NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

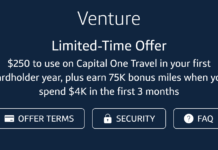

Capital One has launched a limited time 100K offer for the Venture Rewards card. Upon approval, earn 50K “miles” after $3,000 spend in 3 months. Plus, earn an additional 50,000 miles after a combined $20,000 spend in 12 months. That’s a lot of spend, but it comes to only $1,667 per month if divided across all 12 months. Note too that this card earns 2 “miles” per dollar for all spend, so you would earn an additional 40,000 miles with that $20K spend. In the end, you would end up with 140,000 “miles” worth $1,400.

Capital One “Miles” can be used for full value in two ways:

- Reimburse travel purchases: In normal times, you would use the Venture Rewards card to purchase travel and then reimburse those charges with “miles”. Each “mile” is worth 1 cent. So, you could reimburse $1,000 in travel purchases with the 100,000 miles earned from this offer. During the pandemic (through end of year), Capital One is also allowing customers to reimburse some non-travel purchases at full value: restaurant delivery and take-out, and streaming services.

- Convert Venture miles to airline miles: Capital One “miles” really ought to be called points in my opinion. They are not airline miles. However, Capital One does allow converting “miles” to airline miles usually at a rate of 2 “miles” to 1.5 airline miles. This means that the 100K bonus miles from this welcome offer are worth 75,000 airline miles.

You can find a link to sign up, as well as much more information about the Capital One Venture Rewards card here: Capital One Venture Rewards. Here are topics covered on that page:

[…] 100K Capital One Venture Rewards offer! […]

No dice for me. I tried, and they are saying too many inquiries. It is so strange…..I even tried reconsideration.

Do AA and SW gift card purchases qualifying as redeemable travel expenses?

I don’t know, but there are many fully refundable options so why go with gift cards? For example, if you’re thinking of staying in a hotel next year, book now on a site like Expedia where they give you the option to pay now for refundable bookings. That way you can always freely change your plans later.

Kinda tempted – at 5/24 now.

But Cap1 is the only company to deny me a card for too many accounts in the last 10 years… Twice. And they hit all three bureaus.

Instant approved. Took really just about 1min. Don’t thinkI have had their cards in the past. Just have a checking account with them (former ING360 checking) without any activities for years and years

Below are how my credit monitoring programs respond to this approval in the sequence of arrival time. Just for your fun since I got pulled by three bureau.

11:11AM CapitalOne approval email, “”XXX, you’re approved for a Venture Rewards…”

11:11AM Mint, “A new credit monitoring alert for you” to report TransUnion inquiry

11:11AM American Express, “We detected a change to your credit report”

11:13AM, Experian (due to my AAA membership?), “XXX, your credit file has been updated”. Credit file inquiry

I am surprised that Credit Karma hasn’t responded yet. In my past experience, they responded very fast. I will update if I got further notice.

OK, finally Credit Karma responds:

11:41AM, Credit Karma, “New inquiries happen, XXX”, report TransUnion inquiry

11:41AM, Credit Karma, “”There’s a new inquiry on XXX’s credit report”, report Equifax inquiry.

These are probably all I can receive. Don’t think those monthly score report program will send a timely alert anytime soon.

P.S. Amex Express report TransUnion inquiry alert. Kind of duplicate when there is Mint there.

So if you are new to these monitors, I would suggest: Mint+Creditkarma for Equifax and TransUnion and then I found there that Experian is offering “Free Credit Monitoring” with no credit card required.

https://www.experian.com/consumer-products/credit-monitoring.html

You bet the function should be limited but if you just want to know the alert before any action, it is good enough to know something has happened.

good info!

Yup and sign up to credit sesame as well as they give $50k identity theft insurance free for all members

Sweet. Thanks for all that info!

Welcome :). At least by writing these, make my three pulls “not wasted”.

Now probably last update. Receive a few more alert from various “free” monitoring program:

(format: Time, sender, subject, article headline, comment)

4:37pm (same day), Discover card, “Alert: New Inquiry on Your Credit Report”, “XXX, a new inquiry has been opened on your Experian® credit report”

9:00am (next day), Credit.com, “Is This Negative Item Bringing Down Your Score?” , “XXX, you have 1 negative item on your credit report that may be hurting your score.”, dislike this program. The notification email contains more than what I found when I logged in. The website doesn’t tell me (at least) who pulled which bureau but keeps alluring me to sign up some “credit repair” service. I looked around and can’t even find the “Alerts” tab.

11:15am (next day), Chase Credit Journey, “XXX, you have an alert from Credit Journey”, funny ting is that because I have both biz and personal credit cards, my current online account doesn’t have access to credit journey (to qualify, you have to have an online profile with personal accounts ONLY). However, it doesn’t stop it from sending me the alerts. Again never activated never logged in this program.

11:34am (next day), Credit Karma, “There’s a new inquiry on XXX’s credit report”, Equafax reminder again. It is interesting Credit Karma sent me the reminder again. I think it might be because I didn’t log in when I received the first one. It was nice.

5:22pm (next day), ProtectmyID (experian), “Review Your Credit Notification”, “New Inquiry detected on your credit file”. This is the one I obtained due to my AAA. So the experian account in my previous post is really free then. That’s good as I have cancelled my AAA this year. So far this program is still on, not affected.

What else free credit monitoring programs I have forgotten to register :). With so many “protections”, I think a fraudulent hacker would regret to waste his/her time on your case.

How sensitive is Capital One to MS? Particularly Simon?

I’ve done a fair amount of Simon on them, no issues. I’ve heard of people getting shut down — not sure what the threshold is. I’ve not cycled my limit in a month, but have gone right up against it many times.

Meh, Im still pretty pissed at them for changing the Venture to cheap flimsy plastic instead of metal lol