NOTICE: This post references card features that have changed, expired, or are not currently available

When I started this analysis, I was nervous. For years, I’ve been telling people that Hyatt points are worth “around 1.5 cents each. If this new analysis showed that Hyatt points were worth significantly less than 1.5 cents each, then that would mean that I’ve been giving people bad advice. It turns out that I needn’t have worried. In this new analysis, I found that Hyatt points are worth 1.6 to 1.65 cents each.

In order to determine the value of Hyatt points, I collected real-world cash prices and point prices. As I’ve done previously in analyses of other hotel loyalty programs, I examined 7 major hotel markets in the U.S. (Chicago, Denver, Houston, Los Angeles, Miami, New York City, and Seattle). Within each market, I identified the top 3 TripAdvisor ranked hotels that are bookable with Hyatt points, and I recorded both cash and award prices for three dates each: a weekday, a weekend, and a holiday weekend.

- Why U.S. only? U.S. consumers are known to spend most of their points and miles on domestic travel. Since the majority of this blog’s audience resides in the U.S. we opted for a U.S. centric view of point values.

- Why TripAdvisor? The goal wasn’t to find the 3 best Hyatt hotels in each market. Instead, the goal was to find the 3 Hyatt bookable hotels (including SLH properties) that are most popular. Which ones are people really likely to book? Since many people use TripAdvisor to pick hotels, this seems like a good way to identify those hotels.

- Which paid rates were selected? I always picked the best refundable paid rate shown on Hyatt’s website, but without applying any discounts like AAA, military, government, etc.

- What about point earnings on paid rates? An ideal analysis would include the value of point earnings on paid rates. For simplicity, this was not considered in this analysis. This decision has the effect of slightly over-valuing Hyatt points.

- What about taxes and fees? For simplicity, taxes, resort fees, and other fees are not included in this analysis. This decision has the effect of under-valuing Hyatt points.

- Which specific dates did I use?

- Weekday: Wednesday September 15th

- Weekend Day: Friday October 15th

- Holiday Weekend Day: Friday July 2nd. When that date wasn’t available for both points, and cash, I looked next at Saturday July 3rd, and if that wasn’t available I then looked at Friday November 26th (Thanksgiving weekend). Only one property wasn’t available July 2nd and with that one I had to switch to Nov 26.

Results

| May 4th 2021 Analysis | |

|---|---|

| Point Value (Median) | 1.65 cents |

| Point Value (Mean) | 1.76 cents |

| Cash Price (Median) | $228 |

| Cash Price (Mean) | $261 |

| Point Price (Median) | 15,000 |

| Point Price (Mean) | 15,286 |

The median observed point value was 1.65 cents per point. This means that half of the observed results offered equal or better point value and half offered equal or worse value. Another way to think about it is that without trying to cherry pick good awards, you have a 50/50 chance of getting 1.65 cents or better value from your Hyatt points when booking free night awards.

Peak and Off-Peak Pricing

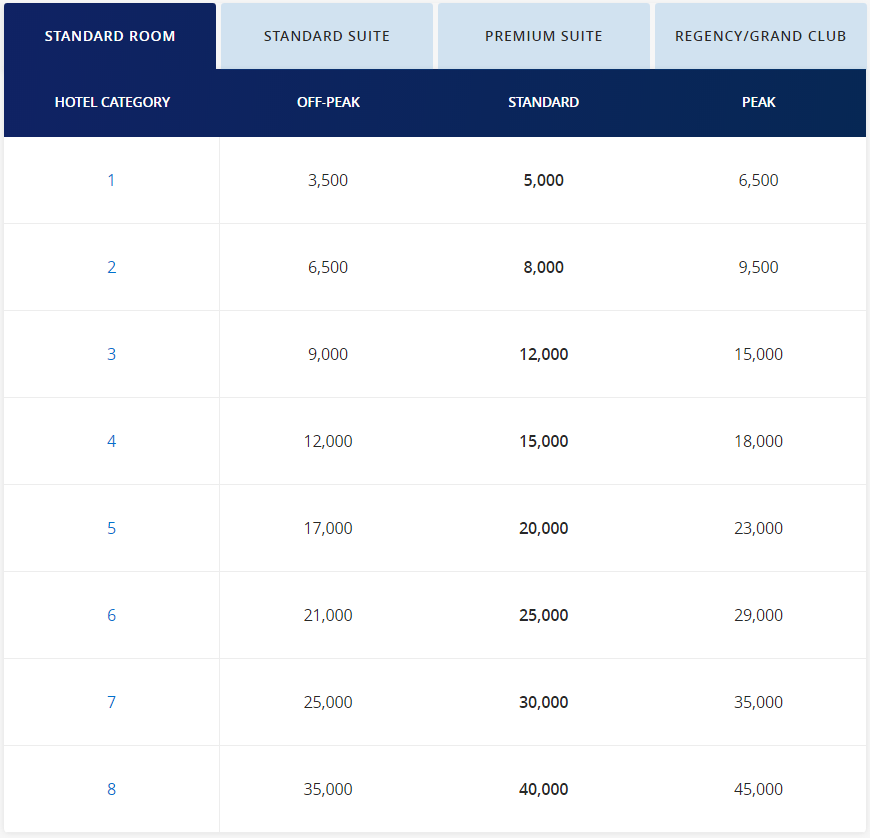

Hyatt is planning to introduce peak and off-peak award pricing in July 2021. The following chart shows the new pricing for standard room awards:

I don’t have any way to know exactly how Hyatt will determine which hotels should be priced standard vs peak vs off-peak, but I did want to estimate what this change may do to point values…

Estimated Peak/Off-Peak

In order to estimate peak and off-peak award pricing, I made the assumption that all of my original data points (which were based on standard pricing) with an individual point value between 1.2 and 1.8 cents per point would be priced standard while those under 1.2 would be off-peak priced and above 1.8 would be peak-priced. I also modelled a worst case unrealistic situation where everything was peak priced. Here’s how those assumptions changed the results:

| Standard Pricing | Peak and Off-Peak Estimates | All-Peak Pricing (not realistic) |

|

|---|---|---|---|

| Point Value (Median) | 1.65 | 1.60 | 1.33 |

| Point Value (Mean) | 1.76 | 1.62 | 1.43 |

In the very unlikely case that Hyatt prices everything Peak, median point prices would drop to 1.33 cents per point. In the much more realistic estimate of peak and off-peak pricing, we see that the median point value is 1.60. That’s not as good as with all standard pricing (1.65), but it’s not too bad of a drop.

New Reasonable Redemption Value

Our Reasonable Redemption Value (RRV) for Hyatt points was previously set to 1.5 cents per point. RRV’s are intended to be the point at which it is reasonable to get that much value or better for your points. In general, I prefer to err on the side of caution rather than overvaluing points. And so, rather than using the observed mean (1.76) or observed median (1.65), I decided to use the median from the estimated peak/off-peak analysis. That’s my best current guess of the long-term value of Hyatt points. Once Hyatt introduces peak and off-peak pricing in July, I’ll redo the analysis and update the RRV if needed. For now, though, we have this:

Reasonable Redemption Value for Hyatt: 1.6 cents per point

The Travel Boom

The U.S. is currently undergoing a boom in domestic travel. As a result, we can expect cash rates to be higher than usual. With programs like Hyatt that have fixed pricing based on hotel categories, higher cash rates lead to higher point valuations. I’ve adjusted for this a bit by using the peak/off-peak analysis to determine our Hyatt RRV, but it’s possible that that alone isn’t enough of a correction. In other words, it’s possible that if/when hotel prices drop down to a new normal, we’ll see lesser value in Hyatt points. To account for that possibility, my intent is to redo this analysis at least once per year. This will lead to regularly revising the Hyatt RRV if we see very different results.

Conclusion

It turns out that the old advice that said Hyatt points were worth “around” 1.5 cents each was a good but overly conservative estimate. In my latest analysis, I found a median value of 1.65 with actual data, and a median of 1.6 with estimated peak and off-peak award pricing. Since the 1.6 number is my best estimate of the long-term value of Hyatt points, I decided to use that number as our new Hyatt RRV.

@ Greg — Why is Chase RRV < Hyatt RRV? That doesn't make sense to me.

I know… it’s frustrating to me but I haven’t figured out what to do about it yet. We could increase the RRV for UR to match or slightly exceed Hyatt, but then we’d be overvaluing the UR points for people who use points for other purposes (such as redeeming for 1.5 cpp with Sapphire Reserve). Alternatively, we could artificially cap the Hyatt value at whatever our value is for Chase UR points.

We had a similar problem years ago when it was possible to transfer UR points to Amtrak. If a niche program like that offers much better value, do we increase the overall value of the transferable points? Hyatt isn’t nearly as niche, but it’s a similar issue.

Hyatt is my favorite chain (despite their smaller footprint), largely due to the high value of their points (and lack of dynamic pricing) which can be earned on their WOH credit card. On this particular CC, earning only 1 point per dollar of spend is still a decent return (1.6%), and doubled on bonus categories such as restaurants.

Here’s hoping that the move to peak pricing doesn’t begin a slippery slide down for World of Hyatt.

I would note that Hyatt points are even more valuable if you are a globalist because of all the valuable free stuff they give you (breakfast, upgrades, parking) at many of their hotels.

Guaranteed 4pm checkout can make the end-of-stay worth another half-day, too.

Having stayed in a lot of Hyatts pre-pandemic, and same ones repeatedly, I built up a pretty strong sense of their cash-price values, i.e., what I would be willing to pay in cash for a stay. This led me to fix my over-under on points at two cents — I use Hyatt points when my sense of their value is at least two cents.

But — to circle back to Iahphx’s point — a lot of my sense of the cash-price values had to do with what I perceived to be the entire experience at a stay, including breakfasts (some of which can be super-fun, like at Andaz San Diego, PH Washington, etc.), late checkouts, etc. However, I don’t know how long it will be until staying at a hotel, including a Hyatt, feels like fun again.

So for now I think I’ll drop my valuation down to Greg’s, which also means I’ll be slightly less promiscuous in “paying for” UR points with various Chase cards.

Well… I’d say that your stays are more valuable but not your points. You get the same perks if you pay cash. The one exception is free parking as globalist does make your points more valuable since it doesn’t apply to paid stays.

Did you use Hyatt member rates, which are often significantly lower than non-member rates? Assume everyone here would be booking a member rate.

Yep. In a couple cases there was another rate available that was even cheaper (and still cancelable) so I used that, but most of the time I used member rates.

I really like the way you approach these. While we could certainly pick about which cities in a given state, there is one state that I would suggest adding: Hawaii. Whether it is state-wide or specific island/city I’m not sure, but this seems like a big domestic destination for award travel – especially for all of us on the west coast.

That’s a good suggestion. I’ll consider it for a future version.

Okay, made an attempt at the analysis, but was having a hard time getting top hotels statewide in trip advisor. Some numbers for the top 3 (& only 3) in Oahu:

Hyatt Centric @ 15kpts: 9/15: $223 (1.49c/pt), 10/15: $223 (1.49), 2/18/21 President’s Day weekend was the first holiday weekend I could find: $252 (1.68)

Hyatt Place Waikiki @ 12k: 9/15: $171 (1.43), 10/15: $180 (1.50), 11/26: $189 (1.58)

Hyatt Regency @ 20k: 9/15: $216 (1.08), 10/15: $216 (1.08), 7/2: $243 (1.22)

Median/Mean (of a very small set):

Cash: $216/$213

Point Value (c/pt): 1.49/1.39

Points: 15k/15667

Using your offpeak methodology would only adjust the Regency (but I have a hard time seeing it off-peak for holiday weekend and will blame it on covid)…

Point Value: 1.49/1.46

Points: 15k/14667

A couple of thoughts on this… Are higher end properties generally better returns on points? Is Hawaii just a lousy points destination due to demand? Are leisure destinations generally worse?

Ran the numbers on one more site just to see:

Grand Hyatt Kauai @ 25k: 9/15: $522 (2.09), 10/15: $636 (2.54), 11/26: $465 (1.86).

This would put the resort in peak year round, dropping point values by about 14% – still at 1.6 or higher.

My best guess of what’s happening here is that Hawaii hotels tend to be put into higher categories than the same hotels would be in other markets. You’ll see much better value (if you can find award availability) during popular times to go to Hawaii such as Christmas break, spring break, etc because cash prices will be much higher. I saw similar results in the Miami Beach market: point values were much lower than other markets I looked at.

Not including taxes and fees is a major undervaluation. These can routinely add thirty percent to the total in certain markets.

I agree, but I need a process that is easy so that I can repeat it over time and with other hotel programs. If I add the full taxes & fees, it would add just enough work to make this hard to do (especially with resort fees which aren’t always easy to find out). So, I’m settling on “good enough”. I always prefer to err on the conservative side and under-value points rather than over-value them, so I’m OK with this trade-off.

We really need legislation or industry standard of displaying final price to consumer with searches.

Respect and appreciate your algorithm for picking hotels, but if you ever have a spare week or so I would be interested in seeing the same analysis done for different markets — UK, Western Europe, Eastern Europe, India, SE Asia, Japan, etc. This might help determine whether there are any interesting market-based quirks (such as the otherwise uninteresting Choice programs value in Scandinavia).

That would be interesting… It’s that part about having a spare week or so that isn’t ever likely to happen. If you’d like to run the analysis, I could show you how to do it and then I’d write up the results 🙂

Do you have API access to pricing and availability in both points and cash, or do you have to do the lookups manually?

I do it manually

I can’t remember if it was you or someone else who did a hotel program comparison, but I always find it interesting how the programs are all essentially the same:

Ignoring any promotions:

If you have the Hilton Aspire you earn 34x per $1 spent at Hilton (20x Diamond, 14x card)

If you have the WOH Visa you earn 9.5x per $1 spent at Hilton (5.5x Discoverist, 4x card)

34/9.5 = 3.58x points earned staying at Hilton vs Hyatt

RRV Hilton $0.0045/pt x 3.58 = $0.0161

RRV for Hyatt = $0.016

Interesting analysis!

Jags brings up a great “point” (pun intended), but here’s another way of looking at it:

Using the Aspire card to pay for your Hilton booking you get a 15.3% discount. Using a WoH card to pay for your Hyatt booking you get a 15.2% discount.

Using the Marriott Boundless card to pay for your Marriott booking you get an 11.9% discount (ouch!).

Math:

(34 HH points “saved”/$1 dollar)x($0.0045 dollars/1 HH point)x100%= 15.3% saved

(9.5 WoH points “saved”/$1 dollar)x($0.016 dollars/1 WoH point)x100%= 15.2% saved

(17 Marriott points “saved”/$1 dollar)x($0.007 dollars/1 Marriott point)x100%= 11.9% saved

Yes, Hilton is great because it gives you top tier status with a credit card.

If you get to top tier with all of the programs + the premium CC though it drops Hilton to the lowest discount.

Hilton 34 pts/$ * .0045 = 15.3% discount

Marriott 23.5 pts/$ * .007 = 16.45% discount

Hyatt 10.5 pts/$ * .016 = 16.8% discount

I think the other thing to consider is that Hilton and Marriott offer 5th night free. If your travel patterns are similar to mine (take one or two 5-7 day resort vacations/yr) this further increases the value of your Hilton or Marriott points 14%-25% each vs. Hyatt.

Blog is interesting as always. What dates will be peak is key.

IHG (while not a completely valid comparison as their rates are even more dynamic) chooses peak dates very unfavorably for the consumer.

For instance, I have been wanting to do a weekend at the IC Porto (I’m EU-based). Mathematically, the best cents per point (cpp) values were reached Monday through Wednesday nights, so the nights really unattractive for us for a leisure stay.

Awards on the weekend were through the roof, like 73k per night and such (-> cpp much lower). Now that Portugal just extended its ban on non-essential travel, points for the weekends in May I was looking at dropped to 44k (-> cpp up). But obv, we are not allowed to enter.

This just as a negative example. I’m optimistic Hyatt sticks to its promise to announce an off-peak/normal/peak dates calendar ahead of time and adhere to it. If Hyatt does that, your estimates look reasonable to me and I’m sure many great redemption opportunities will remain.

I think it’s actually a huge miss to not count resort fees in the calculation.

Taxes and general fees are one thing and it kind of balances out the points earning aspect. But waived resort/destination fees for Hyatt and Hilton (vs NOT for Marriott) makes a massive difference in RRV.

And for Hyatt if you would have had it waived as globalist, then you get a similarly priced benefits (parking).

Looking at Centric South Beach (Hyatt) for. Resort fee of $32 is waived for everyone on points. At the full service hotels in large cities and vacation destinations resort fees are a plague and paying with points should absolutely count that into the value of points, especially because it’s consistent for all members and better shows some differentiation between programs.