NOTICE: This post references card features that have changed, expired, or are not currently available

A number of things are happening with Citi signup bonuses all at around the same time: offers disappearing, new signup rules, and new card designs. What does it all mean? Let’s review…

Citi moves from 18 months to 24 month churn rule

As reported by Doctor of Credit, Citi has changed most of their credit card applications to say that the signup bonus is not available if you’ve opened or closed the same card in the past 24 months. Previously they had similar rules set to 18 months.

Miles to Memories suggests that it should still be possible to churn these cards by keeping your card open for two years and then applying again before cancelling the old one. As soon as you cancel (or product change) the old card, the 2 year clock restarts.

Citi kills off AT&T card?

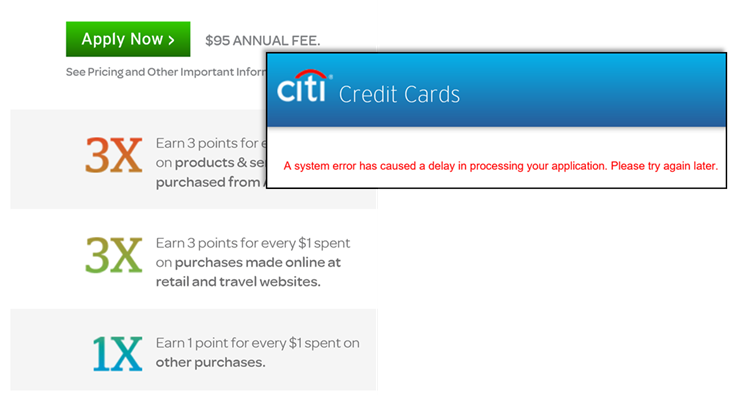

For a while now we’ve been playing hide and seek with Citi’s AT&T card application links. Citi has stopped offering the card on their own website (but it is still available through ATT.com). And, over the weekend, the AT&T link (found here) stopped working. Fortunately, as of yesterday, the link was working again. But… for how long?

Citi eliminates signup bonuses for Premier and Preferred cards

Until recently, the Citi Premier card offered a 40,000 point signup bonus, and the no-fee Citi Preferred card offered a 20,000 point bonus. Now, the public offers for both cards have dropped to nothing. Citi is currently offering absolutely nothing for signing up for either card! Luckily, the 40K Premier offer is still available through a zombie link (found here), but probably not for long.

Citi introduces new design for Preferred card

Via Reddit, baller72 reports receiving an offer for a Citi Preferred card with a new design (but with no signup bonus):

Meanwhile, at the time of this writing, Citi’s own website still shows the old design:

What it all means

Warning: guesswork ahead…

Citi’s movement to a 24 month churn rule is arguably good news. While Chase and Amex have attacked credit card churning through harsh new rules, Citi has made an incremental adjustment that is probably good for their business and probably has less chance of infuriating customers the way Chase’s 5/24 rule and Amex’s once per lifetime rule can.

The on-again off-again AT&T Access More card is interesting. Is Citi planning to kill it off, or are they taking time to learn from mistakes before reintroducing it? My guess is the latter. We know that the card’s free phone signup bonus worked better on paper than in practice (see: “The free iPhone that nearly cost me full price”). Maybe they’re working on fixing it. Or, maybe the 3X category bonus for “purchases made online” was too costly and they’re working to change that up?

The missing signup bonuses for the Premier and Preferred cards are most likely temporary. In the case of the Preferred card, we know that they’re changing the card design. Maybe they’re tweaking the Premier’s design as well. My bet is that Citi will eventually reintroduce both cards with new improved bonuses. We’ll likely see the Premier bonus return to 50K, and I wouldn’t be surprised to see the Preferred card appear with a limited time 25K or 30K offer.

Please me with this question on Citi 24 month rule….

Does the “24 month” count backwards from the date of the new application or from the date of supposed bonus posting date? This is important because if one just closed old card immediately after getting a new card, the new card’s bonus might not post because technically you just closed old card just couple weeks/months from the bonus supposed posting date even though the closure of the account is after new card application.

I *think* it counts backwards from your application date. I’m not 100% sure though.

[…] Much ado about Citi signup bonuses […]

[…] targeted offers, considering their recent changes including the tightening of their bonus rules and removal of bonuses on a couple of cards. Did you receive this offer? Which version did you get? Let us know in the […]

I feel fortunate that I picked up the AT&T Access More while it’s still available. I wonder, is the 3X for online purchases really *that* generous? True, so far as I know, it’s better than anyone else is offering for this pretty broad category, but they’re evidently willing to give 3X on the Premier for all travel expenses, and this doesn’t seem qualitatively different to me.

Just FYI, my Bluebird got shutdown today 🙁 I barely used it to MS 5K.