequency of trips are considered.

I recently redeemed UR points on UR travel site for Saturday ski season night at an independent hotel in Lake Tahoe. It was 8K points less than the Hyatt option, which is also located in a less desirable area. The Hyatt was retailing $225 + $25 resort fee, and the independent hotel was $200. My redemption rate was about 1.5c/pt, fine by me- especially considering every hotel in the area is charging ridiculous rates for weekends in ski season.

Normally I’m happy to pay $200+ retail for a hotel, but when lift tickets for my husband and I for the weekend are $450, a redemption like this really helps, and lets us get up there more often without hesitation.

Here is the site http://www.awardpal.com to search, redeem and compare hotels using your credit points, or price to book hotel room.

Great post. Very helpful. Just wondering about the cashbackmonitor. I’ve never used this but are you saying that in the example you gave I would have to open up a UPromise MasterCard and would receive 5% cashback from anything I had on that card?

The uPromise portal does not require a uPromise credit card. Just create an account and shop through their online portal to get cash back. Once cash is in your account (it can take several months), you can request a check.

I think I made a bad decision, I booked Holiday Inn 3 nights using Chase Ultimate Reward points. What would be the best way to book IHG since I have not yet gotten my IHG credit card?

presume you mean you already transferred points from CUR to IHG — and from there made the reservation. If so, you can cancel the reservation — and then you’ll have the IHG points in your account. (You can’t transfer them back to CUR) Yet you could consider “stretching” them a bit — in some cases, you could find points and cash rates via IHG to be compelling. (Yet “choose wisely”)

ps: great post Greg, and I concur, the only instance where I’d use CUR points for a hotel reservation is for Hyatt lower category properties — e.g., 5-8k per night. (That said, we did enjoy a third night at the all-inclusive Montego Zilara, thanks to 25k rate — and last year’s 20% rebate promotion on points)

Your post also reminds me of why I just don’t get it with Marriott, et. al. — such incredibly high points rates to get a paltry free night.

Yes Chris, that was a bad decision that I too made once. Once.

Is this not also an option:

Book on Marriott website and pay with ink card. Get 5% back from the portal ($14.5) and 2 points per dollar (582) then redeem 29,100 UR as statement credits for the $291 cost)

Cost: 29,100 – 582 = 28,518

we talk a lot about the effective rate you are “buying” points with redemption options. Would this be considered “selling” points to spend an extra 528 points to get $14.5 cash back (36.41 cents per mile!). Plus now you have booked with the hotel for a qualifying night.

Yes, this is the same as my reply to Eric, above. You can always redeem points for cash to cover credit expenses, so you should never pay with points directly unless you’re getting significantly more than 1 cent per point value.

I know this is old, but was working through the math:

Option 1: Spend 27,990 points through Chase UR for a $291 room value, or 1.04 cents per point valuation

Option 2: Have a net spend of 28,518 points (29,100 UR statement credit less the 582 points per dollar spend) for a room that has a net cost of $276.50 ($291 room value less 5% rebate of $14.50). This would only be a 0.097 cent per point valuation. I guess you’d be left with the $14.50 later on, but even if you took that out of the UR statement credit (so 29,100 less 582 less 1,450, or 27,068 points), you’d be left with a 1.02 cent per point valuation, which is still less than the Option 1.

Am I missing something in this?

Also, how does the math all change, and decisions change, with the introduction of the Chase Sapphire Reserved with 3X points and 1.5 cents per point to book?

I think you’re missing the fact that by booking on the Marriott website you get cash back (if you start browsing in a cash back portal), and you earn Marriott points for your stay (which doesn’t happen if you book through the UR portal)

I’m factoring in the 5% cashback by using a net room cost of $276.50, and netting 1,450 (1 cent/point) out of the statement redemption cost. I guess its a question of whether the Marriott points are worth the .02 cent per point lower redemption (1.04 vs. 1.02). My guess its probably worth it if you have enough Marriott points to redeem later.

Excellent post and generally spot-on advice. The one factor you didn’t address, though , and most people often don’t in these analyses, is one’s overall cash budget. Let’s say I’m looking to use some points/miles in order to keep my overall trip within the budget…or to reallocate some budget from the basic airfare & hotel and use it for some activity or tour on my vacation. Or perhaps an unexpected expense comes up and the trip just won’t happen without finding some free lodging through points…that happened to me once. In such cases, finding a better cash rate isn’t a consideration even if it’s a slightly “better” rate.

Obviously that’s not something you can put into a mathematical analysis so I guess I get why it’s not mentioned. But there is that subjective factor that can sometimes come into play.

I just wrote a long comment agreeing with you, but then thought about it further and changed my mind, because… in the case of UR, you can always transfer the points to cash. So, basically if you find that the cash rate would give you 1.04c/point of value, FM’s advice to pay cash is spot on, but misses out the caveat or extra step that if you’re cash poor and points rich, then transfer those ultimate rewards out into your checking account (or whatever you do to convert them to cash) to offset the hotel cost.

I’ve always found the UR travel portal a little nebulous, but I guess it really is almost the same as any other OTA, just with the added layer of complexity that you can use points, cash or a combo. I’m disappointed to hear that their prices tend to be that much higher, though. Kind of makes a mockery of supposedly getting 1.25c/point used on travel then. It sounds more like, pay a 20% surcharge if you use a non-premium card. In which case, you’re better off turning your points into real cash.

Thanks Jamie, that’s basically my answer as well.

If you are cash poor, you may still do better paying with a credit card and then redeeming Chase points for cash to cover the credit expenses. This way you can earn credit card points, hotel points, and maybe a portal rebate and still pay nothing (or close to nothing) out of pocket.

Another thing to consider is elite benefits. There were a few occasion where I transfer points to Marriott to book the hotel due to lounge accesss that came with my status instead of booking it using UR points, even though using UR points cost less .points.

That’s a great point but some hotels do offer elite benefits even when you book through an OTA (or with Chase). After making the reservation, its worth calling the hotel to add your membership number to the reservation. You usually won’t earn points but you might get elite benefits.

Greg, I have heard about this advice before but I have never actually tried it. Now that you bought it up again, maybe it is time to try it. Thanks.

Another thing to consider which you did not mention and is a negative point in my opinion, is that the better rates on Chase with points are all non-refundable. Maybe the best paid rates aren’t either at the way you were looking at them, but if are paying with points, point redemptions on the hotel website are always refundable for any cancellation you may have.

That’s a good point. In this case, I always compared refundable to refundable, or non-refundable to non-refundable. That’s an important factor to be aware of. Chase does clearly show whether or non-refundable when you click to view room types.