NOTICE: This post references card features that have changed, expired, or are not currently available

I often write about the advantage of signing up for two cards from one bank on the same day. When you do so, the credit inquiries usually combine into one. In that way, the inquiry’s small negative hit to your credit score is reduced.

In the past, when I’ve applied for Chase business and personal cards on the same day, the credit inquiries were combined. In all cases (for me), Chase made 2 separate inquiries to both Experian and TransUnion, but only one inquiry remained long-term on each credit report. Meanwhile, Doctor of Credit has previously reported that Chase personal and business inquiries do not get combined. And a couple of readers have told me that their same-day inquiries from Chase have not been combined. It appears that the credit bureaus are inconsistent regarding this.

Do you remember when I reported applying for both the United 75K personal offer and the Ink Plus 60K business card offer on the same day? As a reminder – the United application was approved after a recon call, but the Ink application was still pending after two recon calls. Today, I’ve already received my signup bonus for the United card and I’m still waiting for a decision on the Ink card.

Meanwhile, I checked my credit reports…

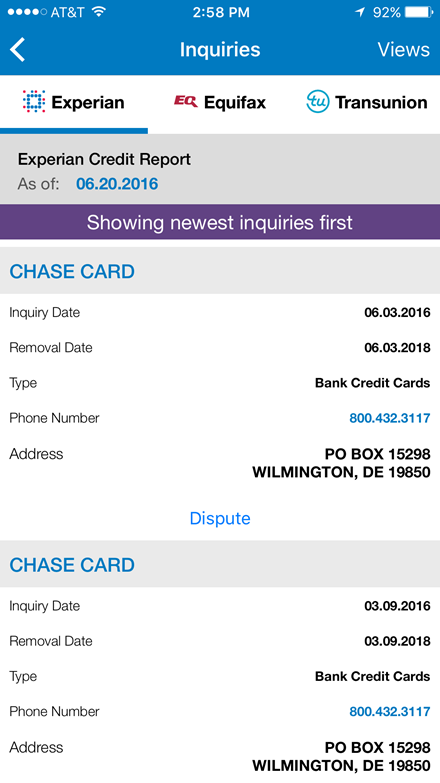

Experian

Alerts from my free ProtectMyID account (thanks to my AAA membership) show only one recent inquiry on my Experian credit report. The free Experian App on my iPhone reports the same thing. Only one Chase inquiry was incurred on June 3rd. After sorting by date, you can see that there was one inquiry in June and one in March (when I signed up for both the personal and business Marriott cards):

TransUnion

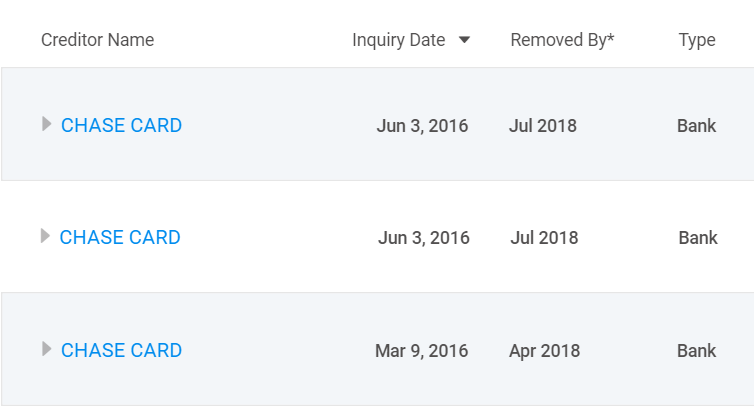

Using CreditKarma, I can see my TransUnion and Equifax credit reports. No Chase inquires were reported on my Equifax report (ever), but two same-day inquiries from Chase are on my TransUnion report:

On Mach 9th, when I signed up for a personal and business card on the same day, the inquiries combined into one.

Conclusion

It is pretty weird that Chase inquiries made to my TransUnion report did not combine this time despite the fact that they always have in the past. Meanwhile, my Experian report shows just one inquiry, as I expected.

What to make of this? Life is like a box of chocolates…

It looks like a number of people are seeing what I saw: If Chase pulls TransUnion for you, the pulls are not being combined (despite the fact that they used to get combined, for me anyway), but inquiries to the other bureaus are being combined.

Data Point: Applied CSR in bank at 5pm (banker had to call verification), Marriott Biz online at 7pm (I had to call verification/reconsideration). 2 separate pulls on TU. 0 on Equifax, 1 on Experian.

Where do you live that Chase is pulling TU? Usually it’s EX and rarely EQ. So 3 pulls total?

[…] at banks which combine credit pulls. Chase happens to be one of those banks that combines inquiries most of the time. It isn’t a perfect science, but I have have had pretty good success before. So, after my […]

[…] way the inquiries will hopefully combine and hey, at least you’ll have […]

Chase inquiries combined (Bus and Personal) for a parent on August 18th, 2016 for BOTH Transunion and Experian.

Chase inquiries did NOT combine for me the same say for Transunion, but did for Experian. We applied the same two cards and the 2nd card, Hyatt, went pending for both of us. The only difference that I got rejected on the 2nd card and called reconsideration for approval. The parents 2nd card was approved later in the mail.

Last year I applied for both the CSP & Freedom 5% card on the same day…

Chase pulled 2 separate ones from EXP, 1 month apart, despite me applying for both the same day. CSP was issued instantly, Freedom was issued a month later by them. No denial letters from them or anything else to indicate why they pulled twice.

I’m in the same boat as you. Applied for 2 Chase cards, got no inquiry @EQ, 1 @EX and 2 @TU..

I applied for IHG and United personal on the same day (3/17) and Experian only shows one inquiry. On 2/13 I applied for one personal and one business and EX shows two inquires

[…] Do Chase credit inquiries really combine? by Frequent Miler. With merging inquiries it’s always best to hope for the best and plan for the worst, especially when it comes to Chase business credit cards. […]

April 26 Fairmont and Sapphire after a bit (not sure when) combined on TU for me.

I may want to add that for some of us unlucky folks, Chase often pulls TWO different bureau for an application even though the app is an instant approval. This happened to me in 2014. Stopped in 2015 and then in 2016 has returned to the 2 pulls from different bureau on each app which is instant approval.

I applied in April and they did not combine, a personal and business MARRIOTT.

I don’t understand why its worth worrying about this. If you’ve got a very good credit score, which you will after doing this stuff for a while (making sure to pay every single bill on time), this stuff is in the noise. Sure it will hurt your credit score a little if you get two hits. But there’s evidence that some people with lower credit scores get targeted for more/better offers, there’s even some evidence that perfect scores are not a good idea as far as automatic approvals, etc. Why bother?

Because many banks won’t issue a new card if you have lots of inquiries, and at that point it doesn’t matter how good your score is.

Ken wrote what I was going to

Twice this year I have applied for two Chase cards and both times the inquiries didn’t combine. One was for 2 personal cards and the other a personal card and a business card.

My wife applied for two Barclays cards June 24th, and there are 2 inquiries on her TU report. So it looks like TU may not be combining pulls on the same day anymore.

Very interesting! Other readers: Has anyone had TU inquiries combine from any bank since June 3rd (the date that mine did not combine)?

New DP here: Applied for 3 BoA biz cards on Friday and I’m seeing 3 separate TU hard pulls on Karma. Ugh

Which BOA Biz cards?