NOTICE: This post references card features that have changed, expired, or are not currently available

There are a couple of really strong targeted credit card offers that have resurfaced recently that feature top-notch bonuses for great return on your spend.

First up, One Mile at a Time reports that there is a new targeted offer popping up for some people via the Card Match Tool for a welcome offer of 100,000 Membership Rewards points after $5,000 spend in the first three months on the Amex Platinum Card.

That’s as good a bonus as we’ve ever seen on the personal Platinum card. Based on our Reasonable Redemption Values, 100K Membership Rewards points are worth somewhere around $1,820 — though you could certainly get more value when redeeming for international business and first class flights with transfer partners.

See this page for a link to the card match tool to see if you’re targeted. I wasn’t targeted and neither was my wife, but it only took a few seconds to check.

As a reminder, there are many flavors of personal Platinum cards (See: Which is the best Amex Platinum card? for a full rundown). Benefits found on all personal Platinum cards, including the one available to some through this targeted offer, include:

- 5X points for prepaid hotel bookings at Amextravel.com

- 5X points for flights booked directly with airlines or with American Express Travel®

- $200 Uber credit annually ($15/month, $35 in Dec). Credit can be used for Uber or Uber Eats (meal delivery).

- Up to $200 a year in statement credits for airline incidental fees

- $100 Global Entry fee reimbursement.

- Airport lounge benefits.

- Rental car elite status.

- SPG Gold status (which also confers Marriott Gold status when you link your SPG and Marriott accounts)

- Hilton Gold status

- Free Boingo wifi

- Access to Fine Hotels & Resorts (See: Chase Luxury Hotel & Resort Collection vs Amex Fine Hotels & Resorts)

- Cruise Privileges

- Transfer points to participating frequent flyer programs

The publicly available welcome bonus on this card is 60K points after $5,000 in purchases in the first three months — so this targeted offer is a significant increase. While there have been occasional targeted offers for a 150K welcome offer on the Business Platinum card, those typically require $20,000 in spend (and are not available via the Card Match tool). As far as I know, this targeted 100,000 point offer, which comes and goes, is the best there is on the personal card.

Keep in mind that American Express generally limits you to receiving the welcome offer on a card once per lifetime, and that limitation would apply to this targeted offer. In other words, if you’ve ever gotten a welcome offer on the plain flavor of the personal American Express Platinum Card, you would not be eligible to receive the welcome offer again.

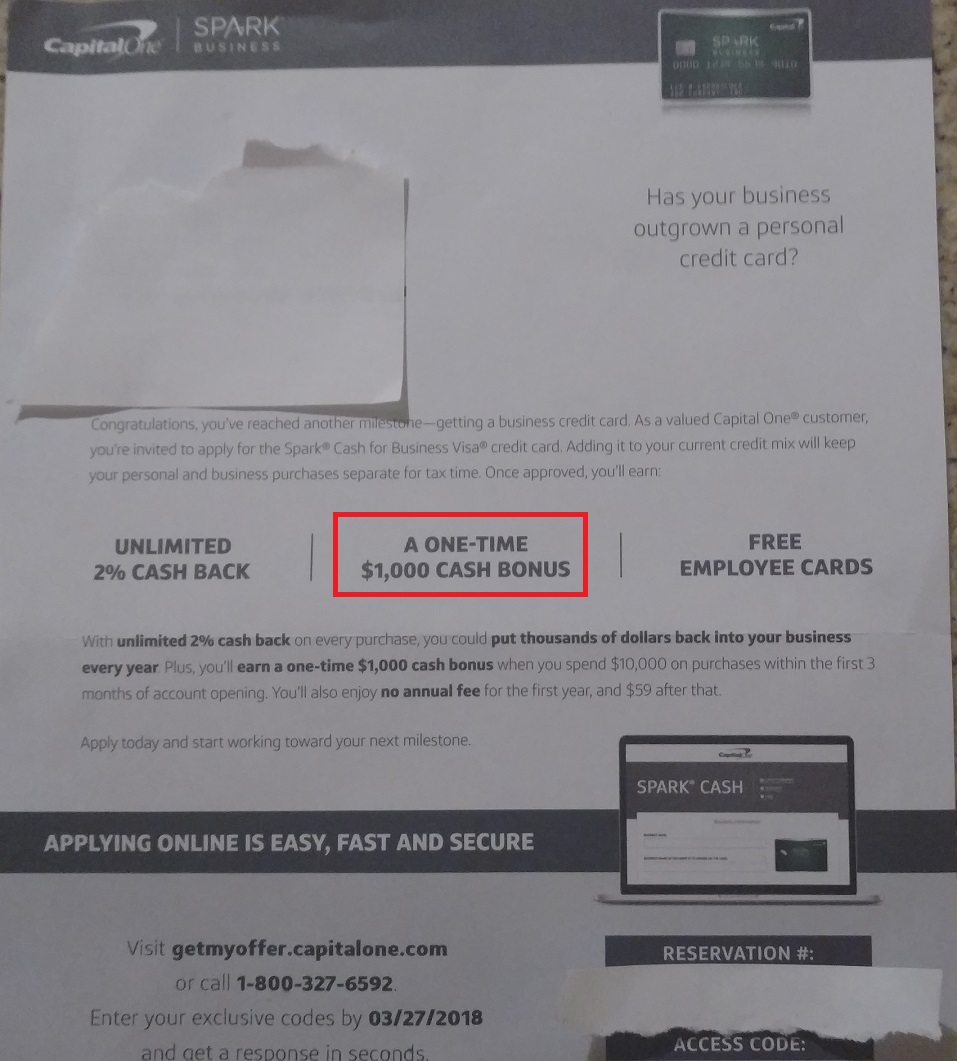

In other targeted offers, my wife recently received a great targeted offer on the Capital One Spark Cash for Business card good for $1,000 bonus cash back after $10,000 in purchases in the first 3 months.

This offer was briefly available online last year (See: [Expired] New monster $1K signup bonus after $10K spend), but that link died quickly. The public offer on this card is usually $500 cash back after $4,500 in purchases in the first three months. I had been keeping an eye on my Informed Delivery hoping to see a mail offer for this card as the offer is terrific. The annual fee is waived the first year and this card earns 2% cash back everywhere. Since the cardholder earns 2% cash back on the minimum spend requirement in addition to the bonus, one would earn a total of $1,200 cash back on $10,000 spend with this offer. That’s a 12% total return on spend. While this offer is only available via targeted mailer at the moment, it’s worth keeping an eye on the mail for it.

Also notable on this targeted offer: you’ll see in the image above that the annual fee is waived the first year and then $59 after that. That’s less than the current public offer, which waives the annual fee the first year and then carries a $95 annual fee after that.

While $10,000 spend in three months is on the hefty side, the return is equally large. Keep in mind if you receive this offer that Capital One usually pulls all three credit bureaus. Furthermore, Capital One reports business cards to the personal credit bureaus, so this account will appear on your personal credit report.

Bottom line

Both of these offers are very strong — the type for which I’m always keeping an eye out. Hopefully some readers will be targeted.

On 10/2/17, I applied and was approved for the Capital One Spark Cash Visa, spent $10K, and received the $1K bonus.

I continue to receive by mail this same offer every couple of months. I would like to take advantage of this offer again.

When would I be eligible to apply for this card again?

Thanks!

Six months.

If I remember correctly Capital One reports business cards to credit bureaus so it would count as one strike in Chase 5/24 rule – correct?

Correct.