NOTICE: This post references card features that have changed, expired, or are not currently available

This week at Frequent Miler we looked at rewards for your spend. We’ve got new resources out so you’ll know which card to use where and which cards you probably shouldn’t use anywhere. See transferable points programs stacked up against one another and join the debate about the value of your points. All that in the FM week in review. Read on for this weekend’s recap.

Best Everywhere Else Rewards Cards

In a continuation of a post earlier this week refreshing our Best Category Bonuses page, this page looks at your best options for everyday unbonused spend — whether you prefer points or think cash is king, this post shows you which cards earn the most valuable returns on your everyday purchases.

Are points worth what they buy or what they save?

In a post that brought ought many strong opinions and some spirited ongoing discussion, I took a look at how to value points. Do you determine that based on what you can buy with them, how much money they save you, or some other formula? It’s worth considering what the rewards are worth so you know you’re getting the right bang for your buck when you spend. I know this much for sure: there are many opinions to be considered.

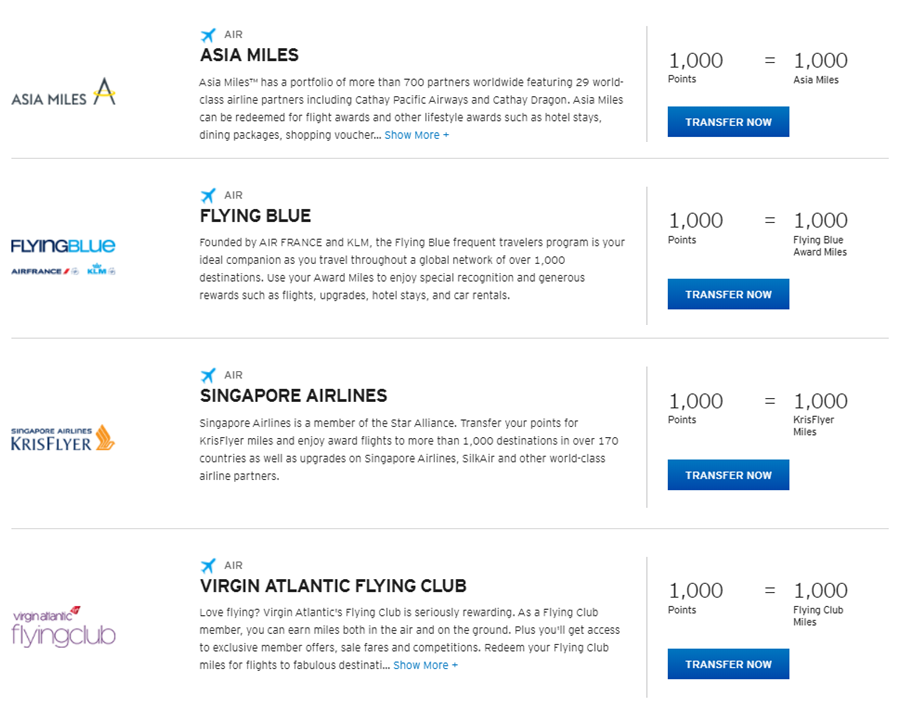

Transferable Points Programs: Amex vs Chase vs Citi vs Capital One

![]()

The report cards are in: Nobody got straight A’s, but you can see how your program of choice stacks up to the competition in a number of key categories. Furthermore, this makes for a great future reference tool for quick comparison of benefits and restrictions as well as how each issuer compares to others.

Does it ever make sense to spend on a Hilton card?

Spoiler alert: it just doesn’t make sense to put unbonused spend on a Hilton credit card as long as they continue to sell their points so cheaply. You’ll earn more Hilton points and have greater flexibility if you focus on cash back. See this post for the how and why.

Best Category Bonuses: Which card to use where?

Here’s your full guide to which card to use in each popular bonus category — as well as your ranked alternative options — all in a table format that will automatically update any time a card makes a change. This is another great tool to bookmark if you or someone in your household has trouble memorizing which card to use where. It can also be good resource to check when you’re looking for a new card with a specific bonus category.

Transfer partners: Chase vs. Citi

Citi’s lone US airline transfer partner is JetBlue. Because of this, some always assert that Citi’s transfer partners suck. The reality is that they don’t. In fact, apart from not having Hyatt, It will require a little Googling and you may even have to make a phone call to redeem, but Citi’s patners do provide some excellent value. I collect more Ultimate Rewards points, but I personally think the value of Ultimate Rewards is overblown. If Hyatt were to undergo a major devaluation tomorrow, Ultimate Rewards would lose a lot of its luster, which is an indication to me that its partners aren’t the best thing since sliced bread after all. If you haven’t even been considering Citi, this discussion is worth a read.

That’s it for this week at Frequent Miler. Check back soon for our week in review around the web and this week’s last chance deals.

![Mileage running 2026-style, playing the AA transition, a coming points conference and more [Week in Review] a group of toy airplanes on a game board](https://frequentmiler.com/wp-content/uploads/2022/01/American-Airlines-Game-218x150.png)

Do you have a post where you analyze non bonus spend to acquire status in a hotel or frequent flyer program?