NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

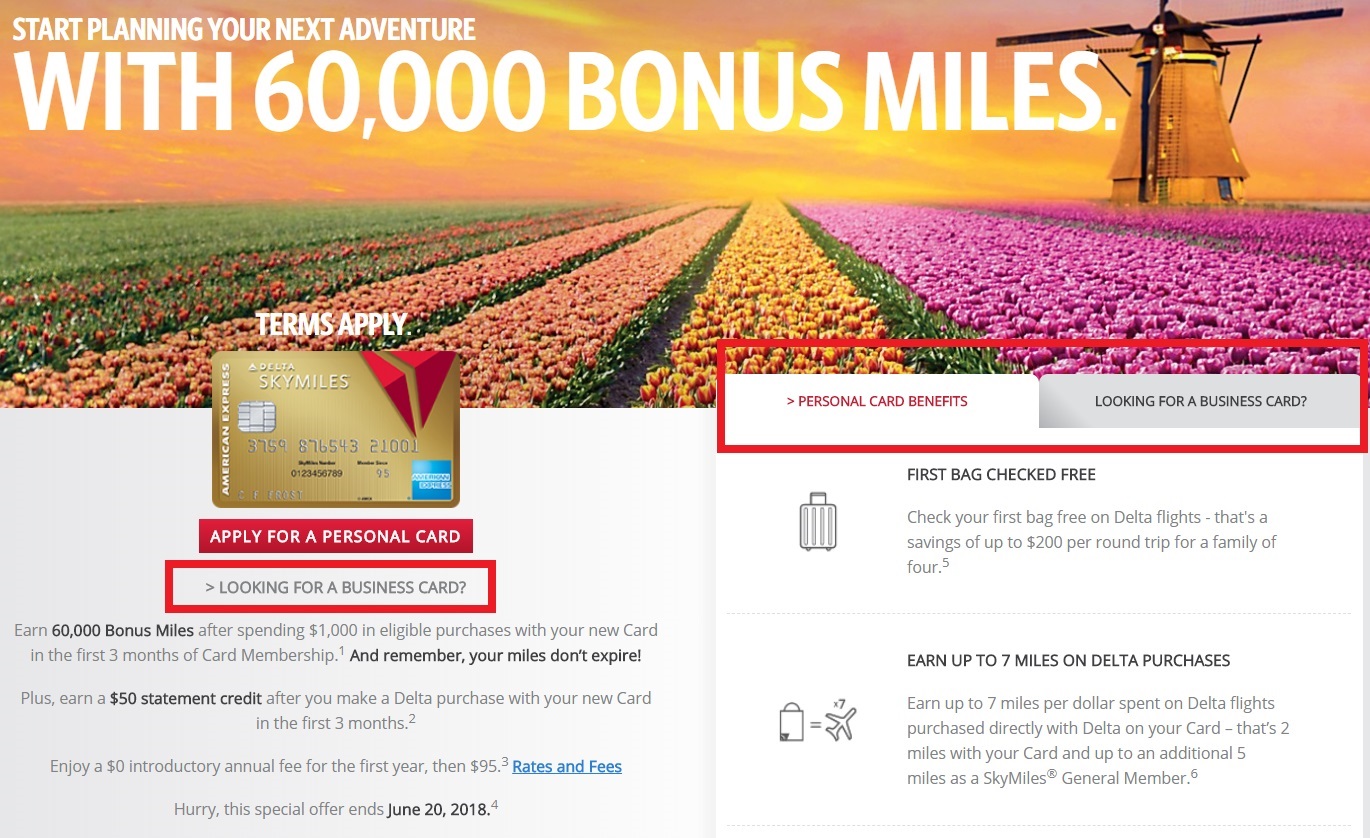

Last night, we posted a Quick Deal for a new targeted offer out on the Delta Gold SkyMiles credit card with an easy link to check your eligibility (See: Delta sending mailers for 60K offer). It turns out that this offer does not have lifetime language and is available for both the business and consumer versions of the card. We are posting again to alert readers to the fact that it is absent the lifetime language and available on both cards, which makes for a very easy haul of Delta SkyMiles.

As seen above, you can click the links that say “looking for a business card?” to toggle between the business and personal versions of the card.

The Offers

- Targeted offers on both the Gold Delta SkyMiles Credit Card (consumer version) and the Gold Delta SkyMiles Business Credit Card good for a welcome bonus of 60,000 SkyMiles after $1,000 in eligible purchases in the first 3 months plus a $50 statement credit after you make a Delta purchase in the first 3 months

- Enter your SkyMiles number and last name at Delta.com/GOLD60K to see if you are targeted.

Quick Thoughts

These offers are excellent in terms of return on spend as just $1,000 in purchases will yield 60,000 Delta SkyMiles. The annual fee on either card is waived the first year, then $95 thereafter. While these cards come with priority boarding and free checked baggage, the only bonus category for spend is 2x on Delta purchases, meaning that they aren’t terribly exciting for everyday spend. Still, 60K miles for $1K in purchases is solid.

The really notable thing about these offers is the absence of the lifetime language normally present in Amex terms. Amex usually restricts the welcome offer by stating in the terms that the welcome offer is not available to those who have or have had the card before. It is always advisable to check the terms of your targeted offer before you apply, but those who have been targeted so far report no lifetime language in their terms. This means that even if you have had one of these cards before, you should qualify for the intro offer if you are targeted.

Keep in mind that not everyone will be targeted (I did not receive an offer), but if you are it’s a nice opportunity worth consideration.

Falo 30 000

Hey i got the offer in the mail. Applied got excepted and then stupidly threw out the offer letter … I just called and they said they have a different offer on my account … They updated the bonus to a bonus of 50k then 10k same spending amounts but I am not sure if it does or doesn’t have the prior bonus language. When i applied online and double checked and it didn’t have the prior bonus language. Anyone have any advice is it possible to have amex pull my application to see the terms … Should I wait till after I got the spend or before…

Thanks

I’m targeted, applied for the personal. Can I also apply for the business one via this or would applying for both trigger a problem with Amex/jeopardizing both?

Yes, you can. I wouldn’t expect any issues from Amex.

awesome, thanks!

So if it doesn’t recognize my number and name it means I am not targeted? I know I entered the right information

I’m having the same issue.

I see the same thing as the two above. My mother in law got this offer though.

Yes, if it doesn’t recognize your number I assume that means you aren’t targeted. Same happened to me, but it works for others.

I got the mailer for 60K yesterday, but am also getting “not recognized” though that link. Odd.

Grr… never eligible for these offers!

I got the offer and it does not have the lifetime language in it. I just finished the spend for the same card for 50k @ $2000 plus another 10k @ $1000. I’m VERY tempted to get it, but I need to finish the spending on the Citi AAdvantage Platinum i got matched to 75k.