NOTICE: This post references card features that have changed, expired, or are not currently available

My wife and I have a total of four Barclaycard AAdvantage Aviator Red MasterCards (we have two each). The cards began life as US Airways cards before the big airline merger. Three out of four cards are long term keepers. We signed up for these cards when Barclaycard offered an annual 10,000 mile bonus with each card. Paying the annual fees is like buying 10,000 AA miles for $89, every year, with each card. That amounts to less than a penny per mile and is a good deal even after accounting for AA’s upcoming award chart devaluation.

One of my wife’s cards, though, is different. This card offered a one time 10,000 mile anniversary bonus:

If you have an AAdvantage Aviator card, you can see if your card qualifies for a 10,000 mile anniversary bonus by logging into your account, clicking “View rewards”, then clicking “How my rewards work”. More details can be found here: Should you keep, upgrade, or downgrade your AAdvantage Aviator card? Do you have a choice?

For the card with the one time anniversary bonus, the 10,000 mile bonus posted on December 10th. And, the $89 annual fee appeared on December 31. My wife could now cancel the card to avoid the annual fee. Since the 10,000 miles have already posted, the miles would remain in her account.

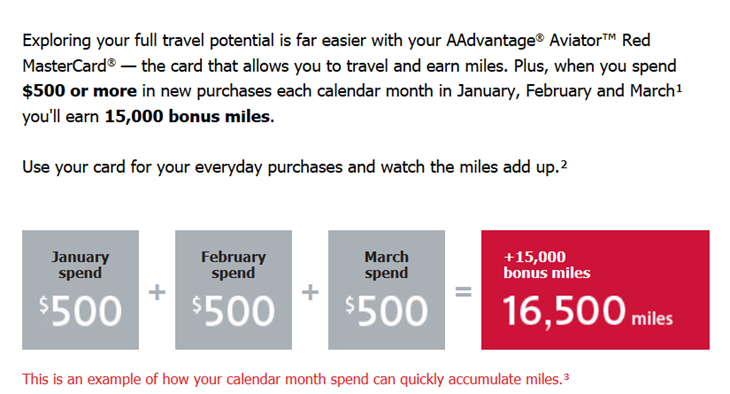

15,000 mile bonus

On December 21, my wife received the following offer via email (and later by snail-mail):

Keeping the card

To qualify for the 15,000 mile bonus shown above, my wife will have to spend $500 or more each month. That’s not hard. But, she’ll also have to pay the card’s annual fee. Since we’re willing to pay annual fees on the other cards in order to keep getting 10,000 miles per year, it’s clearly worth it to pay $89 one time more on this card in order to get another 15,000 miles.

Automatic retention bonus

Barclaycard has been known to send out offers like these fairly regularly. In my experience, the best offers usually coincide with the card’s annual fee. I suspect that the bank has an automated process to detect when accounts are rarely used. Promotions like these accomplish two things for Barclaycard: they encourage customers to pay their annual fee (as in the example above), and they encourage customers to use their cards more often. The hope is that my wife will start using the card for everyday spend in order to meet the $500 per month requirement, and then will continue to use the card going forward. It’s smart.

In our case, we’ll be smarter. We have a number of cards that offer better rewards for spend. So, we’ll setup an automated process to spend $500 per month (as we recently did with a similar offer) and the card will once more get sock-drawered until the next annual fee comes due.

[…] signed up for, including the Citi Prestige 50K offer, and the Citi AT&T card. And, of course, when Barclaycard offers me 15,000 miles for spending $500 a month for 3 months, I have to do […]

[…] Barclaycard, for example, often offers great bonuses to encourage cardholders to use their cards (see this post, for example). And, some cards are worth keeping for their retention bonuses. Citi, for example, often has […]

Has anyone else had issues receiving this bonus?

My promo period is for November-December-January. I’ve hit the $500 limits for November and December, but no bonuses posted yet.

I figure I’ll give it 60 days from November 30 (end of this month) before I inquire about the miles posting, but wondering if anyone else is still waiting as well…

When Barclays has done these promos in the past you don’t get your points till 30-60 days after you complete the spending from the last month. Just sit tight, you’ll get it in time.

To add to what Ken said, you need to complete the spend for all 3 months before you qualify for the bonus. So, make sure to do the spend for January too.

Ah, ok. Glad I checked in here 🙂 Thanks for the info guys.

I called to cancel my card. They replied with three offers. Spend $2,500 a month for 6 months and get 30,000 bonus miles (This also came in the mail just before I called, but the retention specialist made sure I was signed up for it.) The second offer was spend $1,000 on the next 90 days and get 5,000 miles (the $1,000 dollar spend will also count toward the first offer.) The third offer was they waved the fee for this year. To meet the required spend I may have to do some manufactured spend in April and May, but it should be worth the trouble.

Don’t forget the 10% you get back in miles when you book a trip using miles. Too bad there is a 10,000 mile cap per year. Made the card worth the $89 fee with the yearly bonus and extra 15,000 miles for spending in Jan. Feb. and March.

My wife and I both got retention offers:

Me: AF waived, 15k for $500 spend in Dec/Jan/Feb.

Wife: AF waived, 10k points for $1000 spend (promo was already active), 15k points for $500 spend dec/Jan/Feb.

So between us, 40k points for 3k spend, and NO AF (plus keep free bags for a year, 10% points back, etc). Awesome promos, definitely happy we both called detentions.

*retentions

@FM, I don’t remember whether my card had the offer for the annual 10K bonus. Is this something that’s listed in the “How My Rewards Work” page?

Yes, I linked to another post that shows pictures of what it should look like if its there.

I cancelled the card after they converted to Aviator. Maybe I should have continued 🙁

Do they have a sign on bonus for this card and any period you need to wait after cancelling to get the bonus?

There is no way to get this card anymore from Barclays. Citi now has sole rights to AA credit cards.

As Ken said, no one can sign up for this card anymore.

Got the same offer in the mail. Waiting for annual fee to hit, so I could get it waived before spending $$$.

I already did my January $500 spend for this card. I wonder if I call to cancel if they’d see the spending and know I was going to keep the card anyways.

Is there any thing like activation or date before which we need to enroll for this offer? I just saw one card with this offer but there is no activation or expiry date in the email. Thanks…

Nope, nothing to click on or enroll in. Just spend the $500/month for 3 months and you’ll get the points in a few months.

Thanks for your reply Ken. I was wondering because when I called Avaiator master card, the CSR said there is no such promotion in my account. I will spend $500 and hope I will get the bonus points.

As long as you received the physical mailer or an email you’re good to go.

You have to be targeted for the offer. If you haven’t received an email or postcard then you are not targeted. If you do receive them, it will say which particular months you have to spend $500 or more.

Similar to Jon, I called to downgrade to the no annual fee version and they waived the annual fee for the Aviator Red. I also got the 15k promotion via email a week or two after they waived the fee. I expect it will work.

Greg, I had the exact scenerio both last year when the card was a US Air card and this year, as an AA card. Both times I was able to get a renewal fee waiver as well.

http://willrunformiles.boardingarea.com/more-love-from-barclays-20000-aa-miles-and-no-renewal-fee/#sthash.YuK0QiIu.dpbs

Nice!

With Barclays, how long after the annual fee hits do you have to cancel the card and get the AF refunded?

I don’t know

I also got the 15K mile offer in the mail, but decided it wasn’t worth the $89. So we called to cancel and they waived the fee. So now I’m going to do the $500 spend thing and see if it still works. I expect it will, but if not no big loss.

Awesome. That should work.

I got this promo also. I spent the minimums plus a lot more. I never got my award bonus though. I’ve been going round and round with them!

Ron Saul