NOTICE: This post references card features that have changed, expired, or are not currently available

This week around the web, a couple of personal finance-related posts caught my eye. While I haven’t ever redeemed my miles at 1c each for gift cards — does it make sense in some scenarios? I’ve argued no in the past — but maybe I’ve been persuaded. Is your approach to personal finance to enjoy life while you can — or to sock it all away now so you can enjoy more later? All that with some nostalgia and discounts to boot in this Frequent Miler week in review around the web:

Actual vs. Speculative Value, and why I Plan to Cash out My Rapid Rewards Points

I spent about the first half of this post completely disagreeing in my head — I didn’t initially think it made sense to value the points at less than current redemption value simply because they might devalue before you can use them. Of course, the more I thought about it, the more I realized that Leana at Miles for Family was right about that — after all, points you aren’t using aren’t buying you much value (though, I would note that Leana could use her Rapid Rewards points for that dream trip to Costa Rica). I personally value Rapid Rewards points even a bit more highly than their redemption rate because of the flexibility they provide — I can speculatively book trips and decide up to ten minutes before go time whether or not I’m going to take the trip (whereas I’d only get a voucher food for a year from the date of booking if I made a cash booking, the points just pop back into my account). But when I got about halfway through the Now or Never section of this post, I got on board with Leana’s plan: the long-term cash value of investing for retirement far outweighs the value of holding the points. And so that’s a long winded way of saying that this post was a good reminder that the best value play isn’t necessarily booking an unnecessary trip.

How I view personal finance

While in the summary above, I just advocated for cashing out points at 1c each in order to invest towards retirement, but I’m definitely not a FIRE guy. This post from Miles Per Day really captured my general approach to personal finance: save more than you think you need and find a side hustle — but don’t forget to live. I find the FIRE movement interesting to read about, but I’m not really drawn to the concept of retiring early. I enjoy what I do and my side hustles. I do value financial security, so we do make an effort to both save and invest, but I loved Vinh’s take on balance. I didn’t marry rich…..but lucky for me, neither did my wife. 😀

What people born in the 2000’s will never understand about travel

Gosh, am I getting old enough to feel nostalgic? Gilbert Ott at God Save the Points ruins the illusion of my perpetual youth by reminding me that I am old enough to not just remember these, but to clearly remember them. A year or two ago, my wife and I stumbled on an old roll of film we had never developed….getting the pictures back provided the disappointing reminder of just what poor photographers we were back before you got a thousand takes at the same shot.

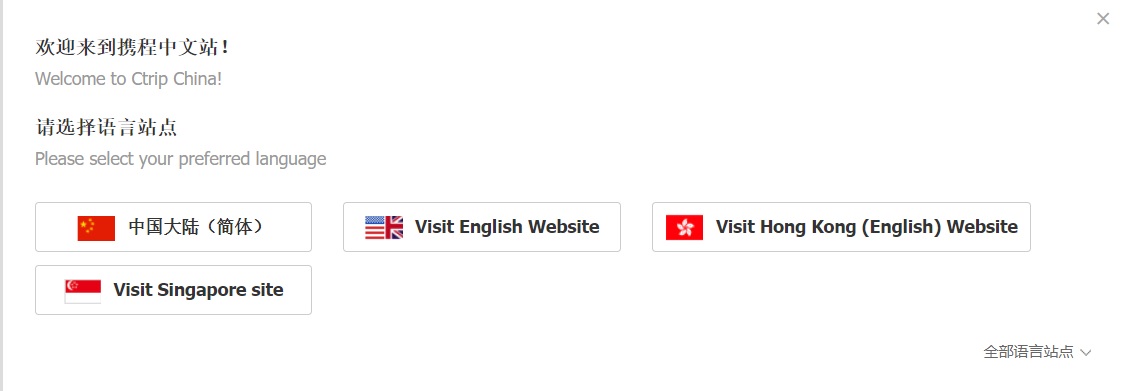

Some British Airways Fares 40% Cheaper On Ctrip – Whats The Catch?

Years ago, I was living in Ecuador and booking a flight from Cuzco, Peru to Lima on what was LAN at the time. I had the language on the airline website set to English and had been pricing things out. A few hours later, I must have brought up a different browser and the site came up in Spanish. Rather than take the second to switch the language, I went ahead and searched….and found that the price was about 27% cheaper. I then brought up a different browser and searched in English — nope, the price on the English-language version hadn’t changed, they were just charging foreigners more :-). I don’t often find that kind of difference, but every now and then you stumble on a flight pricing differently out of a foreign market or on a foreign website. Despite having known about Ctrip for years, I’ve never used it much. This post from Loyalty Lobby will have me taking a look.

That’s it for this week around the web. Check back soon for this week’s last chance deals.

![A Marriott that’s an actual prison, United/Emirates partnering, a $900 credit card/bank bonus and more [Saturday Selection] a woman sitting on a beach with her hands out](https://frequentmiler.com/wp-content/uploads/2023/04/Untitled-design-2023-04-07T181036.038-218x150.jpg)

Hi, Nick! First of all, thanks for the link. I enjoy your round-ups as well as original content.

The decision to cash out Rapid Rewards points wasn’t an easy one. I went back and forth on whether it makes sense or not. I absolutely love Southwest and agree with you on the fact that it’s the most flexible airline currency around. We’ve canceled our flight once 30 minutes before the departure and got all of our points back. An absolutely wonderful feature, no doubt.

That said, this has been an unusually expensive year for us in terms of travel. I don’t like the idea of not funding an IRA, so this seemed like a reasonable compromise. Also, I don’t like to hoard currency that I’m unlikely to use within a three-year period. And at the moment, Southwest falls into that category.

You are right that Southwest flies to Costa Rica, in fact, they just added non-stop flights from FLL. However, Orlando is much more convenient for us, and Jet Blue is the only airline that flies non-stop from MCO to SJO.

There is a decent chance that I will regret my decision, and I don’t think it’s a good option for those who use Southwest frequently. If you absolutely have to fly to visit relatives and Southwest serves that route, it would be downright crazy to burn points at 1 cent apiece when you can get 1.5 cents. As they like to say in our hobby, YMMV

P.S. Sorry for the long-winded comment!