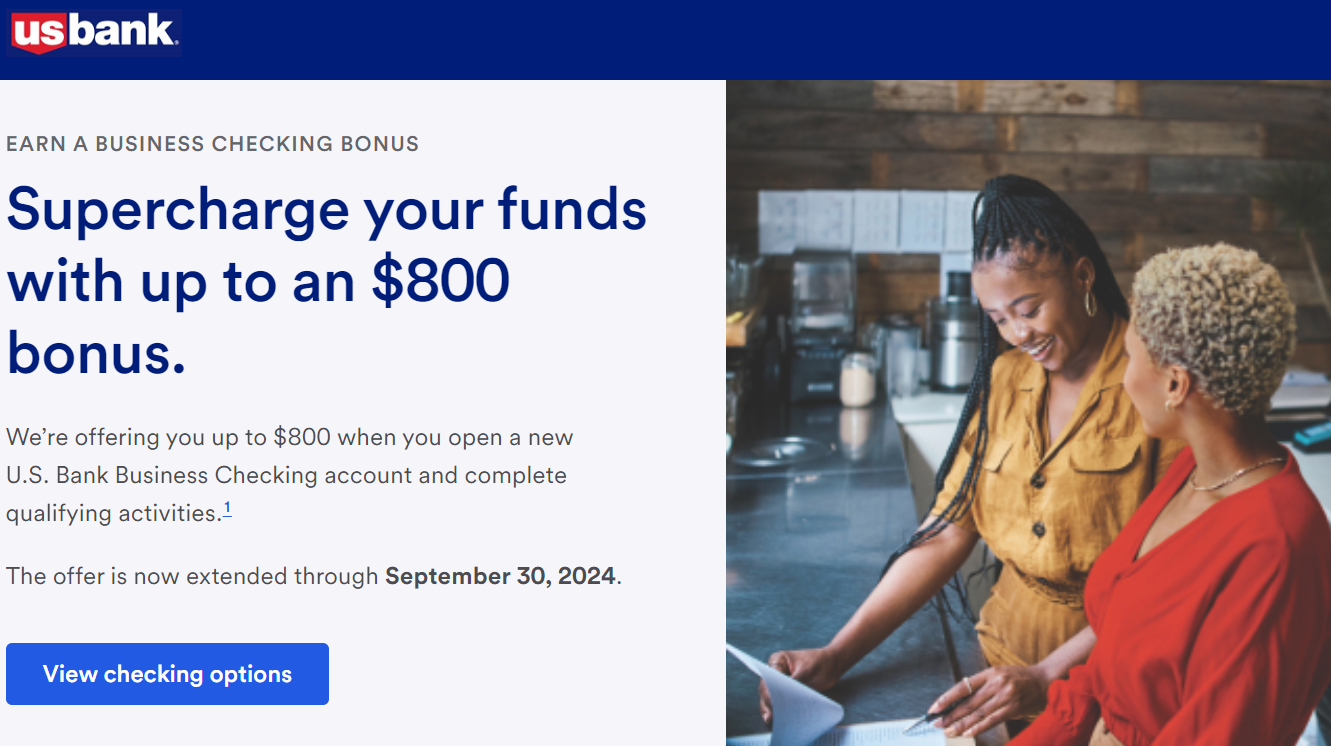

US Bank has a promotion for new Business Checking accounts that offers either a $300 or $800 bonus with very simply requirements. This deal is available in states within US Bank’s footprint (or for US Bank cardholders) and requires making one or more deposits totaling either $5,000 or $30,000 within 30 days, then holding that money in the account until 60 days after account opening. The total of the deposits will determine the bonus amount. $5,000 gets you $300; $30,000 gets you $800.

US Bank seems to again be allowing up to $3,000 of credit card funding on new accounts, so use it if you got it.

The Deal

- US Bank is offering a bonus of $300-$800 when opening a U.S. Bank Business Checking account (Silver, Gold, Platinum) using promo code Q3AFL24 and completing the following requirements within 30 days of opening:

- For the $300 bonus, complete one or more deposits totaling $5,000 or more and maintain the balance for 60 days from account opening

- For the $800 bonus, complete one or more deposits totaling $30,000 or more and maintain the balance for 60 days from account opening

- Expires 9/30/2024

Terms and Conditions

- This offer is only valid for new business checking customers, existing customers (businesses) with a business checking account or customers (businesses) who had an account in the last 12 months, do not qualify.

- Earn your $300 Business Checking bonus by opening a new U.S. Bank Silver, Gold, Gold with Interest, Platinum, or Business Essentials (Only available in certain markets) Business Checking account between 7/3/2024 and 9/30/2024. You must make deposit(s) of at least $5,000 in new money within 30 days of account opening and thereafter maintain a daily balance of at least $5,000 until the 60th day after account opening.

- New money is considered money that is new to U.S. Bank. Funds must come from outside U.S. Bank and cannot be transferred from another U.S. Bank product or a U.S. Bank Affiliate.

- Earn your $800 Business Checking bonus by opening a new U.S. Bank Silver, Gold, Gold with Interest, Platinum, or Business Essentials (Only available in certain markets) Business Checking account between 7/3/2024 and 9/30/2024. You must make deposit(s) of at least $30,000 in new money within 30 days of account opening and thereafter maintain a daily balance of at least $30,000 until the 60th day after account opening. The new money cannot be from an account at U.S. Bank or its Affiliates.

- The business checking bonus will be deposited into your new U.S. Bank Silver, Gold, Gold with Interest, Platinum, or Business Essentials (Only available in certain markets) Business Checking account within 30 days following the last calendar day of the month you complete all of the offer requirements, as long as the account is open and has a positive available balance.

-

Monthly Maintenance Fee Waiver Options: Gold Business Checking: U.S. Bank Payment Solutions Merchant Banking OR $10,000 average collected balance OR $20,000 combined average collected business deposit balances OR $50,000 combined average collected business deposits and outstanding credit balances. Platinum Business Checking: U.S. Bank Payment Solutions Merchant Banking OR $25,000 average collected balance OR $75,000 combined average collected business deposits and outstanding business credit balances.

Quick Thoughts

This is an easy checking account bonus, as the requirements are very simple: make deposits totaling $5000 or $30,000 within thirty days of account opening, hold the money in the account for 60 days after account opening and sign-up for online banking. That’s it.

Since you can open an account with as little as $100, you don’t need to deposit the remainder until day 25-30. After 60 days (from account opening), you just need to maintain a positive balance until the bonus gets credited (US Bank gives themselves up to 45 days to do that). So, you shouldn’t have to leave the full amount in the account for longer than 30-35 days.

There’s three different types of business checking, but you can get the bonus by signing up for Silver, which has no maintenance fees. The account is limited to 125 transactions per month and then each transaction gets charged a $.50 fee, but, why would you do more than 125 transactions in a month?

There’s two other levels that have increased transactions levels, but also have maintenance fees that require a relatively significant balance to waive, so there’s really no reason to do one of those instead of the free Silver account.

US Bank bonuses hare usually been limited to those states that have a US Bank branch (which is a wide net…see locations here). If you live in one of the states that doesn’t have a branch, you used to be able to get around this requirement by opening a US Bank brokerage account first and then opening the checking account afterwards. Based on previous comments, it sounds like US Bank may have closed that loophole but instead is now allowing folks with a US Bank credit card to open checking accounts, even if they’re outside of the US Bank footprint. YMMV.

US Bank seems to be fairly strict on its churning rules so I wouldn’t mess with it if you’ve had an account or received a US Bank bonus within the past year. If you haven’t, this is easy money.

Does someone have a screenshot of the TnCs? Now US bank is saying this offer required a Platinum account for the $800 offer.

Did anyone help you with this? I got screwed by this too. Got told by the rep that i only got 300 because i had a SILVER despite having 30k in my account.

I just waited and automatically got 800! Guess the rep on the phone was mistaken in whatever he was reading

Thank you so much! Did you need to provide them a screenshot of the terms or did you just insist the rep misread?

Is there an ETF? Not finding any mention of it in the terms?

anyone have any experience funding the account with an American Express credit card? particularly if it counts towards welcome bonus spend? I know this can be tricky.

Just did this a moment ago up to the $3,000 limit. We’ll see if Amex Biz Platinum accepts this as an eligible expense toward the SUB.

Any update on if it went through ok?

Yes, it counted toward the SUB. Spent just over $20K altogether and got the 250,000 MR points.

Does anyone know if you can get both the $800 business checking and $450 personal checking bonuses with US Bank? I’ve never banked with them previously so I’d be a new customer in both scenarios and would like to take advantage of both offers if possible.

Does the credit card 3000$ post as a charge or a cash advance?? Does that depand on which card used?

Us bank asked for business proof in the past when we applied for credit cards as sole proprietor are they still doing that since then?

Not sure what you mean by “business proof,” but I’ve applied for 5 USB business cards in the last 6 months as a sole proprietor (between P1 and P2) and was auto-approved with no issue.

The previous US Bank Business Checking offer (which ended on 8/31) was a little better:

I was able to do a $3,000 account opening deposit with my Citi Double Cash and the transaction posted as a normal purchase (earned 2% cash back x $3,000 = $60 cash back).