NOTICE: This post references card features that have changed, expired, or are not currently available

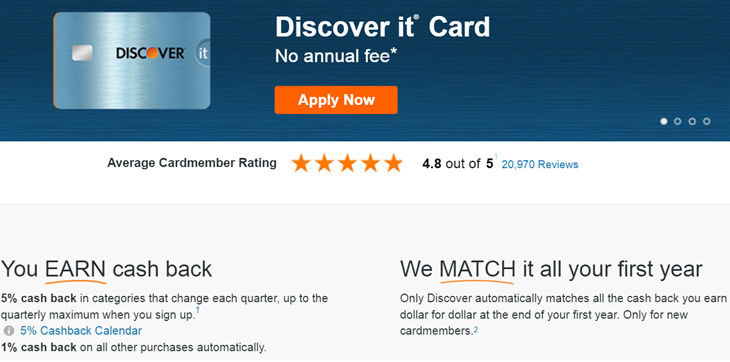

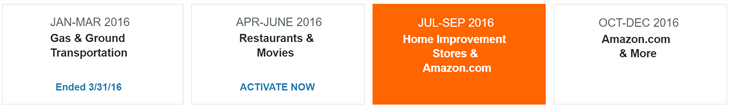

Discover’s Double Cash Back for a year promotion is pretty awesome, especially with the Discover It card. For review, the Discover It card offers 5% cash back in categories that change each quarter (up to $1500 spend per quarter), and they have a high paying cash back portal (Discover Deals) for earning extra rewards when shopping online. Often, portal promotions and quarterly 5% cash back categories overlap such that even better rewards are possible. For example, while Discover Deals usually offers 5% cash back at Sears, they often increase that rate to 10%. And, several common 5% categories include Sears.com as an eligible merchant. Past examples include: Home Improvement, Department Stores, or Online Shopping. This year, Sears.com is likely to count for 5% cash back in the 3rd and 4th quarters (we don’t know for sure yet, but I expect the 4th quarter “& More” category to include Sears.com one way or another):

When Discover Deals offers 10% and the Discover It card offers 5%, you can easily stack these rewards to get a 15% rebate for any purchases from Sears.com. Even better, if you’re enrolled in the Double Cash Back promotion, you’ll end up with a total of 30% cash back.

And, of course, it’s possible to take things further as detailed in the post “Sears and Kmart Extreme Stacking.” For an extreme example of Extreme Stacking, please see: Sears Quintuple Dip Results, and why I should have bet more on Discover. When Extreme Stacking is taken to extremes, it’s theoretically possible to get all of your money back for purchases made at Sears or Kmart.

Sears is just one example of how powerful and rewarding it is to have Double Cash Back with the Discover It card. Just the doubling of the 5% categories alone, or the Discover Deals portal alone would be enough to make this combination worth pursuing.

The end is nigh, for some of us

About a year ago, there was a brief window of opportunity in which Discover was letting existing cardholders sign up for their new Double Cash Back for a Year promotion. Then, around mid-June, Discover wised up and decided to limit the offer to new account holders only.

If you signed up for this promotion in late May or early June, then your time may be up.

I logged into my account and initiated an online chat to find out when exactly my magical year was set to expire. The short answer: June 6th. I will earn double rewards for any cash back that appears on the billing statement for the period ending June 6th. Any rewards that post after the 6th will not be doubled. Portal rewards often take two billing cycles to appear. So, I’m long past any chance of getting new portal rewards doubled.

Starting a new clock

Yesterday, my wife signed up for the Discover It card and was instantly approved. By using a referral link (found here), she’ll get a $50 signup bonus after her first purchase (and that will eventually double to $100). More importantly, we can now use her account for the next 12 months in order to get double rewards.

When is the best time to re-start?

The third quarter tends to be a good time for Discover double-dips. My wife could have waited until late in the 3rd quarter to get her card. That way we would have a chance of maximizing the 3rd quarter category both this year and next year. To be honest, we didn’t even think of that until she had already applied.

The second card re-start option

Discover allows people to hold two Discover cards at any one time. So, if you only have one Discover card now, you should be able to sign up for a second card in order to re-start the clock. In my case, that’s not an option. I have both the Discover It and the Discover It Miles cards.

Can I qualify again next year?

I will, of course, keep my Discover It card open until I’ve received my double cash back for the year. That might take a few months still. Then, I’ll have a decision to make. Should I cancel the card so that I can reapply next year after my wife’s card turns into a pumpkin? If I do reapply next year, will I really qualify for Double Cash Back, or does Discover keep track of who has been enrolled before, even if they get a new card?

I probably will take a chance and close my card. The main downside to this is that I’ll have to withdraw all of my Discover Cash Back. I don’t mind taking it out as cash, but I like having some of it available in my Discover account for those times when I want a discount gift card (Discover makes a number of these available). On the other hand, by then my wife should have built up a stash of Discover Cash Back. We can always use her account to get those gift cards.

I have seen references to people having their Discover card product changed from either the It or the It Miles to the other and then being eligible for having their cash back doubled for the first year. Any knowledge of this? Wouldn’t mind skipping the hard pull if I could do this.

I don’t have any knowledge of this, no. Anyone else?

I have a Discover IT card and the 1 year of Double Cash back has ended. I would love to get another Discover IT with a new year of Double Cash Back !

Before applying for a new Discover IT, I was thinking I should do one of the following:

(1) cancel my old Discover IT or

(2) PC it to another Discover product

Can anyone confirm either of these methods would work? Thanks.

My guess is that both would work, but I think you’re slightly better off with option 1 since when applying for a 2nd Discover card you can only get approved by calling in.

Thanks Greg. Guess I need to get to work monetizing the Rewards balance my old IT and then cancel it

Sorry for revisiting this old topic. But i am confused about the information on “home improvement store.”

Does 2016 Q3 include furniture stores like Home Goods, IKEA, etc?

I read conflicting information from one forum to another.

thanks in advance.

I don’t think those would be included, but I can’t say for sure. Anyone else know?

Here is the list taken directly from their website. I don’t see those stores listed, but they also include “and many more,” so it’s a little unclear.

Home improvement retail stores

Lumber and building material stores

Paint and wallpaper stores

Hardware stores

Lawn and garden supply centers

Ace Hardware

Benjamin Moore

Colt

Empire Today

Floor & Décor

Harbor Freight Tools

The Home Depot

Lowe’s

Lumber Liquidators

Menards

Rural King

Sherwin Williams

Stanley Steemer

TrueValue

…AND MANY MORE!

Purchases from IKEA don’t show up as Home Improvement on my statement, so I am assuming that the answer is no. I don’t however know a way to see the cashback per item break down to know for absolute certain.

The terms and conditions of the offer state that the double cash back promotion is “available only to new cardmembers.” Why has no one mentioned that? Am I misreading this in some way?

https://www.discover.com/credit-cards/cash-back/it-card.html#q2

Greg…?

Sorry, forgot to answer this. I think that when you get a new Discover card, you ARE a new cardmember as far as they are concerned.

I keep digging through older blogs… anyone by change got a definite answer to this one – that a second card will be eligible for 2x cash back?

Figure someone has to have got in on it a year ago as a second card and after 13 months got the bonus, but haven’t seen a definite DP anywhere.

Shipping costs to Hawaii pretty much negates all portal earnings. Haha

[…] year. I won’t go too much into the details here since Frequent Miler did a good job of covering all of the considerations for getting another Discover it card the other […]

I actually just applied for a Discover It card. It made me call a phone number. When I called they said I already had one. I was unaware of this. I said, if I get this new one can I still get my double rewards? She said, yes as long as I cancel my previous card. She cancelled it and immediately issued me a new care. YMMV.

Great to know! Thanks!

Thanks for the reminder Greg I also contacted Discover Card and mine has just ended.

Greg, do you happen to know if June 6th is the 11th or 12th statement after the date you signed-up for the offer?

12th statement.

Thanks. I went back and looked at the terms and everyone was supposed to get 12 full statement periods after they signed-up (with a stub period at the beginning that didn’t count).

Seems like you are on the leading edge of people timing out. Thanks for the heads-up, especially regarding the Discover Deals, which seem to take a minimum of 33 days to post.

I haven’t dove into discover cards yet. Anyone have a link to a comprehensive review where I can learn all the in’s and out’s.

While I’ve written many times about the cards, I should probably write a stand-alone review of Discover It. There are two cards worth considering: Discover It and Discover It Miles.

Discover It:

-1% cash back, 5% cash back in rotating categories

-High paying cash back portal

-Cash back can be redeemed for cash or for discount gift cards

-No annual fee, no foreign transaction fee

-Double cash back after first year

Discover It Miles

-1.5% “miles” (really cash back) everywhere

-“Miles” can only be redeemed for cash, not for gift cards

-Portal is not nearly as good as Discover It portal

-$30 automatic statement credit per year for in-flight internet

-No annual fee, no foreign transaction fee

-Double cash back after first year

-More: https://frequentmiler.com/2015/02/19/discover-introduces-a-new-card-and-a-potentially-very-lucrative-1st-year-offer/

I thought a person is allowed to sign up for a second discover card after you’ve had one for at least one year. I love my discover it card for 3% everywhere without having to think about it, and when my double cash ends, I plan on convert it to a discover it, and apply for another it miles card.

yeah, thought discover allowed a max of 2 cards, after you’ve had the first one for a year. should be good to go

That’s correct — I have two Discover cards. Had the first one open for over a year before opening the second. Took a recon call to explain why I needed two and the credit limits are low on each, but I was able to get it.

Yep, that’s correct. I’ll add something about this to the post. In my case I already have both the It and the It Miles and they won’t let you get a 3rd card.

Just used the 5% apple discover deal doubled to 10% on a new iPhone – not bad. Already made $1,700 from the Apple Pay promo on two cards last year, which will double later this year!

Be aware with the referral link provided,

Under my discover (original account) the conditions specific from discover website.

Look like if you have “discover it miles”, you won’t get the credit to refer a friend.

Am I understand correct? Anyone has any experience on this situation?

“You will receive a $50 Cashback Bonus referral reward if your friend applies for the specific offer you send via the link provided and is approved by December 31, 2016. Maximum 10 referral rewards ($500) per calendar year. You are not eligible to refer a friend if you have a Discover® Business card, Discover® Business Miles card, Essential by Discover® card, Escape by Discover® card, Miles by Discover® card, or Discover it® Miles card. Your account must be in good standing to receive your referral reward. Each eligible friend will receive a $50 Cashback Bonus after making a purchase within three months of opening a new Discover account. Existing Discover cardmembers and those who have opted out of receiving marketing communications from Discover are not eligible referrals. You will not be notified whether a specific referral was approved or declined. Please allow up to 5 weeks for Cashback Bonus to post to your account after each referral is approved. The Cashback Bonus you receive may be taxable to you. Please contact your tax advisor. Offer may not be combined with any other introductory offer.”

My interpretation of this is that there is no refer-a-friend program for the Discover It Miles card. As long as you have a Discover It card, you can refer friends to the Discover It card regardless of whether you also have the Discover It Miles card. I know this is true because I have both cards and have successfully earned referral credits for the It card.

I don’t have discover it card. I only have discover (0riginal card) and discover it miles.

Do you think the original discover card with the referl link would work , even though I have discover it miles card?

Thank you

In the same boat. Really sad to have “The Year of Discover” come to and end, but excited to see the final payout for the Apple Pay promo and all the 5% bonuses.

One strategic point: it would be smartest to sign up in the middle of a quarter–that will ultimately allow you to max out one additional quarter under the promo period, since you’ll have a “half” quarter on the front and back end that can be treated as full quarters.