NOTICE: This post references card features that have changed, expired, or are not currently available

American Express and Walmart today announced a new prepaid card called Bluebird (see press release here). This replaces a product with the same name that American Express had beta tested through Walmart earlier in the year. The new Bluebird prepaid card will be available next week.

What is it?

Bluebird is a prepaid American Express card very similar to the prepaid American Express cards I’ve written about many times before (for examples, see “One card to rule them all,” “How many Amex prepaid cards can I have?,” and “Amex Prepaid cards for foreign travel.” Like American Express’ other prepaid product, BlueBird has no fees other than $2 for ATM withdrawals.

How can you get one?

Starting next week, you can either buy a .temporary card at Walmart and then upgrade to a permanent card, or simply order the card for free from www.bluebird.com.

How is it different?

Here are some features that appear to be different between Bluebird and the regular old Amex prepaid card:

- ATM Use: With Bluebird, if you setup direct deposit, then all ATM withdrawals are free from MoneyPass ATMs. Otherwise all ATM withdrawals incur a $2 fee (plus ATM owner fees). With the old prepaid card, the first ATM use per month is free, then $2 per withdrawal afterwards; and ATM owner fees always apply.

- Bluebird has no fee “electronic bill pay.” We’ll have to wait to see what exactly this entails.

- Bluebird explicitly allows funding via debit card for $2 per load. it will be very interesting to see if we can load from Vanilla Visa debit cards.

- According to the cardmember agreement, Bluebird allows loading from Vanilla Reload packs, but it is unclear to me whether this agreement has been updated with the new card’s features. UPDATE: I called Amex and they confirmed that this card will be reloadable with Vanilla Reload cards.

- Bluebird allows person to person payments (like Amex’s Serve product).

- Bluebird will have a mobile app for managing your money.

- Additional features: “In the first quarter of 2013, Bluebird will be adding additional features, such as more options to deposit money and check-writing capabilities.“

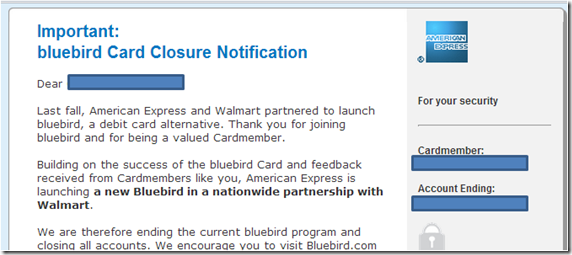

Important: bluebird Card Closure Notification

It appears that everyone (including me) who bought a prepaid Amex at Office Depot and upgraded it to a permanent card has received an email from Amex saying that their old bluebird account will be canceled. The email looks like this:

I’m pretty sure that this email is a mistake.

American Express did have an old Bluebird product that is being shut down, but it is not the same as the product bought at Office Depot. So, I think the email is a mistake. I expect that we’ll get apology emails soon. If it turns out that this isn’t a mistake, it will be a great opportunity to cash out since American Express is offering to send people checks for their balance.

UPDATE: I called Amex and they confirmed that this appears to be a mistake. They are currently investigating.

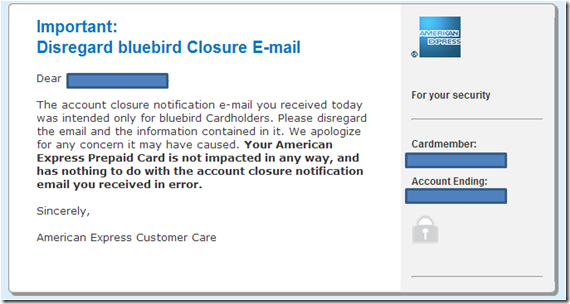

UPDATE 2: I just got this email confirming the mistake:

More about Bluebird soon

As more information comes out about Bluebird, I’ll do my best to keep you informed. Overall, I see this as similar to, but even better than what we have today as long as Vanilla Reload packs can be used. Even without Vanilla Reload cards, though, I think this product is ripe with possibilities.

[…] Then came Bluebird. Bluebird, from American Express, offered all of the advantages of the NetSpend card, but with none of the disadvantages (see “Bluebird takes flight and changes the game“). The combination of Office Depot, Vanilla Reload cards, and Bluebird was too good to be true. Anyone with a credit card that earned a point multiplier at office supply stores could take advantage of these products and basically generate points out of thin air. […]

[…] debit and checking accounts.” I first mentioned Bluebird in my October 8th post “Bluebird is coming. The sky isn’t falling.” Then, once Bluebird was available to consumers, I followed up with “Bluebird […]

very exciting! Closing my Serve now.

I discovered that I could empty my Serve funds by sending money to my wife’s new Bluebird account. That was convenient since I have never linked a bank account to my Serve card.

[…] I’m still excited to see what Amex has in store for us regarding the new Bluebird Prepaid product. Last week, they said that it would be available “next week” (which is now this week). Has anyone seen one in the wild? For background, see “Bluebird is coming. The sky isn’t falling.” […]

Any idea on how the check writing feature will be structured wrt fees? It would

be great to get points for those check only places.

Sam Goth: No, we don’t have any details about the check writing feature yet.

The BlueBird signup is now live! You have to cancel your Serve account first. I just talked to rep. Features are beyond amazing. Too good to be true. Look for a post from me soon!

i don’t use the UR mall due to not having the corresponding Chase cards, but I note that you can fund this card with a debit card for $2 fee. So, I could fund using my Alaska Air Debit Card and earn miles? Any thoughts?

mike: I doubt you would earn miles with the Alaska Air debit card, but its worth a try to find out. The Sun Trust Delta debit card, on the other hand, is a bit more likely to work…

call the number that was listed in the first email, tell them you want to select the cash out option. they will push back that the email was erroneous etc, and there is no need to cash out .. just stay politely adamant that you want to cash out. they will ask usual questions about why you want to cash out versus transfer directly to bluebird etc .. I made up some BS. so then he said it will take 15 business days to cut a check. I said I have bills to pay and can’t wait 15 days. so he processed it as direct ACH transfer to checking account within 3-4 business days. He took the banking info over the phone. let’s see if it comes through .. i trust Amex to not screw up and expect it by Mon/Tues latest.

Titan: how did you go about transferring out the money?

i took the oppty to cash our nearly $5k .. direct ACH transfer to bank account in 3-4 days, no extra fees or anything like that. Amex also offered to keep the Amex prepaid card open/active in case I want to reload again. I just told them I’ll get the bluebird later

Received the apology email from Amex as well. So stop the presses and don’t just load your cards in hope of a live refund…would have been nice though!

ADK- i assume this comment meant re WMT bill pay ala same under MMS post?

Would you suggest not doing that gig at all then, or doing it fast and furious till Fang shuts it down?

[…] I think Frequent Miler did a write up on it. Something like one free ATM withdrawl per month at certain ATMs, plus small relod fees. Max $1k per month, I think. http://boardingarea.com/freque…-isnt-falling/ […]

This is not going to last very long. Cardinal Fang has gotten wind of this scheme and is gearing up for a Spanish inquisition. Be warned.

do you think we can still get a cash out anyway?

Just got an email that said, “The account closure notification e-mail you received today was intended only for bluebird Cardholders. Please disregard the email and the information contained in it. We apologize for any concern it may have caused. Your American Express Prepaid Card is not impacted in any way, and has nothing to do with the account closure notification email you received in error.

Sincerely,

American Express Customer Care “