NOTICE: This post references card features that have changed, expired, or are not currently available

Lately I’ve had a bit of a crush on my Citi Prestige card. I signed up for the card in September in order to take advantage of both expiring and new benefits to the card (see “Citi Prestige experiment failed, yet I’m way ahead. Here’s how…”). Thanks to the Flight Points feature of the card (which is no longer available to those signing up now), I’m currently earning between 2 to 6 points per dollar with the card, depending upon where I use it. And, the points earned are more valuable than ever, especially for someone who flies AA or US Airways often (and I am now in that group thanks to my 30,000 miles to nowhere challenge).

While the Prestige card has clearly been good to me so far (queue Joe Walsh…), I realize that most readers do not yet have the card and have therefore missed out on the card’s expired benefits (flight points, annual companion ticket, etc.). Still, the card has a few terrific new benefits, so it is worth considering. That said, Citi also offers a much less expensive but similarly named Citi ThankYou Premier card. And then there’s the no fee but also similarly named Citi ThankYou Preferred card….

Which is right for you? Any of them? All of them? Let’s drill down into each, from least to most expensive:

Citi ThankYou Preferred

Annual fee: $0

Current signup bonus: 30,000 ThankYou points after $2K spend in 4 months.

Category bonuses: 2X dining and entertainment; 1X elsewhere

There’s not a lot to say about this card. Its best traits are its decent signup bonus for a no-fee card and not horrible earnings for dining and entertainment. Unless you also have the Premier or Prestige card, points are worth at most 1 cent each. So, for spend, you would do much better with a no-fee 2X everywhere card such as the Citi Double Cash card or the Fidelity Investment Rewards card. Still, the card is worth considering for its signup bonus alone.

Citi ThankYou Premier

Annual fee: $125 (waived first year)

Current signup bonus: 50,000 ThankYou points: 20,000 after $2K spend in 3 months + 30,000 more after $3K spend in 3 months in year 2

Category bonuses: 3X dining and entertainment; 2X airlines, hotels, and travel agencies; 1X elsewhere.

Perks:

- Redeem points for 1.25 cents each towards airfare

- Transfer points to participating loyalty travel programs

- No foreign transaction fees

Where the Preferred card is good only for its signup bonus (in my opinion), the Premier offers a decent combination of category bonuses and valuable rewards. If you dine out often, it’s hard to do better than 3X points, uncapped. Also, “entertainment” is a pretty broad category! Here’s what Citi says about it:

Q: How is the entertainment category defined?

A: Entertainment is defined broadly as purchases made for live performances (e.g., concerts, theater), movie theaters, amusement parks and cultural events (e.g., zoos, museums). Entertainment merchants include sports promoters, theatrical promoters, movie theaters, amusement parks, tourist attractions, record stores and video rental stores.

2X for airlines, hotels, and travel agencies isn’t nearly as broad as the Chase Sapphire Preferred card’s “2X for travel” category bonus, but it would probably capture most of your big travel expenses.

When redeeming points, your best value will be to transfer to airline programs such as Singapore Airlines or Air France or to use the points directly to buy airfare at a discount. When used to buy airfare, points are worth 1.25 cents each, which happens to be the same rate offered by Chase with their Ultimate Rewards program for Sapphire Preferred and Ink Plus cardholders.

Compared to the Chase Sapphire Preferred, this card is a bit more expensive ($125 vs. $95) and it has fewer useful transfer partners. On the other hand, the Premier card offers 3X for dining and entertainment whereas the Sapphire Preferred tops out at 2X except on the first Friday of each month when they offer 3X for dining. Overall, I see this card as being extremely competitive compared to the Sapphire Preferred as an all around go-to travel credit card.

Citi Prestige

Annual fee: $450 (or $350 for Citigold customers)

Current signup bonus: 30,000 ThankYou points after $2K spend in 3 months. Note that there is a 60,000 point in-branch signup offer (after $15K spend in 12 months) and I was able to get bumped up to that offer by faxing in a request (details here).

Category bonuses: 3X airlines, hotels, and travel agencies; 2x dining and entertainment; 1X elsewhere.

Perks:

- $250 air travel credit (including airfare) per calendar year

- Free lounge access: AA Admirals Club Lounge access, and Priority Pass Select with free guests

- $100 Global Entry application fee credit

- Use points for 1.33 cents value for any flight; or 1.6 cents per point value on American Airlines

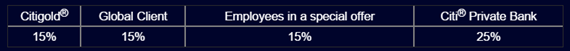

- 15% to 25% Relationship bonus for Citi Gold, Global Client, and Citi Private Bank customers.

- Transfer points to participating loyalty travel programs.

- 4th night free hotel benefit

- Complementary green fees at many golf courses

- No foreign transaction fees

It used to be that the Prestige card offered $200 of travel credits each year, but only to reimburse fees (such as checked bag fees). Now they’ve increased the benefit to $250 per year and made it available for all airline charges. This means that you can pay for a single flight with your Prestige card and automatically get $250 of that charge reimbursed each calendar year. To me, this makes the air travel credit so easy to get that it might as well be considered a discount off of the annual fee. When looked at that way, the annual fee is really just $200 ($450 – $250). Citigold customers do even better and net a mere $100 annual fee after accounting for the $250 rebate. That’s $25 cheaper than the Premier card!

When considering that the annual fee is not nearly as high as it appears (thanks to the air travel credit), the card’s earning rate and perks are pretty darn good. Unlike lounge club access with many other cards, this one includes the ability to bring in guests for free (even with the Priority Pass Select membership). In comparison, the $450 Amex Platinum card offers free lounge club access only to the cardholders themselves except when visiting American Express’ own lounges. Amex also offers $200 in airline fee credits to help offset the annual fee, but you have to pick a single airline each year and are reimbursed only for fees, not for airfare.

Like the Amex Platinum card, the Prestige card offers a $100 Global Entry fee credit. If you, or a family member, or friend hasn’t yet signed up for Global Entry, I think its really worth the effort. Even if you don’t travel internationally often, this will give you automatic entry into the TSA-PRE program so that you won’t have to take off your shoes, take out liquids, or any other such hassles when going through security for most domestic trips.

The Prestige card also makes your ThankYou points more valuable, especially when used on American Airlines or US Airways flights. Where the Premier card gives you at most 1.25 cents value per point towards airfare, the Prestige card tops out at 1.6 cents per point. For example, with the Premier card, a $500 flight would cost 40,000 ThankYou points. With the Prestige card, the same flight (if on AA or US Airways) would cost 31,250 points. That amounts to nearly 22% fewer points.

Another difference between the Prestige and Premier card are the 2X and 3X category bonuses. The two cards are exactly opposite: where one offers 3X, the other offers 2X, and vice versa. The Prestige, for example, offers 3X for select travel whereas the Premier offers 2X. And, the Premier card offers 3X for dining and entertainment, whereas the Prestige offers 2X. In a way, it would be best to have both cards so as to get 3X in all four categories, but I don’t think its worth the extra annual fee for most people to do so.

Another advantage of the Prestige card is the annual relationship bonus. With a Citigold, Global Client, or Citi Private Bank relationship, you’ll earn an annual point bonus of 15% to 25%:

The relationship bonus explicitly does not include promotional bonus points (such as the signup bonus), but it’s unclear to me whether or not it applies to category bonus earnings. For example, if you spend $10,000 on the card entirely within the 3X category, you’ll end the year with 30,000 points. Then, with a 15% relationship bonus, will you earn 1,500 more points (15% of the base 10,000 points) or 4,500 points (15% of 30,000 points)? Either way, it’s a nice little perk.

Which is right for you?

For those who sign up for cards just for the signup bonus (and then cancel or downgrade to a no annual fee card at the end of the year), I think all three cards are good options. Even though the Prestige card doesn’t waive the $450 annual fee the first year, you can easily recoup more than the fee by signing up for the card mid-year. By doing so, you can earn the $250 annual airfare credit twice before the second annual fee comes due.

With the Premier card it’s a bit trickier to avoid the annual fee despite the fact that there is no first year fee. This is because Citi doesn’t pay out the full bonus until after you renew.

Any keepers?

Since the Preferred card is free, there’s no reason not to keep it. However, the question of whether or not to keep each card is less clear for the Premier and Prestige…

For those who eat out often and/or spend a lot within the “entertainment” category, the ThankYou Premier card is likely to be a keeper especially if ThankYou points are spent on airfare or transferred to high value airline loyalty programs. One of the most compelling reasons to keep the card is that Citi may offer to waive your annual fee each year if you call and ask. Last year Citi let me keep my card for free (details in this post), and this year they offered to wave the fee if I spent $4500 on the card in three months.

If you already have a stash of ThankYou points and Citigold checking, then keeping the Prestige card makes sense. Your net annual cost will be just $100, you’ll earn more points, your points will be more valuable, and you’ll earn a slew of useful benefits. For everyone else, I think it really depends upon how much value you get from the card’s earning structure, rewards, and perks. The answer to that will depend upon your own situation. I have almost a year to make up my mind regarding this card. Most likely I’ll try signing up for Citigold checking again (surprisingly they denied my application last time!). If that works out, my guess is that I’ll keep the card for its perks and use it for its 3X categories (airfare, hotels, and travel agencies). Of course, I’ll call at the end of the year to see if they can offer any extra incentives to stay on board…

[…] See: Citi Prestige vs Premier vs Preferred […]

[…] This post is a re-write of a previously published post: Citi Prestige vs Premier vs Preferred. Since that post was written, there have been big changes in the ThankYou […]

I’ve been pretty impressed by Citi prestige so far especially their excellent customer service. I can’t speak the same of Priority pass unfortunately. Their customer service is crap and reps really arrogant. I truly think that the card is worth more than its $450 AF or $350 for citigold members. However I was told at the branch that you need to maintain a balance of $50k in the account to open a citigold account

Most people when signing up in-branch have told me that they got setup with the $350 annual fee, even without CitiGold checking.

[…] The Citi Prestige is an expensive card at $450 per year, but it has a ton of perks that can effectively bring that cost down by more than half every single year. Both Greg and I have extolled the virtues of the card in recent months, so I won’t cover them all again here. If you want to know more about the features of the Prestige, check out Greg’s post “Citi Prestige vs Premier vs Preferred.” […]

[…] recently become a big fan of the Citi Prestige card (see “Citi Prestige vs Premier vs Preferred”). It may even be the single best travel rewards card currently available, but I’ll defer […]

[…] See also: Citi Prestige vs Premier vs Preferred […]

[…] Citi Prestige, Citi Premier, Citi Preferred. Which is best? – The Frequent Miler […]

Does anyone know where I can find how many flight points I have accumulated? My first statement in October showed 300k+ bonus points. Any idea what “bonus points” are? I did pay some award fees with the Prestige in October.

Your flight points will probably show on your next statement

[…] Citi Prestige vs Premier vs Preferred by Frequent Miler […]

The points do pool into one account. And they all do become worth 1.6 cents for travel on American/US Airways. But if you close a card the points earned on that card are forfeited. And I am not aware of a way to figure out how many points are forfeited in advance of closing a card. I learned this when I downgraded a TY Preferred to a Dividend card.

I talked to TYP rewards people and they have access to that info. Supposedly the way it works is oldest points are used first when doing redemptions. But other than calling, don’t know any way to track it.

Sorry to hear that! I think you can keep your points by downgrading to a card that earns ThankYou points like the ThankYou Preferred

I think I will hold off on the Citi TY Prestige Card until my Citi AA Exec Cards reach the 1 year anniversary. Then I will apply for the Citi TY Prestige Card and move credit from my Citi AA Exec Cards. That way I will continue to get AA lounge access for another year 🙂

That makes sense

Can you share any of the golf course info? That might push me over the edge to app for it

And to add to what Travis asked… I’d love to be able to use my Prestige golf benefit to treat a friend or family member to a round of golf (I don’t play golf myself). Any hope for this?

According the T&C (if I recall correctly), the golf benefit is just for the primary cardholder. Not sure if that’s really enforced though

If memory serves, you get 3 rounds per year at your choice of many different golf courses (they have an online tool to find them).

[…] Citi Prestige vs Premier vs Preferred – Frequent Miler Excellent comprehensive review summary of the three different cards. […]

Thanks for the overview! What is needed for Citi Gold? It looks like you need a significant amount of funds on deposit with Citi to waive the monthly fee.

Yep, it is significant:

Waive monthly service fees on your Citigold checking account by linking accounts. There’s no monthly service fee for the first two statement periods. After that, we’ll continue to waive the monthly service fee if the combined average monthly balance of your eligible linked accounts is:

$50,000 or more in eligible linked deposit and retirement balances OR

$100,000 13 or more in eligible linked deposits, retirement balances, investments18 credit cards and loans/lines of credit excluding first mortgage OR

$250,000* 13 or more All of the above including first mortgage

Otherwise, a $30 monthly service fee will apply.1

Nice comparison! A few thoughts/questions:

1) From what I understand, if one earns points on, say, the Prestige and then later cancels or downgrades that card, the points will expire, correct?

2) I was delightfully given the card w/ 60K bonus (30+30) and $350 annual fee when applying in-branch, even though I don’t have a CitiGold account. Any idea whether I’ll still get the relationship bonus? Or, I presume, it’s too early to tell, right?

3) Re Global Entry… I already have this (thanks, Amex Platinum!), but you mentioned gifting this benefit to family or friends. How would one go about doing that?

Point are collected under one TYP account. However, If you cancel one card, the points collected from that account will expire 60 days later.

Yep, just read about that on FlyerTalk. At least upgrading or downgrading a card, though, seems to prevent that expiration. Whew!

If you cancel, you can transfer to one of the partners and effectively let them live a longer life that way. Best redemption value is SQ for Suites but have to pay those pesky fuel surcharges (which look absolutely ridiculous with $60 oil)

1) Yes, if you cancel the card the points will expire. If you downgrade the card to another card that offers ThankYou points I think your points will be preserved (but I don’t know that for sure).

2) I doubt it, but that would be awesome.

3) Simply use your card to pay for Global Entry when someone else signs up