NOTICE: This post references card features that have changed, expired, or are not currently available

Note: The individual card offers mentioned in this post have expired.

Like many Americans, I am once again back to planning more travel. I’ve recently been making a number of new bookings and that process has reminded me of the (occasinonal) value (or sometimes very poor value) of an unheralded hero of credit card bonus hunting: the dummy booking. Don’t be a dummy, start a dummy booking to check for a better offer.

I published an earlier version of this post earlier this year, but I have updated details below with new dummy booking offers, both those that might be worth considering and those to avoid.

Increased Offers

In some cases, dummy booking offers are objectively better than the public offers. For instance, we sometimes see a dummy booking offer that simply adds a $100 statement credit on top of the public offer. In other cases, the difference in offers is more obscure. I saw an offer for the World of Hyatt credit card earlier this year that looked pretty interesting and I wrote about that offer here: Debating the Hyatt dummy booking offer.

In that case, the rest of the Frequent Miler team convinced me that the normal offer was ever-so-slightly better for most people, but in that post I explained why the dummy offer could be better depending on your situation.

Whenever it is possible to link directly to the dummy booking offer, we do that on our Best Offers page — though in some cases, you’ll just have to go through the steps of booking to get an offer to pop up for yourself.

Here are some of the increased offers I’ve found during recent bookings or dummy booking attempts for this post.

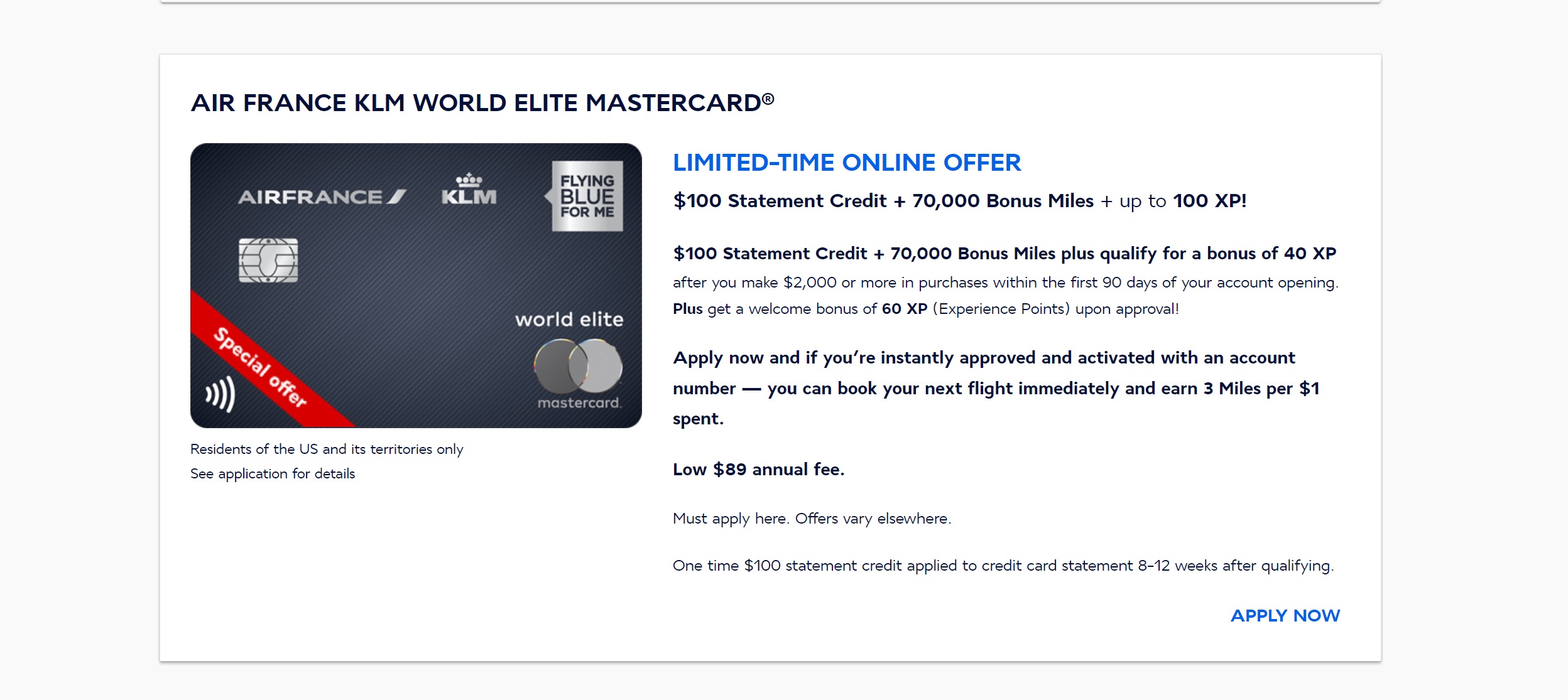

Air France / KLM

Recently, while booking an award flight on airfrance.us, I received the following offer on the checkout page. This offer adds $100 on top of the best public offer (which I believe is the best offer we’ve ever seen on this card).

That $100 statement credit certainly helps to offset the annual fee and then some. The key advantage of the Air France KLM card is that it keeps your miles from expiring. If you’ve never credited a flight to Flying Blue, you might not need to worry about that.

One thing that could make this card kind of appealing at the moment is the (ironic) chance to use toward the end goal of earning American Airlines elite status through SimplyMiles card-linked offers — though I’d only do that while spending toward the initial bonus.

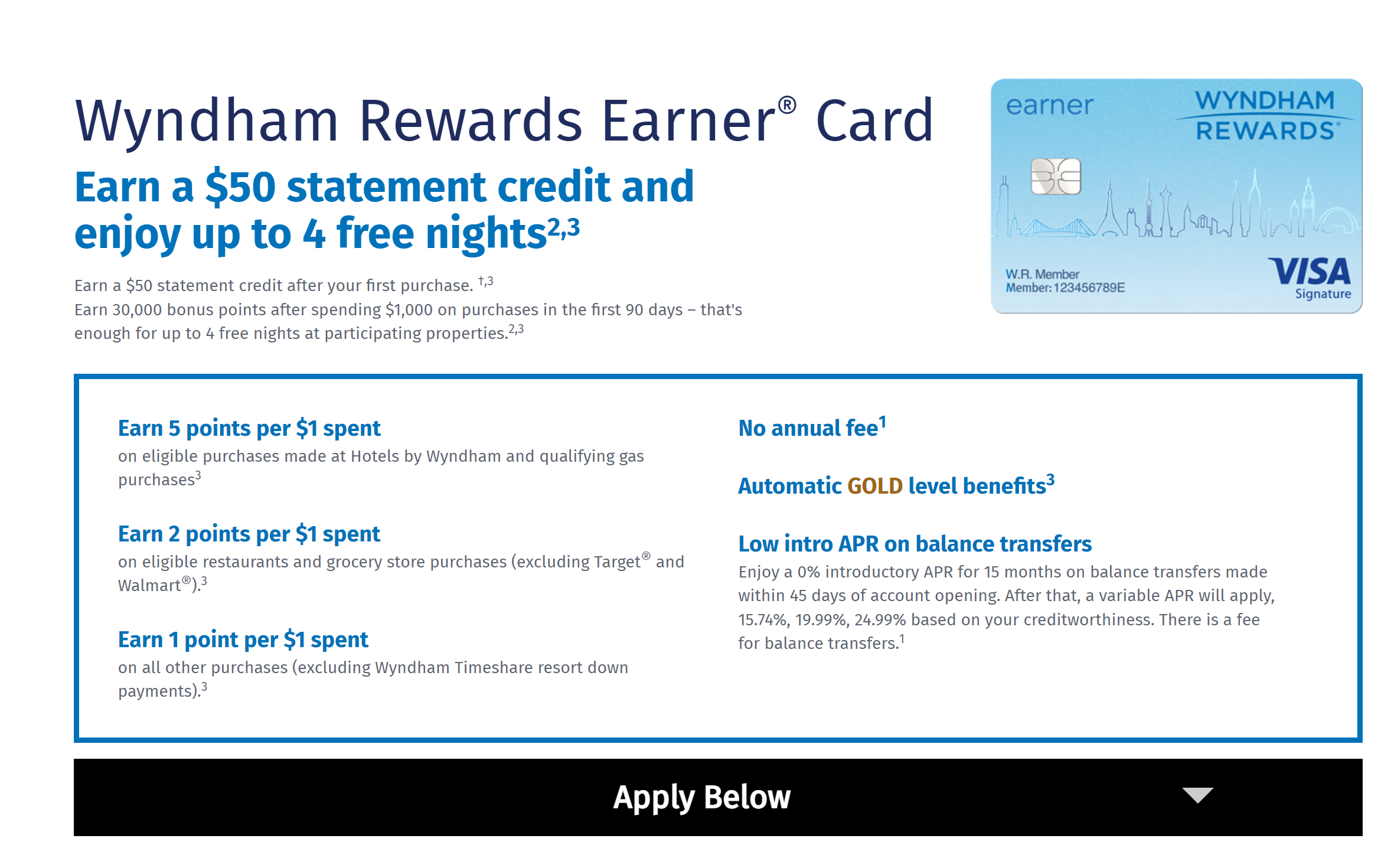

Wyndham Rewards Earner

Stephen came across this offer for the Wyndham Rewards Earner Card several months ago and I still see it now during the booking process with Wyndham as of 5/30/22:

The bump here is the $50 statement credit. We wrote a quick post about this offer here, though we subsequently saw an offer that may have been even better depending on your spending patterns: instead of the statement credit, you can get an extra 2x on all spend for the first 6 months (more info in this post – note that the post says that offer expires 4/30/22, but a month later it still appears to be working). You’ll need to put a little more spend on the card beyond the welcome bonus for that to be worth more than the $50 statement credit.

If you actually want to earn more Wyndham points, the business card probably makes more sense, but if you mostly value the 10% discount on awards this is a way to get it without an annual fee.

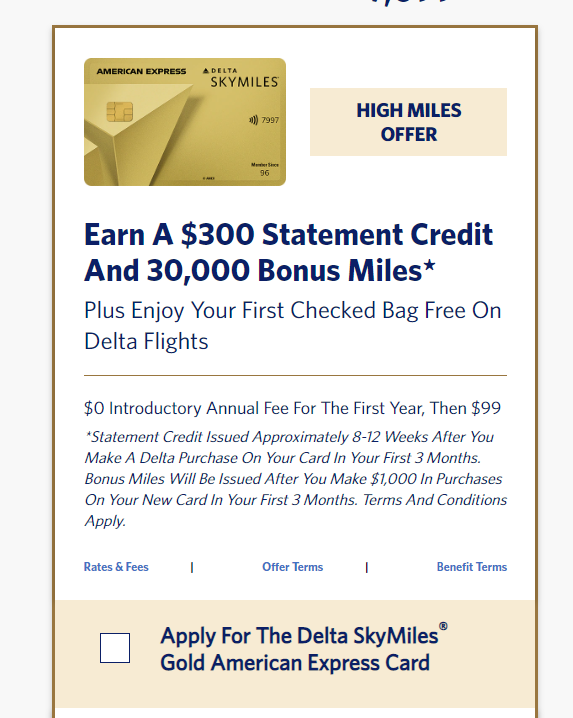

Delta Gold SkyMiles card

While pricing out a business class flight to Amsterdam, I found a very poor Delta Gold SkyMiles card offer:

That’s a pretty awful offer compared to the offer we currently list on our Best Offers page, which awards 70K Delta Skymiles after $2K spend in the first 3 months at the time of writing. You would need to value miles at less than three quarters of a cent per mile for the above statement-credit offer to break even with the current best offer and value miles even less to come out ahead.

The only situation in which I think the dummy booking offer makes sense is if you really don’t care about the miles at all (you have plenty or don’t use Delta miles often) but you do want a relatively easy $300 statement credit (perhaps to offset the cost of the ticket you’re buying?).

Note that there isn’t a way to directly link to this offer as you need to go through a dummy booking and check the box to apply — then the application box pops up over the Delta site in your browser on the payment page before entering payment info.

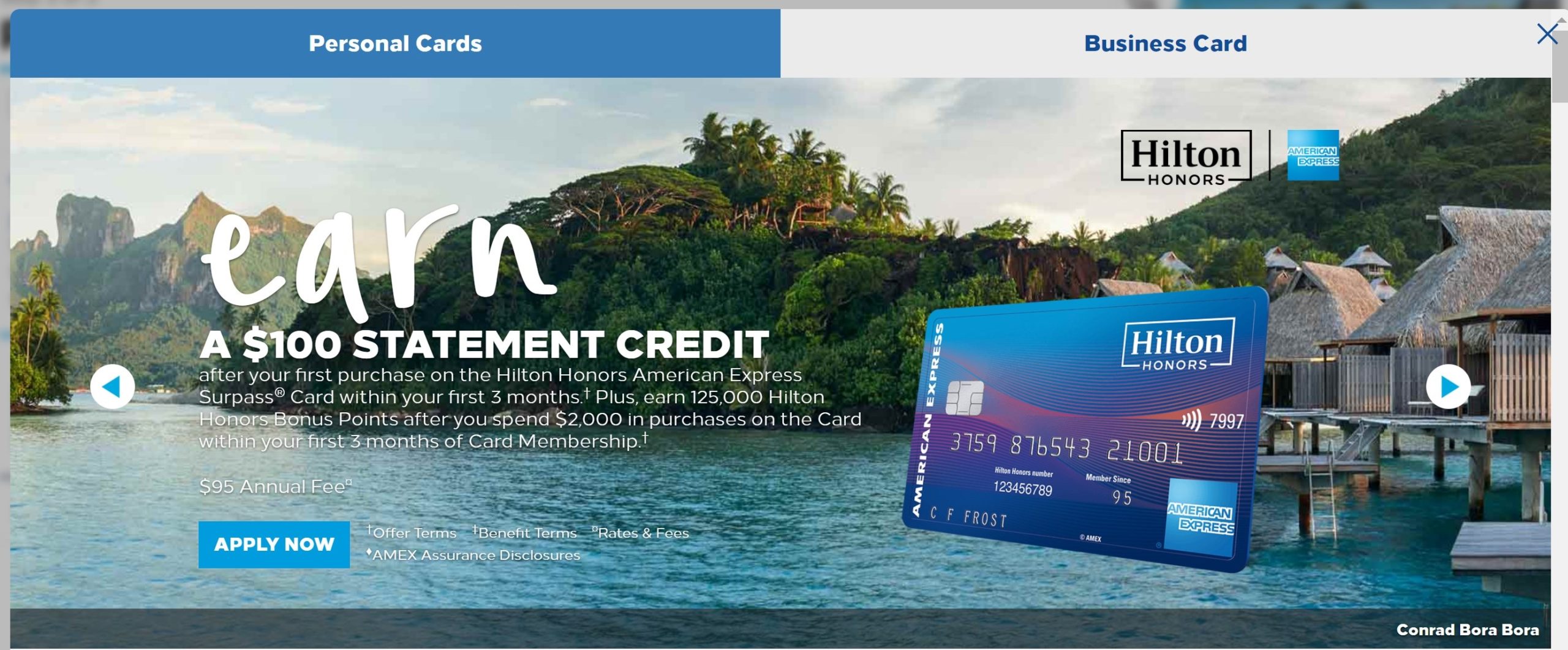

Hilton Honors American Express Surpass Card

Unfortunately, the dummy booking offers I saw at Hilton this time around were even more clearly inferior to the public offers. During the booking process, I was presented with offers on a couple of Hilton cards with statement credits that matched the current best offers, but they came with fewer points than the current best offers at the time of writing. No deal.

However, remember that there are a few different offers you may see while connected to Hilton Wi-Fi. I’m not sure what the current Hilton Wi-Fi offers are, but in the past they have included offers that featured a couple of free night certificates that may be more appealing, particularly if you can maximize their use at a property near the top end of the award spectrum like this soon-to-open property in the Maldives.

United MileagePlus Explorer

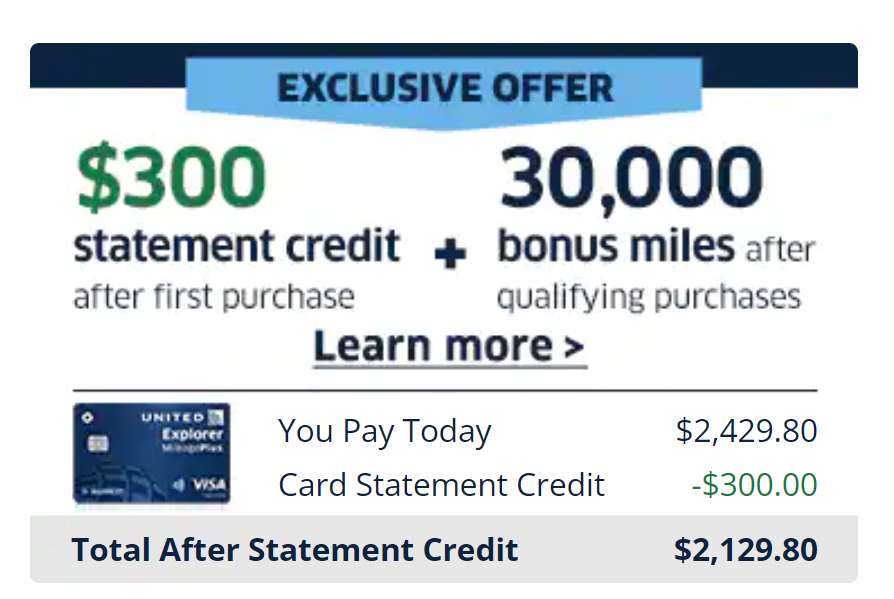

During the booking process on United.com, I came across this offer for the United Mileage Plus Explorer card:

Similar to the situation with the Delta card offer, unless you value United miles at less than one cent each, you’d be better off with the public 60K offer on that card.

Note that this dummy booking offer varies slightly from the one I reported last time around (which was $250 and 35K miles). Both times, the public offer was better, but it’s interesting that they continue to test different mixes of statement credits and miles.

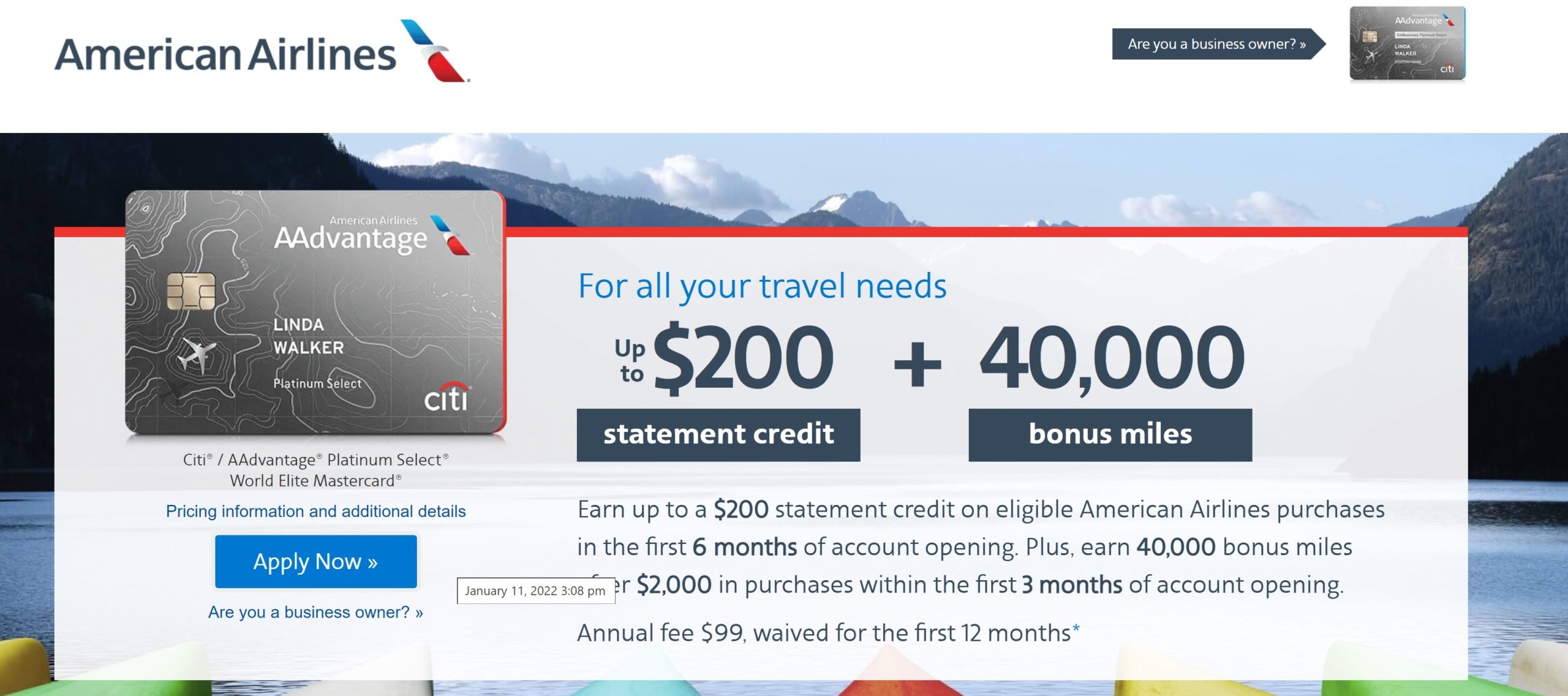

American Airlines

It’s the same story with American Airlines: if you value miles at less than one cent each, the dummy booking offer (which is the same for either the American Airlines AAdvantage Platinum Select card or the Citibusiness AAdvantage card) could be better than the public offers on those cards, but in most cases I wouldn’t consider the dummy offer.

JetBlue

Airline card dummy booking offers seem to be “having a moment”, and not in a good way. The offer I found for the JetBlue Plus card during the booking process looks may be the worst of the bunch.

As you can see above, the dummy booking offer here offers a $250 statement credit and only 15K bonus points after spending $1,000 in the first 90 days and paying the annual fee. Contrast that with the offer you’ll find on our Best Offers page for 60,000 points after the same spending requirements and you would have to value the points at less than 0.71c per mile for the dummy booking offer to be better. Since JetBlue miles are worth a fixed value of around 1.4c per mile toward most fares other than Mint class, the public offer (not the dummy booking offer) is far better.

Bottom line

Keep in mind that whatever offer you see during the checkout process may not always be better than other publicly-available offers found on our Best Offers page and sometimes the relative value is debatable depending on your situation. However, if you’re thinking about a co-branded credit card, it can be worth at least going through the motions of a booking to see if you get an elevated credit card offer during the checkout process. We keep links to those offers on our Best Offers page when they are the best offer and it is possible to do so, but there’s no harm in double checking for a smarter dummy offer.

A warning to all … booking a discounted fare using Delta miles courtesy of your DL AmEx platinum card. I had to cancel two first class tix booked like this and now I can’t get at the credits to rebook the flights. The credits are not in our SkyMiles accounts, although Delta can see them. DL chat says that an “agent needs to unravel the cash and the miles” in order to rebook. Yes, a phone agent. And how exactly should I reach a phone agent? “Oh, just call them.” Since I’m not going to spend more than 30 minutes on hold to do anything, Delta has effectively locked up my money and won’t let me use it for new flights. I find this astonishing for an airline that was known for great customer service for so many years. Beware of this nice discount if you think there’s the slightest chance your flights will have to be cancelled.

Should you log in before the dummy booking?

No, that’s why it’s called a dummy booking.

I think dummy booking United offer not so bad under certain circumstances. If one has a decent stock of United miles and is less interested in increasing that stock but primarily looking to get access to lower mileage awards as a credit card holder, this offer has some appeal. And for that same person, after the first year when the fee waiver expires, one could just downgrade to a free card.

Do these offers only appear after completing a dummy booking?

no, just when you act like you are going to make a reservation, prior to entering payment information

I saw one other difference with the dummy booking offer for the United Explorer card, at least when I checked a few weeks ago. The dummy booking offer had a $2k minimum spend requirement instead of the $3k for the public offer.

Nick, both you and Stephen Pepper do excellent work! Is it true Greg is getting waxed at Miravel

Something to consider, for the amex cards, you loose the ability to get referral bonuses between partners if using dummy bookings.

Could also get the business delta gold via dummy booking if your profile is set as a business.

Alaska Airlines dummy booking offer is for 60k miles plus $100 statement credit your best offer listing is 60k miles plus a $99 companion fare

cash is arguably better unless you have specific use in mind for the companion fare and are sure you will be making the trip..

Thanks, Nick! A friend just told me 2 days ago he was going to lose his AF award points at some point, a result of a canceled award flight. Will those be protected by getting the card?

Generally as long as there is activity in your loyalty account, your miles/points won’t expire. It’s all spelled out in the Terms & Conditions.

I imagine that you need to turn off popup blockers for some of these offers to appear.