NOTICE: This post references card features that have changed, expired, or are not currently available

In mid August, my wife applied for 8 credit cards across three banks. After a few phone calls, all 8 cards were approved. You can read the full details here and here. Currently, we’re still working on the minimum spend requirements for some of these cards, but in the end we expect to earn a total of 470,000 points and miles. In the prior posts I added plenty of warnings and caveats. If you’re thinking of doing something similar, please take a look at the prior posts and read the “Caution” sections.

Now that almost two months have passed, I thought it would be interesting to look into the results of this application spree. How was my wife’s credit report and credit score affected?

Credit report

Everyone is entitled to a copy of their own credit report every 12 months from each credit bureau. My wife requested all three, online, from annualcreditreport.com. The credit reports do not show her credit scores. Instead, they show all of the data used to calculate her score and much more. My primary interest in these reports was to to find out which credit bureau’s issued “hard inquiries”. These are the inquiries that can affect your credit score and your ability to get approved for additional cards. Soft inquiries do not affect your score or your ability to obtain credit.

In some cases, when you apply for multiple cards from the same bank on the same day, the inquiries get merged together by the credit bureau. Since my wife applied for cards from just 3 different banks, she could have ended up with as few as 3 hard inquiries. That would have been ideal. Here, though, is what we found. Inquiries are separated by credit bureau:

Experian

- American Express August 13

- American Express August 18

- Bank of America August 13

- Citi Cards August 13

- CBSD August 13 (I believe this to be CitiBusiness)

TransUnion

- Bank of America August 13

Equifax

- Bank of America August 13 (soft inquiry)

As you can see above, my wife’s Experian report suffered 5 hard inquiries and her TransUnion report had only one. Let’s look at these by bank:

American Express

My wife applied for 3 American Express cards on August 13. Two were auto-approved and one was pending. I’m guessing that if she had called on August 13th to get an instant decision on the 3rd card, then all three inquiries would have combined into one. Instead, the call was made much later and appears to have resulted in another hard pull.

Citi

Citi has a rule limiting people to applying for no more than 1 personal card in a day. So, my wife signed up for both a personal card and a business card. The two inquiries were issued from different named organizations and they were not combined.

Bank of America

My wife applied for 3 BOA cards on August 13th and was eventually approved for all three. It’s interesting that BOA issued hard inquiries to two bureaus and a soft inquiry to the third. It is likely that multiple inquiries were issued to each bureau and that they were combined into one (per bureau).

Credit Score

As you can see above, my wife ended up with more than the hoped for 3 credit inquiries. With Experian alone, she had five. So, what did this do to her credit score?

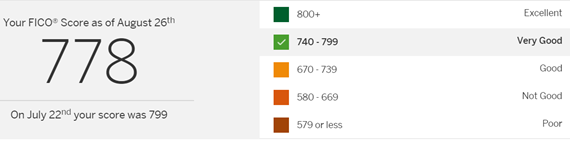

American Express offers free Experian credit scores to many cardholders, so were were able to easily check her score. On August 26th, her score was 778. A month earlier, her score was 799. So, it appears that the credit card applications may have decreased her score by 21 points (799-778). I wrote “may have” because many things can affect a credit score from month to month, so there’s no good way to know how much of this change was due to the credit card applications.

5 weeks later, Amex displayed a new score: 782. It is common for scores to incur a hit of about 4 or 5 points per hard inquiry and then to gradually go back up (often to new heights) afterwards. We don’t yet have much data to prove it, but I do think that’s what is happening here.

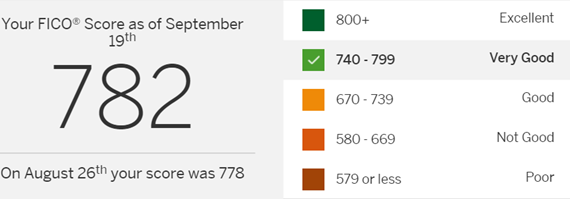

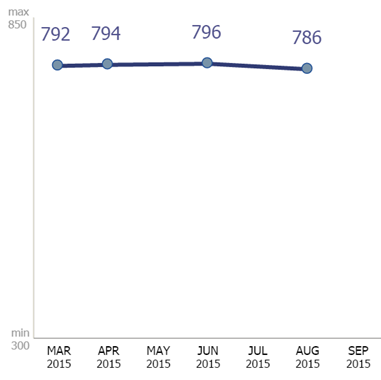

My wife’s TransUnion report showed one hard inquiry, so we looked at how her TransUnion score was affected. Barclaycard lets cardholders see their TransUnion score over time. As you can see below, my wife’s TransUnion score has hovered in the mid 790’s for a while, but then dropped to the mid 780s in August. Specifically, between June and late August, her score dropped by 10 points. Again, we don’t know how much of that change was due to the credit card applications.

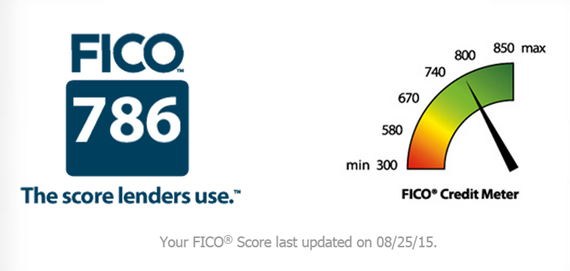

My wife’s Equifax report didn’t have any hard inquiries. Citibank let’s her see her Equifax score for free, but Citi hasn’t yet collected historical scores for her. The one score shown is from late August. And, it looks good:

Wrap up

Banks don’t necessarily pull from the same bureaus every time and for every person. So, if you were to replicate my wife’s set of credit applications (which I don’t particularly recommend), you will likely see different results. Still, there are a few useful conclusions (admittedly based on very little data) that can be made:

- Amex inquiries apparently do not get combined when the approvals are 5 days apart. If my wife had called to force a decision on the day she applied, it is likely that she would have had one fewer hard pull.

- Bank of America inquiries made to the same bureau on the same day do get combined, but there is no guarantee that you won’t have inquiries hit more than one bureau.

- Citibank inquiries do not get combined across business and personal cards.

Even though my wife’s credit reports ended up with more inquiries than I had hoped, her 21 point Experian dip isn’t something I’m concerned about. Based on past experience, I expect that her score will steadily rise month over month and it will most likely reach or even exceed its previous high. Unless, that is, she applies for more cards before then…

The issue with the 2nd SPG wasn’t the 4 card limit. It was the 1 CC approval per day rule. 2nd CC app is held and repulled 5 days later. There have been exceptions but they’re few and far between.

You’re probably right. I forgot that Rapid Travel Chai told me about that. Thanks for the info.

If the updated credit scores do not reflect your wife’s new open accounts, would you please post an update when they do? In my experience, the initial inquiries have minimal effect but when the new accounts are opened, the scores take an additional dip. I guess this is because the average account age gets pulled down as well as number of accounts goes up.

I’m pretty sure that the new scores do include the open accounts, but yes I’ll post back here when we get updated scores later this month and next.

I wish there is a post about churning wives.

Curious why anyone would apply for three Amex cards with the new one bonus per lifetime rule? I would assume at this point anyone in the miles/points game has long been done with Amex as far as signup bonuses go.

Two of the Amex cards were business cards. Business Amex cards are not subject to the once per lifetime rule. They require that you haven’t had the card for 12 months. The 3rd was the personal SPG card. I can’t remember ever seeing SPG cards offer more than 30K, so my wife was happy to go for that one.

Are you closing the existing accounts and opening new ones?

Why you didnt include the Annual fee for the cards? Are you closing the cards before the anniversary .? If thats the case , does bank lets you to open more cards even they know that you will be closing the account soon.

Every year, as annual fees come due, we evaluate whether they are worth paying. Usually not. So, in most cases, we downgrade the card to a no-fee card. Yes, most banks let you keep applying for new cards. Chase seems to be getting much more strict about this, though. So, we stayed away from Chase for this.

.

You can find all of the annual fee info on my Best Credit Card Offers page

In the past, CBSD = Citibank, South Dakota. They used to be the issuer of a lot of their cards until they merged a large part of it into Citibank, N.A. However, this is strange since according to the website, the issuer of the Citibusiness AA card is Citibank, N.A.

It could possibly be just a system that hasn’t been fully updated (with Citi, there appears to be a lot of those).

Hmm. I guess the conclusion remains the same: we now have one data point showing that the inquiries do not get combined.

With the tightening cc restrictions, 470,000 is a pretty big haul for someone who has been playing this game for a while. Curious to know if your wife gets cards every three months or if she has plenty of “opportunities” left.

My wife hasn’t applied for many cards in the past (at least, not many compared to me). Either way, there are still plenty of good options for both of us.

Had the same thought. Usually my wife and I can get accepted for 3-5 cards apiece every 3 months or so. We’re in the low 800s. I could see how 8 might be possible if holding back for 6 months or more. Still 8 is quite the score regardless.

How will this effect your next round of applications? Will the credit card companies look past a high credit score and factor in all the inquiries and new credit lines?

It can make the next round tougher. It depends how sensitive the credit card company is to the presence of multiple applications in the recent past. For example, Barclays has been very sensitive to it, and recently Chase has become extremely sensitive to it.

Looks like that benefit has been discontinued as of 9/30/15 per the link in this Dr. of Credit post:

http://www.doctorofcredit.com/get-your-free-experian-credit-report-plus-credit-score-from-american-express/

That was a different thing. Amex now shows a link when you log in. Depending upon which card I have selected, there is sometimes a link titled “My Free FICO® Score” under the heading “Useful Links”

Thanks for the clarification – ironically just got an email from amex promoting the benefit this morning!

Are you using any particular source to get your experian scores for free now that creditsesame/kharma don’t show experian?

Yes, American Express shows Experian scores for free to many cardholders