NOTICE: This post references card features that have changed, expired, or are not currently available

Credit card companies want cardholders to add authorized users (AUs). The hope is that more users will result in more spend which means more profit for the card issuer. Because of this, it’s sometimes possible to earn points for adding authorized users. But, is that a good idea? There are both benefits and disadvantages to adding authorized users…

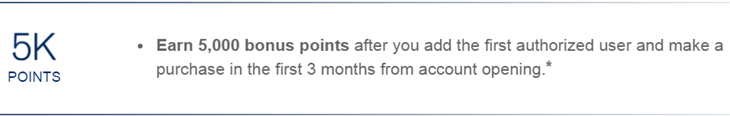

Many credit card signup offers include bonus points for adding authorized users. Chase does this with most of their personal cards:

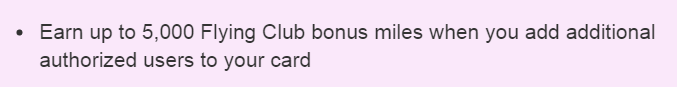

And, Bank of America offers up to 5,000 bonus miles on their Virgin Atlantic card (2,500 miles per authorized user):

Recently, Amex and Citi have jumped into the game by sending emails to targeted cardholders offering bonus points for adding users:

Everyone likes bonus points, but is it worth it? Is it really a good idea to add an AU or two to your account?

Benefits for the Primary Cardholder

Adding authorized user accounts does not affect the primary cardholder’s credit (see this Experian post for details). That’s not really a “benefit”, but at least its not a negative.

The primary benefit of adding an authorized user (besides earning bonus points through promotions) is to facilitate transferring points to the authorized user. With American Express Membership Rewards points, for example, it is possible to transfer points from your account to other people’s frequent flyer accounts, but only if they are authorized users. Similarly, Chase Ultimate Rewards points can be moved only to authorized users in certain situations (see: Chase point transfer rules made simple [Infographic]).

Another “benefit” that credit card companies like to advertise is that your AU can help you earn points and miles through spend. Of course, you as the primary cardholder still have to pay the credit card bills for that spend, but if you’re the one paying the bills anyway it might be useful to you. In most cases, for purposes of meeting minimum spend requirements, earning credit card rewards, and earning big spend bonuses, all AU purchases are treated the same as purchases made on the primary cardholder’s card. The only exception I can think of is with US Bank business cards. A number of readers have reported learning the hard way that US Bank employee card spend does not count towards signup bonus minimum spend requirements.

Benefits for the Authorized User

If the primary cardholder handles the primary card responsibly (e.g. always paid on time and keeps a low utilization ratio), it is possible to help another person’s credit score by adding them as an authorized user.

In most cases, credit card perks (free checked bags, elite status, lounge access, etc.) are available only to the primary cardholder. In some cases, though, authorized users do get some of the perks of card membership. Here are a few examples:

- Starwood Preferred Guest (SPG) authorized users get free, unlimited Boingo Wi-Fi for up to 4 devices (details here)

- All Amex card authorized users get their own Amex Offers (offers such as “Spend $250 or more at Best Buy and get $25 back”)

- Some premium cards that offer airport lounge access also include lounge access for authorized users. Examples include all versions of Amex Platinum cards (not counting Amex Delta Platinum, which is different), Citi Executive AA card, Chase Ritz Carlton card, etc.

- Cards that offer travel and purchase protections usually extend those same protections to authorized users as well (check your card’s benefits to be sure).

Another benefit for the authorized user is, in some cases, the ability to receive points transferred from the primary accountholder. With American Express Membership Rewards points, for example, it is possible for the primary account holder to transfer points to the authorized user’s frequent flyer programs. Similarly, Chase Ultimate Rewards points can be moved only to authorized users in certain situations (see: Chase point transfer rules made simple [Infographic]).

Disadvantages for the Primary Cardholder

Adding authorized user accounts does not directly affect the primary cardholder’s credit. However, the primary cardholder is responsible for all charges made with AU cards.

Additionally, the primary cardholder is responsible for any fees for adding authorized users. With many cards, AU accounts are free, but those that extend premium benefits to the AU typically charge a fee for each AU.

Disadvantages for the Authorized User

There are a couple of significant disadvantages for the authorized user:

- AU accounts usually show up as new accounts on the authorized user’s credit report. In many cases, negative factors (late payments or high utilization, to give two examples) on the primary card will show up on the authorized user’s report as well. This can lead directly to lower credit scores.

- Chase includes AU accounts in their infamous 5/24 rule (in most cases they won’t approve a new credit card if you’ve opened 5 or more accounts in the past 24 months). In other words, being added as an AU can reduce your chances of getting new Chase cards. When that happens, you can call Chase and explain that you are not responsible for paying the credit card bill (where you are the authorized user) and they will reconsider your application, but it definitely adds a hassle factor that you probably wouldn’t want.

When is it worth adding Authorized Users just for the points?

The key is to add AUs only when doing so has no known negatives. Some credit card companies do not ask for the authorized user’s social security number. In those cases, the AU card can still appear on the AU cardholders credit report, but only if there is matching information between your credit report and your AUs. For example, if you share (or have ever shared) a home address, then the matching is likely to occur. So, theoretically, one way to avoid AU disadvantages is to add someone who has no known ties to you.

A better approach, I think, is to add people when the following conditions are true:

- You have handled the primary card responsibly (always paid on time) and will keep it that way.

- Your authorized user has no plans to sign up for many cards within the next two years.

- Your authorized user agrees to be added.

And a bonus if:

- Your authorized user needs help building their own credit.

In my case, both my teenage son and niece are students who will likely benefit from being added as authorized users to my or my wife’s accounts. In those cases, I believe its worth going for the easy points. As a rule, I no longer add my wife as an authorized user (or have her add me), unless we need the ability to transfer points to each other. For me, this is only relevant to Amex Membership Rewards points. With Chase Ultimate Rewards, since we live in the same household and both have Chase Ultimate Rewards cards, we can freely move points from one to another with or without AU cards.

Remove your authorized user cards from you credit report

If someone has added you as an authorized user and you’re not happy with that, you can close the authorized user card and request that it be removed from your credit report. Full details can be found here: Doctor of Credit: How To Remove Authorized User Accounts From Your Credit Report

Question – does the spend on the AU’s account count to SPG gold status for the SPG Amex? Aka if I spend 20k and my AU spend 10k, will both count toward the minimum 30k required to hit SPG Gold?

Yep, AU spend counts too. Your scenario would work.

If I were your son, I’d wait till you went out of town then charge you card to the limit for a big party.

Fading the heat would be worth it. You’re not so scary.

I’m glad you’re not my son

If AU is added with a nick name or dogs name, how’s that gonna show up on someone’s credit report? Talking Citibank here.

Yeah, it should be fine.

I am an AU on my 25-yr-old daughter’s Amex accounts since I did her MS and min spends for her. She kept getting amazing Amex offers in the mail. She jumped on an Amex Gold w/ 50K MRs after $1000 min spend, AF waived first year.

How old should a kid / teenager be to be added as an AU? Mine are probably all too young, but I’d like to do this at some point down the road.

I think that Amex has a minimum age of 15. With the banks that don’t ask for SSN you can do any age.

From my experience, you CAN add yourself as a authorized user for bonus reasons (ant for any other reason…)

I think that this eliminates some of the disadvantages

True

I was added as an authorized user on my sister’s and my husband’s Sapphire preferred accounts for their bonus points a year ago. these cards started showing up on my credit report. I secure messaged Chase and asked them to be removed from my credit report and they were both removed.

Thanks for the reminder about that. I’ve added a note and link to the end of this post with more details about how to remove AU cards from credit reports.

Ya this seems to me to be the answer, add your spouse or whomever, swipe the card once at the grocery store or whatever, get the bonus points, then have the AU close it and get it off their credit report.

You should probably clarify that it’s not the primary user’s credit report that affects the AU. It’s merely that particular card. The PU can have black marks all over (elsewhere), but if that card itself is clean (on which there is an AU), it won’t reflect on the AU at all.

Good point! Updated.

I’m struggling with this subject right now. I recently signed up for the MB AMEX Platinum card with the 75k bonus. I want to add my SO, who is not into the credit card game for the Delta lounge access benefit because she travels often for work and Delta is her preferred airline. The issue is I do not plan on keeping this card more than a year and AMEX requires the AU’s SSN, I don’t want the new account and then a cancelled card on her credit report. I was able to sign her up with out the SSN but it’s my understanding I will eventually need to add her SSN. Is it worth the drop in credit score to add her as an AU?

Canceled cards do not hurt a FICO score. If you add her as an AU, and then cancel the card, her score should go up, if anything.

Though if the card has been open less than a year it could impact her average age factor, lowering her score.

I agree with others that she’s probably better off signing up for a new card of her own. A 100K Platinum offer has been showing up for some via the Card Match Tool (found here: https://frequentmiler.com/how-to-find-the-best-credit-card-offers-and-support-this-site/).

Otherwise watch for targeted by-mail offers or Quick Deals when other offers come out. Of the public offers, the 50K Morgan Stanley offer may be the best. All current public offers for Platinum cards can be found here: https://frequentmiler.com/best-credit-card-sign-up-offers/#AmexMR

If Delta SkyClub access is really the only perk your wife would use, then you might consider the same priced Delta Reserve card which offers a domestic companion ticket each year upon renewal. But, I mainly suggest that card only for people who seek Delta elite status (since it offers MQMs): https://frequentmiler.com/best-credit-card-sign-up-offers/#AmexAirlines

I got the United and Hyatt Chase cards pre 5/24 and then proceeded to get my wife AU’s on both in order to get 5k United and 5k Hyatt pts. In retrospect that was a mistake. Now she’s 14 months from being under 5/24. That aspect of 5/24 really sucks and I’m not sure it really helps Chase’s bottom line all that much.

@ben. Why didn’t you sign her up for her own account vs adding her as a SO? The bonus on the new cards would be dramatically more than adding her to your account.

@kendall. Same for you. May it make sense yo get your wife her own card with her own first year bonus? There is a cost for adding additional platinum cardholders so it may be worth it if you aren’t planning on holding the cards. And it sounds like you wife may want to keep hers longer.

Now the dilemma is , so I wait for a better Plat AMEX offer?

This might help: http://www.doctorofcredit.com/removing-authorized-user-accounts-credit-report/

Another disadvantage for the AU is that if they use the card they do not earn miles in their own account. Most frequent flyer programs (not all!) do not allow free mileage transfers between accounts.

That’s true

I would also argue for adding an authorized user when the authorized user has well surpassed 5/24 (let’s say 10/24 for example) and doesn’t intend to pull back the sign up frequency anytime soon…

That seems reasonable, but you never know if it might hurt in the future. For example, it is unlikely but possible that another bank will adopt Chase’s 5/24 rule but with a higher limit (e.g. 10/24). Also unlikely but possible that Chase will revise the rule upwards.

I see it might help in my case. But the AU I plan to add does not have SSN. The online Amex will not proceed unless I provide SSN.

Will the SPG bonus work if I sign up by online chat or by phone?

I don’t know. If you call or online chat to ask, please let us know what they say.