NOTICE: This post references card features that have changed, expired, or are not currently available

Last week, as the clock ticked down towards the last chance to use US Airways Chairman Preferred upgrade certificates, I finally found a reasonably good use for them. My wife and I had been planning a short trip to London where she has a business meeting in May. Our plan was to buy economy seats and use my wife’s Delta Diamond global upgrade certificates to fly business class. We were going to leave our son in my mom’s care, which would have been fine, but we still wanted to minimize our time away, so non-stop Delta flights were key.

Then, our son decided that he wanted to go too. And, what the heck, I asked my mom if she’d like to join us. Yep!

Our new plan was to use my wife’s Delta upgrades for her and our son while I would use my US Airways upgrades for myself and my mom. Delta upgrades were readily available, but US Airways upgrades were hard to find. I used Expert Flyer to search for upgrade space. Nothing was available to London. And, due to the merger of the US Airways and American mileage programs, wait-listing wasn’t an option. I then checked the US Airways Route Map to look for other options. Back to Expert Flyer, I checked almost every single US Airways transatlantic flight. I found return upgrade space on a number of routes, but very little outbound. That made sense. Almost all outbound flights are overnight, and people value the ability to lie flat and get a few hours sleep, so business class seats on those routes are in high demand. In the end, I found two options that would work for us: Philadelphia to Athens and Philadelphia to Shannon, Ireland. Both were similarly priced. The Athens flight had the benefit of offering more earned miles, but would land us pretty far from London. The Shannon flight, on the other hand, would get us close to our desired destination, and was a good fit overall time-wise. I booked the latter with a return flight from Dublin. I would worry about booking flights between Ireland and London later.

Unfortunately, I hadn’t done all of my homework ahead of time… When I called to apply my upgrades I learned that the outbound flight to Shannon does not have fully lie flat seats. Ugh. Still, I expect that we’ll be substantially more comfortable than in coach. I realize that, to many, it must sound crazy to book a two-stop route to London just to make use of expiring upgrade certificates. Yeah, I agree. But, my mom was up for the adventure and it will help me re-up my AA Executive Platinum status for 2016 so I think it’s worth it.

I paid for the US Airways flights with my Citi ThankYou points. Citi Prestige cardholders automatically get 1.6 cents per point value from ThankYou points when they’re used to book US Airways or AA flights. The flights I booked weren’t particularly cheap (about $1200 each), but it took only 149,220 ThankYou points to book both flights. And, we’ll both earn miles for the trip. Considering that some airlines charge almost that many miles at their saver level for a single round trip business class award flight to Europe, I think we got a great deal. Delta, for example, would charge at least 125,000 miles per person, plus taxes and fees. Since ThankYou rewards are tied directly to airfare, it would have been possible to get an even better deal if I had found a lower priced itinerary.

Prestige, plus AA Executive Platinum

Shortly after booking and upgrading our flights to/near London, I logged into my American Airlines account and discovered my US Airways status had already been merged into my AA account – I now had Executive Platinum status! And, unlike US Airways, AA lets you see your available international upgrade certificates online (www.aa.com/loyalty/profile/summary). Yep, I had 8 certificates, as expected. I immediately called AA to apply two of the certificates to my Beijing flight (details about my flight can be found here). I had booked business class, but hoped to fly in first class. They were able to upgrade my return flight immediately, but my outbound flight was waitlisted. I’ve been told that upgrade space often opens up very close to departure, so I’m hopeful. If it doesn’t clear, I’ll be fine in business class.

The two recent upgrade experiences described above made me realize how valuable it is to have both AA Executive Platinum status and the Citi Prestige card. With both, I can book economy international flights on AA or US Airways, pay with ThankYou points at a very reasonable rate, and, when lucky, upgrade to business class.

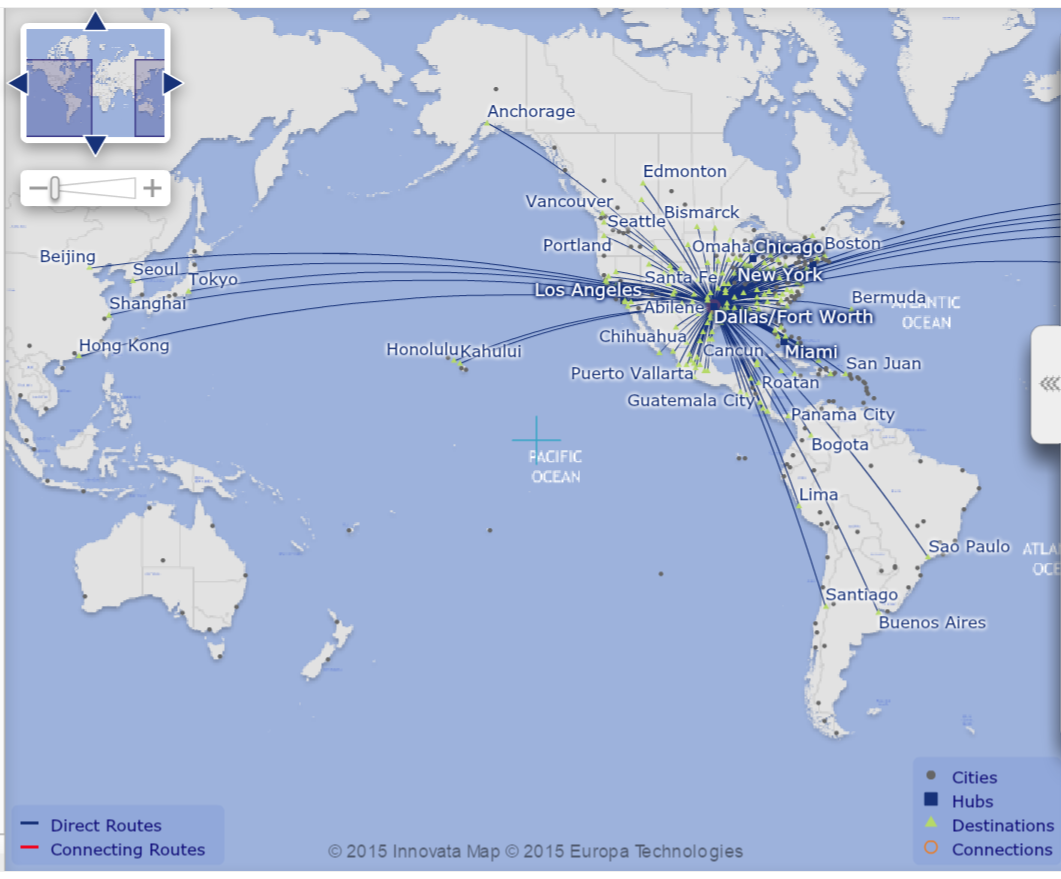

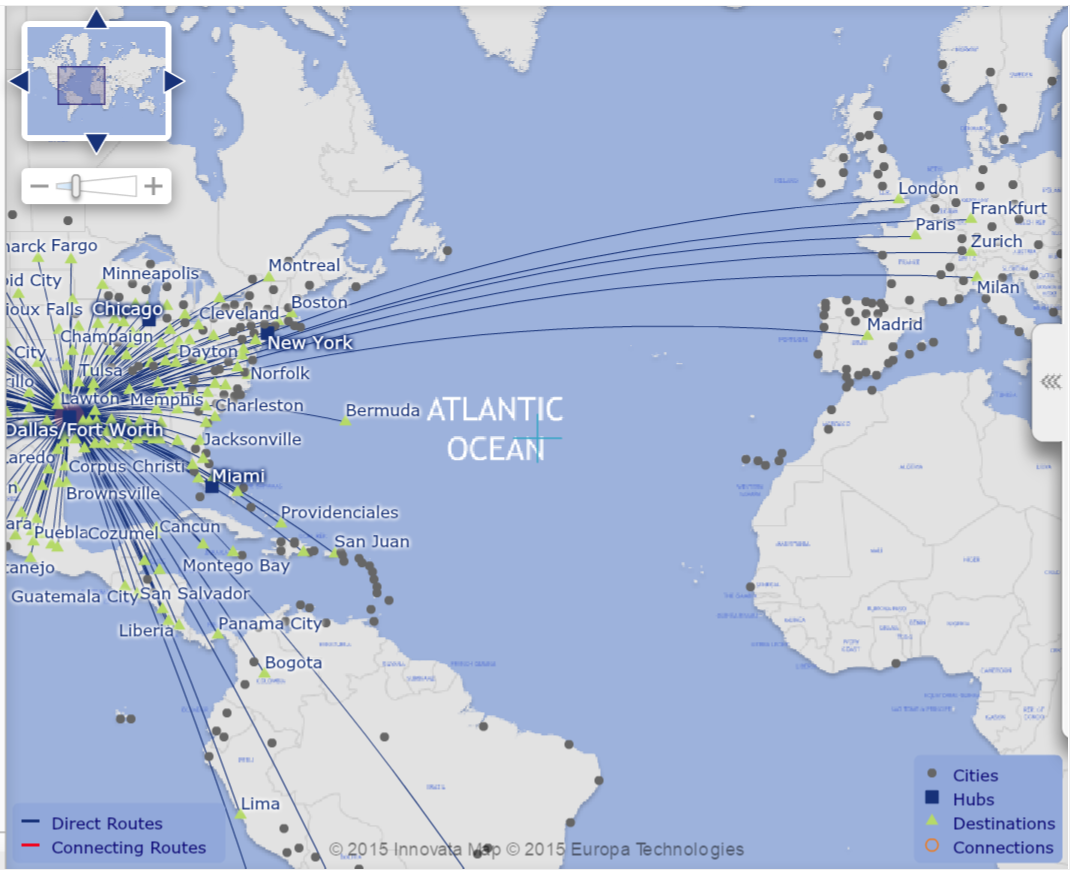

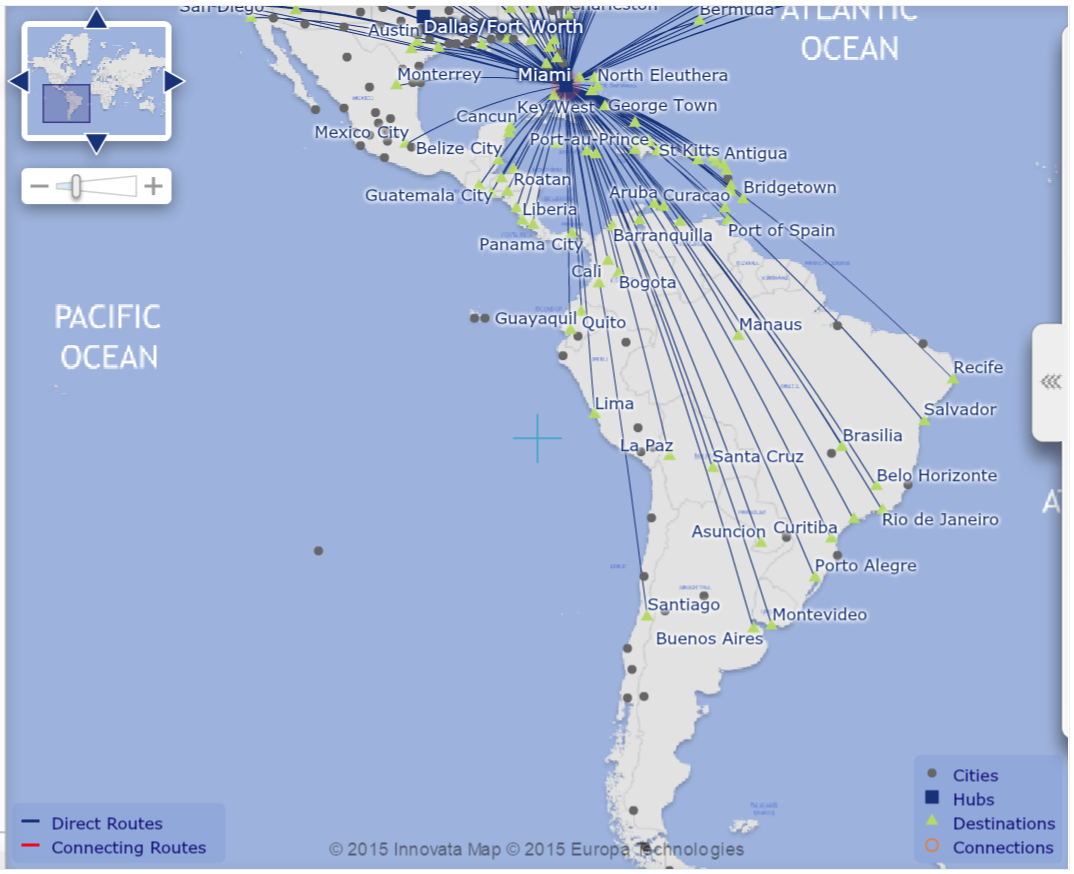

The maps below show many of the international routes that are available. Complete route maps can be found on AA.com and USAirways.com.

The maps above show excellent coverage of Central and South America, good coverage of Europe, and reasonable coverage of east Asia. Let’s spot check a few routes to compare the price in ThankYou points to award prices…

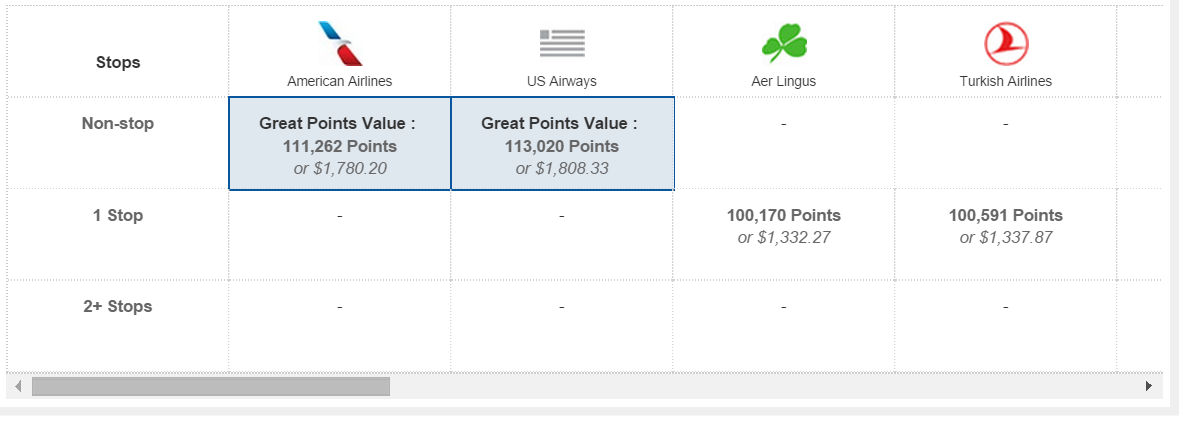

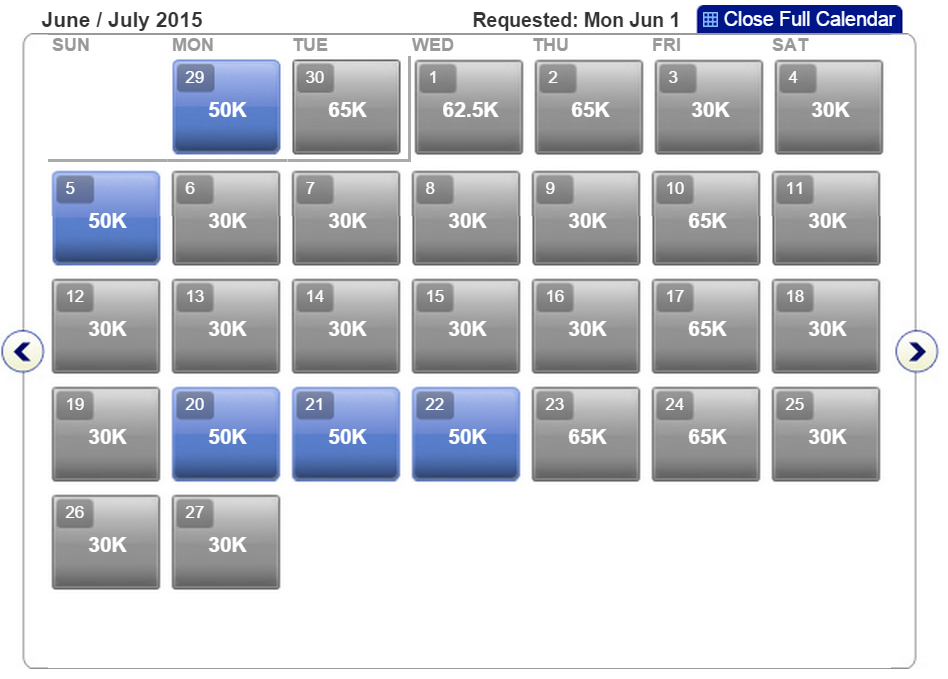

To estimate ThankYou point prices, I somewhat arbitrarily picked a middle-ish starting point and a popular summer-ish time of year: I looked at prices in July for flights from Chicago to various destinations.

| Route (Chicago to…) | Best price on AA / US Air | ThankYou point price | AA award price economy* | AA award price business* |

|---|---|---|---|---|

| Rome | $1780 | 111,262 | 60,000 | 100,000 |

| Hong Kong | $1518 | 94,875 | 70,000 | 110,000 |

| Santiago | $980 | 61,250 | 60,000 | 100,000 |

* Award prices are round-trip MileSAAver level prices (which are not always available). AAnytime awards tend to be around double in price.

As you can see, above, the cost for each economy flight using ThankYou points is usually less than the cost in AA miles to book business class. And, in some cases, the cost in ThankYou points is very close to the economy award mileage cost. Since economy awards are not upgradeable, and since awards booked with miles do not earn miles or elite credit, the flights booked with ThankYou points are considerably more valuable. That doesn’t even take into account the fact that awards are subject to additional booking fees and fuel surcharges, whereas the ThankYou point price is the all-in price.

To flesh this out a bit, let’s take the route from the table above that shows the least value in ThankYou points compared to AA MileSAAver awards: Chicago to Rome. There, the ThankYou point price (111K) is higher than economy (60K) and business (100K) awards. Suppose our goal is to fly to Rome in July in business class. We already know that the ThankYou point price (for those with a Citi Prestige card) is 111,262. Most travel dates are currently available at that price and the flight is non-stop.

Now let’s look at business class award availability in July. A few MileSAAver dates are available for the outbound:

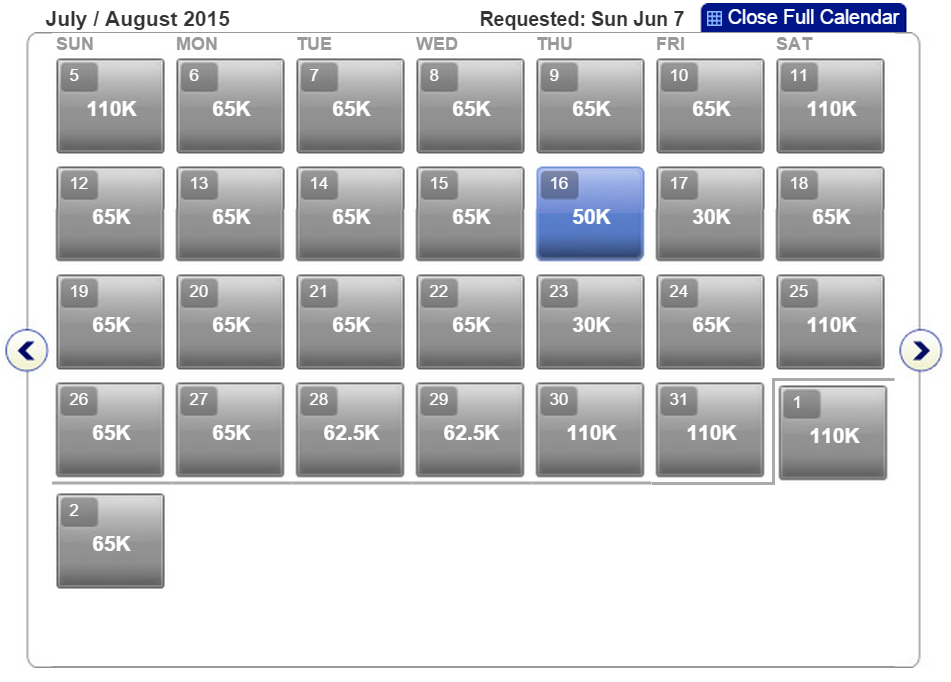

However, the return looks bleak:

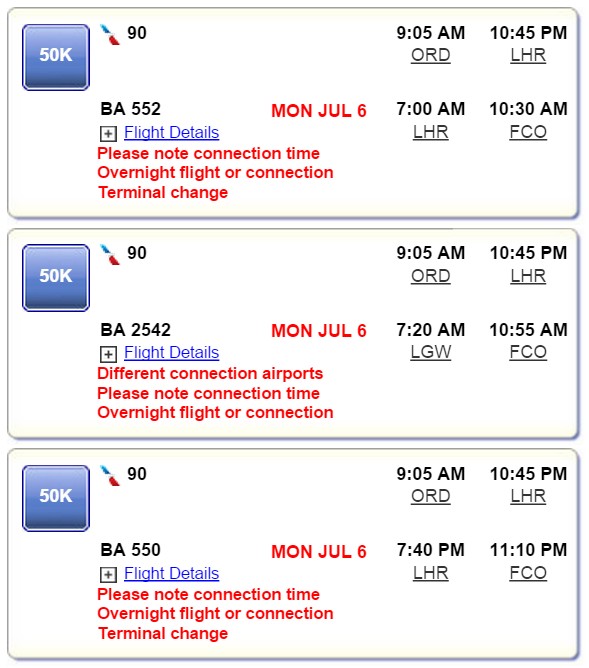

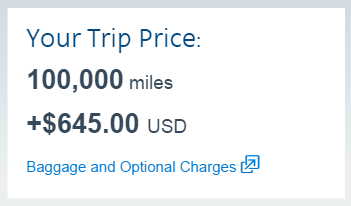

Given the above availability, let’s plan to fly July 5th to July 16th. Unfortunately, outbound flights are on British Airways (which means high fuel surcharges) and they require an overnight stay in London:

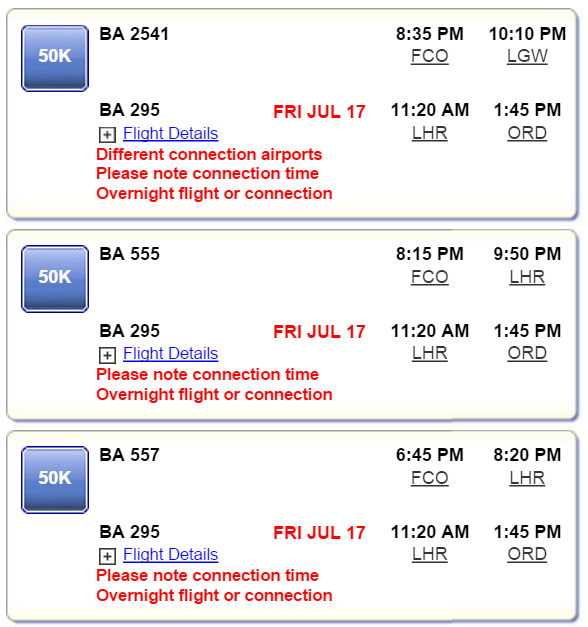

Return flights are just as bad:

The final price (not counting the price of hotel stays in London) comes to 100,000 miles plus $645 in fees. Clearly the 111K all-in ThankYou point option is much better.

We could, of course, go with other airline miles, such as United. United doesn’t charge any fuel surcharges on awards so the cash portion of a United award would be substantially lower. Saver award prices for this route would range from 115,000 to 140,000 miles (depending upon whether the transatlantic flights are on United or a partner). Those prices are higher than the ThankYou point price and would not earn miles. Plus, very few Saver level awards are available during peak summer travel.

On the other hand…

Overall, I think that the Prestige card paired with AA Executive Platinum status is a killer combination thanks to the ability to book economy flights for any time and any destination and upgrade to business class with systemwide upgrade certificates. Importantly, those same flights would get you closer to re-upping elite status for the next year. That said, there are a few downsides..

- Upgrades are not certain. It appears that AA makes very few seats available for upgrade until very close to departure. So, most of the time, this approach will be a gamble: book an economy flight and hope to score the upgrade.

- Flights are not changeable / refundable. One big benefit of AA Executive Platinum status is that award change and cancellation fees are waived. The same is not true of paid nonrefundable flights (which is what you would get when you pay with ThankYou points).

- Awards are not limited to AA and US Airways flights. Miles can be used to book awards on any of their partner airlines, but paid upgradeable flights must be on AA or US Airways. So, many more flights are available for mileage awards, and in some cases the experience would be much better as well (via Cathay Pacific, for example).

- Awards can be booked into First Class. If you’re looking to fly in ultimate luxury, booking first class awards is the way to go unless you find an outrageously good price for business class and upgrade from there.

Why the Prestige card?

There are a number of bank credit cards that let you pay with points for airfare, so one might wonder why I’m singling out the Prestige card. For example, the BarclayCard Arrival Plus card earns two points per dollar on all spend, has a great signup bonus, and it automatically gives you a 10% rebate on points used for travel. Plus, Arrival points are redeemed after you pay for travel rather than as a means to pay for travel. Let me explain… cards like the Prestige card let you use points to pay for travel, but to do so you have to go through the bank’s rewards website to find flights and redeem points. With the Arrival card (and some others, like the Capital One Venture Rewards card), you use your credit card to pay for travel directly, then use points after the fact to pay for those charges. This means that you would earn both airline miles and Arrival points for flights paid for with Arrival points. And, you can increase your rewards by going through a portal to an online travel agency (Orbitz, for example) to book your airfare. With ThankYou points, conversely, you earn only airline miles when using points to pay for flights. And, don’t forget, the Arrival Plus card costs only $89 per year whereas the Prestige card costs up to $450 per year. That’s a huge difference!

All of the above are good reasons to prefer the Arrival Plus card over the Prestige card, and that was just one example of a competing card. I could write an entire post (or three) on alternatives. Let’s look, though, at the reasons I like the Prestige card and the ThankYou points program…

ThankYou points can be shared.

Points can be transferred, for free, from one account to any other. This means that not everyone needs to have the Prestige card to benefit from its high value for booking AA flights. You just need a friend or family member willing to book the flight for you. Transferred points expire after 90 days, though, so you should not initiate a transfer until you have concrete plans for using the points.

ThankYou points are incredibly easy to get

The Prestige card’s signup bonus goes as high as 60K (found in-branch); the Premier card regularly offers 50K; and the Preferred card often offers 30K. Each card has category bonuses that increase points earned from spend. And, it is easy to get very lucrative retention offers. See: How one call led to a points bonanza and rethought plans and 5X ThankYou offer returns… sort of.

The Prestige card has valuable perks

- Free AA / US Airways lounge access when flying AA / US Airways

- Free Priority Pass Select membership (which, unlike with competing cards allows up to 2 guests in free with you)

- 4th night free hotel rebate

- $100 Global Entry application fee credit

- Complementary golf green fees

The Prestige annual fee can be lowered to $350

When you signup in-branch, it should be possible to qualify for a $350 annual fee. If you’re stuck with the $450 annual fee, though, you can lower the fee to $350 by signing up for Citigold Checking. Unfortunately, Citigold Checking has high fees unless you have combined balances of $50K or more. One work-around, found by Doctor of Credit, is to open a CitiBusiness® Preferred Banking account. The CitiBusiness account is free when you maintain a $15K average monthly balance, and it gives you Citigold Checking fee-free. Citigold checking also offers Prestige cardholders a 15% annual relationship bonus. In this way, it makes your Prestige card more valuable. Plus, you can often earn ThankYou points for signing up for Citigold checking too.

The Prestige annual fee can be lowered to $100

The Prestige card offers an automatic $250 Air Travel Credit each calendar year. This means that anytime you use the Prestige card to pay for air travel, your account will be reimbursed up to a total of $250 per year. Since the card offers 3X points on Air Travel and Hotels, it’s a no-brainer to use this card to pay for flights anyway, so I think of this as an automatic $250 per year rebate on the card’s annual fee.

The Prestige card annual fee can be better than free (if you decide not to keep the card)

If you signup for the Prestige card mid-year and earn your $250 Air Travel Credit both this year and next year, you can still cancel or downgrade the card before paying the next annual fee if you decide you don’t want to keep the card. That means that the Air Travel credits will have more than paid you back for the annual fee regardless of whether you paid $350 or $450. Tip: downgrade to the ThankYou Preferred card so as to keep your remaining ThankYou points active and to potentially receive valuable retention offers.

Summary

I currently have AA Executive Platinum status and I carry a Citi Prestige card, and I think that the combination is terrific. The Prestige card increases the value of my ThankYou points (when I use points to pay for AA airfare); and my Executive Platinum status means that I can book economy, but fly business class. And those two benefits feed each other: The Prestige card makes it a better deal to fly AA with paid tickets (paid with ThankYou points) than to use AA miles to book awards. And, this makes it easier to maintain AA elite status. In turn, AA elite status makes the Prestige card more valuable because one can book economy flights with ThankYou points, but fly up-front thanks to regional and systemwide upgrades.

For those wondering… no, I’m not trying to “sell” the Prestige card to anyone. I currently do not have any Citibank affiliate links. Even if I did – you’re better off signing up for the card in-branch. I truly believe that the Prestige card is an excellent card, especially for frequent American Airlines travelers.

[…] Ideally you either have AA upgrade certificates or have a friend willing to part with a few. If so, you can book economy cheaply and then upgrade to business class. In return, you’ll earn miles for your flight. Ideally, use bank currencies to book coach (e.g. use Citi Prestige ThankYou points for 1.6 cents per point value). Please see: A great combination: American Airlines status plus Citi Prestige. […]

[…] In March of last year, Citibank increased the value of ThankYou Rewards points for Citi Prestige cardholders. When used to purchase American Airlines flights, each point is now worth 1.6 cents each instead of the previous 1.33 cents (which still applies to tickets on other airlines). Since then, I’ve been a big fan of the combination of the Citi Prestige card and ThankYou Rewards points for those who fly American Airlines often. For details and a gushing review, please see: A great combination: American Airlines status plus Citi Prestige. […]

I was denied use of system wide upgrades with a ticket purchased with Citi Thank You points. The AA rep said the purchase was coded as bulk/discount purchase and not able to be upgraded.

Anyone else had this issue? I’m not sure it’s worth calling another rep as the system had this fare coded as non-upgradeable.

Wow, that stinks. You can cancel if its been less than 24 hours since the purchase?

.

I successfully used an upgrade with a ticket to Ireland on US Airways that I bought with TY points.

A couple of comments on a (nicely done) old post.

For me, I think the best (or at least handiest) use of TYPs may be for domestic tickets on AA. For example, a 25,000 mile “saver” award with AA miles equates to a $400 ticket with 25,000 TYPs — but with no capacity controls.

And on the “combination” front, adding to the mix a Citi Gold/Private account nets you a further 15% or 25% annual TYP “loyalty” bonus as well as 11,700 free extra “banking side” TYPs per year.

Yep, good points. Plus, when booking that 25K TYP award, you’re still eligible for upgrades unlike an AA award.

[…] to choose just one. Citi ThankYou points are awesome for those who fly American Airlines often (details here), and Amex Membership Rewards is great for its long list of transfer partners and its frequent […]

[…] about the product. Yes, the card earns Citi ThankYou points – that part was interesting (since ThankYou points can be very rewarding), but the card didn’t seem to offer much beyond what was already available from other Citi […]

[…] our upcoming four night stay in London, my family and I need three rooms (we added another family member to the trip since I last wrote […]

[…] FrequentMiler highlights greater benefits with AAdvantage status and the Citi Prestige. […]

FM did you see this in the T&C?

$250 Air Travel Credit

….Please allow 1-2 billing cycles after the qualifying incidental air travel fee is charged to your Card Account for statement credit(s) to be posted to the account. This statement credit is an annual benefit available for purchases appearing on your billing statements from December through the following December. Pending transactions that do not post in your December billing cycle will count towards the next year’s Air Travel Credit.

I don’t see anything in there that indicates that it couldn’t be used twice in a 12 month period.

Correct. It is based on calendar year. So, for example, you can do $250 in November, then another $250 in February.

What is special about the T&C?

I have taken a look at redeeming Thank You points for business or first class flights, and the prices used are insanely higher than those on the aa.com site, or at least have been on the searches I’ve used. For example, I just checked a first class non-stop flight from LAX to BOS on September 24: On aa.com it is listed at $606 and on thankyou.com it is $1,552!!! And I know the former isn’t a phantom because I booked it and I’m ticketed. Try a few premium flights on both sites and see if you’re getting similar results.

It appears that you can get reasonable thankyou.com prices on economy flights but not on premium flights. Of course, your post was about people with Executive Platinum status able to buy economy and upgrade, which is fine, but I’m disgusted with the low value of my TY points for the premium travel I want, given the weak options for transfers and the jacked up prices for paying with points.

If you book a flight on AA with TYPs and then use an Exec Plat upgrade, do you end up with bonus miles for your status and for your class of service in addition to the miles you get for the paid flight with AA?

your article points to the fact that AA miles are very hard to use. Then it says: “a benefit of TYP is you can earn AA miles!” But is that such a benefit? Considering they can’t easily be used?

I didn’t mean to suggest that AA miles are hard to use. Instead, I showed an example in which Thank You Points offer a better value. AA miles are probably best used for aspirational travel, such as Etihad First Class Apartments or Cathay Pacific First or Business class. ThankYou Points wouldn’t be much good for either of those.

Citi TYPs have been my go to points forever due to what you mention above. I only recently got the Prestige to sweeten the pot but it was already a very nice deal for me.

I have had a Premier card since before it was a Premier card so I have enjoyed the 1.25 cents per point redemption rate, similar to the Chase cards. Where I really stack up is that I have a grandfathered Citi Forward card with the 5x for restaurants, entertainment, and bookstores (Amazon). I had a couple hundred thousand TYPs last year and Platinum status with AA. I flew to Europe twice and Colombia once. With the routing it secured me something like an additional 35k AA miles while I flew for free along with pushing me closer to elite status.

It would be nice if eventually TYPs could transfer to AAdvantage miles, but they are so valuable right now if you’re sitting at an AA or US hub/focus city.Put it this way, I am saving up my TYPs right now so I can use the 1.6x bump to book a flight to Australia early next year, secure all of the AAdvantage miles, and set myself well on my way to renewing status. I don’t know if anyone’s got it better than me. :p

Call Citi to see if they’ll offer you a retention bonus for the Forward card. My Forward card is earning an extra 2 points per dollar everywhere for 6 months thanks to such a call. That means: 7X restaurants, 7X Amazon, 7X movies and such, 3X everywhere else.

Is there any way to bump the 30k point offer to the 60k offer without going into a branch?

Yep, I gave step by step instructions for bumping up to the 60K offer here: https://frequentmiler.com/2014/11/19/citi-prestige-experiment-failed-yet-im-way-ahead-heres-how/

If you are a golfer, the Prestige card is a no brainer. 3 free rounds of golf/year can easily pay for the $450 fee if you use them at some nicer courses like Pasetiempo, We Ko Pa, etc. Each of those can be upwards of $200-$300/round depending of the time of year. I got it recently, and I’ll be canceling my Amex Business Platinum. I love the Centurion lounges, but they are not that widely available. Admirals Club access will do just fine for me.