This week, an unlikely assassin makes a stealthy return as US Bank unveils its new real-time mobile rewards benefit — which could be a game-changer if it catches on. If you have a friend with benefits, you might be able to enjoy Globalist status without staying sixty nights. Speaking of benefits, I forgot about an important benefit I’d lose when creating multiple Amex logins. All that and more in this Frequent Miler week in review.

How to buy more than 30K SPG points

SPG points are the currency with which I hate to part most. It’s always a conundrum — they are so valuable that I’d love to keep them, but they’re only valuable if I use them. While I love to earn miles and points without cost or with very low cost, I have to admit that I’m tempted by this sale. As I already have both SPG cards I’m not eligible for the newly increased 35K offer, and I’ll only earn so many points through spend before the programs eventually merge. I’ve got my eye on more than one Marriott Travel Package redemption, where I’ll get plenty more value than the cost of the points…..so I might consider trying to bulk up my balance. If you’re looking to do that but you want more than 30K, see this post to find out how.

A drawback of multiple Amex logins

Since sometime last year, I’ve been creating new logins for newly-approved Amex cards in order to make sure I’m able to take advantage of slow-rolled Amex Offers. But there was one thing I didn’t consider in separating my login for my new Amex Hilton Aspire card — and I’m going to have to switch things around to fix it.

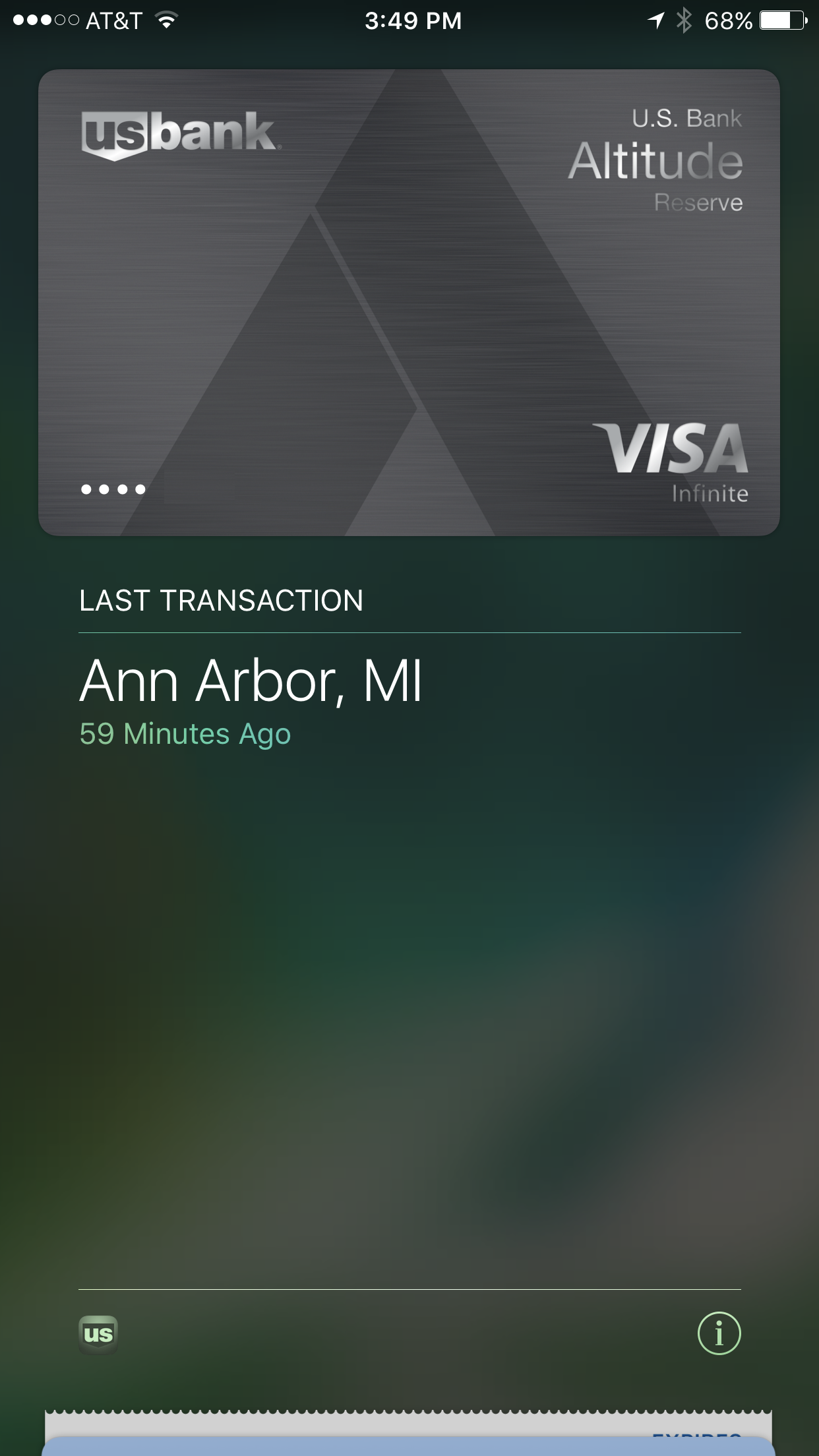

A second look at US Bank’s Altitude Reserve

When the Altitude Reserve was first announced, I called it dead on arrival — a card so generous with regard to mobile payments would be so abused my manufactured spenders as to lead the card to an early demise. It turned out I wasn’t that far off — US Bank immediately shut people down for the tiniest amounts of manufactured spend. However, with the new method of redeeming points, this card might have just become the go-to “everywhere else” card for unbonused in-person spend for those with the right kind of phone or watch. Due to Samsung’s proprietary technology, mobile payments are possible at almost any payment terminal with a Galaxy phone or Gear S3 watch (far more than just the places that take Apple Pay or Android/Google Pay). I have none of the above — not the card, the Galaxy, or the Gear….but those who do will want to check this out for sure.

What’s the best Chase card that’s not subject to 5/24?

Is it the IHG card? The Hyatt card? The Ritz? Some people took me to task in the comments for not showing any love to the British Airways card. I didn’t strongly consider that card because of the high opportunity cost and relative ease of picking up Avios via Ultimate Rewards and/or the shopping portal. That said, the commenters weren’t wrong to say that one could also be worth more of a look — though I’d still stick with my picks on this one, both objective and subjective.

Mercedes-Benz Platinum discontinued; get 60K while you can

While we don’t normally include “deals” in the week in review, this one seemed important enough to make sure you don’t miss it. American Express is discontinuing its relationship with Mercedes-Benz and the associated credit cards are being discontinued in January 2019. This makes for a good opportunity to jump on a signup bonus that you will eventually no longer be able to get. I’m not sure if you’ll have a chance to pick up a free $100 in Mercedes-Benz swag, but the juice is still worth the squeeze on this one. Will they continue taking applications until the card is discontinued in 1/19? It’s hard to say, but I’d bet that the application disappears before then, so this is one to consider sooner rather than later. With tax time creeping up on us, it should be easy for those of us paying taxes to meet the minimum spend.

How to get top-tier Hyatt elite benefits without status

They say sometimes it’s not what you know, it’s who you know with Globalist status. Hyatt has a generous program in that they allow top-tier members to share their status with others through a Guest of Honor program. The perks are excellent and can save you a bundle if you have a friend with benefits who is willing to share. However, see the warning within for why it’s not a good idea to try this with paid stays.

That’s it for this week in review. Check back soon for our week in review around the web and this week’s last chance deals.

![Maximizing free night certificates, award booking for beginners, and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2024/07/Sailrock-Resort-SLH-218x150.jpg)

![Why you might want to stop spending on Delta cards (and start spending on Hilton cards?), misAAdventures, and more [Week in Review] a room with a bed and a television](https://frequentmiler.com/wp-content/uploads/2023/01/img_1508-218x150.jpg)

![The British are coming (for your favorite award sweet spots), maximizing Platinum, dumping Gold, and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2024/07/British-Are-Coming-for-DL-AA-AS-218x150.jpg)