NOTICE: This post references card features that have changed, expired, or are not currently available

Note: As of October 13, 2015, the Target REDcard (REDbird) can only be loaded with cash in-store at Target. Gift cards and/or debit cards no longer work to load REDcard. For more info, see: Here is the REDbird memo, “Cash is the only tender guests can use”

As of May 6, 2015, Target no longer accepts credit cards for in-store REDbird reloads. For more information, please see “REDbird Post Memo Answers“, and “REDbird grounded. Now what?“

In the past two weeks, since REDbird (AKA the Target Prepaid REDcard) was launched, I’ve experimented to see what it can and can’t do. Here’s what I found so far…

Background

REDbird is a prepaid card very similar to Bluebird and Serve. As such, it has capabilities that make it very attractive to those who like to earn credit card rewards. To catch up on the basics, please see: REDcard changes everything.

Initial Purchase Limits: 1 per day

When buying a temporary REDbird card at Target, the register requires that the cashier scan and type in your drivers license details and then it requires that you enter your Social Security number, phone number, and date of birth.

If you want to buy the card for someone else, that’s fine. They can register the card online in their own name (see Online Registration, below).

One problem I’ve found is that the register only allows you to buy one temporary card per calendar day. This is inconvenient since the card is currently only available in select stores (see “How to find REDbird”) and so it makes sense to buy temp cards for multiple friends and relatives.

With a helpful cashier, we experimented with ways to get around the one card per day limit. Changing my address didn’t help. However, when I accidentally typed in an incorrect digit in my SSN, the purchase (of a second card) went through successfully.

Online Registration

Despite having to put in all of your personal info at the store, its necessary to do so again online to register the card. This is a good thing since we’ve found that a person other than the one who bought the card can register it. So, if a friend sent you a temporary card, you can register it with your own name, address, SSN, etc.

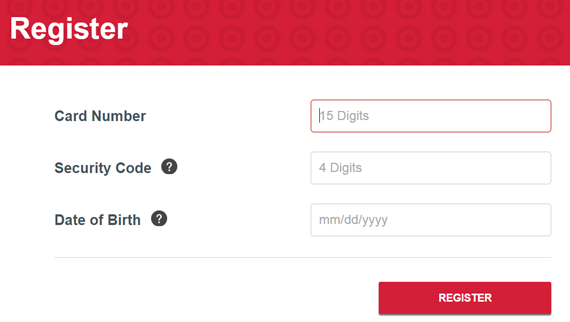

One confusing part, is the first screen when registering where it asks for your card information and date of birth:

If you enter the date of birth of the person who bought the temporary card, the next screen will prepopulate with that person’s details (address, etc.), which can then be changed.

A good alternative option (which was suggested to me by several readers) is to simply leave that field blank. If you leave Date of Birth blank, you can proceed with registration without seeing the card purchaser’s personal information. I can now personally confirm that this works.

Reload Anywhere (in the US)

I know I’ve answered this before, but I keep getting questions about this. YES, if you (or a friend) buy a temporary card at a participating Target store, you can reload it at any Target store in the US. Note though that some stores in North Carolina seem to be having technical difficulties with both the purchase and reload of cards.

Life-cycle Limits

In the post, “The REDbird Life-cycle [Infographic],” I showed that REDbird has multiple stages (thanks again to Travel is Free for the infographic artistry, by the way). As a temporary un-registered card, REDbird can be loaded up to $500 at purchase time, but then works only work as a credit card. As a temporary, registered card, REDbird can be loaded up to $1500 and has ATM capabilities. One the permanent card arrives and is activated, the card gains its full abilities. At each stage, the card has the following limits:

- Temporary, unregistered: $500 load (at time of purchase)

- Temporary, registered: $1500

- Permanent, activated: $1000 per transaction; $2500 per day; $5000 per month

Here’s the new part:

Limits are inclusive of the amounts loaded in the preceding stage

This is confusing, but here’s what I believe to be true based on my experiments:

- The temporary registered card limit of $1500 includes the amount put on the un-registered card at purchase time. So, if you loaded $500 initially, you’ll only be able to add $1000 more to the temporary registered card.

- The permanent activated card limit of $5000 per month includes the amount put on the card when it was temporary and registered, but does not include the amount put on the card at first purchase.

Example:

- Buy temp card and load $500 at time of purchase.

- Once card is registered online, you can add up to $1000 more to the card.

- If permanent card arrives and is activated in the same month as the previous loads, then you can add up to $4000 more that month.

I’ll be interested to hear if anyone has different experiences than those I described above.

REDbird Doesn’t AmexSync

I tried syncing REDbird to Twitter via Amex so that I could sign up for Amex Sync promotions, but it didn’t work. Of the three related cards (Bluebird, REDbird, and Serve), Serve remains the only one (so far) that works with Amex Sync promotions. Please see: Maximizing Amex Sync offers. Part 1: sync multiple cards.

Read more about REDbird:Also: |

|---|

[…] REDbird Advanced – Experiment Results […]

First of all thanks for all the info. Wifey and I have begun experimenting with prepaid REDcard. This is the best financial instrument in my toolbox since we got a HELOC. Now every 0% APR card that we get becomes a zero percent personal loan. With cashback and signup cash, and perks, debt now earns high yield tax free interest in a sense. I have heard economists postulating the possible effects of a negative interest economy, something never before known in history. We are there now. With widespread responsible use, the effect of this prepaid REDcard is actually good for an ailing US economy. If you understand banking, and have an enlightened world view, you will agree.

Some are saying elsewhere that the prepaid REDcard might become restricted at any moment. While that is possible, the opposite is just as likely, though expect legislation to prevent abuse, i.e. waves of bankruptcy filings. It could be that many financial institutions will climb on board this new trend in banking.

To preserve this deal as we head into the new frontier of banking, please have a healthy share the wealth policy. That is, create financial relationships with banking institutions for the cards you are using, AMEX being the number one. Offset 0% APR cards with some deposits at those institutions you are using. Keeping at least 5% to 10% of the generated debt on deposit in savings and checking accounts, should keep this deal alive a bit longer as there remain promising prospects for banks. Keeping more like 20% on deposit should keep the deal alive for a long time. Note that those on government programs will likely not be permitted to keep substantial deposits; average daily balances can be a little high but month end and first of month balances must be low. Again, expect that some legislation might need to be changed, no problem at all if enough banks are in favor.

Oh yes, and remember to allow Target some competitive advantage when doing your shopping. Remember you still get 5% off in addition to your cashback, points, perks, etc. You will already be going to Target often. Why not browse around a bit? Use the REDcard store card for a little more time to pay if you like; you know where to get the cash to pay off your store card. Right? Tying some good amount of spending to the prepaid REDcard should be better since store managers see direct results from prepaid REDcard spending rather than speculating as to reasons why store purchases may be increasing.

To pay off our HELOC without substantially damaging credit, just at the cusp of getting the nice cards, has required my wife and I going the ATM route for immediate daily balance transfer. It’s cash out from Allpoint, then cash in at our financial institution where our HELOC is held, both ATMs nicely positioned together near Target in a safe location. Note that a HELOC is a revolving line of credit just like a credit card. So our overall utilization remains relatively same though exact reporting times of the month for the institutions involved are anyone’s guess.

One bit of unreported info I can leave you with is that the ATM limit is actually $780 at Allpoint ATMs around our location. Another bit of info I had not found anywhere, especially important at tax time, is that the $20 targeted bonus for federal tax return direct deposit, might be had online after registering your prepaid REDcard and then logging in to your account after something like 24 hours or so. When eFiling taxes, the direct deposit can be split three ways. Only put $1 direct deposit toward those not listed first on the tax filing, since it might take considerably longer to get the money. Even though REDcard costs $5 and BlueBird is free, REDcard gives $20, while BlueBird gives only $10 and has excessive hassles on loading, especially if you are liking the Citibank products like DoubleCash. Citi should be fine with the 2X bonus. It’s at 5X where the banks are not going to be happy. Remember, do for America your express duty, share the wealth.

Oops, I read the fine print which says that the $20 tax refund credit is only applied within 30 days to the primary tax filer. Since filing separately eliminates the EIC, I’ll still try the $1 direct deposit and report back, Insha’Allah. Worst comes to worst I’ll haggle on the phone an hour to no avail. Most financial institutions just give up the dollars to keep you happy, because after all, money is all purely an banker’s illusion. Like, right, 30 days will be 4 or 5 anyway.

Hmm… 5x grocery spend cashback, how might USbank sustain that anyway? I’m going for USbank if and after I get Chase IHG. I’m pre-approved for a USbank Kroger 123, mostly worthless in terms of credit hit considering my over 40MPG. But would the Kroger 123 help in any way towards getting the USbank relationship and 5x grocery spend?

FYI, Citi products give 5X back on $500 grocery spend soon after running negative statement balance. Call to request refund check or log in and I see such and such about being inactive and wanting you back. It happens to me on 3 different Citi products and only commonality I can see is the negative statement balance. It’s only small $25 per month per product; and I’m new to yout’s guys’ game, I’m just trying to give back what I have to offer. Groceries and home improvements are my biggest categories, 5x Discover at Menards with 11% rebate check, repurchase with rebate,

Between Discover and Citi, I have plenty 5x grocery spend to fill before March 31, 2015. I’m treating for multiple $60 Kroger spend (with 2x fuel rewards) for $70 Outback Steakhouse gift cards plus free Bloomin’ Onions and/or desserts per table today. I’ll be right next door to Target, yeah! Does anybody else have a better idea on grocery spend before March 31?

I forgot to finish the bit about Discover. Discover returns are processed at the cashback rate for the quarter in which they occur. Purchase at 5x and return at 0.25X = 4.75X cashback for your credit limit with no spend.

Oh and BTW, what’s with these in-store Menard’s BS-MF checks? Don’t they even realize I can use the 11% rebate to repurchase everything from past 90 days, take it to register, and return it with wads of paper receipts going back to credit cards? The prices do not even fluctuate. It takes hours. It’s a waste of everyone’s time and Menard’s money and customer satisfaction because the employee’s are paid and customers are pissed waiting in line! Nowadays, I just go to the register and say, “Are you really going to inconvenience me to get all this stuff!” Manager! Nope, they don’t because they know my next step is asking for a personal shopper (aka kiss A&& slave) to bring it all to me.

An issue that I’m having when I go to load the card it says ‘amount too small’ even if that amount is $1500. So if i try a lower amount, say $1000 then it works. It’s bizarre, but a minor inconvenience.

Yep, that happened to me the first time I went to reload my card. As you wrote, as long as you keep the dollar amount to $1k or less, it will go through.

I purchased a temporary card the other day at a Target store in PA outside of Philadelphia. Everything I see on the REDcard website says that there is a reload charge of $3.00. Also, I thought that when I used my temporary registered card at Target I would get the usual Target 5% off my purchase. That did not happen and when I asked the cashier he said only the Target credit and debit cards get the discount.

RBrock – I have used the prepaid target card and there is no reload fee. Can you post the text where you see this please? You also get 5% off your purchase by using the card…on a purchase, not for loading the card. If you did not get 5% off see customer service at your target store.

Unfortunately, you didn’t get the Prepaid REDcard, you got the American Express for Target card. That card is still useful, but not nearly as good as the REDcard

Which store outside of Philadelphia did you get the card from?

Hi which store did you purchase the card from? I’ve been looking everywhere! Thanks.

Can anyone post details about what the cashiers need to do to load this card. i.e. at stores that aren’t selling it and they might not be familiar with the process.

What I’m looking for is akin to what we tell WM cashiers: “transaction code 70, blah blah”

TIA!

Tell them to swipe the REDcard on their terminal just as they would with a gift card reload. Instructions will be on the screen after that.

Anyone try loading 2 cards in one transaction for $1000 each ($2000 total)?

I got the permanent card today. It seems that I can’t withdraw money to my bank account. Can you do it? If not, I will use it to pay my credit card bills.

You can. Settings > Withdraw Funds.

I followed your instruction: “If permanent card arrives, you can add up to $4000 more that month.” Actually, it can only add up to $3500 because the total amount should be $5000 including the $500 temporary card + $1000 Temporary registered card. I tried to load $1000 unsuccessfully (over the $5000 limit), but my credit card was still charged. I called Target AMEX and my Chase credit card, as well as went to the store, but now I still couldn’t get my $1000 back. I can only dispute the charge. I hope my $1000 can be refunded. Do you have any other solutions?

No, my statement was correct. The initial load amount (e.g. $500) doesn’t count towards your monthly limit.

.

I don’t understand why your load failed but your credit card was still charged. Has the charge moved from pending to actual? If not, maybe it won’t. If so, yes I would dispute the charge if calling REDbird support doesn’t help.

Picked up a couple of these on my way through the Milwaukee area last week. Chase may flag these as fraudulent transactions (they did for me) – just wait a couple minutes until they send the confirmation email and click Yes, then have Target reprocess the transaction. Activated the permanent cards (one for me, one for my gf), and was able to load another $2500 (across three transactions) per card with my Sapphire. Withdrew the money to my checking account, no problem. Looking good!

If you make the switch from Bluebird to Redbird, I wonder if you can time it properly to double dip for a month. So for example keep Bluebird for the first few days/week of November, earn the 5k points – then empty the account and open a Redbird card and get another 5k in points for the month. So 10k points instead of a normal 5k for the month?

Yes, definitely. Whenever I switch products (e.g. Bluebird to Serve, Serve to Redbird, whatever), I try to do that

[…] case, I was the purchaser, but I was registering the REDbird to a relative’s name. I used Frequent Miler’s suggestion of leaving the Date of Birth blank on the first screen, and it worked […]

[…] the system won’t allow the second purchase. Its not hard to work around this limit (see: “REDbird advanced – Experiment results”), but still its hard to imagine what purpose it […]

I can verify that I was allowed $500 via credit card at a participating store. After registering I then added $1000 to the temp card via credit cards at a store that does not offer the cards and had no idea what I was talking about, yet it was still fast and easy. I was then unable to add more money to the temp card – probably verifying the $1500 total limit before you receive the permanent card. Question for other users – any cases of cash advance fees being charged, maybe by Citi or US Bank? I haven’t tried those brands yet. And can you pay with an Amex or is that not allowed? And if you are not allowed Amex’s, are the Citi Amex branded cards allowed?

As a backup to CCs, can someone confirm debit cards with pins will work for loading Red cards?

Yes: https://frequentmiler.com/2014/10/09/confirmed-redcard-likes-vanilla-and-more/

Can someone confirm *exactly* what details of personal info is required at both the initial (purchase of the temp card in store) and registration (online for the permanent card)?

Because the card is not available within 1000 miles of me, I need to ask a friend in another state (who knows nothing about the game) to get the temp card for me. Since I have not actually seen the cards myself (or what the user sees when purchasing them), I’m looking for details so I can guide my friend through the process.

In store, to purchase the temp card, I’ve seen references to the following – is there anything else?

– SSN (which, it now appears, can be random? wow, they don’t do any check on this?)

– security code (is this printed on the card or it’s packaging?)

– purchaser’s date-of-birth (does this one need to be accurate, or can they use any date indicating the buyer is a legal adult?)

– Drivers license info (anybody know if this gets verified?)

Is there anything else that the buyer needs to enter/provide besides this?

Thanks.

My sister in Arizona just got one for me. Here’s her email briefly explaining her experience.

“I bought the card yesterday, will mail tomorrow. There was a requirement to put $$ on it, so I did. The cashier confused me, the cost of the card was $5, so I said load it with $15, and I paid with a $20 bill. The receipt shows a $25 charge, but the cashier said $5 was waived. So I don’t know if there’s $15 or $20 on the card.”

Your friend would have to:

1) hand cashier a Prepaid REDcard to buy (make sure it is the Prepaid one, not the debit or credit one!)

2) Tell cashier how much to load (1 cent to $500)

3) Give cashier his/her drivers license.

4) Cashier will enter DL #, name and address

5) Your friend will then be prompted to enter: SSN, date of birth, and phone number

6) Your friend will then have to pay for the load (1 cent to $500)

When you get the card you can then register it online to your name and address and SSN

For those of us who have to travel for these would it be possible to buy your first temporary card at store A then drive to store B and buy a second temporary card in the same day without fat fingering one’s SSN?

I don’t know. My guess is that the SSN is known system wide, but I definitely could be wrong about that.