I’ve been making loans through Kiva for many years. It’s a great way to increase credit card spend and do good. It’s not a panacea though. You won’t earn interest on your loans, it usually takes many months to get your money back, and there’s no guarantee that you’ll ever get your money back. In my case, I’ve made hundreds of thousands of dollars of loans since 2011 and have received all but 1.69% of it back. I feel great about that result because I believe my loans have made a positive impact on the world, and it has helped me earn countless rewards, including credit card welcome bonuses, and big-spend bonuses (such as elite status and free nights).

Kiva Overview

Kiva is a nonprofit organization that helps supply funds for microloans across the world. They do this by contracting with microlending institutions who post information to Kiva’s website about each of the microloans that they have funded or intend to fund. Kiva displays these loans to lenders (like me) who want to fund them. Lenders can optionally add a charitable donation to Kiva, along with each loan, but that is not required. Money collected by Kiva (not counting charitable donations) goes to the the microlending organizations. This helps those organizations make many more loans. When the loans are repaid with interest, the microlending organizations keep the interest payments to cover their expenses and return the principal to Kiva. Kiva then returns that money in full to each lender.

With Kiva, you can make loans with your credit card, and the transactions count as regular purchases for the purpose of earning credit card rewards. You do not have to worry about being charged cash advance fees. Additionally, PayPal generously waves Kiva’s credit card processing fees so 100% of your money goes to servicing loans. You can also fund Kiva loans with Visa, Mastercard, Amex, or Discover gift cards. This is useful for when you see opportunities to buy these gift cards at a discount and/or to earn large rewards when purchasing them.

Overall, Kiva has a low default rate of 1.79% (as of 5/14/25). My personal default rate over the past 14 years is currently 1.69%.

Kiva is completely free to use. If you’d like to give Kiva a try, you can sign up here:

- www.kiva.org/invitedby/FrequentMiler

Even though this is our referral link, we don’t get any compensation if you use it.

Doing Good

Over the years there has been a lot of debate over whether or not microloans are a force for good in the world. In 2019, I did a deep dive into the controversy and convinced myself that Kiva is a force for good in the world. In the post “Why I love Kiva for earning rewards and doing good,” I concluded:

There is some evidence that microlending is a good thing, but the evidence isn’t strong. Regardless of past outcomes (or lack thereof), I believe Kiva is a good organization that intends to make the world a better place. Still, if your primary goal is to use your money to make the world better, you may be better off simply donating to highly rated charities. But if you want to do good and earn credit card rewards, I think that Kiva is worth a look.

I’ll say again, if your primary objective is to do good, then consider simply making charitable donations rather than loans. In the post “Rewards for Charitable Giving” I listed some of the best ways to earn rewards through charitable donations. For example, the PayPal Giving Fund Fundraiser Hub passes 100% of your donation to your selected charity without charging credit card fees.

The cost of Kiva-ing

The obvious cost of making Kiva loans is the default rate. If your loan default rate is 1.7%, for example, then you could say that those loans cost you 1.7%. A much bigger cost, though, is due to your money being tied up for many months. If you fail to pay your credit card bill in full because your money is tied up in Kiva loans, then your costs will skyrocket. But even if you pay your credit card bills in full each month, you should consider that every dollar tied up in Kiva loans is NOT earning interest in a bank account or other investment. When interest rates are very low, this can be a minor issue, but when they’re high, this “cost of money” can be significant.

The vast majority of loans are scheduled for full pay back in 24 months or less, and many are 12 month or shorter loans. Most require borrowers to make monthly payments, so not all of your money is tied up for the entire course of the loan.

Kiva as a quasi-investment

It’s possible to think of Kiva loans as an “investment” where your credit card rewards are your tax-free earnings. I won’t argue that this is a good investment opportunity if your primary goal is to earn money (it’s not), but as a way to earn rewards AND to do good, I like it. Here’s an example of how it can work:

Loan a fixed amount every month. Be sure to select from “safe” loans (more on this in the next section, under KivaLens) that offer quick payback. Then:

- After about 12 months, you should reach equilibrium: on average, you’ll then put in the same amount that you take out each month, and…

- The amount of money “tied up” in Kiva should eventually equal approximately half of your annual loan amount or less (e.g. $30K in annual loans at $2.5k per month = $15K tied up)

Your “income” from this long term “investment” is the rewards from your credit card. If you use a 2% cash back card for all of these loans, then at $2,500 in spend per month, you’ll earn $50 per month or $600 per year. If none of your loans defaulted, that would be like a 4% return on the $15,000 that is tied up long-term. In reality, some loans will default. If your average default rate is 2% then you’ll lose $600 per year to defaulted loans and your return would be 0%. Of course, things look better with lower default rates, and especially when you use credit cards with higher rates of return (found here), or when you earn big welcome bonuses from new credit cards.

For more about this idea of Kiva as a quasi-investment, see: My Kiva spend experiment.

KivaLens

KivaLens URL: http://www.kivalens.org/

KivaLens is a free tool which is not directly supported by Kiva, but I find it indispensable for three things: 1) the ability to filter available loans to “safe” loans; 2) the ability to sort available loans by those that will pay back the soonest; and 3) the ability to bulk add loans to your Kiva basket.

KivaLens doesn’t use SSL encryption, so your browser may warn you before letting you visit the site, but in my experience it’s safe. You do not need to (or have the ability to) give any personal information to the site.

“Safe” Loans

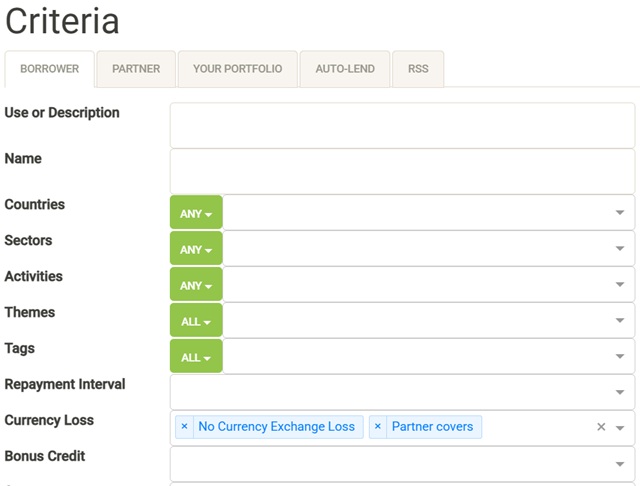

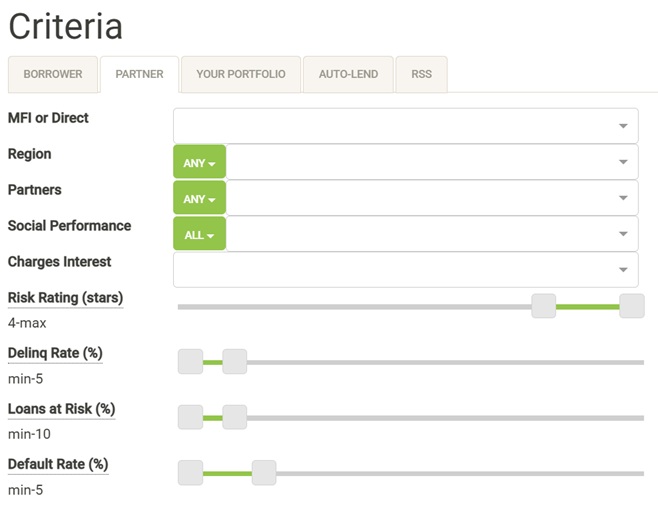

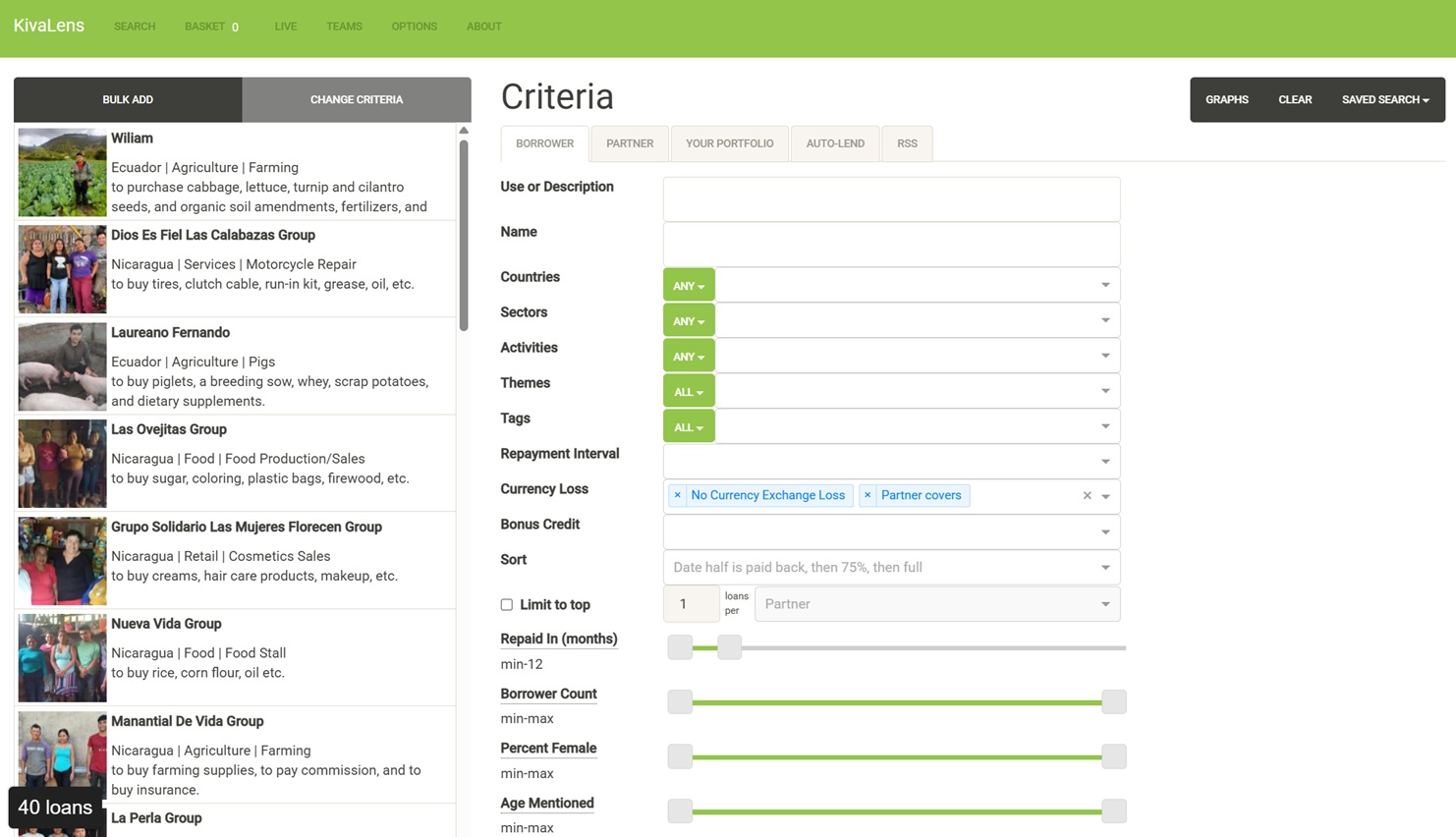

In order to filter to loans that have the best chance of being fully paid back, you’ll want to set criteria under both the Borrower tab and the Partner (microlending institution) tab…

Under Criteria… Borrower tab, on the “Currency Loss” setting, I recommend picking both “No Currency Exchange Loss” and “Partner covers”:

Under Criteria… Partner tab, you’ll want to put in a high minimum for “Risk Rating (stars)” (which is Kiva’s overall rating of the microlending institution) and a low maximum for Delinq Rate (%), Loans at Risk (%), and Default Rate (%). If you set the numbers too low, you may not have any loans available to pick from. If that happens, play with the sliders to get more loans to appear. Here’s how my sliders are currently set:

Fast Payback Loans

Ideally you’ll fund loans that will pay back quickly. There are a few settings you can use to help with that:

Under Criteria… Borrower tab, set the Sort to “Date half is paid back, then 75%, then full:

![]()

On the same tab, just slightly below the Sort, set a maximum number of months for the loans to be Repaid In (months):

![]()

Finally, on the same tab, but at the bottom, set the Disbursal (days) to a low number. This indicates how soon the money will be disbursed to the borrower. The sooner it is disbursed, the sooner the clock starts for them paying back. I like to set it to -1. A negative number means that the loan has already been disbursed. Yes, you can fund loans that have already been made. That’s an unintuitive quirk of how Kiva works.

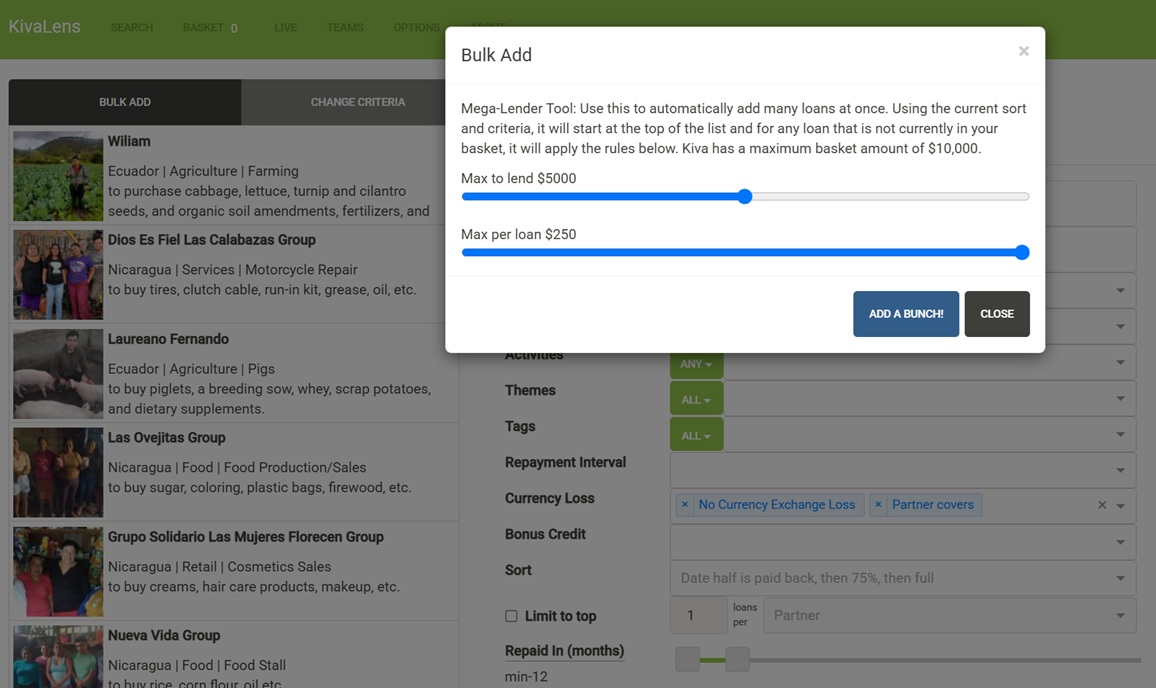

Bulk Add Loans

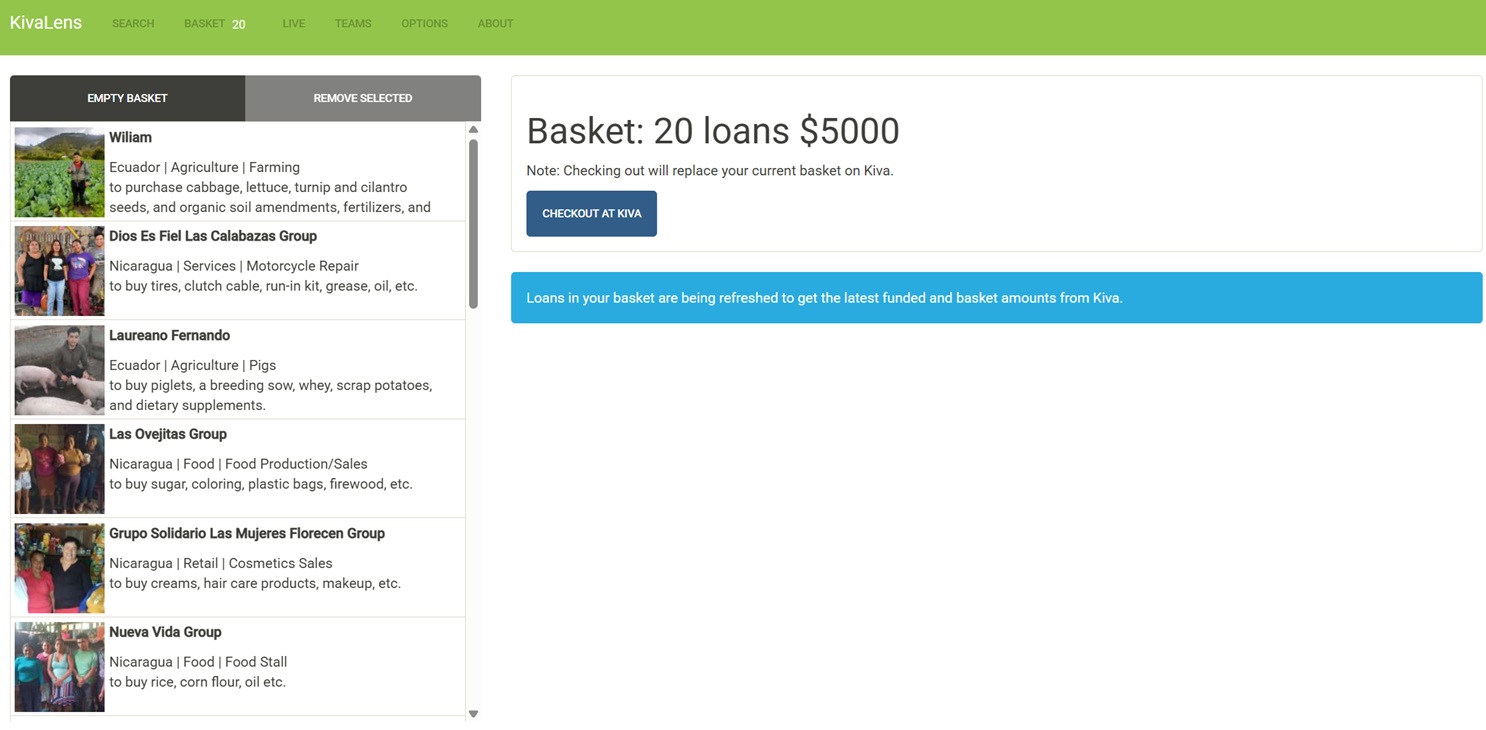

Once you’ve set up KivaLens with safe and fast loans, you can click “Bulk Add” to add a bunch of loans to your Kiva basket all at once. KivaLens lets you set the maximum amount to lend and the maximum amount for each individual loan. For example, I completed spend for a welcome bonus recently by loading $5,000 with $250 going to each separate borrower, like this:

After clicking “Add a Bunch”, go to the Basket menu and click “Checkout at Kiva”. This will move the loans to your Kiva loan-shopping cart where you can then pay for the loans.

Paying for Loans

Once you have loans in your Kiva basket and you go to check out, there are a couple of things to be aware of. First, if you added loans manually, there will be a suggested Kiva donation on top of the loan amount. This doesn’t happen when you add loans through KivaLens. I don’t mind donating to Kiva, but I like to keep the loan process separate from the donation process, so I would find the option to remove the donation.

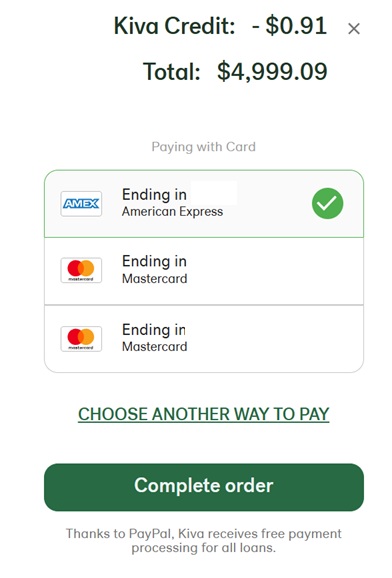

Additionally, if you have any Kiva Credit that you don’t want to use, make sure to click the little “X” next to the credit to remove it:

To pay with a credit card that’s not already on file with Kiva, click “Choose Another Way to Pay” and then click “Card” and enter your credit card or Visa/Mastercard/Amex gift card information.

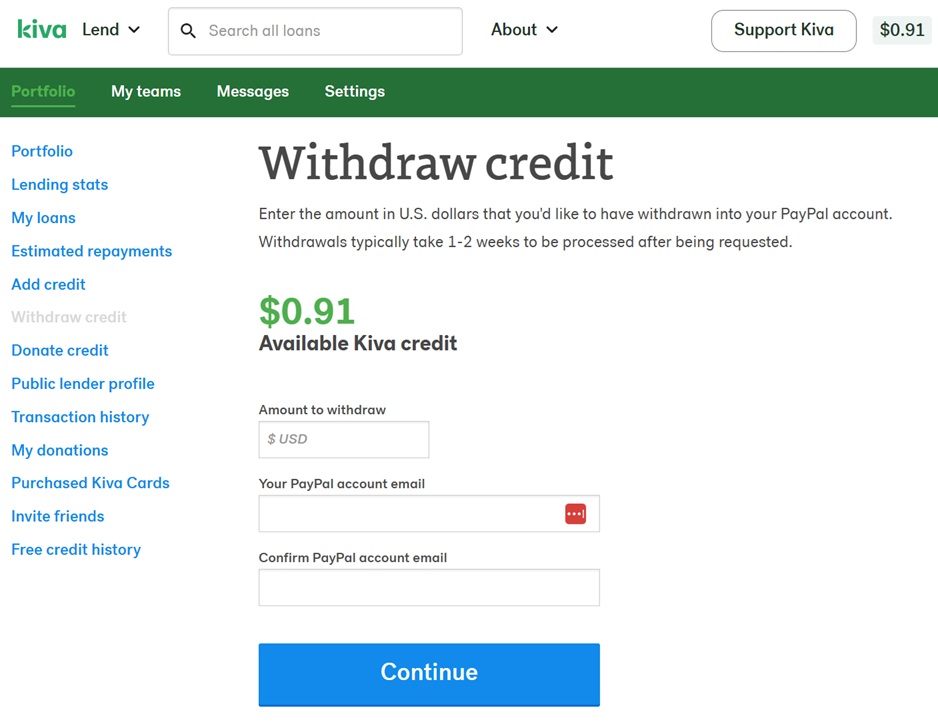

Cashing Out

Once loans are repaid, you’ll have a Kiva balance. To withdraw that money, go to your Portfolio, and find the “withdraw” option. Here you’ll enter the amount you want to withdraw and the email address associated with your PayPal account. In two weeks or less, you’ll receive the money through PayPal.

Since there’s a manual process on Kiva’s end to withdraw credit, I always wait until a lot of credit has built up before I request a withdrawal. I definitely would not request a withdrawal in a situation like the one shown above where I only have 91 cents available.

Conclusion

Kiva can be a great way to earn credit card rewards AND do good at once. It’s not the single best way to earn rewards, nor is it the best way to do good, but it’s the best way I know of to do both at once.

It’s very important to understand that you shouldn’t lend more money than you can afford to lose. There is no guarantee that loans will be paid back. So, for people on tight budgets, this is not a great option.

[…] You can still read Greg’s updated thoughts on that microloan strategy in his Kiva points-earning guide. […]

Any concern for account shutdown from Chase or Citi if using Kiva to chase status (Globalist or AA Platinum Pro)? What is the best way to avoid issues and stay on their good side?

No concern at all with spend going to Kiva. It’s absolutely a legit purchase. Now, if you cycle your credit multiple times per month, that could lead to bad outcomes, but that’s true no matter what your spend is for.

Anyone else having issues paying with registered visa GCs (Staples/Pathward)? Tried direct, through PayPal, and adding funds, but all failed.

BTW, yes I saw the thread below already, but thought I had heard of this working more recently.

All: I just created a Frequent Miler group on Kiva: https://www.kiva.org/invitedto/frequentmiler/by/FrequentMiler

Awesome thanks! I made my first contribution to a loan with the Frequent Miler Kiva team. Blue bank 5X for the win on my (OG) Freedom by paying through PayPal because of December’s bonus category for the fee-free Freedom cards.

Is KivaLens working? I cannot load any loan…

It did seem to be down for a while, but it’s working now

is anyone struggling to get the Kivalens site to work? I have used it for a long time, but now I’m not getting any loans downloaded at all

@Greg Does Kiva accept payment via PayPal or Discover? Both are running promos right now on spend.

Yes to PayPal. I’m not sure about Discover but I think so

Greg, have you ever thought of starting a Kiva FM team? I’ve been using Kiva on-and-off ever since I first read one of your posts about it. (Long ago, I believe back in the BoardingArea days…) I think a team could be fun, and it could encourage some who are on the fence to dip their toe in the Kiva waters if they can see what you’re funding and how the process works. There could be a potential downside of having TOO many people on board and raising eyebrows, but I did see a Flyertalk group so I imagine if there is any riff-raff it’s already there.

Yep I thought about it but then promptly forgot. I’ll look into that when I get a chance.

Any update on a Kiva FM Team?

Yep, thanks for the reminder!

https://www.kiva.org/invitedto/frequentmiler/by/FrequentMiler

FYI I deleted some comments that were overly political. I’m not interested in fostering political debates on this blog

Something to note (without judgement) is that, while you’re not collecting any interest on the loan the loans are not interest-free to the recipient. In fact, I’m pretty sure that the interest rates, expressed as a percent, are quite high. This allows the lending organization to raise the funds it needs to operate, but I also believe that the excess is used to cover loans the default — and that the default rate that you see as a Kiva lender is not really related to what actually happens with the underlying loan portfolio.

All of that is true.

This comment is silly. I don’t know if it will stay around since it seems primarily political with only the slenderest thread of relationship to the subject of the post, but here are my thoughts for as long as they are readable:

You cannot know absolutely what happens to any dollar you spend or invest. If I run out to the corner bodega (run by lovely people of, I believe, Yemeni origin) for eggs I cannot know whether some cents of that dollar will go to a hunger relief program that, in return, will benefit some organization I’m opposed to. The same if I tip the waiter in a restaurant — I don’t vet their charitable contributions. The same with my own charitable contributions. If I give to some charity that alleviates third world hunger among children, the odds are that some of the people that are helped by that charity will grow up to do bad things, whether that’s terrorism or simply “regular” crimes like theft or rape.

That said, the micro-loan “industry” probably has more vetting and controls than almost any other organization you deal with — and certainly more vetting than you yourself are able to exercise. When lending via these organizations you do have the ability to choose which loans to “fund”. I suspect this is largely a fiction (the money is probably netted together into the micro-lender that sponsors that loan, and that particular loan was probably already funded out and, in any case, money is fungible), but no more of a fiction than you’re being “pure” in the money you spend.

Larry says the micro lending industry “probably” has more vetting. That’s laughable. You really typed out 3 paragraphs for that? I’d say that’s pretty silly.

Yeah my comment will likely be nuked, and if this blog keeps supporting hamas terrorist fund then I’ll probably stop visiting. Such is freedom. I didn’t need to take hostages though to get my point across. Weird, huh?

“Probably doing more evil than good” is quite a take. Do you have any hard evidence to support that accusation?

Here’s quite a take: “I’m sending money blindly to ‘palestine’, but it’s on you to prove it’s going to Hamas”.

So … that’s a no on the supporting evidence?

@Landon. Since you’re such a warrior for the cause, how about you go to Gaza yourself and investigate? Or is protesting at colleges for a cause you don’t even understand more your speed?

This is a red herring. I said nothing about Gaza or Hamas.

You argued that loaning money through Kiva probably does more harm than good. If you have evidence that microloan funds (through Kiva or generally) are subject to high rates of fraud or misuse, that would be a welcome insight.

If you don’t have evidence of that, then what are you adding to the conversation?

Thanks for this article. Are there tax implications to using Kiva? Or just the rewards you’re earnings?

Are there any specific cards you think make more sense than others to use with Kiva? Assuming I don’t want to go to stores to buy gift cards to pay with and I just want to use my cards directly, I guess the Sapphire Reserve or Amex Platinum could help pay for their high annual fees by doing MS with Kiva?

If you’re not working on a welcome bonus I’d recommend using a card that earns 2 transferable points per dollar: Blue Business Plus, Citi Double Cash, Venture, Venture X, etc. No there is no tax implications unless you try to write off losses (I don’t do that personally)

There are a small number of Hamas militants in Palestine which does not lend itself to the correlation that sending funds to a project in Palestine equals funding Hammas. Innocent people are currently on the brink of starvation for something they did not choose.

You are sadly ignorant. First, they did choose. They voted multiple times for hamas. They have overwhelming supported hamas for their atrocities….even idiot leftist gen zs support them! Second, A large percentage of the cement, steel, etc sent to Gaza under the guise of rebuilding was used to build the tunnels used to slaughter innocent civilians. Hamas controls all of Gaza. There are no independent, small businesses. All money sent their goes to hamas. How naive are you, seriously?

I have loaned out $1.5m and it help with meeting sign-up bonuses- and I just add spend even if it mathematically might not make sense (interest – default risk – …). It is doing good too. If I loose some money so be it

Did you also lose 1.69% like Greg, meaning $25k+?

Default 13k Currency Loss 7k – close to Greg.

But 20k for 5m points(just a wild guess) or so is still a bargain and the money is used to do good.

Oh. If you earned 5m points, does that mean Kiva is in a bonus category? I know PayPal Freedom 5x could be one, but that’s not enough. At that rate of $20k per 5m, Kiva can work.

You could use PayPal to pay with a Freedom card, but that has a cap of $1500 spend (7500 URs) when it’s the 5X bonus category.

Several (or a lot) Sign-Up-Bonus spending requirements were reached using Kiva. The Amex Biz Plat 200k MR for $20k etc. Some where 1pt per USD if I needed to reach a spending threshold, others 1.5UR/2UR per USD, … But I’m using Kiva now for a lot of years and spending $1 to get 2MR for a six month loan resulted in 4MR per dollar “APR” when the banks gave you 0.25%. Obviously different at the moment.

Wawawewa, how long have you been Kiva-ing may I ask??

Started with Kiva 11 years ago