It’s no secret: we like to stack deals. This week, we talked about some good stacks and how to get as much as you can back. Whether you’re looking to increase your spend while decreasing your cost or you’re looking to choose the right tool for the job (i.e. the card that provides maximum return), we’ve got you covered. Here was this week at Frequent Miler:

Stacking for big discounts on unique hotel experiences

This week, Staples has had a discount on Hotels.com gift cards. Not all Staples stores carry them, and according to reader comments some stores that do have been sold out since last weekend. However, if you can find a store with stock, it might be worth picking up a couple for the ability to stack them into a decent savings on the unique / non-chain hotels that usually qualify for Hotels.com promotions.

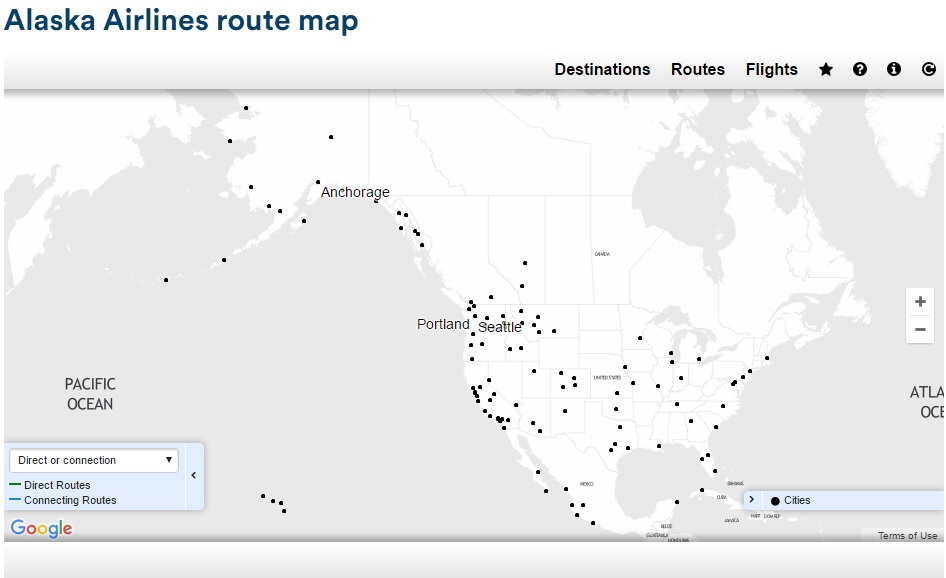

Can you split payment for Alaska Airlines companion fare?

A reader asked an excellent question — he wanted to stack his $250 annual Citi Prestige air travel credit with his wife’s in order to maximize his discount on an Alaska Companion fare. We took a stab at an initial solution that did not prove to be the one. After completing a test of the alternate method, there will be an update to this story to come this week. Thanks to reader Larry for asking a good question and to Elizabeth who promptly responded to this post to offer a data point. More to come this week.

Increase credit card spend (and get most of it back). What still works March 2017?

Whether you’re looking to gain or maintain status, meet your minimum spend, or just increase the rewards you earn, we publish a monthly reminder of what’s new in the world of spending a lot…without spending much. See both what has changed this month and the link to our complete guide with all of the details you need.

Real world extreme stacking in-home dining and more

As you can probably imagine, I hate to pay more when I know I could have paid less. But I’d be lying if I said I’ve never overpaid for a gift like steaks. Greg shows us how to pile up big time savings on a range of specialty food products that are great for gifts — whether for someone else or yourself.

Best cards for grocery store spend, and dining, and…

Let’s face it: life is expensive. A guy’s gotta eat….and put gas in his car…and pay for hotel rooms….and get a train ticket at a kiosk in Europe….and get as much of that money back as possible. And, ladies and gentlemen, Greg has crunched the numbers and created the resources so you can do just that. Read the introduction to the revamped Best Category Bonuses page and bookmark the page so you can keep on top of new developments to make sure that you’re getting back as much as you can.

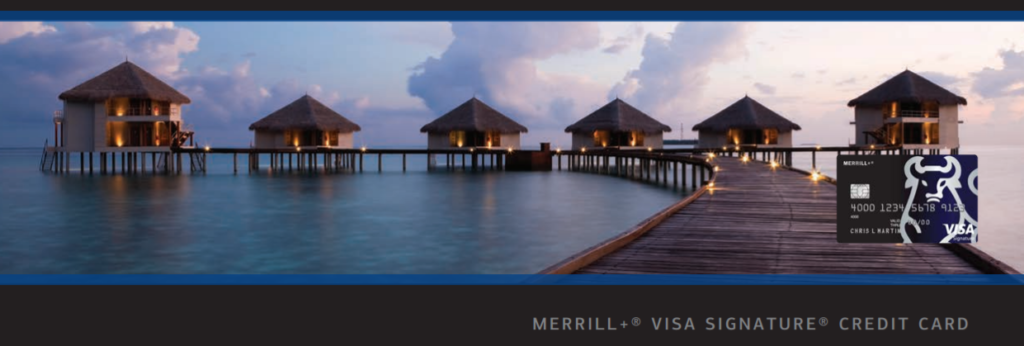

$1000 worth of airfare? Sure. $50K spend? Maybe not.

The reappearance of the 50K point Merrill+ Visa Signature offer has been met with excitement by credit card enthusiasts for its generous sign up bonus. It is beyond rare to see a signup bonus this valuable on a card with no annual fee. But is the card worth continuing to use after meeting the required spend for the signup bonus? Greg analyzes the value of the big spend bonuses on the card to determine whether this card should be in your wallet or your sock drawer.

Suite deals in Las Vegas with American Express Fine Hotels & Resorts

Finally, for Friday, we took a look at how American Express Fine Hotels & Resorts can provide a decent value in Las Vegas. There’s no doubt that Amex is making a push to try to enhance the benefits of both the personal and business Platinum cards. But let’s not forget that the Platinum cards have long held strong value. With this look at a benefit that’s an oldie but goodie, we see one of my favorite benefits of the Platinum cards: Fine Hotels & Resorts for scoring a sweet deal on a decent suite in Vegas.

That’s it for this week at Frequent Miler. Check back for the scoop around the web and your last chance at this week’s expiring deals.

![Viral marketing proves infectious for two more airlines, a new card lands with a thud and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/06/viral-airline-marketing-218x150.jpg)

![Prices rise, benefits cut: The new normal coming for ultra-premium cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/06/Increasing-fees-218x150.jpg)

![Juicy rumors, but how far will cardholders be squeezed? [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/06/Juicy-rumors-218x150.jpg)