Yesterday, a friend named Ariana published a negative post about Kiva “Why I’m No Longer Using Kiva To Earn Points And Miles.” In that post, Ariana complained about the “farce” of Kiva’s peer to peer lending, Kiva partners’ sky high interest fees, the repayment rate myth, and lending inefficiency. This post concerned me deeply. In the past 7 years, I’ve lent nearly half a million dollars through Kiva (not all at once of course!) and received almost all of it back. During that time, I’ve viewed Kiva primarily as an easy way to earn credit card rewards, and secondarily as a way to do good in the world. Was the second part all wrong?

Background

For many years, microloans were touted as a cure for poverty and a solution for empowering women. The problem that microloans seek to solve is the fact that most traditional lending institutions refuse to offer loans to the poor in developing countries. There’s simply too little potential profit, and too much risk to bother. As a consequence, it’s nearly impossible for an aspiring entrepreneur to lift herself out of poverty through entrepreneurship. It takes money to make money.

Starting in the early 1980’s, micro-lending institutions became a big thing. In most cases, they charge interest to borrowers, and also apply for grants and other sources just to cover their costs. Microloans are often short term. Some may be expected to be fully paid in as few as four months, for example. As a result, the annualized interest rates appear to be excessive and maybe even predatory. For example, a 10% fee on a 4 month loan is like a 30% annual interest rate if you simply multiply by 3 (the number of 4 month periods in a year), but the effective annualized rate is 33.1%.

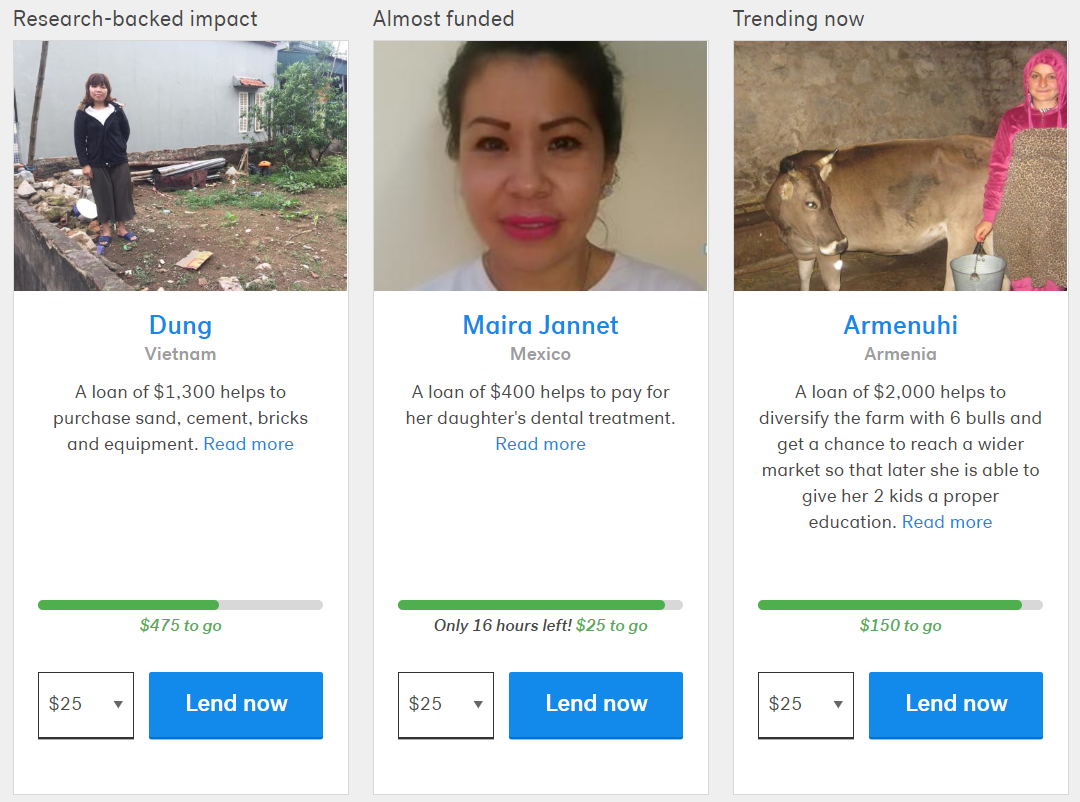

Kiva is a nonprofit organization that helps supply funds for microloans across the world. They do this by contracting with microlending institutions who post information to Kiva’s website about each of the microloans that they have funded or intend to fund. Kiva displays these loans to lenders (like me) who want to fund these loans. Lenders can optionally add a charitable donation to Kiva, along with each loan, but that is not required. Money collected by Kiva (not counting charitable donations) goes to the the microlending organizations. This helps those organizations make many more loans. When the loans are repaid with interest, the microlending organizations keep the interest payments to cover their expenses and return the principal to Kiva. Kiva then returns that money in full to each lender.

Kiva criticism evaluated

Ariana’s negative post about Kiva was based on a 10 year old blog post published by a site called the Center for Global Development, and a 5 year old blog post published on a site called Next Billion. To me, Kiva’s response to Next Billion’s post so thoroughly discredited the article’s “facts” that I don’t think the original article is worth debating except at a very high level when questioning whether or not microloans are a force for good in the world. I’ll get to that debate in a moment.

Kiva Is Not Quite What It Seems

The Center for Global Development post, Kiva Is Not Quite What It Seems, is more thoughtful. It points out that the way Kiva displays loans on its website is misleading. And it is. Kiva makes you think that the borrowers you choose to fund will not get their loans unless you and other Kiva lenders support them. In reality, many loans are funded by the microlenders before they make their way to the Kiva website. Ironically, the author goes on to argue that Kiva’s duplicity is the right thing to do. He makes the case that presenting information the way Kiva does encourages lending, and that the pre-funding of loans is the only realistic way to make the process work. Kiva responded by acknowledging the problem and promising to do better in the future. They wrote:

A main focus of the article has to do with the fact that most of Kiva’s loans are disbursed before they are funded on the Kiva site, which is true. The article points out, rather accurately, that most lenders on the site do not understand this. It goes on to imply that Kiva is taking an active role in perpetuating this misperception.

My response to this critique is two-fold. First, I believe that allowing pre-disbursal is necessary for the success of this model. Second, I think we can do better at educating our users about how and why this is the case.

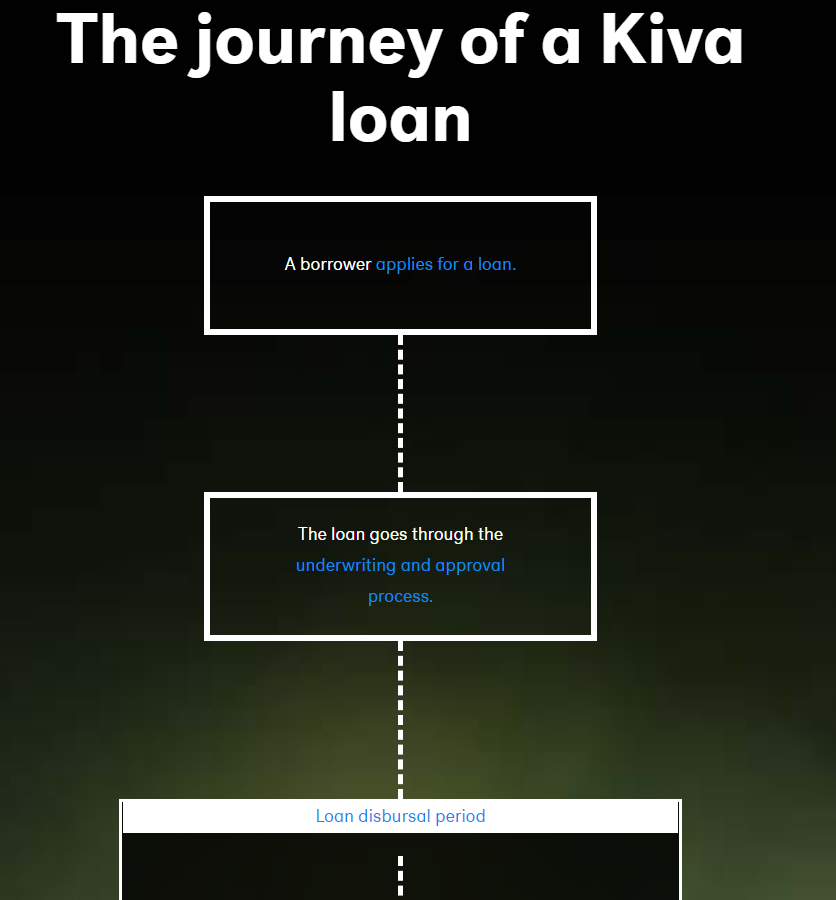

And now, when looking at Kiva’s website 10 years later, have they fixed the problem? In my opinion, no. The “how Kiva works” page shows the journey of a Kiva loan in a way that I think is still a bit misleading. To be fair, it definitely does not say that the loan is disbursed after fundraising, but the diagram doesn’t dispel that assumption either.

It’s necessary to read the FAQ at the bottom of the page to find the the full story (bolding is mine):

How does the money for the loan get to each borrower?

Loan funds reach borrowers through Kiva’s Field Partners, or through the money transfer platform PayPal.For most loans on Kiva, our local Field Partners are responsible for distributing the funds to borrowers. Depending on the Field Partner, the funds may be given to each borrower before, during or after the individual loan is posted on Kiva. Most partners give the funds out before the loan is posted (what we call pre-disbursal) because it allows borrowers to use the funds immediately. So when a lender supports a partner loan on Kiva, the borrower may already have those funds in hand. However, support for that loan is still needed and as the borrower makes repayments, they’re passed along to the specific Kiva lenders who supported the loan.

So, yeah. If you don’t pay careful attention to the details on Kiva’s website, you won’t know that loans are often pre-funded. But now you know. Do you care? I don’t. To me, the more important question is whether Kiva loans are a force for good or bad in the world.

Kiva loans: good or bad?

Next Billion’s scathing post about Kiva (The Kiva Fairytale: It’s a microlending superstar – but who is it really serving?) argues that microlending not only does not alleviate poverty but it makes it worse (bolding is mine):

Does Kiva work? In terms of poverty-alleviation using microcredit, Kiva’s apparent aim, the answer is no. Despite many years of trying, independent academics have been unable to find any convincing data confirming an overall positive impact on poverty reduction achieved by indebting the poor. David Roodman at the Center for Global Development summarized its impact most succinctly: “zero.” With interest rates often exceeding 100 percent, it is not hard to see how microcredit can progressively increase rather than decrease poverty, as demonstrated poignantly by crises in Andhra Pradesh and elsewhere.

As I mentioned earlier in this post, Kiva effectively discredited most of Next Billion’s article. But Kiva didn’t have much to say about whether or not microlending helps to alleviate poverty. In fact, in another post, Kiva admited that “there’s limited evidence that microfinance has helped alleviate poverty.” But they went on to say that they’re working the problem:

Kiva’s mission is to connect people through lending to alleviate poverty, so we’ve been following these findings closely to learn as much as possible about how we can evolve Kiva to make the biggest difference.

I personally spent several hours yesterday reading newer research findings to try to find an up-to-date answer. Do microloans do good or not? Here are some of the articles and research papers that I found most informative:

Six Randomized Evaluations of Microcredit: Introduction and Further Steps

By Abhijit Banerjee, Dean Karlan, and Jonathan Zinman

American Economic Journal: Applied Economics 2015, 7

This research paper analyzed six studies which used randomized assignment methods to evaluate the impact of microlending on various outcomes including income and consumption. The overall headline finding was this: “there is little evidence of transformative effects.” On the positive side, the article states that there is some evidence of positive outcomes “on occupational choice, business scale, consumption choice, female decision power, and improved risk management.” Further, the article states that there is little evidence of harmful effects “even at a high real interest rate.” The paper also goes into detail about why the studies were underpowered for answering these questions. In other words, the lack of positive or negative findings should not be considered conclusive: There isn’t really enough data (at least in the studies they examined).

According to an article in FiveThirtyEight, one of the authors of this evaluation, Dean Karlan, founded Innovations for Poverty Action which is “a nonprofit organization that works with researchers to conduct studies that measure the impact of global anti-poverty programs. IPA is now working with organizations, including the microlender Kiva, to help them find ways to make their programs more effective.”

Does microfinance reduce poverty? Some international evidence

By Quanda Zhang

The B.E. Journal of Macroeconomics 2017-05-10

I have to admit, I didn’t actually read this research paper since it was behind a pay-wall, but I did read the author’s summary, found here: Yes, microlending reduces extreme poverty. In this paper, the author compared “microfinance participation” (meaning the extent to which people sought and received microloans) to poverty and found a negative correlation. In other words “the more people in a given country received small loans, the less poverty it registered.” It’s important to note that this was not an experimental study. There were no experimental groups vs control groups. This is significant because there may be other unmeasured variables that led to this correlation. In other words, while the author used the correlations to infer that microloans reduce poverty, the author had no causal evidence.

Group-based microfinance for collective empowerment: a systematic review of health impacts

By Lois Orton, Andy Penningto, Shilpa Nayak, Amanda Sowden, Martin White & Margaret Whitehead

Bulletin of the World Health Organization 2016;94:694-704A

This bulletin evaluates research into group-based microfinance (where groups rather than individuals obtain microloans) and looks specifically at health outcomes rather than poverty. In this study, the researchers weeded through 4,050 articles to find 23 studies that met their criteria. Within those studies, they found a number of positive health outcomes associated with group-based microfinance. They noted though that very few studies employed “robust designs.” By that, I think they mean that there may have been other reasons for improved health outcomes. For example, they note that some of the microlending organizations may have “health-promotion and/or health-care components” which may have led to the positive results.

Greg’s research summary: Identifying whether or not microloans are a force for good in the world is a surprisingly difficult task. Recent(ish) reports have found some positive outcomes, but they’re not conclusive enough to be the final word.

My take on Kiva

I’ve had the opportunity a couple of times in the past to meet Kiva’s staff and leadership at their headquarters in San Francisco. It’s hard to describe how refreshing it was to talk one on one with people who seemed to truly believe that they were making the world better. They told heart warming stories where they personally witnessed the positive transformative power of microloans. And while I’m routinely skeptical of corporations and politicians that rely on stories to try to assert big picture “truths,” in this case I believe. More accurately, I believe that they believe. And I don’t believe articles that insinuate that evil motives underlie Kiva’s innocent facade.

To be clear: I’m not convinced that my loans made through Kiva are really doing good for the world. I think the loans are tipping things in a positive direction, but I don’t have proof of that. However, I am convinced that Kiva as an organization means well. And I believe that they’re working every day to find ways to make loans more effective. My bet is that loans made today do even more good than loans made 7 years ago.

Kiva is not my charity

I make Kiva loans primarily for earning credit card rewards and secondarily to do good. Separately, I donate money to highly rated charities that help alleviate homelessness, feed the hungry, provide medical aid in the most desperate places, etc. Those are my charitable donations. I’m pointing this out not for a pat on the back, but rather to explain partly why I’m inclined to give Kiva the benefit of the doubt. If Kiva loans were my primary “do good” strategy, I’d probably be more concerned about reports suggesting that they don’t do good or that their motives are impure.

Credit card rewards via Kiva

Here’s how to use Kiva to help earn credit card rewards (for more details, see this post):

- Use Kiva’s filters to find “safe” loans (loans most likely to pay back in full).

- Use your credit card to fund those loans (there’s no fee for credit card processing)

- Wait for the loans to pay back (this can take anywhere from about 6 to 12 months depending upon the specifics of each loan)

- Withdraw the funds to Paypal and then to your bank account

The best credit cards to use with Kiva are those with which you are working towards completing minimum spend requirements for a new welcome bonus, or one of the many cards with big spend bonuses, or a card that has very high rewards for everyday spend.

There are obvious downsides to using Kiva for credit card rewards:

- You may lose money. There is no guarantee that your loans will be paid back.

- Your money is tied up for many months. This is a lost opportunity. During that time, you could have made money with your money via interest payments or investments.

- It can be time consuming to find and fund many loans.

There are ways to alleviate these issues: Use kivalens.org to lend in bulk, filter to “safe loans”, sort by the loans that pay back more often and more quickly, make many small loans rather than few big ones, etc.

I’ve been loaning through Kiva for years, but I haven’t always followed what I now consider to be best practices. A little over a year ago, though, I created a new account and started lending the exact same amount every month and followed these practices to the letter. The goal is to have real world results showing what is likely to happen if you follow these same practices. So far, so good. My default rate is only 0.68%, and I’ve been paid back for most loans a bit more quickly than I expected. I’ll cover this experiment in more detail in the future.

I plan to write up a new guide soon, but for now if you want more details about earning credit card rewards via Kiva, please see: Manufacture Spend (and do good) with Kiva and Kivalens.

Bottom Line

There is some evidence that microlending is a good thing, but the evidence isn’t strong. Regardless of past outcomes (or lack thereof), I believe Kiva is a good organization that intends to make the world a better place. Still, if your primary goal is to use your money to make the world better, you may be better off simply donating to highly rated charities. But if you want to do good and earn credit card rewards, I think that Kiva is worth a look.

[…] Use a credit card to make micro-loans. Most loans pay back in 6 to 12 months, but with no interest. There is no charge to use a credit card to fund loans. Kiva provides filters which can be used to filter out risky loans. As a result, in my experience it is easy to limit loan defaults to far less than 2%. For more details, see: Manufacture Spend (and do good) with Kiva and Kivalens. Yes, I’ve written that defaults are higher than I’d like (see this post), but I still firmly believe that Kiva does a lot of good in the world (see this post). […]

Hey, wonderful analysis, and awesome writing. Wow. Also, fivethirtyeight.com assured us that Hillary Clinton was going to beat Donald Trump too.

I read this article when FM advertised a “loan $25 get $25” promotion. I took advantage of the promotion and was just reviewing my account and found that the $25 “credit” they give you to loan gets repaid to Kiva!

So that was misleading/ a waste of time. I’ll make sure to stay away from Kiva in the future.

Yes, Greg, would love to see your overall lending stats.

I personally have made only $6.5k in loans, primarily to meet minimum spend. My default plus currency plus delinquent is around 1%. One third of that was a loan to a group in Pakistan that defaulted completely.

Some loans I am happy to make even if they are not “safe”. My objective is not always safe loans. I also want to support regions (and groups) where access to capital is otherwise limited, places that I want to visit one day. I still see Kiva as charity, but like you not my main charity.

For those complaining about high interest rates charged by microlending organizations, the alternative is probably no access to lending. Access to capital is key to raising living standards. Kiva is doing a small part in my opinion. Paypal as well since they are absorbing the credit card processing fees.

If Kiva started charging credit card fees, I would probably still use it on occasion.

Greg, I’ve been using Kiva for years now (I’ve loaned out almost 100K), and I have some major issues with it. Money orders are getting harder for me to get, and I need to decide how much I want to use Kiva. I only do 4.5 star loans. Some of concerns…

1. Their interface is shady. They try to sneak on extra fees, and they have changed it many times.

2. Their “default rate” is BS. I have a 7 month loan from 2015 that is still “paying back delinquent”. One payment in the last 4 years. 2 loans from 2017 that haven’t had a payment in a year. My current delinquency rate is 45%.

3. The lack of follow through. Shouldn’t there be some sort of communication if a loan isn’t paying out for a year, and it’s not going to default? Maybe they think that the people that lend $25 and get $10 of it back won’t notice. If I made a $800 loan, I might notice. And spreading out my loans doesn’t eliminate risk in the long term.

These are good points. Thanks for sharing. I’m hoping to do an interview with Kiva to ask them about things like this. I doubt they are intentionally lowering the default rate by the way the handle delinquent loans, but lets hear from them why they do it that way. As to the extra fees: I assume you mean the way the encourage lenders to donate to Kiva with each loan? That’s probably true that they’ve tried different approaches to increase charitable donations to Kiva (this part is tax deductible, unlike the base loan). If you use Kivalens to fill your Kiva basket, that doesn’t happen at all. Kivalens automatically zeros out the donation component.

Shame on you Greg. Kiva is a scam to fleece 3rd-worlders so that 1st-world do-gooders can absolve themselves of their latte-slurping excesses while billions live on less than $3/day. Kiva charges upwards of 60% interest to those least able to afford it – no, 60% IS NOT a typo. The few 3rd-worlders who can repay at loan-shark rates subsidize those who can’t – all so Kiva can fatuously claim their 1st-world latte-sipping supporters get 98% repayment on their loans (or whatever current repayment nonsense is touted).

That you then conveniently “overlook” this scam just to “earn” a few points is beyond contemptible.

If you really want to make a difference of helping the 3rd world, then fund an account over at Zidisha – where the issue loans as low as 5% interest all-in. That’s social justice – where the 3rd World actually pays lower interest than the 1st World. Of course, you won’t be getting points. But are points worth fleecing some of the poorest in the world because you want to fly first class? Shameful choice.

Did you even read this post? Kiva doesn’t charge any interest. It is the field partners that do. And they don’t do so because they’re greedy. They do it so that they can pay their staff a meager wage to keep doing what they do. While research into the Kiva model isn’t conclusive, it seems be a force for good. At the very least, I 100% believe that the Kiva organization intends to do good and will keep tweaking their model to improve.

Yes, Zidisha has a completely different model that doesn’t include field partners. That’s great. But the point of this post was to look at a means for increasing credit card spend and getting most of it back. Zidisha isn’t that. I was very clear in this post that I think of charitable giving as something separate from Kiva loans.

Pretty clear that some of SJW trolls on here are just anti-capitalism in any form. They keep repeating lies over and over, such as the interest rate that “Kiva charges”, no matter how many times you try to tell them it isn’t true.

They use the word “bank” as a swear word. As such they have no place on a travel blog. They are basically opposed to the very raison d’etre of Frequent Miler. “are points worth fleecing some of the poorest in the world because you want to fly first class? Shameful choice”. I suggest you just tell them “thanks for sharing, now go back to whatever socialist blog sent you here”.

Greg, can you do a short analysis on your returns (including ~2-3% for using a CC) vs. investing in S&P500 or another index (fixed income maybe) over that time period? thanks

Yes, I’ll probably do a post comparing Kiva credit card earning to real investment options. Thanks for the suggestion.

I enjoyed this post and learned some things, even as someone who has used kiva for the past year or two. So far I’ve stuck to the $25 minimum for each loan. Greg, do you typically stick to the $25 minimum for each loan and get to a high amount through volume, or are you willing to go above $25 on some loans?

Yes, I use Kivalens’ “bulk add” to add lots of $25 loans to my Kiva basket. I rarely go over $25

Great post, Greg. I don’t doubt that Kiva’s motives are good. My concern is that they don’t disperse the loans as we’re led to believe: Interest-free. You make a good point about the high cost of lending in impoverished countries, but Kiva already has the solution: People who are willing to lend those funds interest-free. Why the loansharking, then?

Kiva itself doesn’t impose any interest. It is the microlending field partners that do. Those organizations have expenses (like employee salaries) that have to be covered somehow. My understanding is that some of these loans are crazy expensive to provide (which is one of the reasons that regular banks don’t do it). Transportation to get to some of these tiny villages in remote places can be crazily time consuming. I’m willing to bet that the field partners charge as little as they reasonably can. The problem is that with small loans, a small fee looks big. For example, a $50 fee on a $500 4 month loan appears to be a 36.7% fee when annualized.

Kiva should be upfront about that. But they’re not and that’s a huge problem. Ask the average Kiva user and they’ll tell you they’re making an interest-free loan to a poor person who can’t afford the initial amount, let alone interest rates of up to 100%. In the post, I linked to an article that stated Kiva spends 6-7 what is normal in microfinancing to disperse loans. They can do better.

Zidisha does actual peer-to-peer lending at 0% interest. The repayment rate is way lower, but plenty of Kiva users are willing to make direct loans with no expectation of return. And platforms like GoFundMe are able to find a way to disperse donations without massive upcharges. My point is, there has got to be a better way than loansharking. But to take those interest-free loans and hand them off to a bank that profits off them through sky-high interest fees? That’s dishonest and should be disclosed for those who are not ok with it.

Kiva and Zidisha work very differently from each other. I’m not arguing that Kiva is better. Not at all. It very well may be that Zidisha does more good. I don’t know. But if you want to earn credit card rewards, then Kiva is obviously better. If you primarily want to be charitable, then Zidisha may be better.

By the way, this was found in the Zidisha FAQ… It looks like borrowers do pay fees. 5% service fee plus up to 30% “credit risk payment”:

As far as leading us to believe that the loans are dispersed interest-free, I never felt led to believe that. Maybe it’s because I had read so many of Greg’s posts about Kiva over the years or because I often read FAQ pages, but I always knew that the lenders charged the borrowers interest. Kiva answers that right on the “how it works” page:

https://www.kiva.org/about/how

I haven’t loaned via Kiva and I certainly haven’t done Greg’s level of research on this. I further am no expert on lending, but I’ll add to what he said. My first reaction whenever I hear people mention high interest rates on these loans is this: The micro lender has to accept applications, review/evaluate those applications, meet with applicants to talk about the loans, disperse the money, collect the payments, do bookkeeping, pay legal costs, pay the rent and utilities for their office, etc. The flat cost in terms of labor hours / overhead to provide a $250 loan seems like it probably isn’t substantially different than the cost of offering a $50,000 loan (of course the labor cost in a developing country is much less than in the US, but I still expect there are multiple hours of labor going into a single loan and the folks with the skill set to work in micro-lending could also use that skill set at major institutions, so they likely command a salary that isn’t so far below whatever people at the major banks in those countries are earning). If cost is relatively constant between a $250 loan and a $50,000 loan, of course it would represent a much higher proportional cost on a smaller loan. Further, since microlenders are likely offering many fewer loans than large traditional banks, it would stand to reason that the basic overhead costs that get split over all loans end up representing a larger relative slice of each loan. I assume that this is why you don’t see major banks in the US offering $250 personal or business loans — if it were profitable to do so at the twenty-something-percent they would be allowed to charge here, I imagine they would all do it. All of that is to say nothing of the additional risk that needs to be covered in terms of things like potential hyper-inflation / unsteady currency values, etc. As Greg notes, a relatively small amount of money (like $50) to cover labor and overhead costs can lead to what looks like an absurdly high interest rate even though that amount of money might not at all be unreasonable given the cost of doing business.

Again, I’m no expert on Kiva or microlending — there are a lot of complex factors involved. But in my mind, logic dictates that higher interest rates would be necessary to sustain the loans on a basic level. Us lending the money interest-free doesn’t equate to no cost for the micro-lender.

That’s not to convince you that you should use Kiva, but rather to say that I think focusing on one fact (high interest rates) distorts the conversation if that fact is considered in a bubble and as compared to very different scenarios (i.e. much larger loans made by much larger institutions in developed countries).

I was referring to the average Kiva lender. Most of them think their interest-free loans are going directly to the individuals they’re sponsoring. And that’s simply not what’s happening. There is a huge disparity between thinking that (or even being ok with interest rates being applied to these loans) and seeing interest fees as high as 100%. That’s completely cruel. There are people in this country who are in credit card debt over 25% interest fees. Imagine paying 100% (or even 35%) and that being your only option in an impoverished part of the world. They should be able to do better than this. And if not, be transparent.

Ariana

Most correct how about the Kickbacks by the locals to the person who got them the loan ? No need to look further then the College BS going on right now . Good idea but very few or it never it turns out right Help the locals by your advise .

CHEERs

I think Ariana is right. Kiva charges usurious interest rates that are simp,y immoral, for me. I did make some small loans using kiva many years ago to help desperately poor people living under occupation; a neighboring country sent military bulldozers into the community and caused even more devastation. I wanted to forgive the loans I’d made since obviously these circumstances weren’t the fault of the borrowers, but kiva wouldn’t allow it.

I felt then, and still feel, ashamed to have had anything to do with kiva.

I feel much better being out of the loan shark business. Now I help poor and oppressed people through groups like Maryknoll, CRS, or Caritas.

Kiva doesn’t charge interest rates. It is the microlending organizations that do. They need to charge something in order to make even a meager living.

Over the past several years, I’ve also loaned several hundred thousand dollars through Kiva. Most of that occurred when the USBank Flexperks card was still coding Kiva as a charity, therefore earning 3x rewards there. Since then, I’ve substantially reduced my loans there, only using it for minimum spends where necessary.

However, I’ve also slowed down because — setting aside any ethical questions between Kiva and its borrowers — I’ve noticed some dishonesty between Kiva and its users. Kiva claims that its users are repaid at a 96.8% repayment rate. First, as of just two years ago, it was claiming to pay back at a 99% rate. A 2 percentage point drop, when factored against a history of $1.3 billion in loans issued by Kiva over the years, means that the last year or two has been ATROCIOUS in terms of repayment. In order for the LIFETIME repayment rate to have dropped by 2 percentage points, the recent repayment rate (say, the past year or two) must be closer to 90%. I’d love to hear Kiva address this. Second, Kiva does not honestly report “defaults.” I still have outstanding loans in my portfolio that were due to be fully repaid as of 1-3 years ago, that still remain unpaid. It is obvious that these loans are defaulted, but instead of moving them into the “default” category, Kiva has kept them in the “paying back – delinquent” category. This allows them to under report true default rates.

As I said, I still lend through Kiva, but I am VERY careful. I fund only the shortest term loans (6-8 months max, preferably with pre-disbursement dates and a front-loaded repayment schedule), and I pay as much attention to delinquency rates, currency exchange loss rates, and repayment schedules as I do to default rates. As a result, on $470k loans lifetime, my total default rate is 0.1%, and my total currency exchange loss rate is 0.05%. Assuming all of my delinquent amounts wind up in default (which, given the age of the delinquencies is a fair assumption), then my default rate would be 0.23%. Still good (but notice how my default rate doubles by exposing Kiva’s technique for leaving long-past due balances in the “delinquent” bucket instead of the appropriate “default” bucket).

In short, in exchange for approximately $1,250 in losses (plus the opportunity cost of tying up money short term), I was able to earn over 1.3 million in flexpoints, as well as to conveniently meet minimum spends. Well worth it. But proceed with extreme caution.

These are interesting points. To summarize what you said:

1) Kiva’s reported payback rate has plummeted from about 99% to 96.8%. And, if they are looking at all time loans for that calculation, that means that the recent loans have been far worse than 96.8%.

2) Kiva isn’t promptly moving loans from delinquent to default, thus making the default rate appear to be smaller than it really is.

Have you reached out to Kiva to ask them about these things? I’d be very interested to hear their response. I don’t believe that they are doing anything deliberate to be deceptive. It would be interesting to learn either why your logic doesn’t apply here or to hear them say something like “you’re right. this is what we’re going to do to fix it…”

About the plummeting payback rate:

The second time I visited Kiva, I remember them talking about the high payback rate as a problem. They felt that if payback was that high then it meant that funds probably weren’t going to the most desperate people. So they expanded into riskier areas and types of loans. I think that most of these are considered experimental, so you can easily filter these out when picking loans.

I believe that filtering to “safe” loans is keeping the payback rate high. My experimental account that I mentioned in the post is doing quite well.

I haven’t reached out to Kiva, mainly because my lending volume has dropped so much, that it doesn’t really matter to me. The explanation that default rates are increasing because they are expanding into more needy areas is logical, but sounds a lot like PR spin — creatively turning a negative into a positive — and so I am skeptical of that answer.

Interestingly, I don’t use the “safe” filter at all, as I think that focuses on Kiva’s star-ratings of these facilities. In my observation, the star ratings don’t appear to bear any meaningful relationship with the hard stats covering default, delinquency, etc. I filter by loan length and default rate, and then manually look at delinquency rates, disbursement dates, repayment schedules. At this point, I tend to end up lending through the same 5 or so field partners.

My experiences in aggregate:

– Loaned almost 200K

– Lost $900 due to default

– Lost $125 is currency valuation

I still have about $350 in delinquent. Looking through all my prior loans it *appears* that they give 2x the repayment period before they default.

So if you have a 12 month loan from July 2017, it was “due” July 2018 and won’t be in default until July 2019.

I’ll also say that when I run into issues, it is primarily from individual partners. I won’t name names, but I had one in Africa that had a significant percentage of loans default about 18 months ago, and I’ve recently had one in SE Asia that has a large number of loans delinquent (but only going to lose 5%-10% of the loan value)

Wait, this is an argument about whether or not a loan thru Kiva helps to eliminate poverty in the entire world? That’s stupid !

If I contribute to a Food Bank in Atlanta, I don’t expect to eliminate hunger throughout Georgia. I just expect to feed some hungry people in Atlanta. Likewise, when I fund a loan in a fourth world country, I don’t for a moment expect to alleviate poverty thru that entire country. I only expect to give some hard working would be entrepreneur/s the funds to improve their lives, and provide for their families. That seems like a grand enough goal for me. 😉

In the same way, if the Micro Lenders build in a cushion to cover defaults, that just makes the whole system function more efficiently. When people expect to get their money back, they are more likely to make a loan. What’s wrong with that?

As for the interest rates, that did shock me at first. Then I realized that if folks had a better option than Kiva, they would use it. Clearly they don’t have a better option. It’s going to cost the Micro Lender money to evaluated potential borrowers and their projects, disperse the money, and collect the repayments. Somebody has to cover those costs. Unless you are willing to travel to a fourth world country, find and evaluate the people/projects yourself, and then go back each month to collect the repayment, risking your entire loan without any interest. Didn’t think so…

The studies don’t look at whether it helps eliminate poverty worldwide. Many looked at whether they helped alleviate poverty in the communities where the microloans were concentrated. Others looked at whether or not the particular people who received the loans ended up earning more.

I find Kivas model to be shady as fcuk and stopped using it after $200k in MS. The 97-99% repayment rate is NOT reflective of what happens on the ground. So how do the banks decide which one of the 100 borrowers default on Kiva’s site? Increased transparency is badly needed.

The question isn’t if microlending is “good”. The only important question here is if Kiva’s model is “good”. An independent organization should have been able to assess this by now. And since there’s no independent report clearly evaluating their model, the answer is not known. But the high interest rates and lack of transparency make it hard for me to say it’s a force for good.

1) The fact that some microlenders (I don’t think that “bank” is an accurate term) cover defaults doesn’t change the fact that Kiva is presumably accurately reporting the default rate from our point of view.

2) To me, this is a feature, not a bug. Since my primary motivation is to earn credit card rewards, I love the fact that microlenders help reduce default rates. This way, I get closer and closer to 0% loss.

ABC

Go buy a Goat for a farmer and be done with it .It worked well giving everyone a home too didn’t it .

CHEERs