I’ve become a huge fan of the U.S. Bank Altitude Reserve card over the past year. The primary reason for my excitement about this card is the fact that mobile wallet transactions earn 3 points per dollar spent and those points can be used at a value of 1.5c per point either when you book travel through the US Bank travel portal or when booking travel directly and using real-time mobile rewards. This turns the card into an effective 4.5%-everywhere card for spend that is done via mobile wallet. However, while we’ve addressed this within other posts, we haven’t had a standalone post about what counts as mobile wallet payment. The answer is that it is pretty easy to get this category bonus, but as my own experiments over the past few months have shown, it isn’t as intuitive as it seems at first glance.

Some have been affected by a glitch in 2024

Before I delve into what counts and what doesn’t count, I want to recognize that a glitch is affecting a significant number of Altitude Reserve cardholders whereby transactions that previously earned the 3x mobile wallet bonus category stopped earning the additional two points per dollar in late 2023. That is to say that places where those cardholders earned 3x in the past suddenly stopped earning 3x over the past several months.

That appears to be a known glitch. Quite a few readers have reported speaking with U.S. Bank agents who are familiar with the problem and the bank’s line has been that it is a known glitch that will get corrected. I’ve heard nothing about an expected timeline on the fix.

We reported that glitch here recently (note that I originally thought this was primarily a Google Pay problem, but Apple users reported the same problem). I’ve since read up in this Flyertalk thread about it and it sounds like if you have been affected by this problem, you may be able to resolve it yourself (for transactions moving forward) by removing your card from your mobile wallet and re-adding it. It sounds like U.S. Bank intends to eventually run a fix that will automatically resolve past transactions, but in the meantime they have not been able to handle individual cases. Some have reported receiving a small “customer appreciation bonus” of a few thousand points when calling about this problem, but others haven’t received anything yet.

There is no doubt that this glitch has been frustrating for those affected and it is really disappointing to see U.S. Bank so slow on implementing a fix. On the flip side, my mobile wallet transactions have consistently coded correctly at 3x. I expect that this will get fixed in the long-run. In the short-term, I recommend removing and re-adding your Altitude Reserve to your mobile wallet(s) if you run into this problem.

Tapping with your device to pay with Google Pay, Apple Pay, or Samsung Pay should always earn the 3x mobile wallet bonus

Notwithstanding the above, using your phone or smartwatch and tapping to pay with Google Pay, Apple Pay, or Samsung Pay should work 100% of the time to code at 3x. I’m now very much in the habit of almost always tapping my phone or watch when I’m out and about.

In doing that, I’ve consistently earned 3x everywhere I would expect. That includes both in the United States and abroad in multiple countries over the past year, both at big stores and little Christmas Market shops where the seller just held out a credit card reader for me to tap. Even vending machines and video games in the mall with tap-to-pay code at 3x as expected when I tap my phone or smartwatch to pay. Parking charges that I made at a couple of hotels where I tapped to pay worked.

The Altitude Reserve card also earns 3x on travel, so at hotels I have sometimes used the physical card since I expect to receive 3x for that bonus category. However, after a recent hotel stay that did not code as travel (at Great Wolf Lodge), I am making it my habit to tap my phone or watch when I check in and provide a card for incidentals rather than using the physical card.

In a travel-related tidbit, I’ll add that while I’ve received 3x on rental car charges (as expected), I have not received 3x on follow-up charges from the rental company after my rental (for tolls).

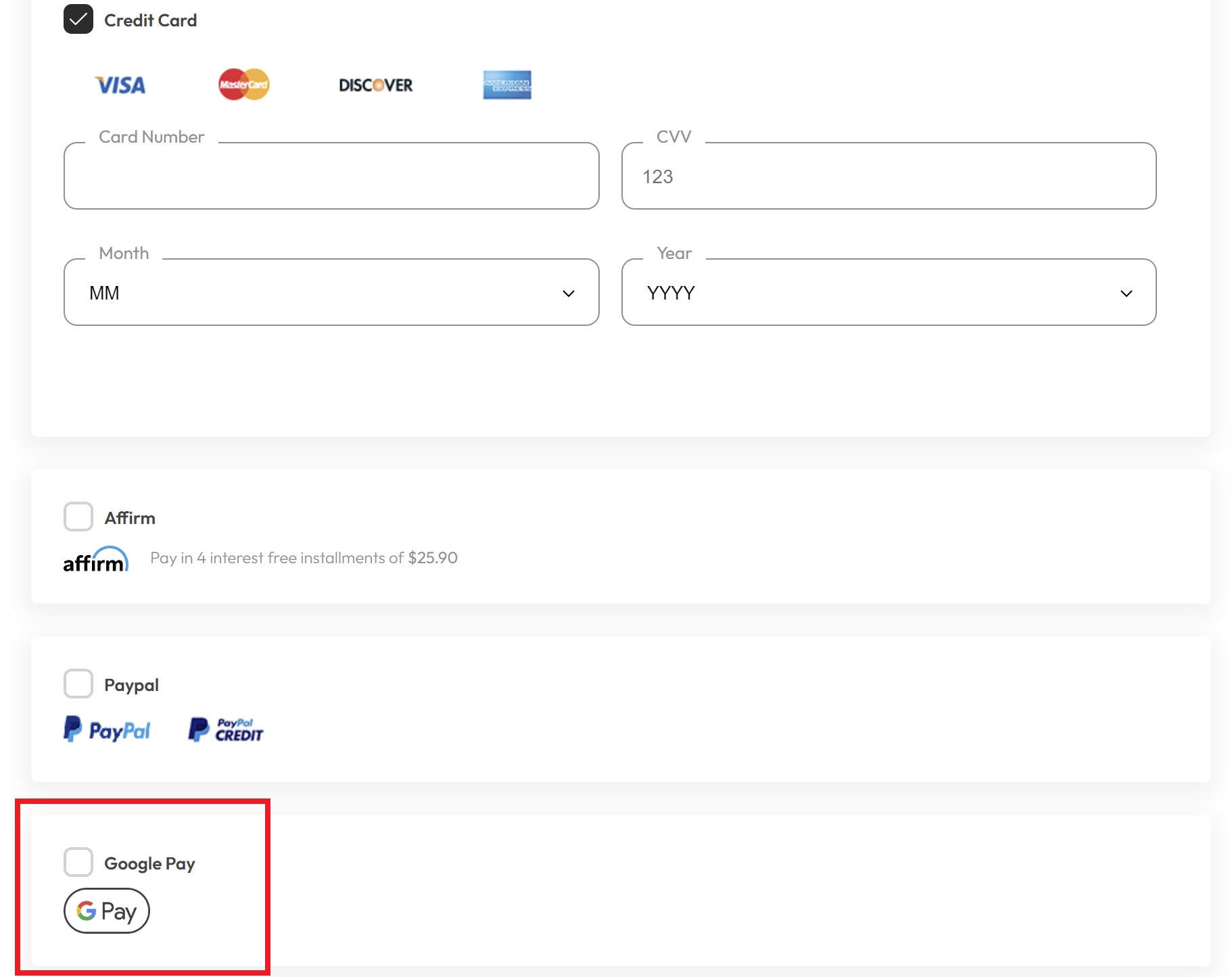

Using Google Pay via the Chrome browser has not worked for me at all, but web-based Apple Pay does work

When using the Google Chrome browser, some websites have the option to pay with Google Pay. I’ve never been successful with this from a desktop browser. For instance, I bought glasses from Kits.com recently (as an aside, I love kits.com glasses!). I used the “Google Pay” option at checkout in a Chrome browser and I only got 1x.

That’s one of quite a few experiments failed.

To be clear, I have tried using the “Google Pay” button both in a desktop Chrome browser and in a mobile Chrome browser. Neither codes as 3x mobile wallet for Google Pay for me (and I use an Android phone).

Conversely, Apple Pay users report that using the Apple Pay checkout button during checkout in their Safari browser (like on a Macbook) does code as mobile wallet.

Apple Pay works on phone-based payments within apps, but Google Pay does not

Apple users report that using the Apple Pay option within apps on their phone codes as mobile wallet.

Payments within apps that have Google Pay do not trigger 3x for mobile payments for me, either. For example, I recently used the app “Too Good To Go” while visiting New York City (shout out to a reader recommendation about this a couple of years ago – I’ve picked up food numerous times and mostly been really happy with this app!). The app had a Google Pay option at checkout, so I went ahead and tried that. It didn’t code as mobile wallet.

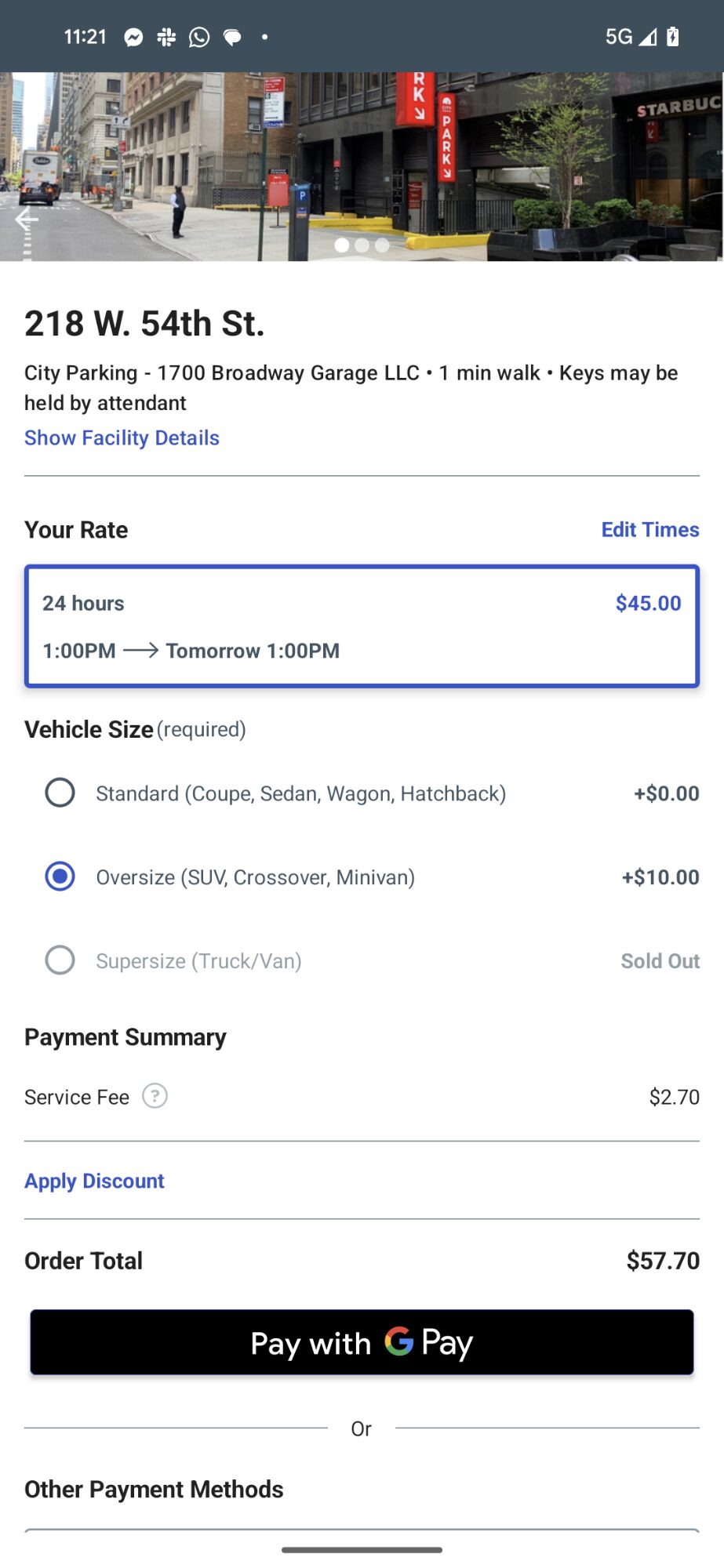

I did the same with a ParkWhiz parking reservation — I hit the Google Pay button within the ParkWhiz app on my phone and paid with Google Pay and it did not code as a mobile wallet payment.

That is disappointing as I would have expected to receive the mobile wallet bonus for those transactions, but I didn’t.

As an Android user, I now only expect to receive the mobile wallet bonus when using my phone or smartwatch to tap and pay.

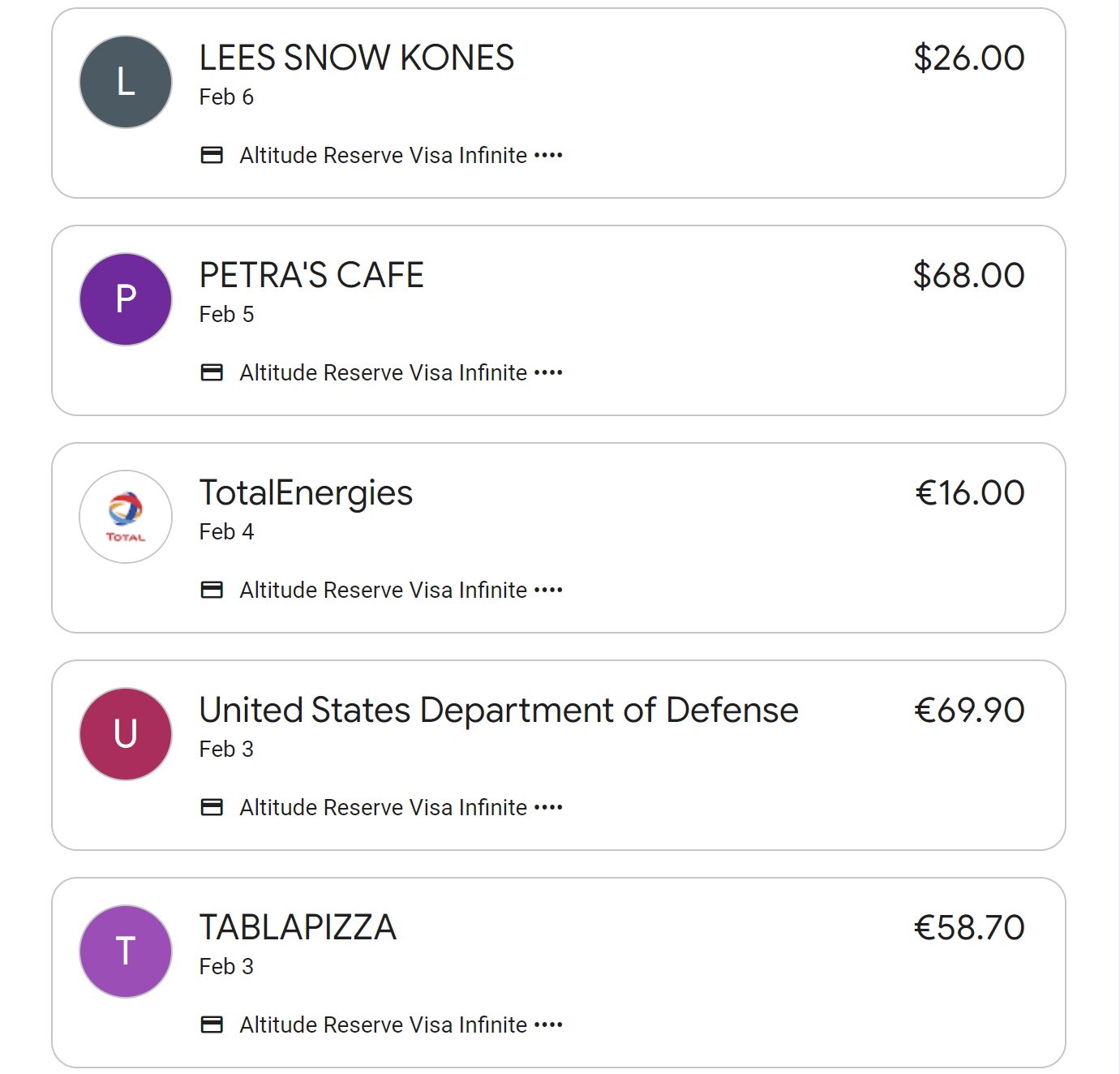

Can’t remember how you paid? Use your Google Pay history

When trying to go back through my records to check the results of my many test attempts, I found it more difficult than I expected to recognize transactions and remember how I paid for them.

The good news for Android users is that the Google Pay app is incredibly helpful with this as you can view transaction history.

The bad news for Google Pay users is that the Google Pay app is being discontinued on June 4th, 2024. The good news is that maybe we’ll still be able to access transaction history? I should note that this is also available via pay.google.com (and maybe that will continue?).

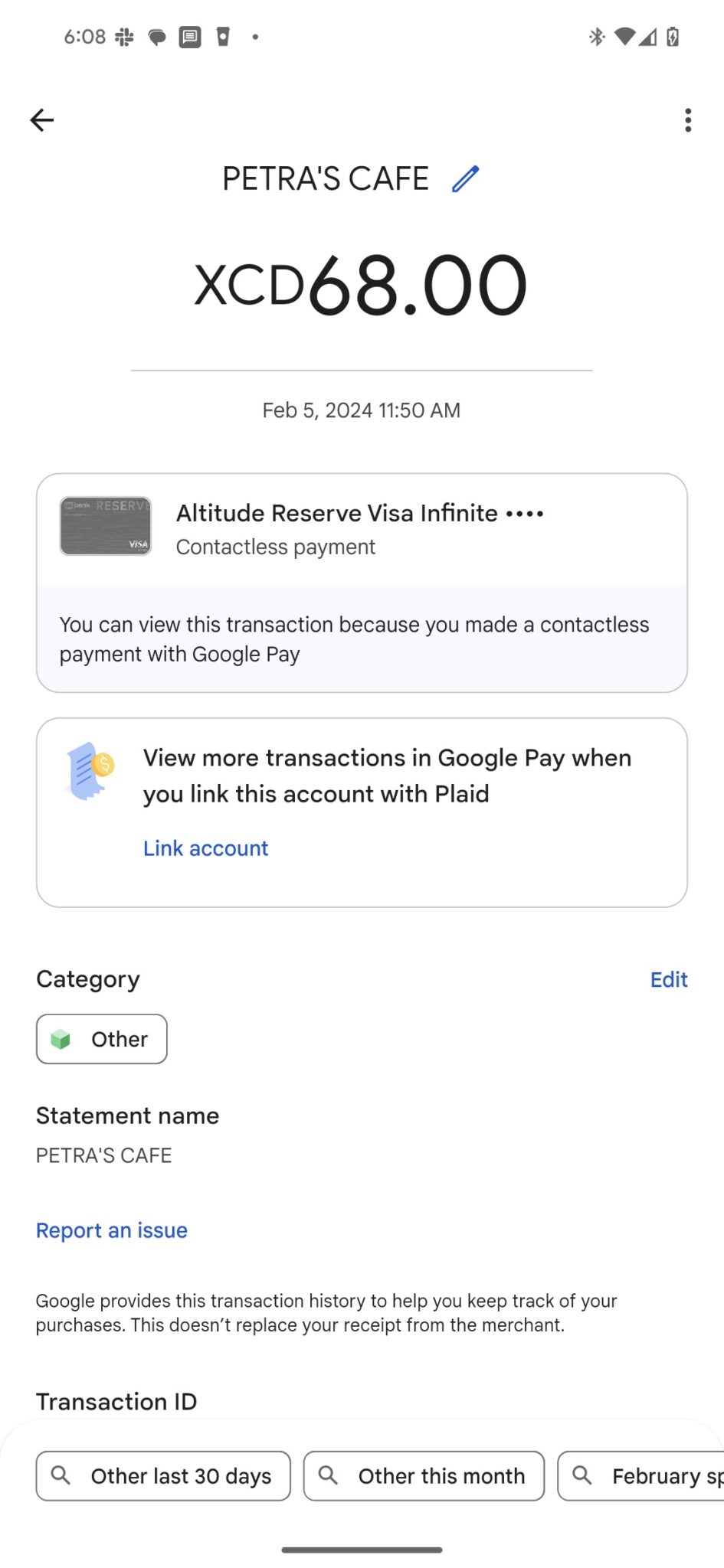

In trying to comb through my own transactions, I found the existence of that Google Pay transaction history to be incredibly useful. You can click on an individual transaction to see more detail and in this case easily verify that I paid with the Altitude Reserve via contactless payment with Google Pay.

In fact, after a bunch of cross-referencing purchases (which in some cases was a slow process because Google Pay was reporting the total spent in local currency whereas the Rewards page on U.S. Bank was showing the US dollar converted total and names of merchants didn’t always match up), I came to realize that the Google Pay app / desktop site only show transaction history for transactions where you successfully used Google Pay for contactless payment. Purchases like the ones I made via the Chrome browser and clicking on the Google Pay checkout option did not show up in my Google Pay transaction history at all.

Ultimately, I think that’s why those other purchases did not code as 3x mobile wallet purchases — Google clearly doesn’t even internally code those as “Google Pay” transactions.

To be clear, Apple Pay users long reported contrary data points: until the glitch of 2024, Apple Pay users had been reporting that they earned 3x everywhere they used Apple Pay — including on desktop sites or in apps where Apple Pay could be used to pay the total. I understand that many Apple Pay users have not received 3x on any Apple Pay transactions for months now, though I expect that will eventually be resolved.

I mentioned this above, but it bears repeating that reconciling the transactions from Google Pay with those on the US Bank website was a bit challenging. You’ll likely be looking at your Rewards detail page on the US Bank site, which looks like this:

If you compare that snippet above with the one from further above from Google Pay, you’ll notice a few discrepancies:

- The number of transactions in the screen shotted sections don’t match. That’s because the “Rewards” section includes transactions where I used the card itself rather than Google Pay. If I had a bigger screen shot from Google Pay, you’d also see some Google Pay transactions that I had put on a different card — so it takes some back and forth to line things up.

- The date on the transactions on the “Rewards” page does not always match the date on the Google Pay transaction. Unfortunately, there isn’t a consistent disconnect. The date on the U.S. Bank site was 1 or 2 days behind the date of the Google Pay transaction.

- Google Pay lists transactions in the currency in which you paid. U.S. Bank only shows the converted USD equivalent (in your credit card transaction history, you can expand the transaction and see the original currency charge, but in the Rewards dashboard, there is no more detail beyond what you see above).

- Merchant names don’t always match. An obvious example is “Total Les Abymes” on my Rewards history, which shows up as “TotalEnergies” via Google Pay. That’s pretty close though. A more interesting example is the transaction dated February 3rd on Google Pay that says “United States Department of Defense” on Google Pay for 69.90 EUR. I assure you that I didn’t buy anything from the DOD. In the Rewards history, you can see a charge dated February 5th for $76.19 from “Distribio a Les A” — after expanding the transaction details on my credit card transaction history page, I could see that charge was made in Euro at 69.90 — so that’s the “Department of Defense” charge. After some Googling, I came to realize that (I believe) this was a charge from a gas station in Guadeloupe before returning our rental car. Somebody explain to me why that coded as the US DOD?

Therefore, reconciling transactions can be a paid if you have a lot of transactions. Still, I found this helpful despite being time-consuming as I was able to verify when a transaction (like the $6.46 one from “Total” above) didn’t show up in my Google Pay history and then was likely a case of me using the physical card because it happened to literally be at the top of my wallet (which happens sometimes when we’re traveling since I now use it for rental cars and when checking into hotels).

Bottom line

The U.S. Bank Altitude Reserve card can be a powerful earner for day-to-day spend since most payment terminals within the US can now easily accept Google Pay, Apple Pay, or Samsung Pay. Outside the United States, tap-to-pay has long been even more broadly accepted (and is in fact the norm in many places). That has made the Altitude Reserve card incredibly valuable for me. During a trip to Europe over the holiday period, I used my phone to pay for almost everything as any business that accepted credit cards accepted tapping to pay. That has made this card a go-to daily driver in my household. It is the best card to use at our local warehouse club and on most in-person transactions thanks to the mobile wallet bonus and how easy it is to use.

It is worth noting that not all phones have the NFC technology necessary for mobile payment, so it’s worth checking your equipment before rushing out to get the card. That said, if your phone has the ability to make mobile payments, the Altitude Reserve is a powerful one to have in your (mobile) wallet.

All that said, Apple Pay users seem to have the best deal going since, apart from those affected by this year’s mobile wallet glitch, Apple Pay users report that in addition to tap-to-pay transactions with their phones or smartwatches, they also earn 3x when checking out with Apple Pay on websites and within apps when using Apple devices. The return on spend here probably isn’t enough to make you convert to the Macbook world, but if you’re an Apple user it sounds like you may love the Altitude Reserve even more than I do.

![Which Premium Cards are Keepers? [Updated w/ Strata Elite, Atmos Summit, and refreshed Platinum] Pile of credit cards with calculator on top](https://frequentmiler.com/wp-content/uploads/2025/06/Calculator-with-Credit-Cards-218x150.jpg)

[…] Reference […]

Thanks for the heads up about this. I checked my rewards activity (it only goes back for a cycle or two) and most of my spend (which was / is almost always tap and pay) did NOT receive the 3x mobile wallet uplift. So that sucks. I have normally not bothered verifying this since it was such a reliable card.

I called into the USB Customer Service desk – they picked up on 1 ring with a native English speaker – and they stated ‘no fix available yet, will be dealt with retroactively’ and suggested removing/readding the card to the mobile wallet. No courtesy points either.

Historically I have been very careful / respectful of USB, always abiding by the spirit of their program rules, but his has been very disappointing and makes question the overall value. Mobile Wallet is the whole reason for this card, and if that is not working, why use it?

I used Google Pay for the Altitude Reserve bonus for several years before I replaced my Android phone iwth a new Moto Android phone. I was quite surprised the new phone didn’t support Google Pay. That’s when I first heard about this whole NFC thing. Are there any (relatively) inexpensive Android phones that DO have NFC capability? I’ve also been waiting for this whole “Google Pay is being replaced by Google Wallet” weirdness to play out before looking for a new Android phone.

Does Garmin Pay work for the bonus? I like that because you don’t even need to have your phone with you to use it.

They only list Apple pay, Google pay, And Samsung pay as the available services. That said, maybe it codes similarly? I don’t know.

I’ll also note that I don’t need my phone with me to pay with my Pixel Watch. Some cards do require pairing to the phone every once in awhile, but like my watch has been paired to my phone all day that, so if I went for a run right now and left my phone at home, I would still be able to use my watch to pay for stuff while I was out and about. It essentially seems to save like a token on the watch somehow that passes the payment information to the terminal. I assume that needs to get renewed every so often from the phone connection. But the every so often isn’t even every day.

When we use Garmin Pay (e.g., use the fenix watch to pay the credit card machine), we are only getting 1X.

Thanks for the DP. I have a new Garmin watch coming that will have Garmin Pay and I would have considered it for this if it would work. Instead I will probably just put my BofA Premium Rewards to use as a 2.625% backup if I ever found myself needing to use it for payment in a pinch.

Another DP to watchout for is to remember setting your phone’s default language back to English if there’s another language used on the iPhone, when trying to re-add the USBAR back to Apple Pay. Took me 3-4 calls with USB’s regular and wireless payment special agents. I researched on Reddit and found this tip, then the re-add worked perfectly.

I’ve actually had luck on Android phones using Google Pay to make purchases online/in-app and get the 3x. It doesn’t seem to work on any sort of Google Play purchase (so in-app games, subscriptions to apps, etc.) but it seems to generally work when making mobile orders (such as in the McDonalds app.) I also find that it can work in the browser sometimes, though it’s hit-or-miss. Generally speaking, if the Google Pay button leads you to another website, it won’t work, but if it pops up the overlay on top of the browser/app, it will work. Kind of hard to explain, and YMMV, but it definitely works enough of the time that I find it useful.

My examples from the post were ones where the Google Pay button pops up the overlay — I didn’t get 3x on any of those (and I’ve tried multiple times).

Question: Do you see those in-app McDonalds purchase type things in your Google Pay transaction history in the Google Pay app?

It looks like my old transactions aren’t there or were removed, guessing because US Bank deleted the old card and I added a new card with a new card number about a month ago.

That said, I just did a transaction a couple minutes ago in the Subway app (gotta get that $6.99 6″ meal!) and it’s showing up on pay.google.com when I look at my transactions. I’d expect the transaction to earn 3x (it did before the new card) but I’ll confirm in a few days when everything posts/processes.

Following up – the purchase posted yesterday and I see in my rewards area that the purchase earned 3x.

Anyone have data points on Walmart pay and Kroger pay?

I have often wondered about wallpay?

I’m an Android user as well (Samsung S20 phone). I thought I had read that Google Wallet would be replacing Google Pay when it’s discontinued.

Yes, but I find it as clear as mud. Google Wallet is replacing it, but the way they have things worded basically says “you’ll continue to be able to use Google Pay through Google Wallet, but we’re discontinuing the app”.

Same thing.

Great post Nick, I just used Apple Pay for my car ins (Geico using the app). I have a hard time with real time rewards,I am never really sure what counts .

Progressive takes Apple Pay in the Progressive app as well.

If the card moves your needle, fine. Not enough for me. And, my experience with US Bank’s customer service was seemingly like Nick’s experience with Turkish Airlines’ customer service. Just wasn’t worth the frustration.

Nick. Great article. I forget if you have the venture x and if you do how do you use the 2 cards? Seems like with more opportunities to tap and pay having both cards could be redundant

I don’t use the Altitude Reserve for any type of shenanigans.

Holy moly. Apple user. Thanks to this post I noticed I’m only getting 1x on mobile payments. Growl. Should we call us bank?

It won’t help. They need to fix it, and they aren’t there yet (as Nick points out).

they have been offering some people points as compensation. A call can’t hurt

Great article Nick, what about Samsung Pay? Didn’t see any references to it in the article except in headline that it counts like Google and Apple pay.

Great question. I haven’t seen much data about Samsung Pay, so I don’t have a good sense as to when it might fail unexpectedly.

I use Samsung Pay for the most part with this card. It works much like Google Pay in that using the MST (AKA LoopPay) works much like a swipe in older Samsung phones that have that capablility.

Thanks!