NOTICE: This post references card features that have changed, expired, or are not currently available

There are a number of interesting current events relating to Marriott, Starwood, and their co-branded credit cards…

- The big news, of course, is that Marriott is buying Starwood. No they’re not. Yes they are. As Marriott and Anbang fight over Starwood, we’re left on the sidelines waiting and watching.

- Amex (issuer of the Starwood co-branded credit cards) has stopped letting people get signup bonuses for cards more than once (see: Amex business cards now once per lifetime). So, it has become more important than ever before that people sign up for Amex cards only when the best signup bonuses are available.

- Chase (issuer of the Marriott co-branded credit cards) is expected to soon stop approving applications for co-branded credit cards when the applicant has opened 5 or more credit card accounts in the past two years (see: Chase calls an end to the game. Should we seek quick wins or long term benefits?). In other words, for many people, the ability to sign up for Marriott cards may be ending very soon.

- Both Amex and Chase are currently offering the highest signup point bonuses ever for the SPG and Marriott cards, respectively. The Amex offer is supposed to end very soon (March 30). The Chase offer is listed as a “Limited Time” offer, but no end date is specified.

With all of this going on, I’ve been thinking a lot about SPG and Marriott, but I realized that I didn’t know the answer to a seemingly simple question: Which signup bonus is better? SPG or Marriott?

Card Offers Background

You can find full offer details for the SPG cards here, and for the Marriott cards here (you’ll have to scroll down a bit). However, here are the basics:

Amex Starwood Preferred Guest (SPG):

- SPG Personal card: Earn 35,000 bonus points after $3K spend in 3 months. First year fee waived, then $95.

- SPG Business card: Earn 35,000 bonus points after $5K spend in 3 months. First year fee waived, then $95.

Chase Marriott Rewards:

- Marriott Rewards Premier: Earn a total of 87,500 bonus points: 80,000 points after $3K spend in 3 months, plus 7500 points for adding an authorized user. $85 annual fee is not waived the first year.

- Marriott Rewards Premier Business: 80,000 points after $3K spend in 3 months. $99 annual fee is not waived the first year.

SPG vs. Marriott Offer Background

If you didn’t know anything about the value of SPG or Marriott points, you might assume that the Marriott offers are far better. After all, you’ll get more than twice as many bonus points with the Marriott offers vs. the SPG offers. However, my Fair Trading Price valuations peg SPG points at 2.26 cents each and Marriott points at 0.56 cents each. In other words, according to my Fair Trading Prices, SPG points are worth about 4 times as much as Marriott points.

On my Top 10+ Hotel Credit Card Offers page, you can see the estimated first year value of each offer. The calculations are based on Fair Trading Prices, minus cost to meet minimum spend requirements, minus first year annual fees (full calculation details can be found here). At the time of this writing, these calculations lead to the following first year valuations:

- SPG Personal card: $769

- SPG Business card: $754

- Marriott Rewards Premier: $332

- Marriott Rewards Premier Business: $276

When looked at that way, the SPG card offers look incredible and the Marriott offers look good, but not great.

SPG vs. Marriott: Other ways to look at it

Putting aside the hard-to-grok Fair Trading Price estimates, there are other ways to fairly compare these offers. I took a look at:

- Hotel Hustle Median Point Values (explained below)

- Number of free nights each offer could deliver

- Transfers to airline miles. Which offer would result in more miles?

- Hotel + Miles packages.

To simplify comparisons, I looked only at the personal cards, not business cards, and I looked at the number of points you would have after meeting the $3,000 minimum spend requirements:

- SPG card: After spending $3,000, you would have a total of 38,000 points (assuming no 2X bonus spend at SPG properties).

- Marriott card: After spending $3,000, you would have approximately 91,000 points (assuming $500 of spend within 2X categories: airline, car rental, & restaurants).

Each of these comparisons is shown below. I found the results surprising…

Hotel Hustle Median Point Values:

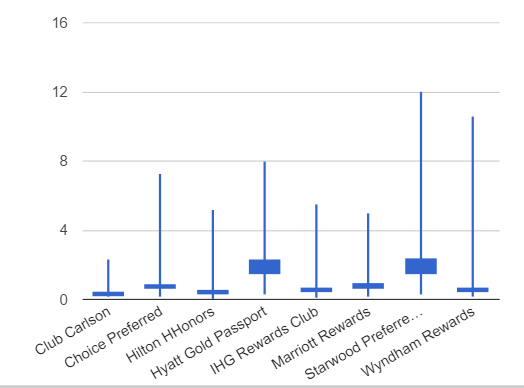

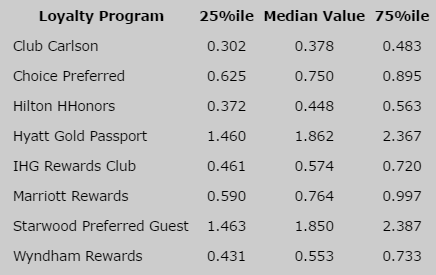

Hotel Hustle is a free tool that lets you search for hotel availability in a geographic area. Results are shown in dollars, points, and cost per point. As a nice side benefit, the tool keeps track of these search results and shows average results in charts and tables:

At the time of this writing, the Hotel Hustle tool reports the following median values:

- SPG: 1.85 cents per point

- Marriott: 0.764 cents per point

We can use these values to compare the signup bonus offers:

| SPG | Marriott | |

| Signup Bonus Points | 38K | 91K |

| Median Point Value | $0.0185 | $0.00764 |

| Total Point Value | $703 | $695 |

| Less first year fee | $0 | $85 |

| Signup Bonus Value | $703 | $610 |

In this analysis, the SPG offer does come out ahead, but the Marriott offer is clearly very strong too.

Winner: SPG

How many free nights?

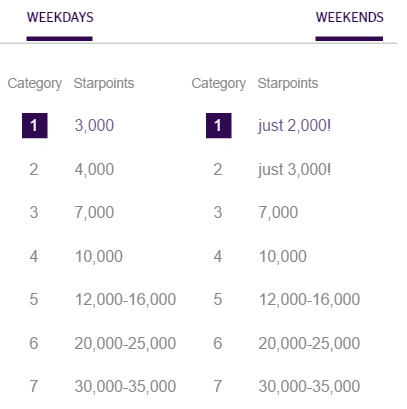

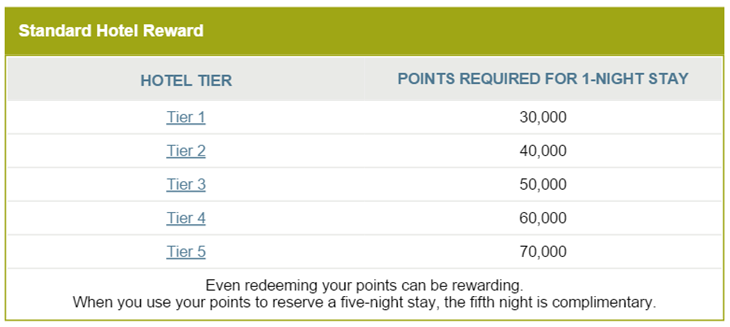

Another way to look at this is to simply compare the free night award charts between SPG and Marriott to see how many free nights one could get from each signup offer. First, here are the award charts:

SPG:

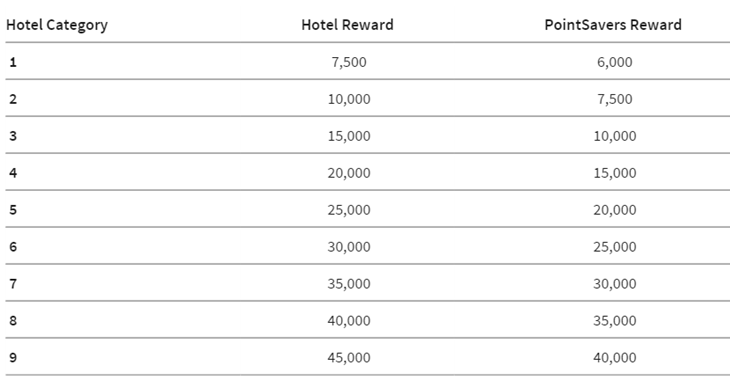

Note that Marriott maintains a separate chart for their upscale Ritz chain:

Both programs offer 5th night free awards, so that is not a differentiator in either case.

Simplifying assumptions:

It’s not easy to directly compare award charts, so it helps to make a few simplifying assumptions:

- To analyze bottom-tier categories, we’ll compare SPG weekday rates to Marriott regular awards (i.e. not to PointSaver awards)

- To compare mid-tier categories, we’ll match SPG category 4 to Marriott category 6

- At the top end, we’ll use Marriott’s Ritz award chart

With those assumptions, we can compute the following results:

| SPG | Marriott | |

| Signup Bonus Points | 38K | 91K |

| Lowest Category Cost | 3,000 | 7,500 |

| Lowest Category # Free Nights | 12.67 | 12.13 |

| Middle Category Cost | 10K | 30K |

| Middle Category # Free Nights | 3.8 | 3.03 |

| Top Category Cost | 35K | 70K |

| Top Category # Free Nights | 1.09 | 1.3 |

I found it almost startling to see how close the two offers were to delivering the same number of free nights at the low, middle, and top end. With either offer, you could get about 12 free ultra-low end nights, 3 to 4 mid-tier nights, and 1 ultra high-end night. The SPG offer is slightly better than the Marriott offer in the middle category, but the Marriott offer is slightly better at the top end.

Winner: Tie

Covert to miles

Many people love SPG not so much for the hotels, but for the ability to transfer points to miles. SPG has a huge number of transfer partners and most transfer 1 to 1. Even better, when you transfer 20,000 SPG points, you get a 5,000 mile bonus, so you end up with 25,000 miles. Marriott, meanwhile has less attractive transfer ratios which vary depending upon how many points you want to transfer. The best ratio (not counting better ratios available through Travel Packages) is when you transfer 70,000 points to 25,000 miles. Since both programs give you 25,000 miles with the best transfer options, we can compare:

| SPG | Marriott | |

| Signup Bonus Points | 38K | 91K |

| Transfer ratio to 25K miles | 20K points –> 25K miles | 70K points –> 25K miles; |

| Transfer ratio to 50K miles | 40K points –> 50K miles | 140K points –> 50K miles |

| Signup Bonus % of way to 50K miles | 95% | 65% |

In this comparison, the SPG offers look far better. The SPG bonus gets you 95% of the way towards 50,000 airline miles, whereas the Marriott offer gets you only 65% of the way there.

Note about Marriott points to miles conversions:

Marriott has different conversion rates for different airline programs. The rates shown in this analysis are true for all of the following programs: Aeromexico, Aeroplan (Air Canada), Alaska, American Airlines, British Airways, Copa Airlines, Delta Air Lines, Frontier Airlines, GOL/Varig, Hawaiian Airlines, Iberia Airlines, Southwest, and Virgin Atlantic.

Transfers to United are even better: you get 10% more miles. Transfers to many other programs are worse.

Winner of simple points to airline conversion: SPG

Marriott lets some people book 5 Night Travel Packages which offer a better points to miles conversion ratio even if you don’t use the 5 night stay at all. The best deal (if you don’t care about the 5 night stay) is to exchange 235,000 Marriott points for a travel package consisting of 5 category 1-5 nights plus 120,000 airline miles. Let’s compare that to spending 100,000 SPG points for 125,000 airline miles:

| SPG convert 100K points to 125K miles | Marriott 5 Night + 120K miles package | |

| Signup Bonus Points | 38K | 91K |

| Total Point Cost | 100K | 235K |

| % of way 120K or 125K miles | 38% | 39% |

The Category 1-5 5 Night Marriott Travel Package which returns 120,000 miles offers a much better points to miles conversion ratio than Marriott normally offers even if you throw away the 5 night certificate! As you can see in the table above, if your plan is to accumulate enough points to get about 120,000 miles, the SPG and Marriott offers get you roughly the same percentage of the way there.

Winner: Tie

Nights + Miles

If your goal is to get both free nights and miles, you can take advantage of SPG’s and Marriott’s nights plus flights packages. For details about the packages, please see: SPG Nights & Flights vs. Marriott Travel Packages. That post, though, was written before I knew about Marriott 5 night packages: Marriott 5 Night Travel Packages exist, but they’re secret. The 5 night packages make it much easier to compare SPG to Marriott (since SPG’s packages are also 5 nights).

To further simplify the analysis, I’m going to assume that SPG category 4 properties are equivalent to Marriott category 6. That way, we can compare these two packages side by side:

- SPG: Redeem 70,000 Starpoints for 5 nights at a category 4 property plus 50,000 air miles.

- Marriott: Redeem 180,000 Marriott Rewards points for 5 nights at a category 6 property plus 50,000 air miles

| SPG 5 Night Category 4 + 50K miles | Marriott 5 Night Category 6 + 50K miles | |

| Signup Bonus Points | 38K | 91K |

| Travel Package Cost | 70K | 180K |

| % of way to Travel Package | 54% | 51% |

Here we have a virtual tie between the signup bonuses.

Winner: Tie

However, Marriott packages offer better value when you redeem for more miles, so now lets compare two options for getting 5 nights plus 120,000 miles (or 125,000 miles with SPG)

| SPG 5 Night Category 3 Nights & Flights package + 75K miles | Marriott 5 Night Category 5 + 120K miles | |

| Signup Bonus Points | 38K | 91K |

| Total Point Cost | 120K: 60K for Nights & Flights package (which results in 50K miles) + covert 60K points to 75K miles | 235K for travel package |

| % of way to 5 nights + about 120K miles | 32% | 39% |

If your goal is to get both 120,000 airline miles and 5 nights at a mid-tier hotel, then the Marriott offer edges out SPG.

Winner: Marriott

Summary

Amex and Chase are currently offering better than usual offers for their SPG and Marriott cards, respectively.

- SPG Personal card: Earn 35,000 bonus points after $3K spend in 3 months. First year fee waived, then $95.

- SPG Business card: Earn 35,000 bonus points after $5K spend in 3 months. First year fee waived, then $95.

- Marriott Rewards Premier: Earn a total of 87,500 bonus points: 80,000 points after $3K spend in 3 months, plus 7500 points for adding an authorized user. $85 annual fee is not waived the first year.

- Marriott Rewards Premier Business: 80,000 points after $3K spend in 3 months. $99 annual fee is not waived the first year.

Based upon my Fair Trading Prices, the Amex SPG signup offers appear to be far superior to the Chase Marriott offers. However, when we look at various objectives, we see that both sets of offers are very good and, in at least one case, the Marriott offers are even better than SPG.

Here is a summary in terms of a cardholder’s potential objectives:

- Save money on hotel stays: SPG wins, by a nose. Using Hotel Hustle median point values, we see that both offers can save us about $700. SPG’s first year waived fee, though, makes the SPG offer more compelling.

- More free nights: Tie (However, again, you may prefer the SPG offers since the first year fee is waived)

- Convert to miles: SPG or Tie. SPG is the clear winner when the goal is to get 25,000 or 50,000 airline miles. When the goal is to get 120,000 or more miles, Marriott offers an equally good option.

- Get both miles and free nights: Tie or Marriott. Again, Marriott’s value proposition increases when your goal is to get more miles.

Caution

A number of the Marriott findings assume the ability to book 5 Night Travel Packages which are technically only available to Marriott timeshare owners. In practice, though, Marriott often makes these available to Marriott Rewards members who call and ask. The higher your elite status with Marriott, the better chance you’ll have of being able to book these packages.

Other factors

There are many other factors not included in the above analysis that may influence the value you get from one offer or the other. Here are a few examples:

- Hotel preferences. Obviously if you have a strong preference for Starwood or for Marriott, the above results won’t mean much to you.

- Airline transfer partners. If you want United miles or Southwest points, go with Marriott. If you want miles in foreign programs such as Air France, ANA, or JAL, go with SPG.

- Perks differ. One of the best perks across all 4 cards is available only to SPG business card holders: free access to Sheraton Club Lounges.

[…] more information on comparing these two cards visit the Frequent Miler who has enough data to please even the nerdiest Data Scientist out […]

[…] Guest (SPG) credit card signup bonus to the Marriott Rewards credit card signup bonus (see: 35K SPG vs. Marriott 87.5K. Surprising results). I was surprised to find that on a number of dimensions the signup bonuses appear to be roughly […]

Great analysis. I did one recently as well and found it surprising when you compared the value of the hotel points between one another.

Most hotel points are MUCH more valuable when used for hotels than when transferred to their airline partners, of course with the exception of SPG.

Makes a good case for sticking within airlines or hotels and not transferring points between.

[…] FrequentMiler There are a number of interesting current events relating to Marriott, Starwood, and their […]

Unless you have a specific redemption in mind using Marriott I can’t see why you wouldn’t take the flexibility of SPG and run to the bank……….JAL (Emirates distance based) or Alaska both come back to SPG……..

Yes, true, if your main goal is to get miles then SPG wins. The surprise is how close the race is at the high end of mileage transfers (and you can transfer Marriott to Alaska Mileage Plan)

From what I’ve seen throughout EU and SE Asia Marriott has very few hotels that are less than 40k points that people would actually want to stay at. So that’s 2 nights with Marriott. And I’m almost always able to find SPG properties for 10k almost everywhere which is almost 3 nights, and then 12k or 16k hotels would be 2-3 nights still. So pretty even with each other, but with Marriott you have to pay the 1st year’s AF up front while it’s waived for year 1 with SPG.

The total cost to earn those points really matter.

Both the cards earn just 1 point per cent for every day spend. Its easier to earn 130 k points with spg without stays rather than 235 k points with marriot.

SPG is the clear winner in all the cases when you consider the points earning to it and value of it.

Who wants to spend 235 k on a card whose points value just @ 0.75 cents ?

I agree 100% that the SPG card is a far, far better than the Marriott card when used for spend (outside of the context of meeting minimum spend requirements). But, this post doesn’t compare the cards — it only compares the signup bonuses.

Interesting analysis… I would assume that anyone playing game of miles and points would end up with paid stays at least a few a year.

I would think as SPG card holder with family of 3-4, annual spend would vary anywhere from $30 to 40K that can actually be put on credit card. Without taking into consideration of sign up bonuses, if i were to assume you will spend $40k with $2k on paid hotel stays, You would earn 40,000 Star points for daily spend + 4000 star points for hotel spend and 2000 points as a member staying at the hotel. 46,000 if am not wrong.

Marriott on the other hand for a similar spend ( I have to assume atleast $10,000 on restaurants and rest on non bonus category)

30000 points + 20000 points (2x for rentals/restaurants/flights) + 10000 ($2k spend on hotel- 5x) and 20000 points for the stay (10x) + 15% bonus for being silver member (comes with card) 3000 = 83000…

In my perspective, I think they are both pretty good!

although I prefer Marriott card due to its wide acceptance when traveling internationally and a free night cert in Cat 1-5 every year.. VISA Signature also gives me access to VISA signature hotel collection and buy 1 get 1 movie offers through Fandango (though its available only few months a year) … at the end of the day, valuation of points varies from person to person…

What world do you live in where a basic family has 30k-40k in credit card spend a year? It’s no longer possible to put rent/mortgage on credit cards.

Very comprehensive analysis. Thank you. Unfortunately, many of us have had the Amex card before but never looked at the Marriot. Now that’s the only choice we have (Amex take note here). Good to know how the numbers stack up. I’ll sign up for Marriott and save the points to use on SPG down the line, maybe..

Thanks for the thoughtful analysis. I would argue that much of the decision as to who is the winner in each category depends on the individual. For example, on paper the Marriott offer for applying points and miles looks like a “tie” with Starwood. However, I would not be interested in flying coach to Hong Kong to stay at a high category Marriott hotel. The SPG points to airline miles conversion is the best in the business. If Marriott ends this perk and the SPG Amex card with the anticipated merger, I will not be alone in transferring my business to competitors who have already opened the door to solid offers and quality service.

Another data point not referenced in your article is the distribution of hotels among the tiered reward categories. For example, Marriott has vastly more hotels in categories 1-3 than SPG has category 1-2 hotels.

I have not done this analysis thoroughly in the past year, but historically over the past eight years, Marriott had many more hotels distributed through low categories relative to Starwood.

Basically, you can compare low category reward hotels between the two programs, but when you want a low category hotel reward night, the probability is much greater to find one with Marriott Rewards.

Marriott Rewards has had significant category shift upwards over the past four years, but still is weighted much more heavily to low category reward tiers compared to Starwood Hotels in SPG categories.

Overall really great analysis! I just picked up the Marriott personal card and went through a similar thought process. It would be interesting to see what the distribution of categories between Starwood and Marriott like Ric said. But what is tricky about that is just because there are more low level redemptions doesn’t mean people want to stay there.

One other factor is Marriott’s annual cert for cats 1-5. The Starwood card does not provide anything similar, granted this outside the scope of the signup bonus. But it would add 6k-25k points each year depending on how it is redeemed. And I wish Marriott would stop gutting cat 5 hotels… and sending them to cat 6…

Great point Ric!