When a credit card offers a free night certificate, how do you determine how much it’s worth? Which hotel program is the most rewarding for your paid stays? How can you maximize value with Hilton cards? Answers to those questions, information about big Bilt changes, and a lot more in this Frequent Miler Week in Review.

This week on the Frequent Miler blog…

What are hotel free night certificates worth?

While hotel free night certificates are often advertised as being worth “up to” a certain number of points, the fact is that a certificate is not as valuable as points. That’s because a free night certificate has a defined (usually one-year) expiration date and can not be used for multiple cheaper nights (nor in some cases for a more expensive award). We apply a fudge factor to a free night certificate’s maximum value to determine our own valuation — this post includes the fudge factors for each of the most common free night certificates and the resulting “cash” values we use for the purpose of determining the value of those free night benefits.

Which hotel loyalty program is most rewarding on paid stays?

When you need to book a paid stay, it can be difficult to compare apples to apples since the return on spend can vary both in terms of the absolute number of points and the value of those rewards. This post has been updated with more programs and with our updated hotel point Reasonable Redemption Values to provide a side-by-side comparison demonstrating what you can expect when paying for a stay.

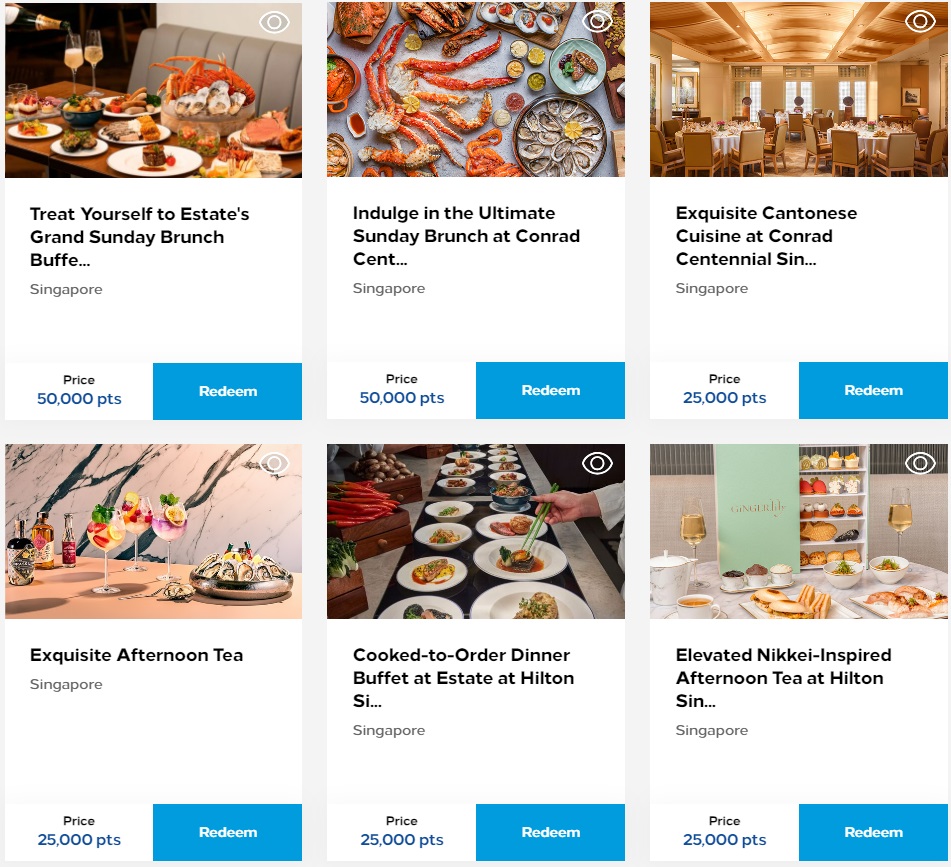

Hilton Experiences might be a better deal than you thought

Most hotel loyalty programs offer experiences that you can buy with points. Whether that represents a good use of points varies wildly. We’ve occasionally seen programs like Choice Privileges and Qatar Avios offer really good deals and Marriott has now and then offered experiences that you just couldn’t get otherwise. However, Stephen digs into Hilton Experiences and demonstrates that in some cases, you can do really well — even buying points to pay for something that would have cost you significantly more in cash.

How to maximize your Hilton cards (with upgrades and downgrades)

Speaking of Hilton, did you recently pick up a Hilton card thanks to the increased welcome offers that ended on July 31st? Wondering whether and when it might make sense to upgrade or downgrade your card? In this post, Tim explains how you can maximize value by strategically considering when to product change.

Here’s how Amex Hilton credits work at SLH & AutoCamp

I’m including this very short post in week in review because it contains very useful information for anyone who has a Hilton credit card and might consider paying for a stay at an SLH or AutoCamp property. As you may hear on the podcast, I’ve got some skepticism about how this is going to work even though we’ve gotten this information confirmed by contacts at Hilton. I’ll be very surprised if SLH properties are coded correctly to trigger credits on any cards, but see this post for what we’ve been told. On the other hand, one listener reports that they had an award stay at an SLH property and used their Hilton business card to pay the $8 overage after using their elite member F&B credit and Amex did in fact credit back the $8 as part of that card’s quarterly Hilton credit. So it sounds like maybe it does indeed work!

How to apply for Chase Ink cards

Newcomers to credit card rewards often assume that the process of applying for a business credit card is more intimidating or involved than it really is. The truth is that it isn’t any more complex than applying for a consumer card, especially if you’re applying as a sole proprietor. This post walks you through everything you need to know if you’d like to go after a big Ink offer.

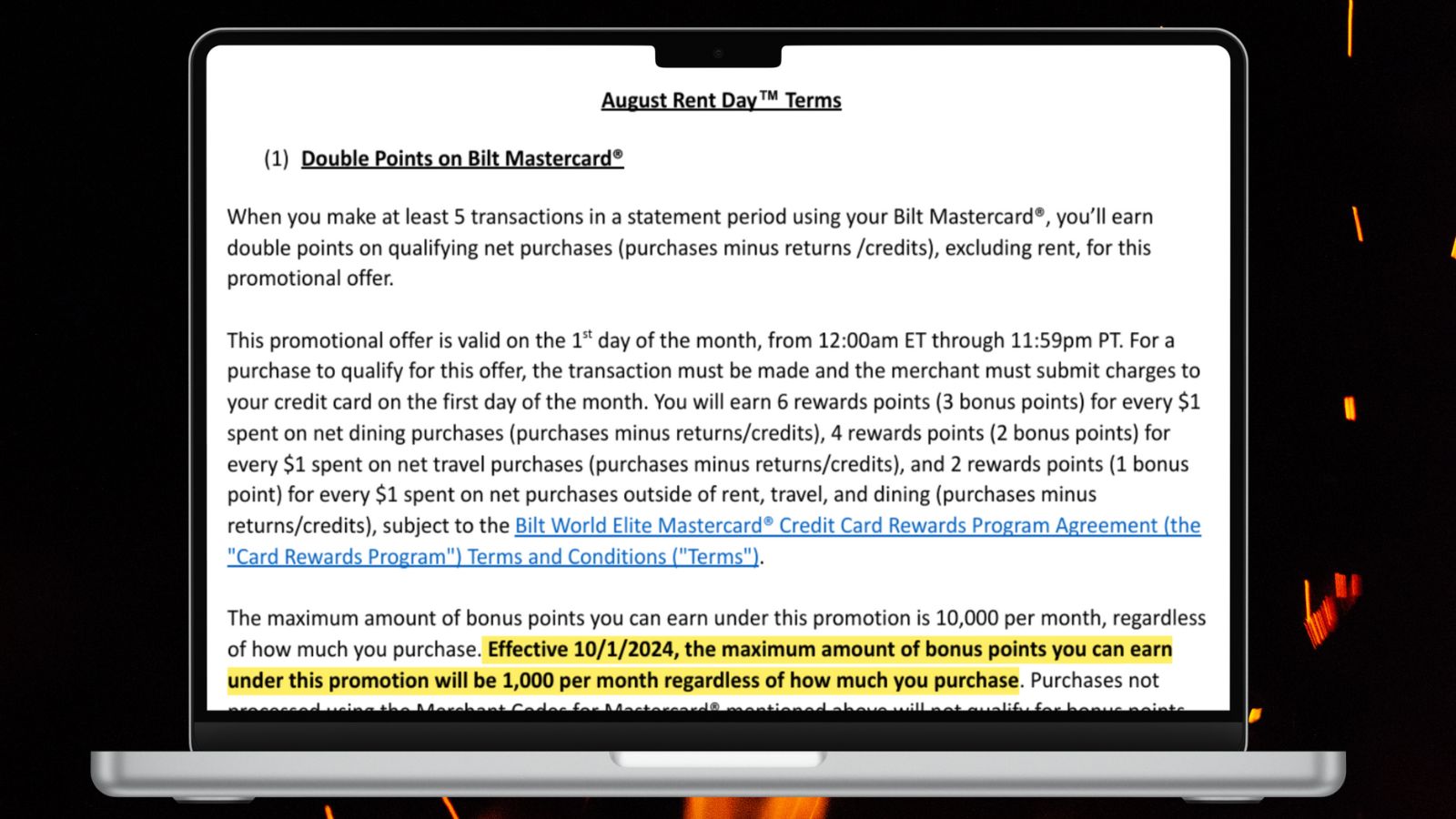

Big change to Bilt Rent Day: Double points only up to 1,000 bonus points per month [Starts 10/1/24]

Bilt has made a massive change to its value proposition for those who focused on paying big bills on the 1st of the month in order to earn double rewards. Starting on October 1st, Bilt will limit Rent Day Double Points to a maximum of 1,000 bonus points each month. A maximum additional return of $10-$15 worth of points just isn’t enough juice to justify the squeeze and it additionally effectively kills the value proposition of spending toward elite status. While the change is obviously very disappointing, making matters worse is the total lack of transparency in communicating it — Bilt buried that info in a tiny link to more terms and conditions at the bottom of a Friday afternoon email.

Bilt Rewards will exempt tax payments from Rent Day bonus

Adding insult to injury, Bilt apparently has another under-communicated devaluation on the horizon. Tim’s eagle eye caught a line in an interview with TPG pointing to yet another change in that tax payments will no longer count toward bonus point promotions. This change hasn’t been broadly communicated to members at all to my knowledge but rather was a passing comment in an interview. It is of course disappointing that Bilt is excluding tax payments from earning spending bonuses when, to my knowledge, every other card issuer on the market counts tax payments toward spending bonuses as they are processed like any other purchase.

What’s next for my post Rent Day Doomsday Bilt card

Due to those Rent Day changes, Greg is preparing to sock drawer his Bilt card. If you’re a renter, it still makes sense to pick up easy points every year for paying the rent (so long as you remember to use your card for 5 total transactions each month), but for the rest of us this becomes a rather run-of-the-mill option, especially given the fact that elite status (which yields the best transfer bonuses) will be so hard to earn. That said, Greg will surely max out the final Rent Day and hope to enjoy another big transfer bonus before his status eventually wears out.

Current point transfer bonuses

A ton of new point transfer bonuses dropped this week, with several major issuers getting in on the action. As a reminder, our current point transfer bonuses resource page includes both current transfer bonus information as well as expired historical transfer bonus information so you can compare current bonuses to past ones as well.

Podcast: Growing Points via Transfer Bonuses | Frequent Miler on the Air Ep266 | 8-2-24

Given big new transfer bonuses to numerous popular awards program, this week’s Frequent Miler on the Air focuses on when you should consider making a speculative transfer because of a transfer bonus. Conventional wisdom has held that it only makes sense to transfer when you have an immediate need to book an award, but is that a universal truth? On this week’s show, we discuss when you should consider making a move and to which programs — as well as when you should sit it out.

Ways I “self-insure” my trips (with strategic booking and credit card choices)

If I were to buy travel insurance, my primary reason for considering it would be for emergency medical coverage. I am not at all concerned with buying travel insurance to cover my flights, hotels and travel arrangements. Instead, I sort of “self-insure” in the sense that I use credit cards with excellent travel protections and I make bookings that can be cancelled for free (or very cheaply). In this post, I explain some of that strategy to show why I wouldn’t buy travel insurance to cover my travel (while recognizing that you may still want it for medical emergencies).

Podcast: Capital One SavorOne Cash Rewards Credit Card | Card Talk Ep1 | 8-1-24

We decided to split out Card Talk as its own mini podcast episode, which should both make it easier to find a specific Card Talk segment if you’re looking for information about a specific card and it will make it easy for us to upload a new episode to replace the old one if and when changes occur. On our first Card Talk segment, Greg and I discuss the Capital One SavorOne card, which is a contender for best grocery & dining rewards.

Podcast: The most rewarding card for groceries & dining | Coffee Break Ep20 | 7-30-24

Recent changes to the Amex Gold card make the new $325 annual fee a non-starter for some folks (and indeed we have agreed that we likely wouldn’t recommend it as a long-term solution for beginners). If not the Gold card, which card should you use for groceries and dining (and more)? On this week’s Coffee Break, Greg and I run through the simply solutions and which we think are most worthy of consideration for the average person.

W Edinburgh Hotel (by Marriott): Bottom Line Review

I spent several nights at the W Edinburgh hotel last week. This is a very nice hotel with a very weird exterior design. I should have noted in the review that our room was actually in a separate attached tower, so we didn’t spend the night in the round building (though we had breakfast there and I visited the bar and rooftop lounge in the main building). I’d gladly stay at the W again with free night certificates, though I might otherwise struggle to part with either so much cash or so many points given that it isn’t a great deal compared to point prices.

Wells Fargo One Key™ Mastercard Review (2024)

Not to be confused with the One Key plus (stylized as One Key+), this is the no-annual-fee Expedia / One Key credit card. As Tim notes in the review, this card mostly doesn’t make much sense. Anyone spending enough at Expedia, Hotels.com, and Vrbo to want a OneKey card would do better with the OneKey+.

That’s it for this week at Frequent Miler. Keep an eye on this week’s last chance deals to be sure you catch those expiring soon before they’re gone.

![A coupon book with a credit card, a credit card program with an airline, and more [Week in Review] a person reading a magazine on a couch](https://frequentmiler.com/wp-content/uploads/2017/05/kick-back.jpg)

I had been a strong supporter of Bilt and greatly profited from the card. Having digested all that has unfolded, that’s changed. Now, it’s a no annual fee version of the Chase Sapphire Preferred that collects points on rent. Nothing more. What about the juicy Rent Day transfer bonuses? Given the pattern of changes, I speculate that Rent Day transfer bonuses are in the cross-hairs. Perhaps less frequently with a cap (a la Alaska) at a lower top rate 2X (a la Alaska). I’m not waiting around to see. If a person pays rent, fine. If not, look elsewhere.